Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

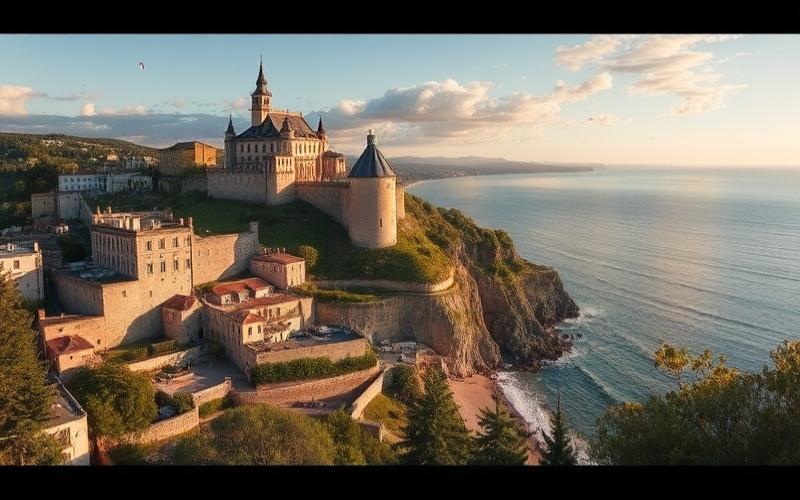

The Maltese archipelago, nestled in the heart of the Mediterranean, stands out as a prime destination for real estate investors seeking lucrative opportunities and an exceptional living environment. With its sunny climate, rich historical heritage, and strategic geographical location, Malta is increasingly attracting the attention of international investors. Let’s dive into the details of this promising real estate market and discover why Malta could be your next investment destination.

To learn more about real estate investment in Malta:

The Maltese archipelago, a Mediterranean gem, has experienced remarkable growth in its real estate market over recent years. With its [...]

Malta, the Mediterranean gem, is attracting more and more real estate investors seeking waterfront properties. With its crystal-clear waters, sunny [...]

Malta, with its Mediterranean climate, rich historical heritage, and favorable tax framework, is attracting an increasing number of foreign investors [...]

Located in the heart of the Mediterranean, Malta has become a prime destination for international real estate investors. With its [...]

The Maltese archipelago, a Mediterranean gem, is attracting an increasing number of real estate investors from around the world. With [...]

The Maltese archipelago, nestled in the heart of the Mediterranean, is attracting an increasing number of real estate investors thanks [...]

The Mediterranean island of Malta, with its sunny climate, rich historical heritage, and favorable taxation, is attracting an increasing number [...]

Malta, the jewel of the Mediterranean, attracts millions of visitors each year drawn to its sunny climate, dream beaches, and [...]

The Maltese archipelago, a Mediterranean jewel, is poised for a true urban transformation. With a series of ambitious projects currently [...]

The Mediterranean island of Malta is attracting an increasing number of foreign real estate investors thanks to its pleasant climate, [...]

The Mediterranean island of Malta has become a prime destination for international real estate investors in recent years. Beyond its [...]

Purchasing property in Malta can be an excellent investment opportunity or a way to acquire a dream home in an [...]

Nestled in the heart of the Mediterranean, Malta has established itself as a premier destination for affluent investors seeking luxury [...]

Malta, this Mediterranean gem, is attracting more and more real estate investors from around the world. With its sunny climate, [...]

Renovating a property in Malta is an excellent way to increase its value and enhance your quality of life on [...]

Commercial real estate in Malta is currently experiencing rapid development, offering numerous opportunities for savvy investors. This Mediterranean archipelago, a [...]

Malta, a small Mediterranean gem, is attracting an increasing number of real estate investors thanks to its pleasant climate, quality [...]

Selling a property quickly in Malta requires a well-thought-out strategy and meticulous execution. In this article, we will explore the [...]

The Irresistible Advantages of Maltese Real Estate

Malta stands out due to a unique combination of benefits that make it a particularly attractive real estate investment destination. The island enjoys remarkable political and economic stability, reinforced by its membership in the European Union since 2004. This stability, coupled with a robust legal system inherited from British law, provides a secure framework for foreign investors.

The Maltese economy shows sustained growth, driven notably by booming sectors such as financial services, tourism, and information technology. This economic momentum translates into constant demand in the real estate market, both for rentals and acquisitions.

Another major advantage of Malta lies in its favorable tax regime. The country offers a particularly attractive tax residency program for expatriates, with income tax rates that can go as low as 15%. This favorable tax policy attracts many investors and highly qualified professionals, thereby fueling real estate demand, particularly in the high-end segment.

The exceptional quality of life that Malta offers is a strong argument for investors. With over 300 sunny days per year, beautiful beaches, a rich cultural life, and an efficient healthcare system, the island appeals both to retirees seeking a pleasant lifestyle and young professionals looking for a balance between work and personal life.

Good to know :

Malta offers a unique cocktail of economic stability, tax advantages, and quality of life, making the island a top choice for real estate investment in the Mediterranean.

The Maltese Real Estate Market: A Price Analysis

The Maltese real estate market is characterized by a diversity of offerings and an upward price trend, reflecting the island’s growing attractiveness to local and international investors. In 2025, property prices in Malta continue to show stable progression, supported by robust demand and limited supply, especially in the most sought-after areas.

The average price of a property in Malta stands around $990,467 USD, with a range from $492,624 USD for the most modest properties to $14,089,901 USD for luxury properties. This wide price range reflects the diversity of the Maltese real estate market, capable of meeting the expectations of a varied clientele, from first-time buyers to wealthy investors seeking exceptional properties.

It is important to note that prices vary considerably depending on the location, type of property, and its characteristics. Properties located in prized coastal areas or in the historic centers of cities like Valletta typically command higher prices. For example, a luxury apartment in Pembroke can be offered starting from $661,421 USD, while a villa with a sea view in a sought-after locality can easily exceed one million euros.

The upward price trend is explained by several factors:

- The scarcity of land on a limited-size island

- The continuous influx of foreign investors attracted by residence and citizenship by investment programs

- The constant improvement of infrastructure and services

- Sustained demand from expatriates and European retirees

Despite this upward trend, the Maltese real estate market remains competitive compared to other leading Mediterranean destinations, offering excellent value for money for savvy investors.

Good to know :

Although property prices in Malta are experiencing a steady rise, the market still offers interesting opportunities for investors, with a wide price range suitable for different budgets and investment objectives.

A Range of Choices: The Main Types of Housing in Malta

The Maltese real estate market stands out due to its diversity, offering a wide range of properties to meet the varied needs of investors and residents. Each type of housing has its own characteristics and advantages, reflecting both the island’s architectural heritage and modern real estate trends.

Modern Apartments: They represent a significant portion of the market, particularly sought after in urban and coastal areas. These homes often offer amenities such as shared pools, parking spaces, and security systems. Prices vary considerably depending on location and features. For example, a luxury apartment in Pembroke can be offered starting from $661,421 USD, while a studio in a less sought-after area could be accessible around $200,000 USD.

Traditional Townhouses: These properties, often called “townhouses,” are characteristic of Maltese architecture. They are typically found in historic centers and offer authentic charm with their stone facades and typical balconies. The prices of these properties can range from $400,000 USD to over one million USD depending on their condition, size, and location.

Villas and Single-Family Homes: Ideal for those seeking more space and privacy, these properties are particularly sought after in upscale residential areas. A villa with a pool and sea view can easily reach or exceed $2 million USD. In Valletta, a renovated historic palazzo can be offered at even higher prices, reflecting the scarcity and prestige of such properties.

Farmhouses: These renovated old farmhouses, typical of the island of Gozo, attract investors seeking authenticity and tranquility. Their prices can range from $500,000 USD to over one million USD depending on their size and state of renovation.

Seafront Properties: Highly sought after, these properties offer breathtaking views of the Mediterranean. For example, a seafront villa in Marsaxlokk can be offered starting from €540 per week for seasonal rental, illustrating the attractive rental potential of this type of property.

It is important to note that the Maltese market is also seeing the emergence of new real estate projects, particularly luxury residential complexes integrating high-end services. These developments, often located in strategic areas, can offer apartments starting from $300,000 USD up to several million for the most exclusive penthouses.

Good to know :

The Maltese real estate market offers a wide variety of properties, from modern apartments to historic properties, and luxurious villas. This diversity allows investors to find the ideal property matching their budget and objectives, whether for personal residence or rental investment.

The Golden Zones for Real Estate Investment in Malta

The Maltese archipelago, although modest in size, offers a remarkable diversity of attractive zones for real estate investment. Each region presents its own assets, whether it’s urban vibrancy, historic charm, or seaside tranquility. Here is an overview of the most promising zones for investors in 2025:

Valletta and its Surroundings: The Maltese capital, a UNESCO World Heritage site, remains one of the jewels of real estate investment. Its historic center, with its Baroque palaces and picturesque alleys, attracts both tourists and permanent residents. Properties in Valletta, particularly renovated palazzi, can reach very high prices, reflecting the prestige of the address. Adjacent neighborhoods like Floriana or Pietà offer interesting opportunities at more affordable prices while benefiting from proximity to the center.

Sliema and St. Julian’s: These coastal areas north of Valletta are particularly prized for their dynamism and leisure offerings. Sliema, with its lively promenade and high-end shops, attracts a cosmopolitan clientele. St. Julian’s, known for its nightlife and restaurants, is very popular among young professionals and tourists. Modern apartments with sea views in these areas are among the most sought after on the island.

Mdina and Rabat: For those seeking the charm of old Malta, Mdina, the ancient fortified capital, and its neighbor Rabat offer unique opportunities. Historic properties in these areas, although rare on the market, can constitute prestige investments with strong appreciation potential.

Marsaxlokk and the Southern Coast: This region, less developed touristically, is increasingly attracting the attention of savvy investors. The picturesque fishing village of Marsaxlokk, with its colorful houses and fish market, offers a very appreciated authentic setting. Seafront properties in this area, like the previously mentioned Villa Bayside, present excellent rental potential.

Gozo: Malta’s sister island charms with its slower pace of life and preserved landscapes. Investors find interesting opportunities there, particularly in the renovation of traditional farmhouses. Coastal areas like Xlendi or Marsalforn are particularly prized for their tourist potential.

Smart City and Development Zones: Malta is heavily investing in the development of new activity zones, like the Smart City project near Kalkara. These emerging zones offer investment opportunities in new real estate, with significant medium and long-term growth potential.

It is important to note that each zone has its own market dynamics. For example, while prices in Valletta and Sliema have seen strong appreciation in recent years, areas like the southern coast still offer purchase opportunities at more affordable prices, with interesting growth potential.

Good to know :

The diversity of attractive zones in Malta allows investors to choose between established locations offering stability and constant demand, and emerging zones presenting higher growth potential. The choice of zone should be aligned with investment objectives, whether for immediate rental income or long-term appreciation.

Malta vs Other Destinations: An Enlightening Comparison

To fully appreciate Malta’s appeal as a real estate investment destination, it is instructive to compare it to other popular Mediterranean destinations. This comparison highlights Malta’s competitive advantages while offering a broader perspective on investment opportunities in the region.

Malta vs Cyprus: These two Mediterranean islands share several similarities, including their EU membership and appeal to international investors. However, Malta stands out due to its more pronounced political and economic stability. Moreover, the Maltese real estate market is generally considered more mature and less volatile than that of Cyprus. Both countries offer attractive programs for investors, but the Maltese program is often perceived as more prestigious and secure.

Malta vs Spain (Costa del Sol): The Spanish Costa del Sol is a popular destination for real estate investors, offering a climate similar to Malta’s. However, Malta has the advantage of a more compact market and therefore potentially easier to understand for foreign investors. Furthermore, with the recent announcement of the end of the Golden Visa program in Spain, Malta could attract more international investors seeking investment residence opportunities.

Malta vs Greece: Although Greece offers attractive real estate prices, particularly on some islands, Malta benefits from a more stable economy and a more predictable regulatory framework. Infrastructure and services in Malta are generally considered more developed, which can be an important factor for investors seeking both returns and a high quality of life.

Malta vs French Riviera (France): The French Riviera remains a reference in terms of luxury and prestige. However, real estate prices there are significantly higher than in Malta. For investors seeking a balance between prestige, returns, and growth potential, Malta often offers better value for money.

Malta vs Portugal: Portugal, with its Golden Visa program, has been a serious competitor to Malta in recent years. However, recent restrictions added to the Portuguese program reinforce Malta’s attractiveness. Moreover, the Maltese real estate market is generally considered more stable and less subject to seasonal fluctuations than some regions of Portugal.

In terms of rental yields, Malta positions itself favorably compared to these destinations. While average gross rental yields in Spain or Greece hover around 4-5%, Malta can offer yields ranging from 5% to 7%, or even more in certain market segments.

It is also important to note that Malta stands out due to its advantageous tax regime for non-domiciled residents, which can represent a significant asset for international investors compared to other Mediterranean destinations.

Good to know :

Although each destination has its own strengths, Malta stands out due to its unique combination of economic stability, tax advantages, quality of life, and return potential. This combination makes it a particularly attractive option for investors looking to diversify their real estate portfolio in the Mediterranean.

Investing in Malta: A Process Accessible to Foreigners

One of the most frequent questions from international investors concerns the possibility for foreigners to acquire real estate properties in Malta. The good news is that Malta offers a favorable and transparent legal framework for real estate acquisition by non-residents, making the island a particularly welcoming destination for foreign investors.

The real estate acquisition process in Malta for foreigners generally unfolds as follows:

1. Eligibility: Citizens of the European Union enjoy the same rights as Maltese citizens for purchasing real estate properties in Malta. They can acquire properties without particular restrictions, whether for personal use or as an investment.

2. Restrictions for Non-Europeans: Nationals from countries outside the EU can also purchase real estate properties in Malta, but with certain restrictions. They are generally limited to purchasing a single residential property for personal use. However, there are exceptions, particularly within the framework of certain investment programs.

3. Acquisition through Special Programs: Malta offers several attractive programs for foreign investors, such as the investment residence program (Malta Permanent Residence Programme) or the citizenship by investment program. These programs can offer privileged access routes to real estate acquisition for non-Europeans.

- Property search and price negotiation

- Signing a preliminary agreement (konvenju)

- Due diligence and legal research

- Obtaining an acquisition permit (for non-residents in some cases)

- Signing the final deed before a notary

- Stamp duty (generally 5% of the purchase price)

- Notary fees (approximately 1-2% of the purchase price)

- Real estate agency fees (generally paid by the seller)

6. Financing: Maltese banks offer mortgage loans to foreign buyers, although conditions may vary depending on the buyer’s residence status and nationality. In 2025, the average bank loan rate in Malta stands around 4.67%, which remains competitive compared to many other European destinations.

7. Tax Considerations: Foreign investors must be aware of the tax implications of their acquisition, particularly in terms of capital gains tax and tax on rental income. However, the Maltese tax regime remains overall favorable, especially for non-domiciled residents.

It is important to note that the Maltese real estate market is dynamic and competitive. Foreign investors are encouraged to work with experienced local professionals, such as licensed real estate agents and specialized lawyers, to effectively navigate the purchase process and ensure compliance with all current regulations.

Good to know :

Although the real estate acquisition process in Malta is generally straightforward for foreigners, it is crucial to understand the legal and tax nuances well. Professional assistance can greatly facilitate the transaction and optimize the investment.

Rental Profitability in Malta: Promising Figures

Real estate investment in Malta is not limited to simply acquiring properties; it also offers attractive prospects in terms of rental profitability. The Maltese rental market, supported by strong tourist demand and a growing expatriate population, presents interesting opportunities for investors seeking regular income.

Attractive Rental Yields

In 2025, gross rental yields in Malta are generally between 5% and 7% per year, with variations depending on location and property type. These figures place Malta among the most attractive European destinations for rental investment.

Let’s take some concrete examples to illustrate the profitability potential:

1. City Center Apartment: A two-bedroom apartment in the center of Sliema, purchased for approximately €350,000, can rent for around €1,500 per month, representing an approximate gross annual yield of 5.1%.

2. Luxury Villa for Seasonal Rental: A villa with a pool in Marsaxlokk, acquired for €750,000, can generate rental income of around €4,000 per week during the high season. With an occupancy of 20 weeks per year, this represents a gross income of €80,000, or a yield of approximately 10.7%.

3. Student Studio: A studio near the University of Malta, purchased for €180,000, can rent for approximately €800 per month, offering a gross annual yield of about 5.3%.

Factors Influencing Profitability

Several elements contribute to these attractive yields:

- Strong Tourist Demand: Malta welcomes millions of tourists each year, creating sustained demand for short-term rentals, particularly in coastal and historic areas.

- Growing Expatriate Population: The continuous influx of expatriates, attracted by professional opportunities and the living environment, fuels demand for long-term rentals.

- International Students: The presence of international educational institutions generates stable demand for student housing.

- Limited Supply: The restricted size of the island and strict construction regulations keep the housing supply under control, thus supporting rental prices.

Important Considerations

It is crucial to note that these figures represent gross yields. Investors must consider various factors to calculate the net yield:

- Taxes on rental income (generally 15% for non-domiciled residents)

- Rental management fees (approximately 10-15% of income for full management)

- Maintenance and renovation costs

- Potential vacancy periods

Furthermore, the choice between short-term and long-term rental can significantly influence profitability. Seasonal rentals can offer higher yields but require more intensive management and may be subject to specific regulations.

Good to know :

Although rental yields in Malta are generally attractive, the success of a rental investment greatly depends on the adopted strategy, the quality of management, and the ability to adapt to market developments. Thorough analysis and professional advice are essential to optimize the profitability of your real estate investment in Malta.

Conclusion: Malta, a Promising Investment Destination

Real estate investment in Malta in 2025 presents itself as a seductive opportunity for savvy investors. The island offers a unique cocktail of advantages that make it a destination of choice in the Mediterranean real estate landscape.

A Dynamic and Stable Market: Malta combines the stability of a mature economy with the dynamics of a growing market. Sustained demand, both from residents and international investors, helps maintain attractive prices and interesting appreciation prospects.

Diversity of Opportunities: From the modern city-center apartment to the historic palazzo and the seaside villa, Malta offers a range of choices capable of satisfying a wide spectrum of investment objectives. This diversity allows investors to build a balanced portfolio adapted to their specific needs.

Attractive Profitability: With gross rental yields that can reach 7% or more, Malta positions itself favorably compared to many other European destinations. The dynamic rental market, supported by tourism and a growing expatriate population, offers prospects for regular income.

Favorable Legal and Tax Framework: The real estate acquisition process in Malta is relatively simple for foreigners, particularly for EU nationals. Moreover, the advantageous tax regime for non-domiciled residents reinforces the island’s appeal for international investors.

Exceptional Quality of Life: Beyond purely financial considerations, Malta offers an exceptional living environment, combining Mediterranean climate, cultural richness, and modern infrastructure. This aspect is particularly important for investors considering personal use of their property or a long-term rental strategy.

Future Prospects: With its continuous commitment to developing modern infrastructure and its strategic position in the heart of the Mediterranean, Malta seems well positioned to maintain its attractiveness in the coming years.

However, as with any real estate investment, it is crucial to approach the Maltese market with a well-defined strategy and a thorough understanding of local dynamics. Consulting local professionals, rigorous due diligence, and a long-term vision are essential to maximize the potential of your investment in Malta.

In conclusion, Malta offers an attractive balance between stability, profitability, and quality of life, making the island a destination of choice for real estate investors seeking opportunities in the Mediterranean. Whether you’re looking for a second home, a rental investment, or diversification of your real estate portfolio, Malta certainly deserves a prominent place in your considerations.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.