Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

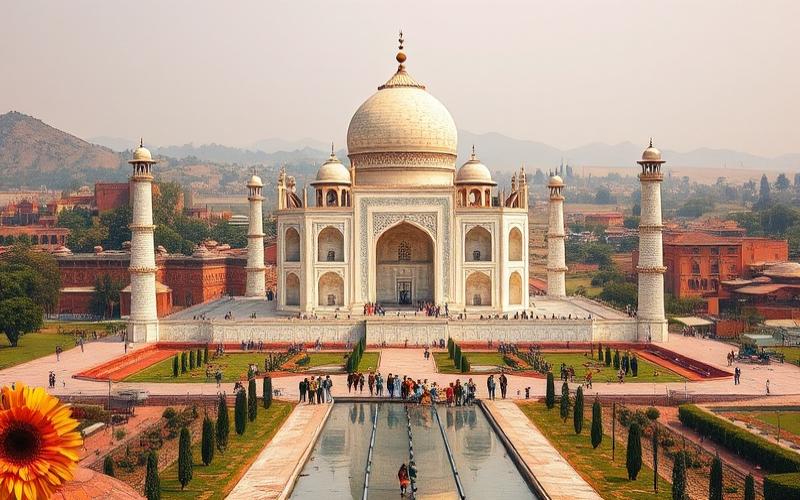

In India, real estate law is a complex and constantly evolving field that deserves special attention, particularly when considering crucial aspects such as contracts and warranties.

With a rapidly expanding economy and growing demand for real estate, transactions in this sector are becoming increasingly complex, reflecting the country’s legal diversity.

Real estate contracts, which include elements such as sales, leases, and mortgages, require a thorough understanding of each state’s specific laws, while also being influenced by federal standards.

Meanwhile, warranties appear as a fundamental element to ensure transaction security, protecting buyers and sellers against potential disputes.

In this context, an overview of contract nuances and warranty mechanisms is essential to effectively navigate the Indian legal landscape and conduct real estate transactions safely.

Real Estate Law in India: General Overview and Legal Framework

The Indian legal system is based on Common Law, with a federal structure defined by the Constitution. This provides for a division of legislative powers between the central government and state governments, giving real estate law a hybrid dimension: main laws concerning urban planning, land acquisition, or real estate taxation are often enacted at the state level, while certain essential provisions fall under federal law.

Main Laws Governing Real Estate Law

- The Indian Constitution

- The Transfer of Property Act

- The Registration Act

- The Real Estate (Regulation and Development) Act – RERA

Distribution of Powers

| Jurisdiction | Federal Law | State Law |

|---|---|---|

| Contracts | Central Law | – |

| Corporations | Central Law | – |

| Urban Planning | – | Local Laws |

| Local Taxation | – | Stamp Duty, Excise Duties |

Each Indian state has its own land laws and real estate regulations that can differ significantly. For example:

- Registration formalities,

- Tax duty caps and exemptions,

- Acquisition or expropriation procedures,

interact with national laws to form a complex framework where investors must navigate carefully.

Role of Local Authorities

The importance of local regulations is manifested through the predominant role of:

- municipalities

- urban development councils

These authorities intervene in:

- Issuing and managing building permits

- Urban planning

- Zoning enforcement

They hold major decision-making power over land use and issuance of land titles.

Acquisition by Foreigners

Restrictions concerning real estate purchase or investment by foreigners are primarily based on:

- Immigration and Foreigners Act 2025

- National Immigration Authority (NIA)

Typical conditions include:

- Specific visa according to purpose (business/investor/skilled talent)

- Detailed justification of the planned project or investment

- Enhanced controls: digital monitoring, sanctions in case of violation

Summary of Restrictions by Buyer Type

| Buyer Type | Main Restrictions |

|---|---|

| Indian Citizen | Free access according to state laws |

| Foreign Resident | Strict conditions; visa required; sectoral restrictions |

| Non-Resident/Expatriate | Conditional investment; NIA control |

Recent Changes and Major Reforms

- Increased FDI cap in certain strategic sectors to attract more investors

- Administrative streamlining to simplify licenses and inspections

- Enhanced digitalization for migration monitoring/foreigner control

Key Judicial Decisions

Key judicial decisions have shaped the current interpretation of real estate law in India:

- Jurisprudence regularly confirms constitutional primacy while recognizing local specificity.

- Several rulings have imposed increased transparency on states in their expropriation procedures.

- The sector faces persistent judicial backlog; however, some recent decisions favor better protection against administrative arbitrariness.

Important Points

Hybrid legal framework: complex interaction between central law and state regulations

Crucial role of local authorities for any real estate transaction

Significant restrictions on foreign acquisition strengthened since 2025

This evolving context requires constant monitoring of administrative, tax, and migration reforms directly impacting all players involved in the Indian real estate market.

Good to Know:

The legal framework of real estate law in India largely relies on the Indian constitution and various national laws such as the Real Estate (Regulation and Development) Act of 2016, which streamlines transparency and protects buyers’ interests. Each Indian state holds its own land laws, which can interact complexly with national regulation, creating significant regional variations in land management. Municipalities and urban development councils play a crucial role in enforcing these laws, overseeing construction permits and urban planning standards. Acquiring property as a foreigner can be complex due to restrictions, such as those imposed by the Foreign Exchange Management Act. Recent reforms, such as promoting infrastructure projects and key judicial decisions, significantly influence the market by clarifying land rights and accelerating dispute resolution.

Real Estate Purchase Contracts: Party Obligations and Rights

Legal Obligations of the Buyer in a Real Estate Purchase Contract in India

Payment

The buyer must respect the payment schedule defined in the contract (typically a down payment at signing, then interim payments and balance at deed signing).

Stamp duties (5 to 7% of value) and registration fees are the buyer’s responsibility.

Inspection and Verification

The buyer must conduct thorough due diligence: verification of property titles, existence of encumbrances or mortgages, permit compliance, absence of disputes.

It is advisable to hire a lawyer to check all documents and obtain, if needed, a tax certificate (certificate 281) attesting to no ongoing tax proceedings on the property.

Signing the Sale Agreement

The sale agreement must be signed by both parties and registered with competent authorities.

Legal capacity to contract is required: majority (18 years, or 21 if under guardianship), full mental capacity, absence of legal prohibition.

Seller’s Obligations

Document Delivery

Provide all property-related documents: titles, plans, no-objection certificates, tax certificates, permits, etc.

Produce certificate 281 if requested, attesting that no tax proceedings are ongoing against the property.

Full Disclosure

Disclose all relevant information about the property’s condition, existing encumbrances, potential disputes, and ownership history.

Report any control changes or conditions affecting the sale’s validity.

Charge Allocation

Settle charges and taxes due until the transfer date.

Pay off existing debts or mortgages, unless otherwise agreed with the buyer.

Summary Table of Main Obligations

| Party | Main Obligations |

|---|---|

| Buyer | Payment per schedule, due diligence, payment of duties/fees, agreement signing |

| Seller | Document delivery, full disclosure, settlement of charges, tax certificate |

Rights in Case of Contractual Obligation Breach

Buyer’s Rights

Demand forced execution of the sale through courts.

Request refund of paid amounts and/or damages in case of seller default.

Seller’s Rights

Terminate the contract in case of buyer payment default.

Retain the down payment (if contractually provided) as penalty.

Remedies and Dispute Resolution

Contract Validity and Timelines

Contractual timelines are generally strict: non-compliance can lead to termination or penalties.

The sale agreement must be registered to be enforceable against third parties.

Dispute Resolution

Most contracts include an arbitration clause: disputes will then be settled by an arbitrator, per Indian arbitration law (Arbitration and Conciliation Act, 1996).

Without arbitration, recourse to civil courts is possible, with options to demand forced execution, termination, or damages.

Main Legal Remedies Available

- Forced contract execution (“specific performance”)

- Contract termination and restitution

- Damage claims

- Arbitration or mediation, per contractual clauses

Key Framed Points

The real estate sale agreement in India is only fully valid once signed, registered, and all title and encumbrance verifications have been completed. Respecting timelines and document transparency are essential for the parties’ legal security.

In case of dispute, Indian legislation provides robust remedies: forced execution, arbitration, compensation, or even contract cancellation if fraud or concealment is proven.

Good to Know:

In India, the legal obligations of the buyer in a real estate purchase contract include respecting payment terms, prior property inspection, and signing the sale agreement within agreed timelines. The seller, on their side, must provide all legal documents related to the property, such as title deeds and urban planning certificates, ensure full disclosure of the property’s condition, and handle charge allocation until transfer. In case of contractual obligation breaches, each party can exercise legal remedies as provided by Indian legislation, potentially including compensation or judicial resolutions. The validity of real estate contracts relies on strict adherence to timelines and clauses; in case of disputes, parties can turn to the Real Estate Regulatory Authority (RERA) or civil courts for resolutions based on applicable laws and precedents.

Warranties for Expatriates in Real Estate Transactions

Expatriates wishing to purchase real estate in India benefit from certain legal warranties, but these are strictly regulated by Indian legislation, with specific protections according to the buyer’s status (NRI, PIO, or non-resident foreigner).

Main Legal Warranties for Expatriates:

- Foreign Exchange Management Act (FEMA): This law governs all foreign real estate investments in India. Non Resident Indians (NRI) and Persons of Indian Origin (PIO) can freely purchase residential and commercial properties, provided they comply with FEMA rules. Foreign nationals without family ties to India generally cannot acquire residential properties without specific authorization from the Reserve Bank of India (RBI).

- Possibility to repatriate funds from the sale, subject to exchange control compliance.

- Real estate inheritance: Foreigners can inherit real estate under certain conditions, even if direct purchase is prohibited in some cases.

Special Protections for Foreign Buyers:

- Mandatory title verification to ensure transaction legality and absence of mortgages or encumbrances.

- Mandatory registration of the sale contract with local authorities.

- Use of a legalized power of attorney for buyers not physically present in India.

Essential Contractual Provisions to Include:

- Clause for clear title certification and absence of debts or disputes on the property.

- Seller obligation to provide all legal documents (property title, administrative approvals, tax receipts).

- Precise definition of payment methods and property transfer.

- Inclusion of dispute resolution clauses (arbitration, competent court, contract language).

- Specification of penalties for non-compliance with contractual commitments.

Seller/Developer Transparency Obligations:

- Provision of all information regarding the property’s legal and physical status.

- Declaration of potential easements, encumbrances, or ongoing procedures.

- Obligation to settle all due taxes before final property transfer.

Legal Remedies in Case of Dispute:

- Possible recourse to Indian courts for any dispute related to property or compliance.

- Option to use mediation or arbitration per contract clauses.

- Claim for damages or sale cancellation in case of fraud or hidden defects.

Influence of Indian Laws on Foreign Ownership:

| Buyer Status | Accessible Property Types | Purchase Conditions | Legal Particularities |

|---|---|---|---|

| NRI/PIO | Residential, Commercial | No quantity limits, FEMA rule compliance | Repatriation possible, no agricultural land purchase without authorization |

| Non-Resident Foreigner | Commercial | RBI authorization needed for residential | Significant restrictions, inheritance possible under conditions |

Practical Tips to Secure Real Estate Purchase as an Expatriate:

- Scrupulously verify title legality and absence of disputes.

- Demand certified translation of all documents if necessary.

- Prefer purchasing from recognized and registered developers.

- Consult a lawyer specialized in Indian real estate law.

- Prepare a power of attorney in case of absence during signing.

- Ensure contract compliance with FEMA and RBI regulations.

Key Takeaways:

Real estate purchase in India by an expatriate is strictly regulated: it requires rigorous title verification, inclusion of protective contractual clauses, and perfect compliance with foreign ownership laws. Seller transparency and recourse possibilities before Indian jurisdictions constitute essential warranties, provided specific legal procedures for each buyer status are followed.

Good to Know:

In India, expatriates benefit from several legal warranties during real estate transactions, such as protection under the Real Estate (Regulation and Development) Act of 2016, which imposes absolute transparency on developers regarding land legal status, required approvals, and delivery dates. Expatriates must ensure their real estate contracts include clauses stipulating penalties for delivery delays and warranties for hidden defects. The law authorizes foreigners to purchase commercial real estate but restricts some residential purchases, requiring vigilance in verifying resident status before transaction. In case of dispute, an expatriate can recourse to the Consumer Court, specialized in real estate disputes, to assert their rights. Finally, foreign buyers are advised to seek services of a local specialized lawyer to verify property titles and ensure all regulations are complied with, avoiding potential disputes.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.