Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

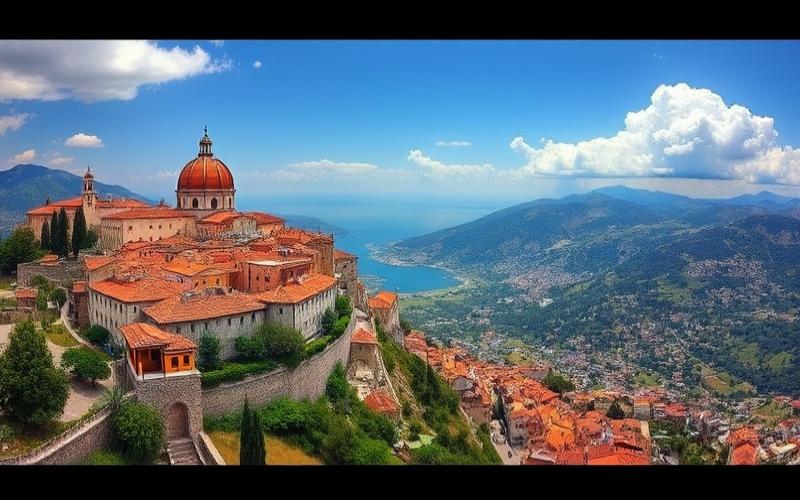

Albania, a Balkan country experiencing economic growth, is attracting more and more expatriates drawn by its affordable cost of living and breathtaking landscapes. However, as in any host country, it’s crucial to understand the local tax system to avoid unpleasant surprises. Let’s dive into the intricacies of Albanian taxation for expatriates.

The Albanian Tax System: A Labyrinth to Demystify

The Albanian tax system has undergone numerous reforms in recent years, aiming to simplify it and make it more attractive to foreign investors. Today, Albania has a relatively competitive tax regime compared to its European neighbors, with moderate tax rates and increasingly digitized administrative procedures.

The main taxes that expatriates need to pay attention to are:

- Personal income tax

- Value Added Tax (VAT in Albanian)

- Corporate tax

- Local taxes, particularly property tax

The Albanian tax administration, although perfectible, has made considerable progress in terms of transparency and efficiency. Expatriates can now handle most of their procedures online, via the e-Albania portal, which greatly facilitates the management of their tax obligations.

Good to know:

The fiscal year in Albania corresponds to the calendar year, from January 1st to December 31st. Tax returns must generally be submitted by April 30th of the following year.

Income Tax: Moderate Progressivity

Personal income tax in Albania follows a progressive scale, with relatively advantageous rates compared to many European countries. Income is taxed according to three brackets:

- 0% for monthly income up to 30,000 leks (approximately 250 euros)

- 13% for monthly income between 30,001 and 150,000 leks

- 23% for monthly income above 150,000 leks

It’s important to note that expatriates are considered tax residents in Albania if they stay there for more than 183 days per year. In this case, they are taxable on their worldwide income. Conversely, non-residents are only taxed on their Albanian-source income.

Income subject to tax includes salaries, rental income, dividends, interest, and capital gains. Some income benefits from special tax treatment, such as dividends which are taxed at a flat rate of 8%.

Good to know:

Albania has signed tax treaties with many countries to avoid double taxation. It’s crucial to check the existence of such a treaty with your country of origin to optimize your tax situation.

Albanian VAT: A Competitive Standard Rate

Value Added Tax, called TVSH in Albania, applies to most goods and services. The standard rate is 20%, which remains competitive compared to many European countries. Some products and services benefit from reduced rates:

- 6% for accommodation services in the tourism sector

- 0% for certain medicines and medical services

For expatriate entrepreneurs, it’s important to note that VAT registration is mandatory as soon as annual turnover exceeds 10 million leks (approximately 82,000 euros). Below this threshold, registration is voluntary.

VAT declaration and payment are done monthly for most businesses, via the tax administration’s electronic system.

Good to know:

Expatriates who start a business in Albania must be particularly vigilant about VAT rules, as penalties for non-compliance can be severe.

Corporate Tax: An Asset for Entrepreneurs

For expatriates considering starting or running a business in Albania, corporate tax is a key element to consider. The standard corporate tax rate is 15%, placing Albania among the most competitive European countries in this area.

However, there are reduced rates for certain categories of businesses:

- 5% for small businesses with annual turnover between 5 and 14 million leks

- 0% for businesses with annual turnover below 5 million leks

Albania also offers attractive tax incentives for foreign investors, particularly in special economic zones and for priority sectors such as information technology or agriculture.

Companies must submit their corporate tax returns by March 31st of the year following the fiscal year. Quarterly advance payments are generally required.

Good to know:

Tax losses can be carried forward for the following three fiscal years, which can be advantageous for businesses in the startup or expansion phase.

Property Tax: An Evolving System

Property tax in Albania, called “taksa mbi pasurinë e paluajtshme”, is a local tax that applies to real estate owners. The rate varies depending on location and property type, with significant differences between urban and rural areas.

Since 2018, the calculation of property tax has been reformed to be based on the market value of properties, rather than their surface area. This reform aims to make the system fairer and increase local government revenues.

Current rates are generally between:

- 0.05% and 0.2% of the property value for residential buildings

- 0.2% and 0.5% for commercial buildings

Expatriates who own real estate in Albania must pay this tax annually, generally before April 30th. Payment can be made in one lump sum or in several installments, depending on the municipality.

Good to know:

Certain categories of properties may benefit from property tax exemptions or reductions, particularly buildings used for agricultural activities or properties of low-income individuals.

Tax Returns: An Increasingly Digitized Process

Albania has made significant progress in digitizing its tax administration. Most tax returns can now be filed online, via the e-Albania portal or the tax administration website (www.tatime.gov.al).

For expatriate employees, the employer is generally responsible for withholding income tax and social security contributions at source. However, an annual return remains mandatory for all tax residents, even if their income has already been taxed at source.

The key steps for tax returns in Albania are:

- Register with the tax administration to obtain a tax identification number (NIPT)

- Collect all necessary supporting documents (bank statements, invoices, etc.)

- Complete the online return before the deadline (generally April 30th)

- Pay any taxes due, if applicable

It’s highly recommended for expatriates to seek assistance from a local accountant or tax advisor, at least for their first return, to ensure compliance with all legal obligations.

Good to know:

The Albanian tax administration offers information sessions and online guides to help taxpayers fulfill their obligations. Some of these documents are available in English.

Practical Tips for Expatriates

Navigating the tax system of a new country can be intimidating. Here are some tips for expatriates in Albania:

1. Anticipate your tax status: Determine in advance whether you will be considered a tax resident in Albania. This will greatly influence your tax obligations.

2. Familiarize yourself with tax treaties: Check if there is a tax treaty between Albania and your country of origin to avoid double taxation.

3. Keep detailed records: Keep all your financial documents, including bank statements, invoices, and contracts. This will greatly facilitate your tax returns.

4. Use online services: Take advantage of the digital tools provided by the Albanian tax administration to simplify your procedures.

5. Consult a local expert: Don’t hesitate to enlist the help of an Albanian accountant or tax lawyer to guide you, especially if your situation is complex.

6. Stay informed about changes: Albanian tax legislation evolves regularly. Keep up to date with changes that might affect you.

7. Plan your investments: If you’re considering investing in Albania, research the tax incentives available in different sectors.

Good to know:

Albania offers simplified procedures for obtaining residence permits for foreign investors, which can have advantageous tax implications.

In conclusion, although the Albanian tax system may seem complex at first glance, it offers many advantages for expatriates, including competitive tax rates and an increasingly modern administration. With proper preparation and appropriate advice, expatriates can effectively navigate this system and fully enjoy their experience in Albania.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.