Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

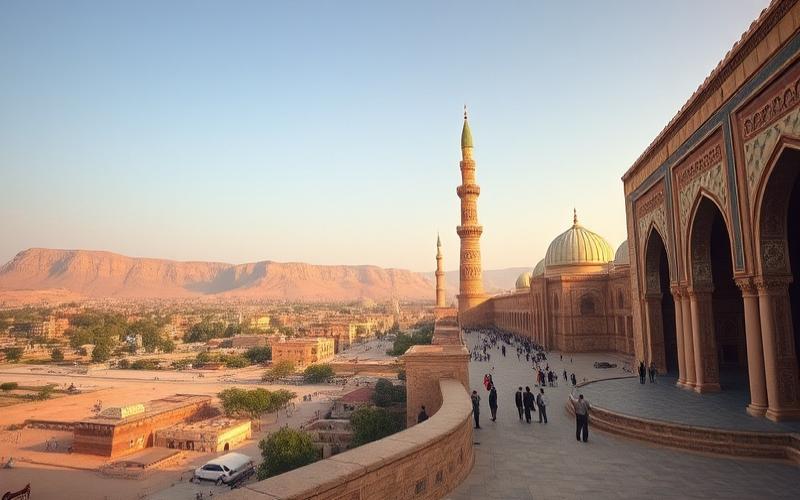

Bahrain: A Booming Real Estate Market

Bahrain, this small archipelago in the Persian Gulf, is increasingly attracting the attention of international investors thanks to a booming real estate market. Despite its modest size, the country offers a surprising diversity of innovative projects and high-end residential developments, demonstrating growth that seems to defy regional trends.

Today, economic dynamics, combined with incentive policies and structural reforms, make this kingdom fertile ground for innovation and real estate profitability. Let’s break down together the driving forces currently shaping this rapidly changing market.

Expanding Sectors in Bahrain’s Real Estate Market

Expanding Sectors in Bahrain’s Real Estate Market

- Luxury Residential Properties and Second Homes

- Significant increase in demand for high-end villas and apartments, particularly in iconic neighborhoods like Bahrain Bay, Amwaj Islands, and Juffair.

- Expatriates represent over 70% of the rental market, attracted by modern infrastructure and attractive tax policies (tax-free rental income).

- Average villa prices increased by 1.5% between 2024 and 2025.

- Entry-level residential prices starting from €125,000.

- Commercial Offices and International Presence

- Increased opportunities in office real estate, stimulated by the arrival of international companies taking advantage of legal clarity and full property rights in key areas.

- Development of business districts like Bahrain Bay, focused on smart city projects and digital connectivity.

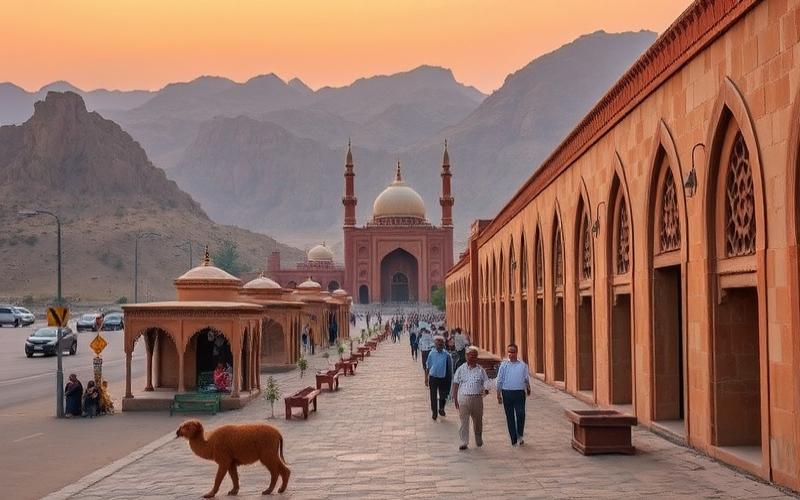

- Hospitality Sector and Tourism Infrastructure

- Sustained tourism growth thanks to infrastructure modernization (beaches, marinas, shopping centers).

- Proliferation of high-end hotel projects in response to rising tourist numbers and Bahrain’s positioning as a leisure and business destination.

Table: Recent Bahrain Real Estate Market Indicators

| Indicator | Value or Trend |

| Transaction Growth (2022-2023) | 4.8% → 5.1% |

| Expatriate Share of Rental Market | >70% |

| Average Villa Price Increase (2024-2025) | +1.5% |

| Residential Entry Price | From €125,000 |

| Rental Yield vs. UAE/Qatar | Higher, stable prices |

| Freehold Areas | Continuous extension |

Recent Large-Scale Real Estate Projects

- Bahrain Bay: Smart city project with residential neighborhoods, office towers, hotels, and a marina.

- Amwaj Islands: Development of artificial islands dedicated to luxury residential, tourism, and seasonal rentals.

- New Hotel Complexes and beach resorts along the coastline, aimed at attracting international clientele.

Impact of Government Policies and Economic Diversification

- Extension of freehold areas, allowing foreigners to acquire real estate in more attractive neighborhoods.

- Recent legislative reforms facilitating foreign investment and securing property rights.

- Economic diversification initiatives, particularly in tourism, health, and wellness, creating new real estate markets (medical residences, wellness complexes, etc.).

- Advantageous Tax Policy: Tax exemption on rental income, no property tax for investors.

Market characterized by stable growth, increased accessibility for foreign investors, and proactive government policy supporting real estate innovation.

Good to Know:

Bahrain’s real estate market is experiencing notable expansion in several key sectors. The growing demand for luxury residential properties, fueled by increasing local wealth and heightened interest from expatriates, is stimulating urban development, particularly in prestigious districts such as the Seef area. Meanwhile, the commercial office landscape is booming with the arrival of international companies, taking advantage of Bahrain’s attractive policies. Iconic projects, like the Avenues Mall Extension, illustrate this dynamic. Tourism is also a growth driver thanks to the development of infrastructure such as new hotels from global chains. A sign of this vitality is the significant increase in foreign investment, encouraged by government initiatives aimed at diversifying the economy beyond oil, such as the Bahraini Development Bank’s economic incubator. These measures create a favorable environment for global and speculative investments, thereby energizing the entire national real estate sector.

Overview of Real Estate Price Evolution in Bahrain

The evolution of real estate prices in Bahrain over the past ten years has been marked by overall stability, punctuated by moderate variations depending on segments and regions. Despite a fluctuating economic context in the Gulf, the market has demonstrated resilience.

Influential Economic and Policy Factors

- Regional Economic Slowdown: The drop in oil prices in the second half of the 2010s affected growth, limiting the rise in real estate prices.

- Government Reforms: The gradual opening of certain areas to full foreign ownership has boosted demand, particularly in sectors like Bahrain Bay or Amwaj Islands.

- Diversification Initiatives: Investments in infrastructure, health, education, and tourism have supported real estate demand.

- Relative Political Stability: Despite some tensions, Bahrain has maintained a relatively attractive environment for foreign investors.

Price Evolution (2015-2025)

| Year | Average Apartment Price (BD/m²) | Annual Variation | Average Villa Price (BD/m²) | Annual Variation |

| 2015 | ~1,100 | – | ~950 | – |

| 2020 | ~900 | -2 to -3% | ~600 | stable |

| 2024 | 668 | -3.5% | 640 | +1.5% |

| 2025 | 668 | stable | 640 | stable |

- Apartments have seen a gradual decline since 2015, with a current average price around 668 BD/m².

- Villas have held up better, recording a slight recent increase to reach approximately 640 BD/m².

- Residential Transactions increased by 0.7% over the last year, for a total value of 1.08 billion BD.

Regional Variations

- Manama City Center: Among the highest prices, up to 1,500 BD/m² for apartments, high monthly rents for luxury properties.

- Amwaj Islands, Seef, Juffair: Attractive freehold areas for expatriates and foreign investors, prices above the national average.

- Suburbs and Outskirts: More accessible prices, between 850 and 1,100 BD/m², strong rental demand from local families and oil sector personnel.

| Location | Apartment Purchase Price (BD/m²) | 1-Bedroom Rent (BD/month) |

| City Center (Manama) | 1,035 – 1,500 | 316 |

| Outside City Center | 850 – 1,100 | 221 |

| Amwaj Islands, Seef, Juffair | 1,200 – 1,600 | 350 – 500 |

Residential vs. Commercial Comparison

- Residential: Mature market, gross rental yield around 6.5 to 7% in the city center, strong demand in expatriate areas.

- Commercial: More volatile, highly dependent on the health of the service, finance, and tourism sectors; higher prices in business districts, but less stable yields during economic slowdowns.

Regulatory Factors and Foreign Investment

- Gradual extension of freehold areas.

- Guaranteed property rights for foreigners in certain strategic areas.

- Residency offered for purchases above a threshold (approximately €125,000).

- Favorable tax policy (tax-exempt rental income).

Recent Statistics

- Price-to-income ratio: 5.42 (moderate affordability index).

- Mortgage: 54.2% of average income dedicated to repayment.

- Gross rental yield (city center): 6.97%.

- Price-to-rent ratio stable for three years.

Forecasts

⬛️ The real estate market in Bahrain is expected to remain stable in the short term, supported by foreign demand, the extension of freehold areas, and economic diversification. Apartment prices may remain under pressure, while villas and properties in premium areas should retain their attractiveness. Regulatory reforms and the rise of new smart neighborhoods (like Bahrain Bay) could stimulate medium-term growth.

In Summary

- Stable market, attractive for investors seeking a clear legal environment, competitive rental yields, and a moderate entry cost compared to Dubai or Doha.

- The residential sector offers more security, while the commercial sector presents higher yield potential but is riskier.

- The future direction will largely depend on regional economic growth, political stability, and the effectiveness of government reforms.

Good to Know:

Over the past ten years, real estate prices in Bahrain have shown moderate growth, influenced by economic factors such as GDP fluctuations, the drop in oil prices, and tax incentives for foreign investors. The Al Seef and Amwaj Islands regions recorded the most significant increases in the residential sector, while neighborhoods like Manama saw relative stability. In comparison, commercial property prices have been more volatile due to variations in business sector demand and economic diversification initiatives. For example, in 2019, the market experienced a 5% decline in some commercial areas, but a recovery was observed following the establishment of new companies. Recent government reforms, promoting foreign investment and simplifying purchase processes, are expected to continue stimulating the market. Looking ahead, with improved infrastructure and efforts to attract more foreign investment, real estate prices in Bahrain are expected to experience gradual stabilization, with potential for moderate increase in the medium term.

Investing Smartly: Which Properties to Prioritize in Bahrain?

Investing Smartly: Which Properties to Prioritize in Bahrain?

Analysis of Popular and Emerging Neighborhoods in Bahrain

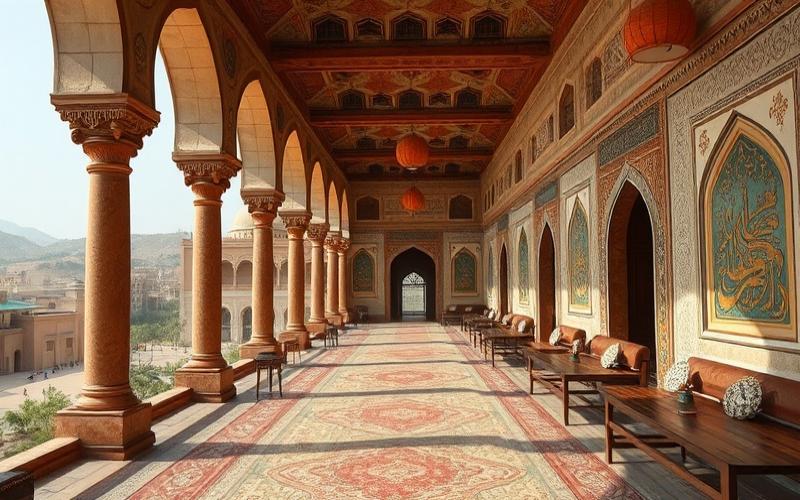

- Manama (Harbour Row)

A central, dynamic, and modern neighborhood, Harbour Row is renowned for its luxury apartments, restaurants, shops, and leisure spaces. The infrastructure is comprehensive: gym, pool, spa, green spaces, and immediate proximity to main business centers and cultural attractions. - Dilmunia Island

An innovative residential project located near the north coast of Muharraq, focused on wellness, health, and tourism. It attracts an international clientele and offers state-of-the-art facilities, including health centers, entertainment spaces, and modern housing. - Amwaj Islands

A rapidly growing residential area, popular for its private beaches, marinas, international schools, and shops. The island particularly attracts expatriates and families seeking a high-end living environment.

| Neighborhood | Dominant Property Types | Key Infrastructure/Services |

| Harbour Row | Luxury Apartments | Restaurants, shops, leisure spaces, gym |

| Dilmunia Island | Villas, Apartments | Health centers, entertainment, wellness spaces |

| Amwaj Islands | Villas, Apartments | Private beaches, marinas, schools, shopping centers |

Trending Property Types and Reasons for Their Attractiveness

- Apartments

Highly sought after by expatriates and young professionals for their ease of management, security, and central location. Luxury apartments offer attractive rental yields, thanks to strong rental demand linked to the expansion of the service and commerce sectors. - Villas

Popular with families and long-term investors, they benefit from a superior living environment, larger spaces, and adapted infrastructure (gardens, pools). - Commercial Projects

Commercial premises and offices benefit from the growth of SMEs and the establishment of multinationals, particularly in emerging business districts and on artificial islands.

Recent Economic and Legislative Factors

- Foreign Ownership Policies

Bahrain allows foreigners to purchase real estate in designated areas, such as Amwaj Islands, Reef Island, and certain projects in Manama and Dilmunia. This openness stimulates international investment. - Tax Incentives

Absence of property tax and capital gains tax on real estate for investors, which increases the net profitability of investments. - Government Development Projects

Vast public investments in infrastructure (roads, airports, hospitals, schools) and the launch of innovative urban projects boost land value in the medium term. - Sector Growth

Bahrain’s real estate market is expected to exceed USD 77.3 billion by the end of 2025, driven by residential demand and the continuous arrival of expatriates.

Practical Tips for Diversifying Your Real Estate Portfolio in Bahrain

- Diversify between residential properties (apartments, villas) and commercial properties (offices, shops) to balance rental yield and value stability.

- Prioritize emerging neighborhoods benefiting from public investments and strong medium-term appreciation potential.

- Rely on rental statistics: Bahrain boasts the best rental yields in the Gulf, allowing for buy-to-sell or long-term rental strategies.

- Evaluate infrastructure offerings: proximity to international schools, transportation, green spaces, and shopping centers increases property attractiveness.

- Stay informed about legislative developments regarding foreign ownership and new government projects to anticipate value increases.

Key Takeaway

Bahrain combines economic stability, tax incentives, and large-scale projects, making it a strategic market for smart investment in residential and commercial real estate, with particular attention to promising neighborhoods and portfolio diversification.

Good to Know:

In Bahrain, neighborhoods like Juffair and Amwaj Islands are booming due to their modern infrastructure and high-end services, attracting promising investments. Apartments on these artificial islands are gaining popularity due to their rental profitability and the luxurious lifestyle they offer, while villas in Diyar Al Muharraq appeal for their proximity to government development projects. Recent foreign ownership policies and tax incentives, such as the absence of income tax, enhance the market’s attractiveness. To diversify effectively, investors should consider a combination of residential and commercial properties, relying on advice from local experts. For example, a mix of villas for long-term stability and apartments in trendy new neighborhoods can offer a good balance, especially since 45% of Bahrain’s population is under 25 years old, fueling demand for modern and affordable housing.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.