Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

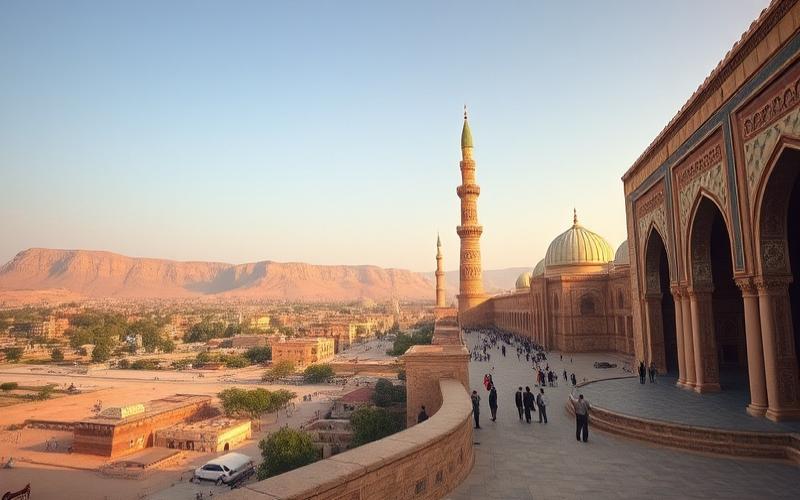

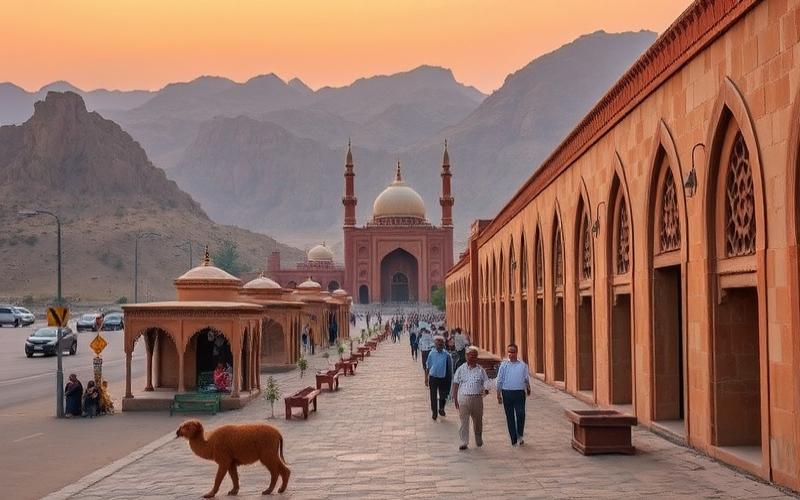

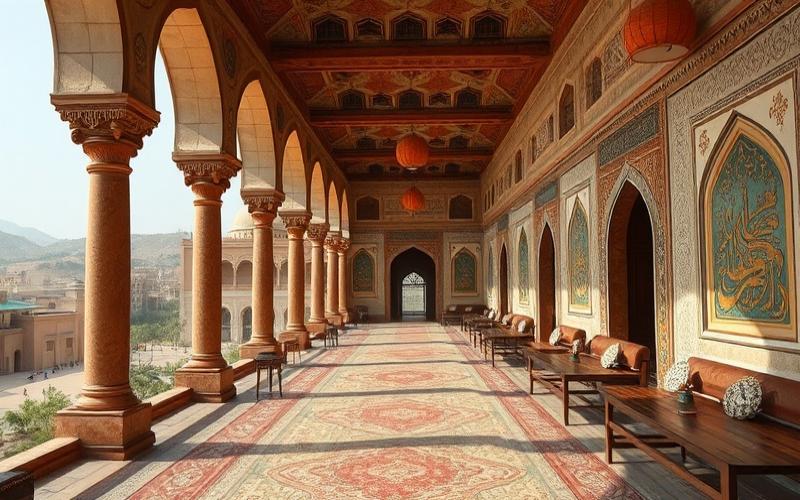

Bahrain’s Real Estate Market: An Attractive Landscape

Within an expanding economic landscape, Bahrain’s real estate market is increasingly attracting foreign investors and buyers drawn to the opportunities it presents.

Understanding Local Regulations

However, to effectively navigate the complexities of local regulations, it’s essential to understand the various mandatory insurance policies that accompany property acquisition in the country.

A Detailed Comparison of Real Estate Insurance

This comparison thoroughly examines legal insurance requirements, highlighting the specifics and associated costs of these essential policies that vary significantly depending on property type and location.

A Guide for All Buyer Profiles

Whether you’re an experienced investor or a first-time buyer, this article provides the keys to master the security and financial aspects of your real estate project in Bahrain.

Good to Know:

Mandatory insurance requirements may differ between residential and commercial properties. Be sure to verify specific conditions relevant to your project.

Understanding Home Insurance in Bahrain

Types of Home Insurance in Bahrain

In Bahrain, several types of home insurance are available, tailored to individual and business needs:

- Multi-Risk Home Insurance (MRH): Protection against numerous risks for real property (houses, apartments) and personal belongings. Typically covers fire, water damage, theft/burglary, liability, and other perils like glass breakage or natural disasters.

- Fire and Additional Risks Insurance: Often offered for residential or commercial properties; primarily covers fire but also lightning, explosion, and sometimes water damage.

- Theft/Burglary Insurance: Optional in some MRH contracts or purchased separately.

- All-Risk Commercial/Property Insurance: Designed for commercial property owners (offices, stores) covering a wide range of incidents including business interruption.

| Insurance Type | Main Risks Covered | Target Audience |

|---|---|---|

| Multi-Risk Home | Fire, water damage, theft/vandalism, liability | Owners/tenants |

| Fire & Specific Perils | Fire/explosion/lightning/water damage | Residential & commercial |

| All-Risk Commercial | Various material damages/business interruption | Businesses/professionals |

Legal Insurance Requirements

In Bahrain:

- There is no general legal requirement mandating home insurance for either owner-occupiers or private residential tenants. However,

- Some commercial lease contracts may require specific coverage depending on the property type.

- Banks typically require fire insurance when granting a mortgage.

Major Insurance Companies Operating in Bahrain

Key players include:

- Bahrain National Holding (BNH): Offers various policies from standard to comprehensive all-risk coverage.

- New India Assurance Bahrain: Provides complete solutions for private and commercial properties with guarantees against fire, flood/storms/theft/burglary/business interruption/etc.

Other companies in the Bahraini market:

- Takaful International

- Solidarity Bahrain

- AXA Gulf

These insurers offer various customizable coverage levels based on property type (residential/commercial), insured value, and geographic or structural specifics.

Common Coverage Examples

Non-exhaustive list:

- Damage caused by fire/explosions/lightning

- Damage from storm/flood/hurricane/tornado

- Theft/burglary/vandalism

- Accidental breakage/electronic equipment

- Third-party liability for material or bodily injury caused

Depending on your policy, there may be deductibles to pay in case of a claim and maximum coverage limits per guarantee.

| Residential | Commercial |

|---|---|

| Tenant not required unless lease clause | Often contractually required |

| Coverage focused on contents/housing | Extended coverage for machinery/stock/business interruption |

⬛︎ Home insurance remains essential even if not legally mandatory. It protects against significant financial losses from unexpected incidents—major fires or costly damages—and ensures peace of mind against daily uncertainties. Prompt coverage also enables better post-incident management for both individuals and professionals. ⬛︎

Good to Know:

In Bahrain, home insurance isn’t legally required but is highly recommended to protect personal and real property. Major insurance companies in the Bahraini market, such as Bahrain National Insurance Company and AXA Gulf, offer varied coverage including protection against fire, theft, and water damage. For property owners, it’s crucial to insure the building itself, while tenants should consider insurance covering their personal effects. Commercial properties may require more specific policies depending on the business activity and associated risks. Subscribing to home insurance in Bahrain ensures financial security in case of incidents, providing peace of mind for both owners and tenants.

Comparing Liability Insurance for Property Owners

In-Depth Comparison of Liability Insurance Options for Property Owners in Bahrain

| Provider | Average Annual Premium (BHD) | Basic Coverage Included | Typical Coverage Limit (BHD) | Common Exclusions |

|---|---|---|---|---|

| AXA Bahrain | 30-70 | Bodily injury and property damage to others; legal defense; limited medical expenses for third parties injured on the property. | 100,000 – 500,000 depending on option chosen | Intentional acts, asbestos-related damage, pollution, losses from undeclared commercial activities |

| Bahrain National Insurance (bni) | 40-85 | Property owner liability towards third parties (injuries or property damage); covered legal expenses. Extension option for domestic acts. | Up to 500,000 per event or annual aggregate depending on chosen level. Possible sub-limits for specific risks. | Intentional damage; war/terrorism; serious maintenance defects reported but not repaired |

| Takaful International Company (TIC) – Islamic takaful insurance: risk-sharing among policyholders under Sharia supervision; guarantees similar to conventional products with specific Islamic exclusions. Premium often comparable to standard market. Limits and coverage comparable to classical insurers. |

Specific Policy Coverages

- Bodily injury: All standard contracts cover accidental injuries suffered by third parties on the insured property.

- Property damage: Coverage if neighbor’s property is damaged due to an incident originating from your home.

- Defense and recourse: Reimbursement or coverage of legal expenses within contract limits.

Frequently Offered Additional Guarantees

- “Domestic/employees” extension: Covers incidents caused by hired help or caretakers.

- Enhanced legal protection: Higher compensation for legal defense beyond standard limits.

- Insurance against theft/vandalism caused to others from your home.

Common Exclusions

- Intentional acts

- Natural disasters not explicitly covered

- Gradual pollution

- Professional use of residence without prior declaration

Specific Parameters for Bahraini Policies

- Generally low deductibles

For all foreign residential owners:

- Verify if your French/non-Bahrain policy explicitly includes Bahrain in its geographical area—otherwise subscribe to a dedicated local policy.

In summary, it’s essential to choose a solution adapted both to guaranteed amounts and ancillary services offered (particularly local legal assistance), while remaining vigilant about restrictive clauses specific to the current Bahraini market.

Good to Know:

When comparing liability insurance for property owners in Bahrain, it’s essential to consider major companies like AXA and Zurich, which offer competitive premiums between 100 and 200 BHD annually. These policies typically cover bodily injury and property damage, but verify coverage limits and exclusions such as damage caused by pets. Some offers include options to add additional guarantees like legal protection against tenants. Bahraini legislation doesn’t require minimum coverage, but it’s wise to choose a policy suited to your property’s size and value. To select the best insurance, compare claim settlement conditions and consider claim processing times. Opt for coverage matching your specific needs, whether for an owner-occupied home or rental property, taking into account suggestions from industry professionals.

Evaluating Rental Risk Coverage in Bahrain

Types of Rental Insurance in Bahrain

The main types of rental insurance available in Bahrain primarily concern protecting real property against various material and financial risks. Here are the main policies offered:

| Insurance Type | Main Risks Covered | Target Audience |

|---|---|---|

| Fire and Additional Risks Insurance | Fire, lightning, explosion, water damage, storms, floods, earthquakes, riots, vandalism, vehicle damage, theft | Owners, tenants |

| Liability Insurance | Damage caused to third parties (neighbors, passersby, etc.) related to property occupancy or ownership | Owners, tenants |

| Multi-Risk Home Insurance | Combination of material damage (fire, theft, water damage) and liability | Owners, tenants |

| Rent Guarantee Insurance (RGI) | Coverage against rent defaults, damages, legal dispute costs | Owners |

Risks Covered by Policies

- Fire, explosion, lightning

- Water damage, storms, floods, earthquakes

- Theft and burglary

- Third-party liability

- Damage caused by vehicles or external events

- Loss of rent and vacancy (for owners)

- Legal protection in rental disputes

Legal Requirements

- There is no strict legal obligation for tenants or owners to purchase home insurance in Bahrain, but liability and fire insurance are often contractually required by landlords or building managers.

- Some lease contracts require tenants to purchase rental liability insurance.

- For condominiums, common area insurance may be required.

Policy Gaps or Insufficiencies

- Standard policies often exclude: damage due to obvious negligence, certain types of natural disasters not explicitly mentioned, intentional acts, or indirect losses (e.g., prolonged loss of use).

- Rent guarantee coverage remains uncommon and limited to owners with solvent tenants or those selected according to strict criteria.

- Some insurance doesn’t cover tenants’ personal belongings or imposes low compensation caps for valuable items.

Comparison of Major Insurers in Bahrain

| Company | Indicative Annual Price (residential) | Coverage Scope | Additional Services |

|---|---|---|---|

| New India Assurance | 0.15–0.30% of insured value | All material risks, liability, theft, flood, earthquake | Free inspection, 24/7 claims assistance |

| Zurich Insurance | 0.25–0.40% of insured value | Accidental damage, liability, theft, natural disasters | Legal assistance, optional extension |

| Gulf Insurance Group | 0.20–0.35% of insured value | Fire, water damage, liability | Online management platform |

Perception of Rental Risks

- Owners primarily perceive risks of payment defaults, damages, and vacancy: they often opt for extended coverage, including rent guarantee when accessible.

- Tenants prioritize protection of personal belongings and liability coverage, but subscription remains limited due to lack of legal requirement and sometimes low risk perception.

- The frequency of major incidents (fires, water damage, storms) remains relatively low, influencing the decision to purchase comprehensive insurance.

Case Studies and Claims Management

- Example 1: During a fire in a residential building, New India Assurance compensated the owner for structural repairs within 45 days, after inspection and validation of the expert report.

- Example 2: A tenant who suffered theft was able to use theft coverage for reimbursement of belongings but encountered limitations due to compensation caps for electronic items.

- Example 3: In case of major water damage, most insurers require declaration within 5 business days and expert intervention; coverage depends on compliance with contract clauses and absence of negligence.

Key Takeaways

Rental insurance coverage in Bahrain varies depending on profile (owner or tenant) and contractual requirements. It’s essential to compare guarantees, exclusions, and compensation limits to tailor coverage to actual risks. Assistance services and responsiveness during claims are determining factors in insurer selection.

Key Points to Verify When Subscribing:

- List of covered/excluded risks

- Coverage limits and deductibles

- Claims declaration procedure and deadlines

- Included assistance services

Good to Know:

In Bahrain, rental insurance typically covers material damage, accidents, and certain liabilities that may occur on the property. Although some insurers like Bahrain National or AXA offer competitive policies, there’s no strict regulation requiring owners and tenants to purchase specific coverage, often leading to protection gaps, especially against natural disasters like floods. Available policies vary greatly in price and services, with quotes ranging from moderate to high depending on chosen coverage scope. Owners tend to perceive these insurance policies more as optional conveniences than necessities, influencing their decision to purchase minimal coverage. Claims regarding rental incidents are generally well managed, though there are accounts of extended timelines for settling more complex damages.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.