Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

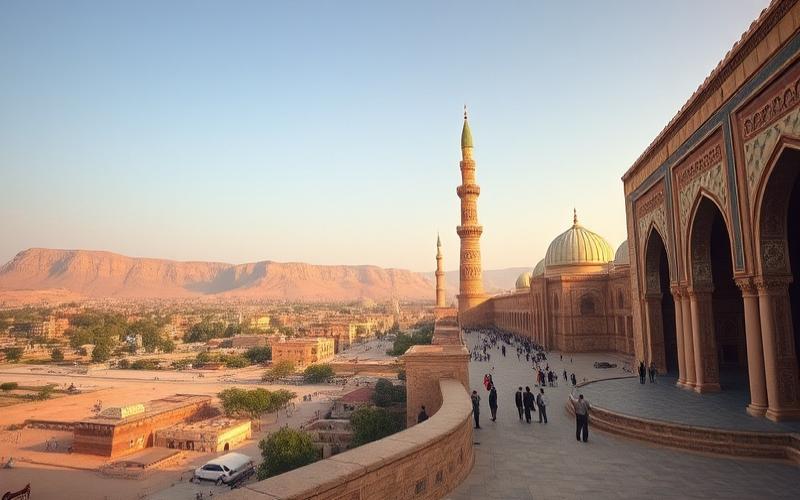

Bahrain: A Major Player in Industrial Real Estate

Bahrain, a small yet influential Gulf archipelago, positions itself as a major player in the industrial real estate sector, offering strategic advantages for investors seeking to establish a presence in the region.

Thanks to its exceptional free zones, such as the Bahrain Airport Free Zone and Bahrain International Investment Park, the country deploys modern and reliable infrastructure, reinforced by a favorable regulatory framework and attractive tax incentives.

These free zones create a dynamic environment for businesses looking to optimize their commercial operations, benefiting from zero customs duties and unparalleled logistics connectivity.

Thus, Bahrain becomes not only a gateway to GCC markets but also an essential hub for industry players eager to capitalize on long-term expansion opportunities.

Understanding the Potential of Free Zones in Bahrain

Definition and Structure of Free Zones in Bahrain

Free zones refer to designated geographical areas where special economic and regulatory regimes apply, promoting the establishment of industrial or commercial activities. They typically offer trade freedom, import, storage, processing, and re-export of goods with minimal customs or tax intervention. Classic forms include port zones (free ports) and export-oriented industrial zones.

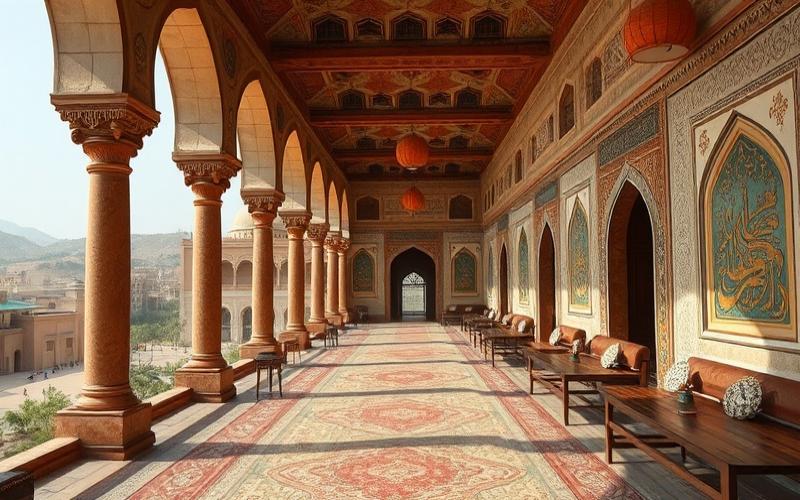

In Bahrain, these zones are structured around strategic industrial hubs near Khalifa Bin Salman Port or close to the new international airport. They are specifically designed to attract foreign investment by offering modern infrastructure (logistics warehouses, specialized banking services), simplified regulations, and facilitated access to regional markets.

Economic and Tax Benefits for Investors

Among the main benefits offered in these spaces are:

- Full or partial income tax exemption

- Reduced or eliminated customs duties on import-export

- Streamlined administrative procedures: one-stop shop for business creation

- Facilitated access to foreign currencies

- Complete freedom to repatriate profits

These measures aim to reduce the overall operating cost for investors while enhancing the country’s international competitiveness.

Thriving Industrial Sectors and Government Initiatives

The sectors that benefit most from Bahraini free zones are:

- Light manufacturing industry (metallurgy, electronics)

- Logistics & regional distribution

- Food processing

- Financial services & fintech

The government implements several incentive initiatives:

- Public program “Invest in Bahrain” dedicated to logistical and administrative support

- Public-private partnerships promoting rapid creation of modern infrastructure

- Digital platforms enabling accelerated management of customs procedures

- Targeted subsidies in certain innovative sectors (e.g., clean technologies)

| Free Zone | Key Sector | Observed Economic Impact |

| Bahrain Logistics Zone | Logistics/transport | Net increase in regional import/export volume; industrial real estate boom |

| Bahrain International Investment Park (BIIP) | Light manufacturing industry | Massive creation of skilled jobs; local productive diversification |

Concrete Examples in Bahrain

The Bahrain Logistics Zone, located near Khalifa Bin Salman Port, has enabled the national logistics sector to achieve annual growth exceeding 10%, while boosting the industrial land market. The Bahrain International Investment Park, meanwhile, attracts over 100 international companies thanks to its tax exemptions extended up to twenty years.

Potential Challenges Faced by Free Zones

Non-exhaustive list:

- Growing competition with Dubai Jebel Ali Free Zone or Saudi Arabian Industrial Zones

- Risk related to sudden changes in national/regional tax policies

- Constant need to invest in technological modernization to meet international expectations

- Increased pressure on available industrial land

Thus, Bahraini free zones play a central role in the national economic diversification strategy but must continuously adapt to regional competitive dynamics.

Good to Know:

Free zones in Bahrain are specific regions where companies benefit from significant economic and tax incentives, such as exemption from certain taxes and reduced customs duties, as well as simplified import-export procedures, thereby promoting foreign investment. Notably, these zones support industrial sectors like logistics, manufacturing, and information technology, reinforced by public-private partnerships and government initiatives, as seen in zones like the Bahrain International Investment Park (BIIP). These zones contribute significantly to the local economy, boosting industrial real estate through increased demand for infrastructure. However, they face regional competition from other Gulf countries and risks from changes in economic policies, requiring constant vigilance and strategic adaptation to maintain their competitive advantages.

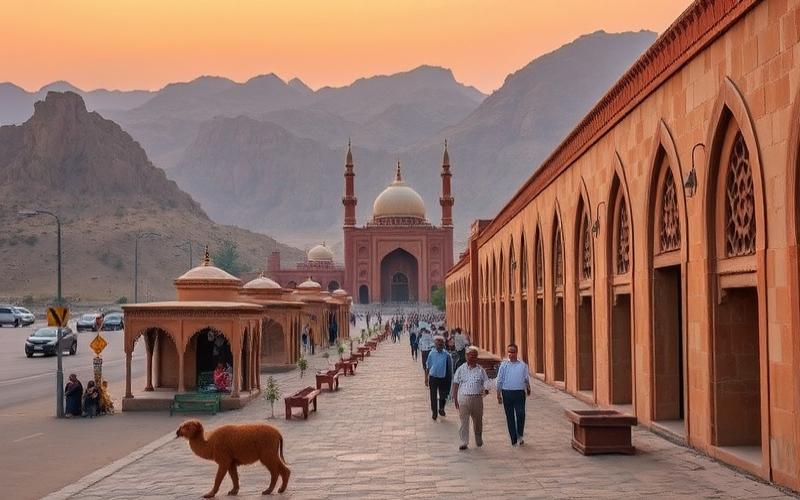

Logistics Warehouses: An Asset for Institutional Investors

The strategic appeal of logistics warehouses in Bahrain rests primarily on the kingdom’s geographical position, located at the heart of the Middle East, at the intersection of major trade routes. This location provides optimal connectivity with Gulf, African, and Asian markets, facilitated by state-of-the-art port and airport infrastructure, such as Khalifa Bin Salman Port and Bahrain International Airport, which handles over 300,000 tons of air cargo annually. These platforms play an essential role in global supply chains by ensuring rapid transit, efficient storage, and smooth distribution of goods.

Financial and Economic Benefits for Institutional Investors

- High rental yield potential: Growing demand for modern logistics spaces, driven by the rise of e-commerce and regional economic diversification, contributes to sustained rental appreciation.

- Long-term stability: Logistics leases are typically long-term with quality tenants, ensuring predictable income streams.

- Tax exemptions and absence of restrictions on capital and profit repatriation enhance investment profitability.

Specific Factors of Bahrain’s Free Zones

| Free Zone Advantage | Description |

|---|---|

| Tax incentives | Tax-exempt status for many activities |

| Customs freedom | Duty-free for re-exported goods |

| Fewer burdensome rules | Simplified regulation and reduced operating costs |

| 100% foreign ownership | No local partnership requirement |

| Free transfer of capital and gains | No transaction controls |

Growth in Demand for Modern Warehouses is Driven by:

- Increased regional and international trade exchanges.

- Rapid development of e-commerce and omnichannel distribution.

- Expansion of international companies choosing Bahrain as a logistics hub to serve the GCC (Gulf Cooperation Council) and beyond.

Concrete Examples and Recent Statistics

- 60% of goods imported to Bahrain are stored in warehouses, according to Customs, illustrating the central role of these infrastructures in national and regional trade.

- Sector modernization: Deployment in 2024 of a digital warehouse management system to improve efficiency, traceability, and operational speed.

Future Outlook and Market Trends

- Increased digitalization: Process automation, smart inventory management, and real-time traceability.

- Rise in international investments, attracted by the kingdom’s legal security, transparency, and political stability.

- Development of new logistics parks and expansion of free zones to meet growing demand.

- Sustainability: Integration of eco-friendly solutions in warehouse design (solar energy, energy optimization).

Bahrain thus establishes itself as a prime destination for institutional investors seeking both yield, security, and exposure to a rapidly expanding logistics market, at the heart of a strategic region for global trade.

Good to Know:

Logistics warehouses in Bahrain represent a major strategic asset, integrally embedded in global supply chains, especially in a context where international trade is rapidly expanding. These infrastructures offer institutional investors significant economic benefits, including high rental yields and long-term stability, reinforced by growing demand for modern spaces, stimulated by Bahrain’s strategic geographical position and its growing economy. Bahrain’s free zones particularly contribute to this appeal through attractive tax incentives and customs freedom, as evidenced by the recent success of several logistics parks developed in the region. For example, the Bahrain Airport Free Zone has attracted several significant investments in recent years, offering optimistic prospects for the sector’s future. Current market trends, such as digitalization and increased regional trade exchanges, continue to strongly stimulate interest in these investments, positioning Bahrain as an essential logistics hub.

Industrial Real Estate Yield: High-Potential Areas in Bahrain

Recent Trends in Bahrain’s Industrial Real Estate Market

The industrial real estate market in Bahrain benefits from positive momentum, supported by economic diversification beyond oil and proactive government policy. Among the drivers of this growth:

- Development of special economic zones and industrial areas, offering tax and regulatory advantages.

- Massive investments in infrastructure, particularly transport, logistics, and information technology.

- Growth of the manufacturing industry and logistics sector, attracting new foreign investors.

Average Yield Rates and Factors Influencing Yields

Yield rates for industrial real estate in Bahrain typically range between 7% and 9%, depending on location, accessibility, and infrastructure quality. The main factors influencing these yields:

- Logistics accessibility (proximity to ports, highways, international airport)

- Quality and modernity of infrastructure

- Political stability and favorable regulatory framework

- Growing demand for warehouses and logistics platforms, stimulated by e-commerce and reorganization of regional supply chains

High-Potential Areas for Industrial Investment

| Area | Available Infrastructure | Accessibility | Favorable Government Policies | Evolution Potential |

|---|---|---|---|---|

| Bahrain International Investment Park (BIIP) | Modern industrial park, proximity to port and airport | Direct access to GCC markets | Tax exemptions, investment facilities | High |

| Bahrain Logistics Zone (BLZ) | Logistics specialization, state-of-the-art equipment | Adjacent to Khalifa bin Salman Port | Free zones, logistics support | High |

| Hidd Industrial Area | Historic industrial park, robust infrastructure | Close to port and road networks | Government incentives | Good potential |

| Salman Industrial City | New zone, focused on diversification | Well connected to national network | Support for manufacturing and logistics | Growing |

Yield Evolution Prospects

Yield prospects in these areas are considered favorable for the coming years:

- Increased demand for modern industrial spaces due to development of manufacturing, logistics, and e-commerce sectors.

- Major industrial development projects planned or underway, notably extension of Bahrain International Investment Park and expansion of Bahrain Logistics Zone.

- Stability of yield rates expected, with possible slight increases in areas benefiting from infrastructure improvements and logistics access.

Economic Statistics and Ongoing Industrial Projects

- Economic growth: Bahrain’s construction market is estimated at $3.04 billion USD in 2024, with forecasted growth to $3.73 billion USD by 2029, illustrating the sector’s vigor.

- Recent projects: Developments in logistics, light manufacturing, and extension of strategic industrial zones.

- Government incentives: Tax exemptions, subsidies, simplified administrative procedures, and support for industrial innovation.

How Investors Can Capitalize on These Opportunities

- Target areas with the best infrastructure and direct access to regional markets.

- Benefit from incentive policies (free zones, tax exemptions).

- Prioritize projects in partnership with local players or integrated into government development plans.

- Monitor evolution of logistics and industrial needs related to e-commerce and regionalization of supply chains.

Summary of Key Success Factors for Industrial Real Estate Investment in Bahrain:

- Strategic choice of location area

- Thorough analysis of available infrastructure

- Monitoring of government policies and incentives

- Anticipation of regional industrial sector needs

Good to Know:

In Bahrain, the industrial real estate market currently offers solid yields, particularly in areas like the Bahrain Economic Valley and Salmabad Business Park, where yield rates reach approximately 7%. These areas benefit from modern infrastructure, optimal accessibility thanks to proximity to Khalifa bin Salman Port, and incentive government policies such as tax exemptions in free zones. Recent trends indicate increasing demand, notably with the expansion of the manufacturing sector and development projects related to the country’s Economic Vision 2030, which promise yield stability and growing opportunities for investors. Experts predict that policies favoring economic diversification will further stimulate industrial investments, while accessibility to regional markets continues to attract international companies, thus offering positive prospects for maximizing future yields in these strategic areas.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.