Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

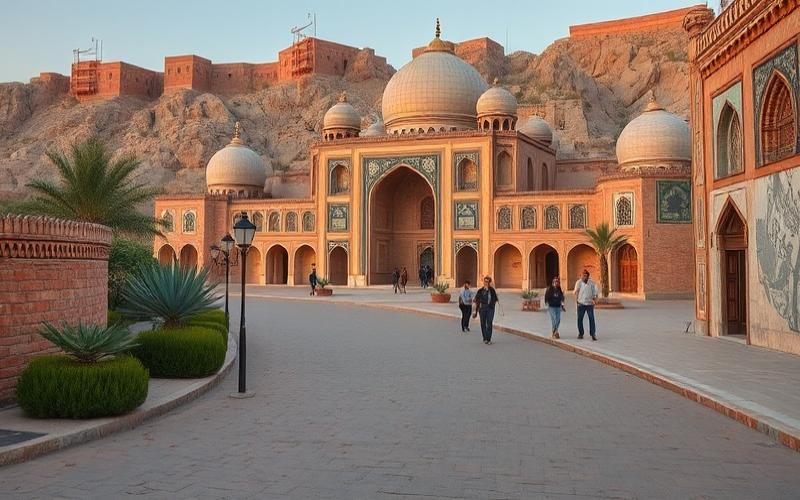

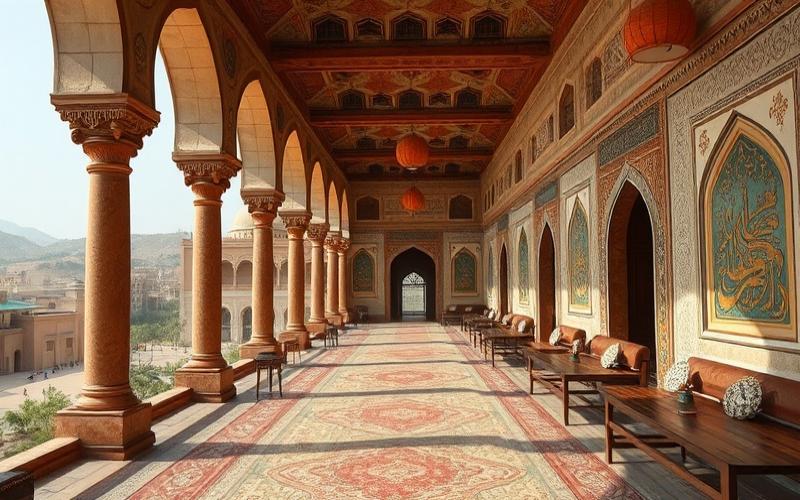

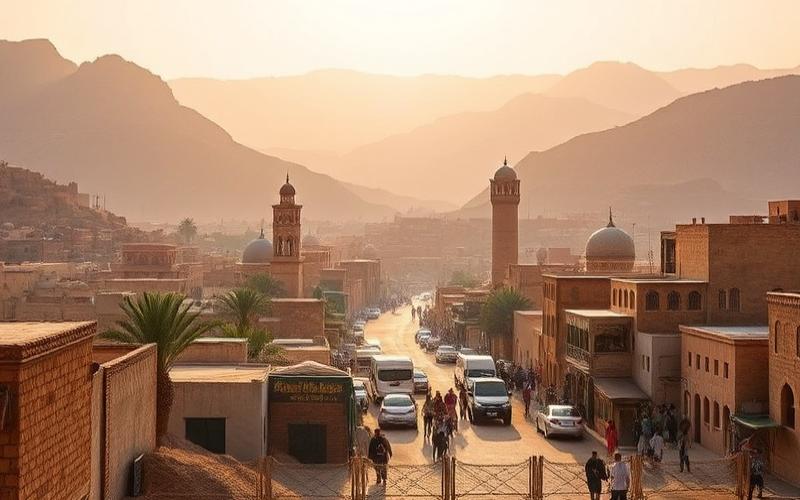

In a rapidly transforming economic landscape, Bahrain is emerging as a promising destination for real estate investment, thanks to an attractive tax environment, ambitious infrastructure projects, and strengthened political stability.

With an expanding market, this Persian Gulf kingdom offers unique opportunities for investors seeking to diversify their portfolios and benefit from long-term growth prospects.

By exploring its various sectors, from residential real estate to commercial developments, discovering the advantages of this dynamic market could prove crucial for those ready to seize opportunities offered by this booming region.

Why Choose Bahrain for Real Estate Investment?

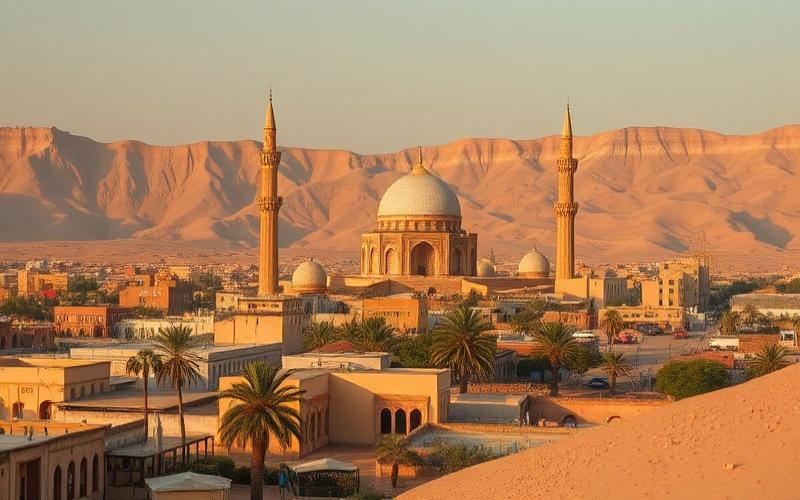

Bahrain is increasingly attracting international real estate investors through a unique combination of stability, favorable tax policies, strategic geographic location, and a booming real estate sector.

Economic and Political Stability

- Strong economic growth, supported by private consumption and investment, together representing about 70% of GDP.

- Stable monetary policy, currency pegged to the US dollar, low inflation, and relatively stable political environment.

Favorable Tax Incentives

- No corporate tax, no personal income tax, and no VAT for most real estate activities.

- Tax environment designed to attract foreign investors and maximize net returns.

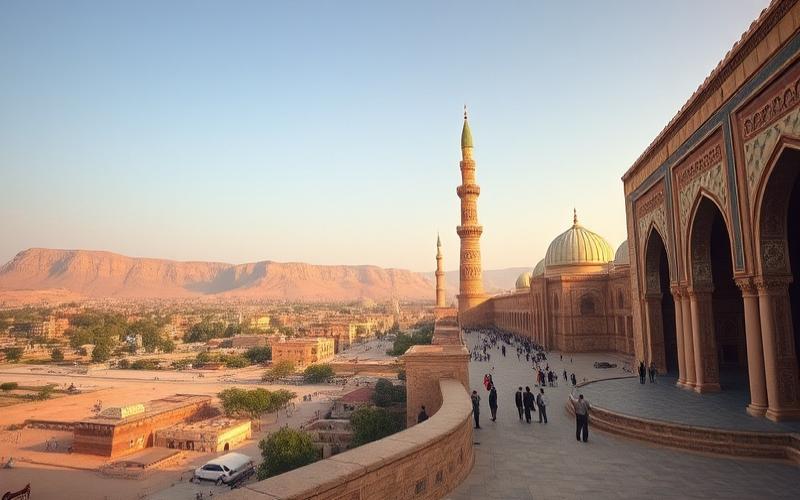

Strategic Position in the Persian Gulf

- Central location between Saudi Arabia, Qatar, and the United Arab Emirates.

- Direct access to major Gulf markets and efficient logistics connections (King Fahd Causeway, modern ports).

Real Estate Development Projects and Growth Opportunities

- Major investments in luxury residential real estate, offices, commercial and tourist areas.

- Recent projects: waterfront districts, high-end residential complexes, business centers, and free zones.

- Increasing demand for luxury villas and apartments, particularly from Gulf, European, and Asian investors.

- National economic recovery plan: over $30 billion invested in infrastructure, housing, tourism, and industry.

Legal Framework for Foreign Investors

- Favorable laws protecting investor rights and ensuring market transparency.

- Establishment of a real estate regulatory authority (RERA) to enhance sector transparency and efficiency.

- Possibility for foreigners to acquire properties in certain designated areas, without major restrictions on ownership or management.

Investor Anecdotes and Testimonials

“I chose Bahrain for the simplicity of administrative procedures and legal security. The rental profitability is higher than in other Gulf markets.”

“Accessibility, diversity of properties, and absence of taxation are decisive arguments for my real estate portfolio.”

Comparison with Other Gulf Markets

| Criterion | Bahrain | Dubai (UAE) | Saudi Arabia | Qatar |

|---|---|---|---|---|

| Real Estate Taxation | Highly advantageous | VAT, high fees | Progressive taxation | VAT, restrictions |

| Political Stability | High | High | Good but evolving | Good |

| Access for Foreigners | Easy, free zones | Very open | More restricted | More restricted |

| Diversity of Offerings | Strong | Very strong | Average | Average |

| Price Level | Competitive | Higher | Variable | Higher |

| Market Growth | Solid, stable | Rapid, volatility | Developing | Moderate |

Summary of Bahrain’s Unique Strengths

- Extremely favorable taxation.

- Direct access and ease of investment for foreigners.

- Diverse real estate offerings at competitive prices.

- Superior stability and legal security.

- Growth potential supported by large-scale projects and proactive public policies.

Bahrain combines ideal conditions for real estate investors seeking security, profitability, and growth prospects in a transparent and welcoming market.

Good to Know:

Bahrain represents a wise choice for real estate investment due to its economic and political stability, combined with attractive tax incentives such as exemption from corporate tax for foreign investors. Its strategic position at the heart of the Persian Gulf offers easy access to neighboring markets. The country is booming with numerous real estate development projects like Bahraini Diyar al-Muharraq, illustrating long-term commitment to sector growth. The favorable legal framework allows foreigners to own properties in certain areas, which is often confirmed by the success of many investors who have described Bahrain as a more open and less saturated market than its neighbors in the region. Compared to other Gulf real estate markets, Bahrain offers a unique balance between innovation and tradition, supported by a welcoming business environment.

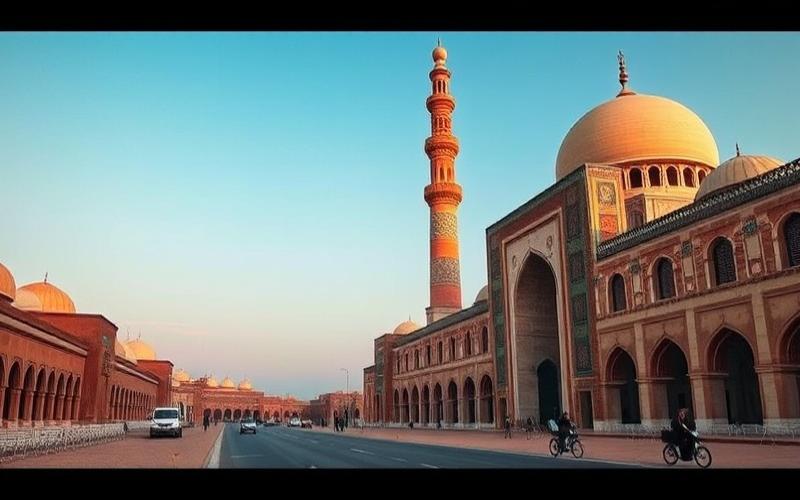

Understanding Bahrain’s Real Estate Market: Prices and Housing Types

Analysis of Current Real Estate Price Trends in Bahrain

In 2025, Bahrain’s real estate market shows overall price stability, with some variations depending on property type and location. The average price per square meter in the city is about 958 BHD ($2,436), fluctuating between 850 BHD ($2,160) and 1000 BHD ($2,542), mainly in urban centers like Manama.

- In Manama, the economic and administrative capital, prices are generally above the national average.

- In Muharraq, the other major hub, rates remain high but slightly lower than in central Manama.

Recent statistics indicate:

- A slight annual decrease of about 3.5% in the apartment segment,

- A moderate increase of 1.5% for villas,

- An overall increase in residential transactions (+0.7%) showing a resilient market despite an uncertain regional economic context.

Classification and Average Prices by Housing Type

| Property Type | Average Price per m² (BHD) | Average Price per m² ($) |

|---|---|---|

| Apartments | 668 | ~1,700 |

| Villas | 640 | ~1,630 |

| Commercial Properties* | >1000 | >2,542 |

*Commercial properties generally show higher rates than classic residential due to demand concentrated in a few strategic areas.

Main types:

- Apartments: From studios to large 4/5-bedroom units in expatriate neighborhoods or economic centers.

- Villas: Mostly located in new residential areas or artificial islands; segment popular with local and expatriate families.

- Commercial/Offices: Mainly present in Manama; dynamic sector thanks to financial services.

Factors Influencing the Market

Summary list of main drivers:

- Government policy:

- Foreign ownership allowed in certain “free zones” with full ownership from 50,000 BHD (~$125,000).

- Continuous expansion of eligible perimeter to attract international investors.

- Notable tax advantages including no tax on rental income.

- Foreign investments:

- Driving role via direct purchases or regional real estate funds.

- Strong demand for high/mid-range housing by GCC families/expatriates.

- Developed infrastructure:

- Major urban projects (e.g., Bahrain Bay).

- Increased deployment of health/wellness infrastructure attracting new buyer/investor profiles.

Regional Comparison with Other Gulf Markets

| Criterion | Bahrain | Dubai | Doha |

|---|---|---|---|

| Entry Ticket for Residence | From ~$125,000 | >$250,000 | >$200,000 |

| Rental Taxation | Exempt | Low | Low |

| Full Foreign Ownership* | Designated areas | Wide free zones | Limited areas |

| Rental Yield | High/stable | Variable | Average |

*Full ownership without Bahraini nationality possible only in specific areas

Bahrain thus stands out for increased accessibility (lower entry ticket), clear legal security, and its smaller size which limits liquidity but favors stability. Costs are significantly lower than in Dubai or Abu Dhabi while offering an environment conducive to stable patrimonial investments.

⚠️ Future Forecasts:

The market should remain stable thanks to the pro-investment policy pursued by the government, gradual extension of “freehold areas,” and rapid emergence of new niches like health/wellness real estate. Growth will be driven mainly by the local/GCC middle class and foreign investors seeking legal security, high yield, and light taxation.

Good to Know:

In Bahrain, the real estate market is marked by a diversity of prices and housing types, with Manama, the capital, showing higher prices than Muharraq, a region in full development. Modern apartments in downtown Manama cost on average 1,500 BHD per m², while villas in popular residential neighborhoods hover around 2,800 BHD per m². Commercial properties, often located in strategic areas, can reach 3,500 BHD per m². Influenced by government policies encouraging foreign investment and infrastructure improvements, the market shows signs of continuous growth. Compared to other Gulf countries like the United Arab Emirates, Bahrain offers attractive investment opportunities, supported by lower entry costs and an expanding tourism sector. Projections indicate price stabilization with a slight increase expected over the next five years, reinforcing interest in this dynamic market.

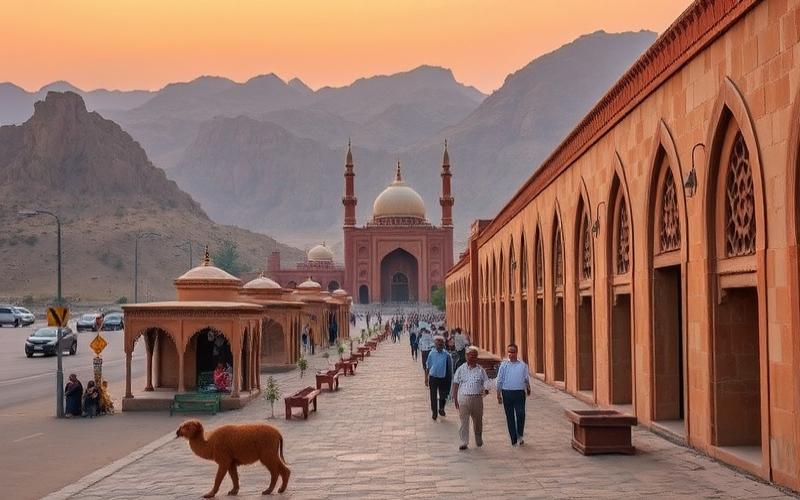

Key Areas for Successful Real Estate Investment in Bahrain

| Area | Available Investment Types | Major Assets | Market Trends and Data |

|---|---|---|---|

| Juffair | Residential (apartments, studios), commercial (restaurants, shops), vacation | Cosmopolitan neighborhood, proximity to US naval base, vibrant nightlife, numerous restaurants and hotels, strong rental demand from expatriates | Stable rents, high rental yield for small units, high occupancy rate, strong appeal for young professionals and expatriates |

| Seef | High-end residential, offices, shops, hotels, mixed projects | Proximity to business district, large shopping malls (Seef Mall, City Centre), international schools, quick access to airport | Among highest prices per m² in the kingdom, strong appreciation of luxury properties, constant demand for offices and commercial spaces |

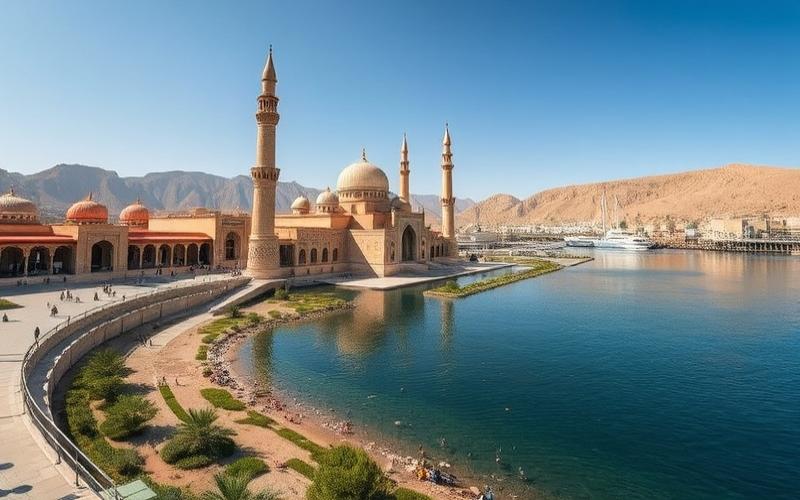

| Amwaj Islands | Residential (villas, apartments), vacation, hotels, shops | Artificial islands, beach setting, marina, luxurious lifestyle, security, modern infrastructure, popular with families and expatriates | Sale prices above average, rising demand for vacation properties, attractive yields on seasonal rentals |

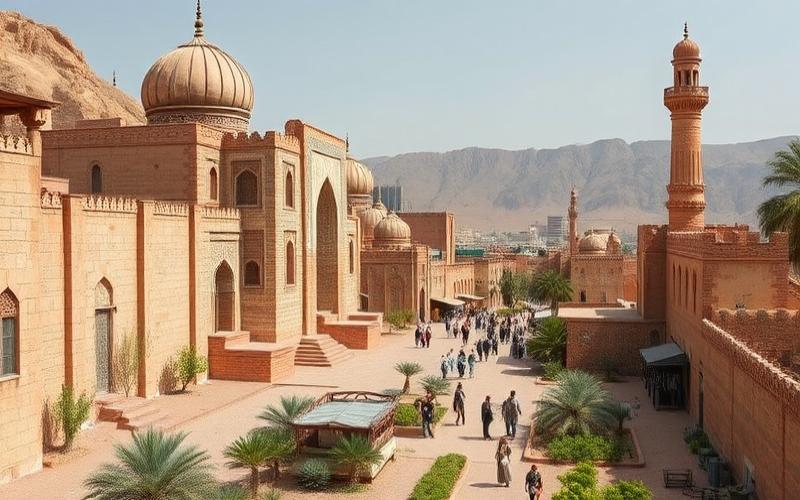

| Manama City Center | Residential, commercial (offices, shops), mixed urban projects | Financial and administrative heart, proximity to institutions, access to transport (roads, port, future metro line), dynamic urban life | Strong demand for modern offices, development of luxury projects (e.g., Harbour Row), prices vary greatly by precise location |

Specific Advantages by Area:

- Juffair: Attracts expatriates for its proximity to military bases and international amenities. Offers vibrant nightlife and services adapted to foreign residents.

- Seef: Major business district, highly sought for commercial and high-end residential investment. Ideal for families due to presence of international schools and shopping malls.

- Amwaj Islands: Preferred destination for vacation and seasonal rentals, with high-end living environment, enhanced security, and direct sea access.

- Manama City Center: Nerve center for business, hosts many international company headquarters, developed transport infrastructure, and innovative real estate projects.

Market Trends and Economic Context:

- Growth in Foreign Direct Investment (FDI): 147.8% increase in 2023, sign of marked dynamism in real estate sector.

- Rental Yield: Juffair and Amwaj Islands show among highest yields in the kingdom, due to strong international rental demand.

- Real Estate Prices: Seef and Amwaj Islands remain the most expensive sectors, but also offer greatest stability and capital gain prospects.

- Strategic Projects: Multiplication of new urban developments (Harbour Row, Waterbay), attractive investment platforms and increased government support.

Perspectives from Local Real Estate Experts:

“Foreign investors favor Juffair for stable rental yields and Seef for long-term appreciation. Families and senior executives are attracted to Amwaj Islands for quality of life and security.”

“Manama city center benefits from sustained demand for modern offices, particularly with the rise of fintech companies and development of the Harbour Row district.”

Strategic Recommendations for Investors:

- Prioritize small and medium-sized apartments in Juffair for optimal rental profitability with expatriates and young professionals.

- Invest in luxury properties or offices in Seef to capture high-end clientele and benefit from business district evolution.

- Choose villas or apartments on Amwaj Islands targeting seasonal rentals or resale to international families seeking secure and luxurious environment.

- Examine mixed and commercial projects in Manama city center to benefit from tertiary sector growth and urban modernization.

Key Takeaways:

Bahrain combines tax attractiveness, economic stability, and modern infrastructure, making its flagship neighborhoods remarkable opportunities for diversified and sustainable real estate investment.

Good to Know:

In Bahrain, areas like Juffair, Seef, Amwaj Islands, and Manama city center stand out for their promising real estate investment opportunities. Juffair is popular for its residential housing and proximity to business centers and international schools. Seef, known for commercial properties, attracts with its proximity to transport infrastructure and shops. Amwaj Islands, prized for vacation investments, offer villas and apartments with sea views, while the vibrant heart of Manama is ideal for varied investments due to its economic growth and strong rental demand. Real estate prices in these areas generally show stable increases, with good rental profitability. A local expert emphasizes the importance of diversifying investments between residential and commercial to maximize returns. Potential investors would benefit from evaluating current market trends and taking advantage of developing infrastructure to optimize their investments.

Opportunities for Foreigners in Bahraini Real Estate

Foreigners can legally acquire real estate properties in Bahrain, but only in certain areas designated by the government. This framework aims to protect national interests while promoting international investment.

Authorized Areas for Purchase by Non-Residents:

- Amwaj Islands

- Juffair

- Seef

- Other specifically designated high-end neighborhoods

Outside these areas, foreigners can only lease real estate (lease up to 99 years) and not become owners.

Property Types Accessible to Foreigners:

- Residential apartments

- Individual villas or in gated complexes

- Offices and commercial premises (in same authorized areas)

Incentives and Financial Facilities Offered:

- No restrictions on repatriation of profits and capital.

Investors can freely transfer income from sale or rental of their real estate property.

- Total exemption from corporate tax for 10 years for certain priority sectors.

This mainly concerns commercial investment or via a locally registered foreign company.

- Absence of personal income tax, which improves net rental profitability or capital gains upon resale.

This applies to both residents and non-residents.

- Local banks sometimes offer special mortgages for foreign buyers with long-term residence permits (e.g., Golden Visa).

Additional opportunity:

Purchase of a real estate property of at least 200,000 BHD allows the foreign owner and their direct family to obtain a golden visa (“Golden Visa”) with residence valid for ten years, renewable under conditions.

| Area | Available Property Types | Tax Advantages |

|---|---|---|

| Amwaj | Apartments, villas, offices | Exemption from personal taxes, free repatriation |

| Juffair | Apartments | Same |

| Seef | Residential & commercial | Same |

Recent Market Trends:

Neighborhoods open to international investments show sustained demand due to their attractiveness to professional expatriates and international families. Gross rental yields generally vary between 5% and 8%, depending on property type and exact location. The country’s positive economic evolution — diversification away from hydrocarbons, development of financial sector — also stimulates real estate appreciation.

Potential Barriers Faced by Foreign Investors:

- Sometimes lengthy administrative procedures during legal transfer of land title

- Need for registration with Survey and Land Registration Bureau

- Prior full payment of regulatory fees

- Limited access outside designated areas (not possible everywhere)

- No land acquisition in certain strategic sectors

- Strict obligation regarding maintenance of purchased property

If investing via a local company majority-owned by a foreigner, all requirements related to creation/management of this local legal entity must also be respected.

In Bahrain, foreign real estate investment is facilitated in several premium districts with full access to apartments/villas/offices; it notably benefits from light or even non-existent taxation as well as the right to unlimited repatriation of gains; however, there are still some legal constraints regarding geographic choice as well as rigorous administrative procedures during each transaction.

Good to Know:

In Bahrain, foreigners can invest in real estate properties in designated areas such as Amwaj Islands, Durrat Al Bahrain, and Bahrain Bay, mainly for apartments, villas, or offices. Current laws authorize these investments, but strict regulations are in place, often accompanied by complex administrative procedures. Opportunities for special mortgages and tax exemptions are available, making the market attractive. Recent trends show growth in new constructions, with potentially high return on investment due to continuous economic development. However, investors must be aware of potential challenges, such as legal restrictions and the impact of changing policies.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.