Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

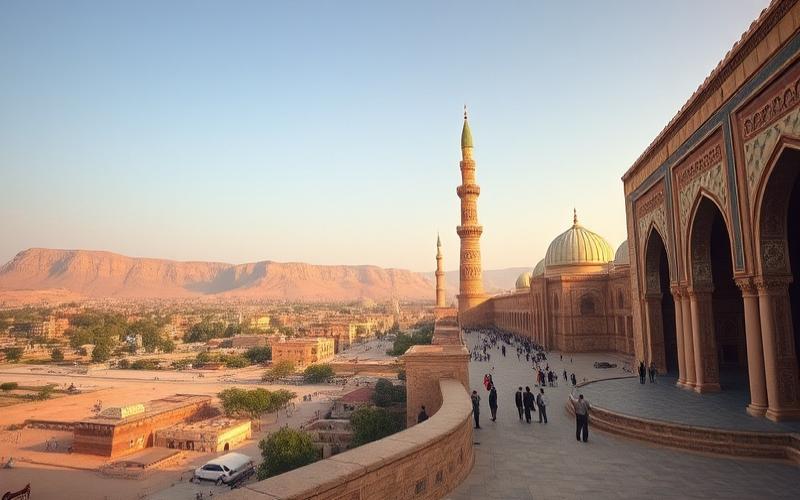

Investing in Bahrain’s Hospitality Sector: A Unique Opportunity

Investing in Bahrain’s hospitality sector presents a unique opportunity to enter a rapidly expanding market within the Persian Gulf. As this island kingdom continues to attract tourists worldwide with its breathtaking landscapes and international events, purchasing a hotel can prove to be a lucrative decision for savvy investors.

Checklist for a Successful Acquisition

This article guides you through a comprehensive checklist, covering crucial aspects such as:

- Legal requirements

- Financing strategy

- Market trends

Good to know:

Understanding the local economic and cultural context is essential to capitalize on the numerous opportunities offered by this dynamic segment.

Bahrain Hotel Market Overview

Bahrain’s hotel sector is undergoing significant transformation, driven by sustained tourism growth and strategic investments in accommodation offerings.

Recent Statistics

- International visitors in 2024: 12.2 million, representing a 6.8% increase compared to 2023.

- Tourism revenue generated in 2024: $4.5 billion, accounting for approximately 6.3% of GDP.

- Jobs related to the tourism sector: over 70,000 people.

- Average hotel occupancy rate (Q1 2025): 52.1%, down from 54.2% recorded in Q1 2024. Specifically in March 2025: net room occupancy rate at 22.5% and permanent bed occupancy at 15.4%, reflecting marked seasonality.

| Year | International Visitors | Average Occupancy Rate |

|---|---|---|

| 2023 | approx. 11.4 million | ~54% |

| 2024* | 12.2 million | ~52% (Q1) |

Main Accommodation Categories

- Luxury hotels (5-star), often affiliated with international chains or integrated into mixed-use complexes

- Mid/upper-range hotels (3 and 4-star)

- Budget establishments and aparthotels

- Alternative accommodations developing around new tourist hubs

In March 2025, the “hotels and similar accommodations” category represented nearly 94% of recorded overnight stays, confirming the dominance of the traditional hotel model for tourist accommodation.

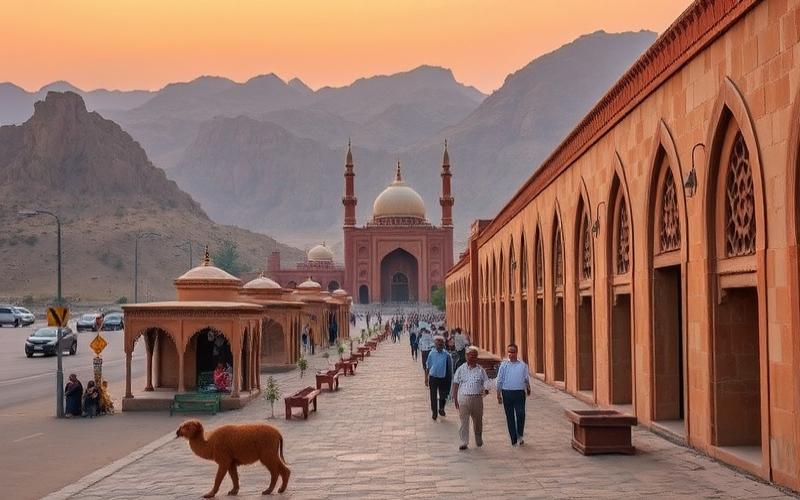

Current Hotel Development Trends

- Continuous construction or renovation of upscale establishments to support the kingdom’s premium positioning in the business/luxury leisure segment

- Growing prominence of hotel projects integrated into major urban or island development plans (example: artificial islands)

- Diversification with increasing integration into international programs such as Marriott Bonvoy

- Accelerated deployment following major seasonal peaks like the F1 Grand Prix or religious holidays

- Strong growth in the luxury/business segment

- Moderate increase in budget/alternative offerings

- Geographic expansion toward newly created artificial tourist zones

Economic & Political Influences

- Strong government commitment to diversify the economy beyond hydrocarbons through massive tourism development;

- Tax incentives/foreign investment facilitation attracting global hotel operators;

- Relative political stability distinguishing Bahrain within the Gulf despite some potential regional tensions that may occasionally impact tourist flows;

- Regulatory environment favorable to public/private partnerships in this sector.

Main Preferences Among Tourists Visiting Bahrain

- Clear predominance of regional tourism (particularly Saudi visitors)

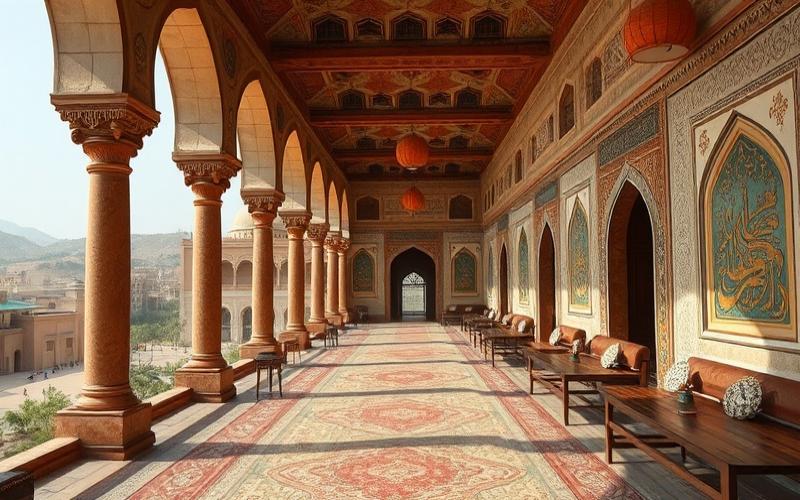

- Increased demand for premium experiences: spas/wellness – gastronomy – luxury shopping – major sporting events

- Growing interest in cultural/historical offerings but volume still lower than conventional leisure-business stays

Major Challenges for Investors

- Significant periodic decline in occupancy rates due to strong local seasonality

- Growing competitive pressure with rapid multiplication of new openings

- Constant need for hotel/F&B innovation to meet high expectations (customer service digitalization)

Key Opportunities

- Facilitated access to land/development through government support

- High potential during major international events hosted annually

- Strategic positioning as a “hub” destination between Europe-Asia-Africa

The Bahraini hotel market therefore operates within a robust yet demanding dynamic: it offers attractive potential provided rigorous management addresses structural challenges, particularly seasonal volatility.

Good to know:

The hotel market in Bahrain is expanding rapidly, with over 200 hotels, approximately 40% of which are classified in the luxury category, offering high-end services to visitors. The average occupancy rate stands around 65%, supported by business tourism and proximity to Saudi Arabia. Budget hotels are also gaining popularity, attracting visitors seeking good value for money. Government-driven economic diversification encourages investments in the hotel sector, but the market remains sensitive to oil fluctuations and regional tensions. Tourists primarily flock for sporting events, culture, and shopping, prioritizing modernity and infrastructure quality. Potential investors must meet international standards while capitalizing on the growth of local and regional tourism.

Practical Guide to Buying a Hotel in Bahrain

Bahrain Hotel Market Overview

Bahrain’s hotel sector is experiencing significant growth, with regional occupancy rates reaching 69.5% in 2024, exceeding pre-pandemic levels. Revenue per available room (RevPAR) increased by 5.4% year-over-year. Demand is supported by government investments in infrastructure and active tourism promotion. Luxury hotels are particularly dynamic and considered a key growth driver.

In 2024, the country welcomed 12.2 million visitors, generating $4.5 billion for the tourism sector (+7.5% vs. 2023). Tourism now represents approximately 6.3% of GDP and employs over 70,000 people.

Main Trends

- Upscaling of establishments (luxury).

- Digital transformation: online booking, enhanced customer experience.

- Development of major infrastructure and new hotel complexes.

- Diversification of cultural and event attractions.

Forecasts

The upward trend is expected to continue with anticipated influx around major regional events and upcoming openings of new high-end hotels.

Essential Steps to Prepare for Hotel Purchase

- Thorough study of the local market

- Analyze occupancy rates by neighborhood (Manama remains central but some coastal areas are rising).

- Identify target clientele: business vs leisure; local vs international.

- Observe seasonal trends.

- Selection of profitable geographical areas

- Manama (capital): strong business & cultural tourism demand.

- Seef District: shopping & business.

- Amwaj Islands/Juffair: leisure/international high-end tourism.

- Understanding sought-after hotel types

- Urban boutique hotels or premium beach resorts currently in high demand.

- Growing demand for innovative concepts blending traditional hospitality/modern technology.

- Competitive analysis

- Identify pricing/amenity positioning of direct competitors in immediate proximity.

Legal Aspects to Consider

- Mandatory obtaining of specific license issued by the Ministry of Industry and Commerce as well as Bahrain Tourism and Exhibitions Authority (BTEA).

- Strict compliance with health/safety fire/architectural specifications regulations.

- For foreign investors:

- Full or partial ownership possibility depending on location (free zones or not);

- Process facilitated by recent incentive policies aimed at attracting foreign capital;

- Potential requirement to go through a sponsored local company if establishing outside free zones;

- Prior verification with the Bahrain Economic Development Board recommended to know all specific sector restrictions;

- Also comply with all regulations regarding recruitment/visas if foreign workforce planned.

Financial Advice

Accurate assessment of hotel property price via specialized agencies/local expert firms;

Consider:

- Average price per m² variable by location/prestige (~$1,500–$3,500/m² excluding fittings);

- Ancillary legal/notary fees (~2–5%);

- Potential renovation/upgrading costs variable depending on initial condition/project scale (~$300–$800/m² for standard renovation).

Financing search:

- Local banks offering professional/hotel real estate credit;

- Sovereign fund Mumtalakat sometimes partner on strategic projects;

- Possibility of co-investment with regional players via hotel joint ventures;

Indicative associated costs list:

| Item | Estimation range |

| Land/building acquisition | $1,500–$3,500 / m² |

| Notary/legal fees | ~2% – 5% |

| Renovation | $300 – $800 / m² |

| Operating license | Variable by category |

| Working capital | Depending on establishment size/profile |

Useful Resources & Contacts in Bahrain

Non-exhaustive list:

- Specialized hotel real estate agencies: Cluttons Bahrain; CBRE Bahrain; Knight Frank Middle East

- Specialized hospitality/tourism investment consultants: Colliers International MENA Hospitality Advisory; HVS Middle East

- BTEA (Bahrain Tourism and Exhibitions Authority), one-stop shop for licenses/operations

- Bahrain Economic Development Board — support for foreign investors

Practical Tips from Local Professional Testimonials

“Properly surrounding yourself from the initial study phase often helps avoid financial losses during due diligence”

“Establishments that quickly adopted digital solutions saw their RevPAR progress faster post-health crisis”

“A location near major road arteries or event hubs guarantees better annual stability in occupancy rates”

Getting local support from the pre-acquisition phase remains crucial to understand administrative nuances/business networking that accelerate obtaining authorizations/effective operation

Good to know:

The hotel market in Bahrain is currently expanding rapidly, with growing demand for luxury hotels and urban establishments in areas like Manama. To prepare your purchase, focus on key locations such as the diplomatic district and remember that mid to high-end hotels particularly attract business travelers and tourists. Legally, a specific license is required and it’s important to familiarize yourself with foreign investment regulations. Financially, carefully assess market prices and plan for purchase financing as well as renovation costs. Collaborating with specialized real estate agents and using recognized hospitality consultants in Bahrain can facilitate the process. Finally, follow advice from local owners, who recommend considering seasonality in operational planning and exploring additional services to stand out.

Hospitality Due Diligence: Key Steps in Bahrain

Key Due Diligence Steps for Hotel Acquisition in Bahrain:

- Analysis of local regulations and legal requirements

- Identification of Bahrain-specific laws regarding hotel acquisition (operating licenses, foreign ownership restrictions, compliance with urban planning and tourism standards).

- Verification of prior obtaining of all necessary authorizations from competent local authorities.

- Consideration of potential incentive schemes or constraints related to the Bahraini hotel sector.

- Verification of property titles

- Thorough examination of land title to ensure seller’s full ownership.

- Search for potential encumbrances, mortgages, or easements affecting the property.

- Validation with local land registry.

- Evaluation of current contracts

- Detailed analysis:

- Supplier contracts (food service, laundry, maintenance…)

- Agreements with financial partners

- Commercial leases or hotel management contracts

- Restrictive clauses that may limit future operations

- Tax and financial audit

- In-depth analysis:

- Recent balance sheets

- Income statements and cash flows

- Detailed verification of existing or deferred tax debts

- Examination of seller’s compliance with local tax obligations

- Complete physical inspection

- General condition:

- Main infrastructure (rooms, common areas)

- Technical installations (air conditioning, plumbing)

- Strict compliance with Bahraini fire and safety standards

- Precise list of urgent work to anticipate

Inspected Aspect Key Points to Verify Building structure Major pathologies, seismic compliance Safety Fire/evacuation systems compliant Maintenance Preventive maintenance history - Local & international reputation assessment

- Qualitative analysis:

- Customer reviews on international platforms (Booking.com, TripAdvisor…)

- Overall rating on local/regional specialized Persian Gulf tourism search engines

- Reputation among local B2B partners

- Commercial & strategic due diligence

- Understanding market positioning:

- Recent studies of direct competition in target region/city

- Current customer segmentation vs. potential post-acquisition

- Analysis of tourism trends specific to Bahrain (business vs leisure…)

Concrete example: When a regional fund acquired a five-star resort near Manama in 2023, it commissioned a cross-competitive study between international hotels and high-end family resorts. This approach revealed that over 30% of bookings came from MICE events during the annual F1 Grand Prix – a decisive element for adjusting pricing policy post-acquisition.

- Socio-cultural & environmental considerations specific to Bahrain

- Sensitivity to local cultural practices: respecting dress codes in certain common public spaces; adapting food offerings during Ramadan.

- Environmental impact: analysis of installation compliance with national ecological regulations; anticipating potential pressure related to regional water stress.

- Consultation with local multidisciplinary experts

- Recommended list:

- Lawyers specialized in Bahraini real estate/hotel law

- Certified accountants familiar with local taxation

- Hotel consultants who have previously managed projects in the Gulf

- Structurally/environmentally accredited local engineers

Summary Table

| Key Step | Main Objective |

|---|---|

| Local regulations | Secure legal compliance |

| Land title | Guarantee absence of legal obstacles |

| Supplier/partner contracts | Map existing commitments |

| Tax-financial audit | Validate economic/fiscal solidity |

| Technical inspection | Anticipate essential CAPEX |

| Market reputation | Quantify customer/distributor perception |

| Commercial due diligence | Position strategy relative to market |

| Socio-cultural/environmental aspects | Avoid exogenous operational risks |

| Consultation with local experts | Limit blind spots through contextualized expertise |

The success of a hotel acquisition in Bahrain directly depends on a multidisciplinary approach integrating both legal specifics and commercial or cultural particularities unique to the Kingdom.

Good to know:

When acquiring a hotel in Bahrain, rigorous due diligence proves crucial to avoid costly surprises. Begin by analyzing local regulations and legal requirements, as they can vary significantly from other regions. Meticulously verify property titles and ensure no encumbrances or mortgages affect the establishment. Evaluating existing contracts, particularly those with suppliers and financial partners, can reveal important commercial obligations. A tax and financial audit should be conducted to scrutinize recent balance sheets and verify any potential tax debts. Physically inspect the hotel to assess infrastructure condition and compliance with safety standards, anticipating maintenance or renovation costs. The hotel’s reputation on online platforms and its strategic market positioning are also key indicators to explore. Finally, consider socio-cultural and environmental specificities unique to Bahrain, which may influence future operations. Working with local experts in hospitality, law, and finance, who have detailed knowledge of the Bahraini market, can provide greater assurance in this complex process.

Impact of Tourism Statistics on Hotel Investment

Recent tourism statistics in Bahrain reveal a clear sector recovery post-pandemic, with significant increases in tourist arrivals and gradual return to pre-pandemic spending levels. These trends directly influence hotel investment, particularly regarding occupancy rates, seasonality, and visitor preferences.

Recent Tourism Trends in Bahrain:

- Tourist arrivals:

- 2023: 17.24 million arrivals (historic record)

- 2022: 13.77 million

- Average (2018-2023): approximately 11.66 million

- Low point during pandemic in 2020: only ~2.84 million

- International tourism expenditures:

| Year | Expenditures (USD) | Annual Variation (%) |

|---|---|---|

| 2017 | 4.38 billion | +8.9 |

| 2018 | 3.83 billion | -12.5 |

| 2019 | 3.86 billion | +0.7 |

| 2020 | 724 million | -81.2 |

Since the global health crisis of 2020 (sharp decline), flows are recovering and gradually approaching pre-pandemic levels.

Hotel Occupancy Rates & Seasonality:

- Occupancy rates are generally high during:

- cooler months (November to March), preferred by international tourism.

- regional holiday periods, particularly during Ramadan or Eid when regional influx increases.

- Low season corresponds to very hot months (June to August), where attendance drops significantly.

Main Tourist Preferences:

- Cultural tourism around authentic Bahraini heritage

- International sporting events and cultural festivals

- Beach stays on the archipelago

Influence on Hotel Investment Decisions:

Investors analyze these statistics to assess:

- Expected profitability, estimated through average occupancy rates and average spending per tourist.

A strong post-pandemic rebound reassures about future growth potential.

- Seasonality, which often requires fine personnel management and price adaptation according to demand.

List – Implications for Hotel Investment:

- Increased profit during seasonal peaks = incentive to invest in high-end or MICE (Meetings Incentives Conferences Exhibitions).

- Possible diversification toward off-season adapted offerings or targeting loyal regional clientele.

- Consideration of gradual return to high spending levels per visitor.

Government Policies & Hotel Market Attractiveness:

The Bahraini government adopts several favorable policies:

- Tax incentives for foreign investments in the tourism sector.

- Active support for modern, connected hotel infrastructure.

- Enhanced international promotion through major events & regional partnerships.

These measures strengthen:

- Investor confidence

- Overall market attractiveness

- Acceleration of innovative projects related to digital tourism

Combined analysis of these elements shows that positive evolution of tourism indicators strongly stimulates appetite for hotel investment in Bahrain while dictating strategic choices according to actual demand observed on the ground.

Good to know:

In Bahrain, tourism statistics reveal high hotel occupancy rates from October to April, with notable peaks during cultural festivals and sporting competitions, making these key periods to maximize profitability. Conversely, summer months experience decreased attendance, prompting investors to offer attractive packages. Tourist preferences include luxury and access to local attractions, influencing investment decisions toward modern facilities and authentic experiences. Government initiatives to diversify tourism offerings and facilitate travel, such as visa extensions and infrastructure development, enhance the hotel market’s appeal. For potential investors, these developments suggest sustained growth and profitability opportunities provided offerings are adjusted to seasonal dynamics and visitor expectations.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.