Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

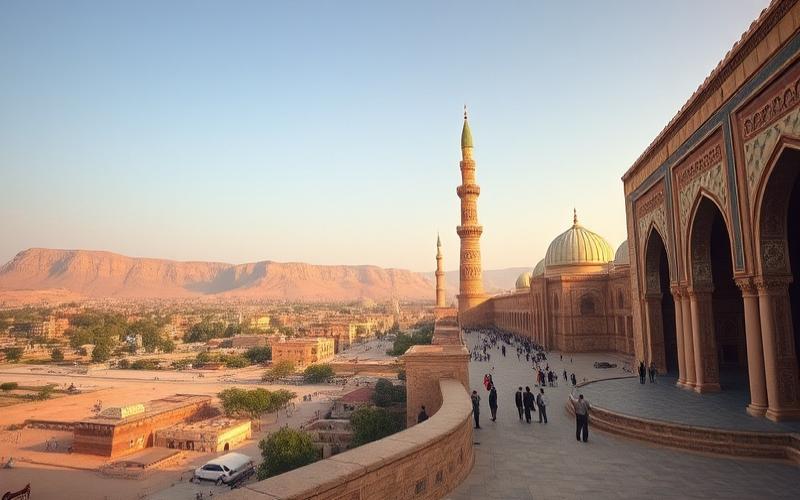

Buying Real Estate in Bahrain: A Paradise with Hidden Pitfalls

Bahrain, with its modern developments and cosmopolitan atmosphere, represents an attractive paradise for real estate investors. However, diving into this market without thorough preparation can lead to costly mistakes.

Whether you’re a seasoned investor or a novice buyer, it’s crucial to be aware of the potential pitfalls that await every real estate transaction here. From legal complications to inaccurate valuations, deceptions are plentiful and can easily turn what seemed like a good deal into a genuine financial nightmare.

Understanding the Bahraini Market

Understanding local regulations and the specificities of the Bahraini market constitutes an essential step to ensure a successful and secure acquisition in this dynamic kingdom.

Good to Know:

Foreign investors can purchase real estate in designated areas in Bahrain, but it’s essential to verify local restrictions before committing.

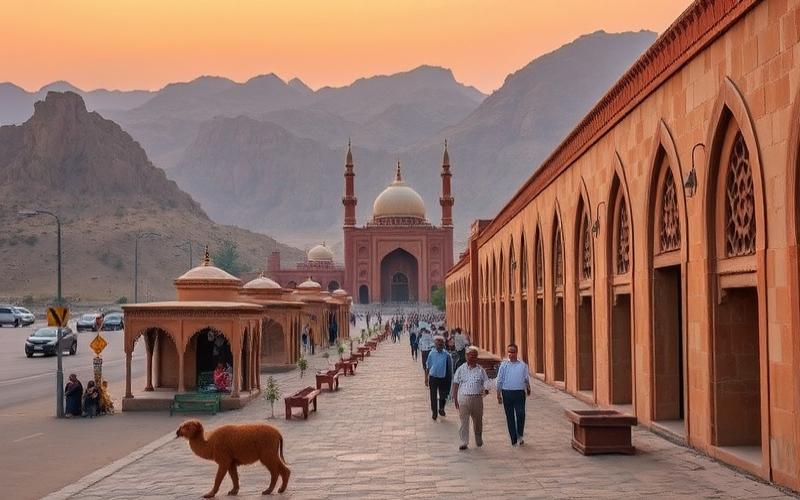

Pitfalls to Avoid When Buying Real Estate in Bahrain

The Bahraini real estate market presents unique characteristics, including increased openness to foreign investors, but also specific restrictions and obligations to respect to avoid legal and financial pitfalls.

Foreign Ownership Zones

- Only certain designated areas (for example Juffair, Amwaj Islands, Seef district) allow 100% foreign ownership.

- Outside these free zones, purchase by non-Bahrainis is prohibited or very limited.

- It’s imperative to verify that the targeted property is indeed located in an eligible area before any commitment.

Real Estate Developer Verification

- Always check the developer’s legitimacy, ensuring they possess required licenses and have a reliable track record in the local market.

- Request to see official registration documents from the land registry as well as any bank guarantees associated with the project.

Practical Tips to Avoid Common Real Estate Scams:

- Carefully read every legal document (purchase contract, deed of ownership, cadastral plans). Never sign under pressure or without understanding all clauses.

- Systematically consult a local lawyer specialized in real estate law before any signing. Contractual errors are frequent among expatriates unfamiliar with local legislation.

- Refuse any “off-the-books” payment (in cash or to an unreferenced account).

Common example: A foreign investor signed a contract directly with an agent without verifying the project’s actual existence; it later turned out the land wasn’t buildable because it was located outside free zones. The financial loss was total due to lack of specialized legal support.

Thorough Property Inspection

List of essential points during an inspection:

- Check general structural condition: foundations, roofing, plumbing and electricity

- Verify administrative compliance: valid building permit; absence of hidden mortgages

- Ensure no easements or land disputes affect the property

Neglecting this step often leads to discovering major problems after purchase like chronic leaks or legal defects that make any resale impossible.

| Critical Step | Risk if Neglected | Bahrain Specificity |

| Free zone verification | Purchase canceled / funds lost | Limited zones for foreigners |

| Developer control | Scam / ghost project | Attractive market = fake intermediaries |

| Technical/legal inspection | Unexpected costs / administrative blockage | Strict regulation |

Realistic Assessment of Future Costs

Frequent mistakes to avoid:

- Underestimating annual maintenance costs (essential air conditioning in hot summer)

- Forgetting indirect tax impact (high common charges in some residential complexes)

Concrete example: A buyer attracted by an appealing price discovers after six months that their monthly charges represent 20% of the initially planned amount—making the investment significantly less profitable.

To maximize security and profitability:

- Systematically surround yourself with recognized local specialists: bilingual French-Arabic/English lawyer specialized in real estate + independent expert for technical inspection + established notary/certified agent

Important reminder:

The absence of appropriate professional support remains the main source of failure for foreign real estate investors in Bahrain.

Good to Know:

In Bahrain, real estate buyers must be vigilant regarding foreign ownership restrictions, as some areas are only open to nationals or GCC citizens. It’s crucial to verify the developer’s legitimacy through the Real Estate Regulatory Authority, as scams could occur if investigation is neglected. Hiring a lawyer before signing any contract is recommended to ensure legal documents are in order and complete. A thorough property inspection helps detect hidden structural or legal problems, such as improperly registered areas, which could cause future troubles. A frequent mistake is underestimating long-term maintenance costs; for example, these costs can significantly increase in large villas requiring regular renovations. Consulting local real estate sector experts proves essential to avoid these pitfalls, as they know the specificities of the Bahraini market and can provide wise advice, thus facilitating a smooth and secure purchase.

Common Mistakes of Foreign Buyers

Lack of Local Market Knowledge

Ignorance of the specificities of Bahrain’s real estate market exposes foreign buyers to several risks: they may misjudge the actual value of properties, ignore areas with high development potential, or underestimate price fluctuations. For example, an investor purchased an apartment in a less dynamic neighborhood thinking they’d achieve quick capital gains, but rental demand there was weak and resale difficult.

Practical advice: Always conduct thorough local market analysis, consult trend reports, and exchange with residents or local experts.

Neglect of Legal and Regulatory Aspects

It’s essential to properly understand local laws governing real estate purchase in Bahrain, particularly restrictions imposed on foreigners and requirements regarding visas or residence permits. Some buyers have seen their transactions canceled or delayed due to failure to anticipate property access restrictions in certain areas or not meeting residence conditions.

Practical advice: Hire a local lawyer specialized in real estate law and verify the operation’s legality beforehand.

Underestimation of Hidden Costs

Many buyers focus on the listed price without anticipating additional fees that add to the final cost:

- Notary fees

- Registration fees

- Local taxes

- Agency fees

- Condominium charges

One testimony reports an investor who had to pay 8% additional of the purchase price in various unanticipated fees.

Practical advice: Request a detailed quote of fees before committing.

| Expense Item | Estimate (%) of Purchase Price |

| Notary fees | 1 to 2% |

| Registration fees | 1 to 3% |

| Local taxes | 1 to 2% |

| Agency fees | 2 to 5% |

Absence of Prior Inspection

Not having the property inspected by a professional before purchase is a common mistake. This can lead to unexpected expenses for major repairs (leaks, structural defects, non-compliant installations). One buyer thus discovered, after signing, moisture problems requiring costly work and temporary family relocation.

Practical advice: Always have an independent inspection conducted before finalizing the transaction.

Choice of Unqualified Real Estate Agent

Surrounding yourself with an inexperienced or unknown agent in the local market can lead to biased advice, poorly conducted negotiations, or risky transactions. Several buyers reported paying an inflated price or signing unfavorable contracts.

Practical advice: Select an agent with a solid reputation and verifiable references.

Reliability of Financing Assistance

Mistakes during financing search include resorting to unreliable lenders or ignorance of specific conditions for foreigners (rates, duration, required guarantees). Some buyers saw their loan rejected after incurring fees, due to failure to meet conditions imposed on non-residents.

Practical advice: Compare multiple financing offers and verify specific requirements for non-residents before signing any commitment.

Impact of Local Customs on Purchase Process

Cultural differences can influence negotiation, contract drafting, and communication between parties. For example, direct negotiation with the seller is common in Bahrain, and respecting local customs can facilitate transaction conclusion. One buyer reported obtaining a significant reduction after accepting a ritual property visit with the seller’s family, according to local tradition.

Practical advice: Inquire about local customs and, if needed, get accompanied by an intermediary familiar with Bahraini culture.

To Avoid These Common Mistakes, It’s Recommended to:

- Thoroughly research the local market

- Consult qualified professionals (lawyer, real estate agent, financing expert)

- Request feedback from other foreign buyers

- Consider all fees and regulatory aspects before committing

Good to Know:

Foreign buyers in Bahrain often make mistakes by underestimating the local market, which can expose them to unexpected price fluctuations and unfamiliarity with developing areas. Ignoring legal requirements, such as purchase restrictions for non-residents and visa requirements, is crucial. Not anticipating hidden costs, like notary fees or local taxes, can inflate the final bill. A common error is not conducting a complete property inspection, which can lead to costly repairs. Choosing an inexperienced real estate agent often leads to biased advice and poorly managed transactions. Reliable financing research is crucial, as choosing an unestablished lender or ignoring specific loan conditions for foreigners can be problematic. Finally, local cultural differences can influence negotiations and contract signing; it’s therefore essential to inform yourself to avoid misunderstandings. An example is a buyer who neglected an inspection and later discovered costly repairs, or another who misjudged additional fees, significantly increasing their budget.

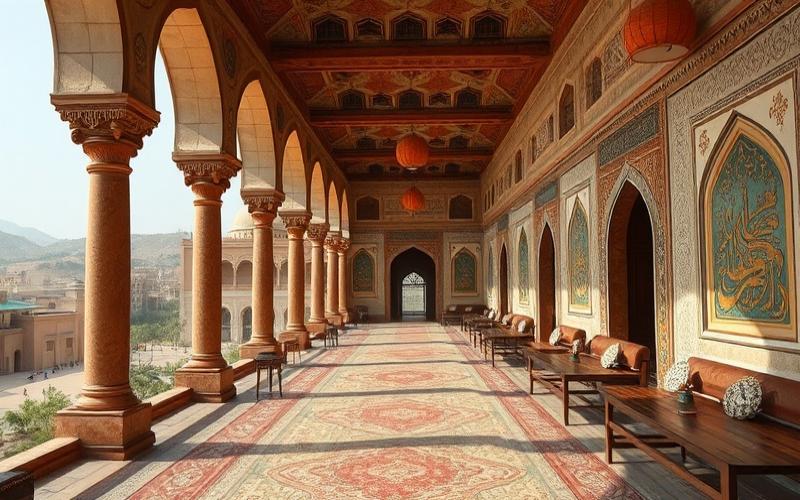

How to Protect Yourself Against Real Estate Surprises

Conducting a complete property inspection before purchase is fundamental to detect any structural defects or malfunctions of essential systems (electricity, plumbing, insulation). Independent expertise helps identify poor workmanship, assess the property’s actual condition, and secure your purchase decision. This approach provides a detailed report that can serve during negotiation or to avoid unexpected expenses related to major repairs.

List of Points Checked During Pre-Purchase Inspection:

- Load-bearing structure (walls, foundations)

- Roofing and waterproofing

- Electrical installation

- Plumbing and drainage

- Heating/air conditioning

- Possible presence of hidden defects

The Crucial Role of a Lawyer Specialized in Real Estate Law in Bahrain:

An experienced local lawyer ensures that:

- The property complies with local legal requirements.

- All construction permits are valid.

- The land title is free of any mortgage, charge, or ongoing dispute.

The lawyer also verifies that the transaction respects the specific legal framework for foreigners (authorized acquisition zones) and supervises the drafting and signing of the notarized contract.

Thorough Understanding of the Sales Contract:

It’s essential to meticulously analyze every contractual clause:

Key Points to Examine in the Contract

| Element | To Verify |

|---|---|

| Transfer fees | Who pays? Exact amount |

| Warranties | Duration, scope on equipment/systems |

| Contingency clauses | Clause on obtaining bank loan/authority approval |

| Payment terms | Deadlines/stages |

Tips to Overcome Cultural and Language Barriers:

It’s recommended:

- To solicit recognized local experts (certified real estate agencies).

- To systematically request references from previous clients.

These precautions facilitate understanding of the Bahraini market and limit risks related to cultural differences in business practices.

Anticipating Taxes and Fees Associated with Real Estate Purchase in Bahrain:

To establish a realistic budget, it’s appropriate to consider not only the listed price but also:

Common Taxes/Fees During Purchase

| Item | Description |

|---|---|

| Notary fees | Official fees to authenticate the contract |

| Registration fees | Mandatory taxes paid at time of transfer |

| Annual charges | Condominium maintenance/public services |

Good prior knowledge avoids any financial surprises.

Guiding your project with a competent team remains indispensable to secure your real estate investment in Bahrain.

Good to Know:

To protect yourself against bad surprises when buying real estate in Bahrain, it’s crucial to conduct a complete inspection to detect any structural defects or faulty systems. A lawyer specialized in real estate law is indispensable to verify legal compliance, construction permits, and ensure the property is free of mortgages or disputes. Understanding contract terms, including clauses on transfer fees and warranties, helps avoid financial surprises. It’s also wise to consult local experts and request references to effectively navigate cultural and language differences. Finally, precise knowledge of taxes and fees related to real estate purchase in Bahrain is essential to develop a realistic budget and protect against hidden costs.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.