Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

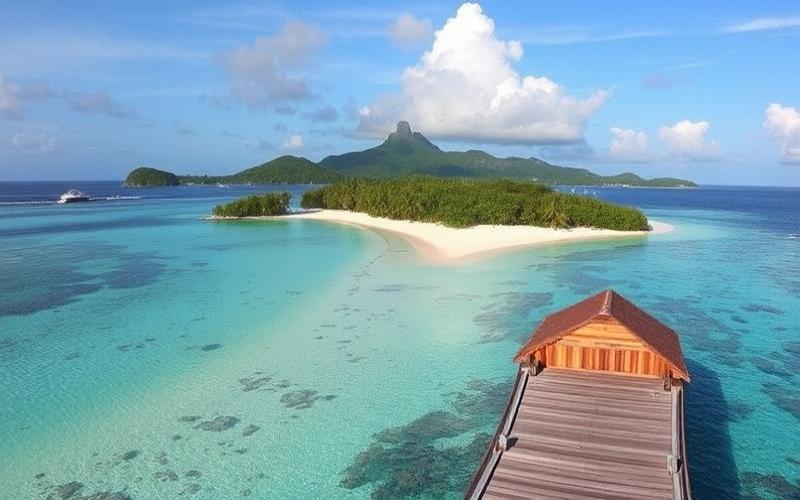

Relocating to the Seychelles is a dream for many French people seeking sunshine, paradise beaches, and an exceptional living environment. However, managing finances in an international context can be complex and requires careful preparation. This article will guide you through the various aspects of financial management for expatriates in the Seychelles, providing practical advice to optimize your finances and fully enjoy your new life in this Indian Ocean archipelago.

Choosing the Right Banks for Your Relocation to the Seychelles

The first crucial step in your financial management as an expatriate in the Seychelles is selecting the right banking institutions to meet your specific needs. A two-pronged approach is recommended: maintaining a bank account in France while opening a local account in the Seychelles.

Maintaining a Bank Account in France

Keeping an account in France can be wise for several reasons:

- Facilitate recurring payments in France (taxes, insurance, etc.)

- Maintain a banking presence in your home country

- Benefit from French banking services tailored for expatriates

Several French banks offer specific packages for expatriates, such as BoursoBank, Fortuneo, or BNP Paribas. These typically include services like remote account management, international bank cards, and advantageous money transfers.

Opening a Local Bank Account in the Seychelles

To facilitate your daily life in the Seychelles, opening a local bank account is essential. The main banks in the country offer services adapted for expatriates:

- Barclays Bank Seychelles

- Seychelles Commercial Bank

- Nouvobanq (formerly Seychelles Savings Bank)

- Bank of Baroda

These banks generally offer a full range of services, including checking accounts in Seychellois rupees and foreign currencies, international credit cards, and online banking services.

Good to know:

When opening a bank account in the Seychelles, you will need to provide several documents, including your passport, proof of local address, and sometimes a recommendation letter from your French bank. It is advisable to prepare these documents before your departure.

Managing Exchange Rate Fluctuations and Optimizing Your Money Transfers

Currency management is a crucial aspect of an expatriate’s financial life in the Seychelles. The local currency, the Seychellois rupee (SCR), can fluctuate against the euro, which may impact your purchasing power and money transfers.

Understanding and Anticipating Exchange Rate Fluctuations

To minimize the impact of exchange rate variations on your finances, several strategies can be implemented:

- Regularly monitor EUR/SCR exchange rates

- Use exchange rate monitoring and alert tools

- Diversify your holdings by keeping part of your savings in euros

Optimizing Your International Money Transfers

Money transfers between France and the Seychelles can quickly become expensive if you don’t choose the right solutions. Here are some options to optimize your transfers:

- Use specialized online money transfer services like Wise or Revolut, which often offer better exchange rates than traditional banks

- Opt for SEPA transfers in euros if your Seychellois bank offers foreign currency accounts

- Schedule your significant transfers based on exchange rate fluctuations to benefit from the best rates

Good to know:

Some Seychellois banks offer multi-currency accounts, allowing you to hold both Seychellois rupees and euros. This option can be practical for managing your daily finances while minimizing exchange fees.

Planning Your Financial Security in an International Context

Financial security is a crucial aspect of an expatriate’s life. In the Seychelles, it’s important to implement a comprehensive strategy to protect your assets and ensure your financial future.

Insurance and Social Protection

As an expatriate in the Seychelles, you must ensure you are well covered in terms of health and retirement planning. Here are some points to consider:

- Subscribe to an international health insurance policy covering both the Seychelles and France

- Check your eligibility for the Caisse des Français de l’Étranger (CFE) to maintain your French social security coverage

- Consider repatriation insurance in case of a medical emergency

Savings and Investments

Diversifying your savings and investments is essential to secure your financial future. Here are some avenues to explore:

- Keep part of your savings in France, for example in a Livret A or a Plan d’Épargne en Actions (PEA)

- Invest in real estate, whether in France or the Seychelles, taking into account potential tax advantages

- Explore local investment opportunities in the Seychelles, such as government bonds or investment funds offered by local banks

Good to know:

The Seychelles offers an attractive tax environment for foreign investors, including a 15% flat tax on income. However, it is crucial to fully understand the tax implications of your investments, both in the Seychelles and in France.

Wealth Management and Legal Precautions

Wealth management in an international context requires special attention to legal and tax aspects. As an expatriate in the Seychelles, you must be vigilant on several points.

International Taxation

France and the Seychelles have signed a tax treaty to avoid double taxation. However, it is crucial to fully understand your tax obligations in both countries:

- Declare your worldwide income in France, even if you are a tax resident in the Seychelles

- Understand the rules of tax residency to determine where you will be taxed

- Take into account potential tax benefits related to your expatriate status

Inheritance and Wealth

Managing your wealth in an international context requires careful planning:

- Draft an international will to clarify the distribution of your assets between France and the Seychelles

- Consider setting up an international life insurance policy to optimize the transfer of your wealth

- Consult a lawyer specialized in international law to structure your wealth optimally

Good to know:

The Seychelles have inheritance laws different from those of France. It is crucial to understand these differences to avoid any surprises in the event of death.

Tools and Applications for Managing Your Finances Remotely

In the digital age, many tools and applications can facilitate the management of your international finances from the Seychelles.

International Banking Applications

Several banks and fintech companies offer mobile applications specifically designed for expatriates:

- N26: a German online bank offering banking services throughout Europe

- Revolut: an application that allows you to easily hold and exchange multiple currencies

- Wise (formerly TransferWise): ideal for low-cost international money transfers

Budget Tracking and Wealth Management Tools

To get an overview of your finances, several tools can be useful:

- Bankin’: a French application that aggregates your bank accounts and tracks your expenses

- YNAB (You Need A Budget): a popular budgeting tool, particularly useful for managing multiple currencies

- Personal Capital: a comprehensive platform to track your investments and overall wealth

Good to know:

Make sure these applications are compatible with Seychellois banks before using them. Some may have limited functionality outside of Europe.

Conclusion: Successful Financial Management for Your Relocation to the Seychelles

Relocating to the Seychelles offers many opportunities but requires rigorous and well-planned financial management. By following the advice presented in this article, you will be able to:

- Choose the best banking solutions, both in France and the Seychelles

- Effectively manage your currencies and optimize your money transfers

- Ensure your long-term financial security

- Navigate the tax and legal complexities of expatriation

- Use digital tools to simplify the management of your finances remotely

Remember that each expatriation situation is unique. It is always recommended to consult professionals (bankers, tax specialists, lawyers) specialized in expatriation to obtain personalized advice tailored to your specific situation.

By taking the time to properly organize your finances before and during your stay in the Seychelles, you ensure a serene and successful expatriation, allowing you to fully enjoy the beauty and opportunities offered by this paradise archipelago.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.