Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

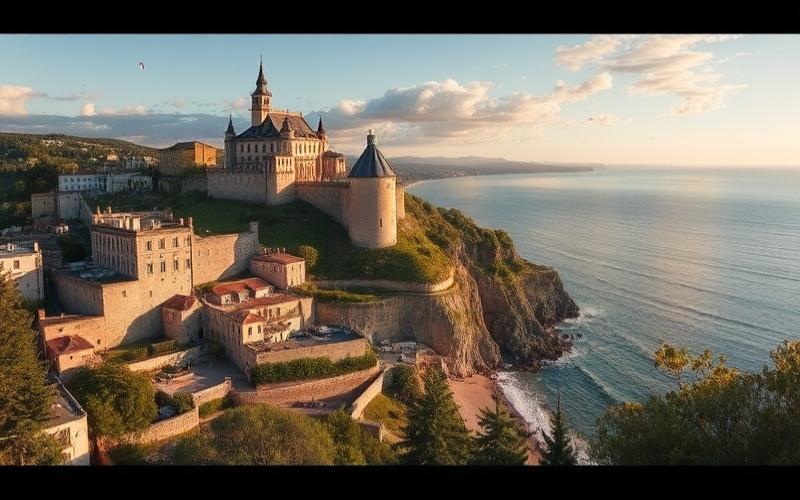

The Maltese archipelago, a Mediterranean gem, is attracting an increasing number of real estate investors from around the world. With its sunny climate, rich historical heritage, and favorable tax system, Malta offers excellent opportunities for those looking to diversify their real estate portfolio internationally. In this article, we will explore the most promising neighborhoods for investing in Malta, along with the growth prospects that make this destination a wise choice for the future.

Maltese Real Estate Hotspots: Where to Invest for Maximum Returns?

Malta is full of attractive neighborhoods for real estate investment, each offering its own advantages. Here’s a selection of the most promising areas:

Sliema and St Julian’s: The Island’s Beating Heart

Sliema and St Julian’s are undoubtedly Malta’s most sought-after neighborhoods for real estate investment. These two adjacent coastal areas offer a perfect blend of vibrant urban life and Mediterranean charm.

- Sliema: Once a peaceful fishing village, Sliema has transformed into a premier commercial and residential center. Its modern buildings and sea-view apartments attract affluent international clients.

- St Julian’s: Known for its vibrant nightlife and upscale restaurants, St Julian’s is particularly popular with young professionals and tourists. The Paceville area, the heart of Maltese nightlife, offers excellent opportunities for seasonal rental investment.

Valletta: The Timeless Appeal of the Capital

Listed as a UNESCO World Heritage site, Valletta is experiencing a spectacular resurgence of interest from investors. The renovation of numerous historic palaces into luxury apartments and boutique hotels has injected new dynamism into the Maltese capital.

- The Valletta Waterfront area, with its warehouses converted into restaurants and shops, is particularly popular.

- The narrow streets of the historic center, like Strait Street, attract enthusiasts of character properties with high rental potential.

Marsaskala: The Authentic Charm of the Island’s South

For those seeking investment in a more authentic and less urbanized setting, Marsaskala, in southeastern Malta, offers interesting opportunities. This developing fishing village attracts with:

- Its still affordable real estate prices compared to Sliema or St Julian’s

- Its significant growth potential, particularly due to tourism development in the region

- Its more family-friendly atmosphere, ideal for long-term rentals

Mellieha: Between Sea and Nature

Located in the north of the island, Mellieha is attracting more and more investors thanks to:

- Its magnificent sandy beaches, rare in Malta, making it a popular tourist destination

- Its proximity to ferries for Gozo, the increasingly popular neighboring island

- Its preserved natural setting, ideal for those seeking investment in a calmer environment

Good to know:

The neighborhoods of Sliema, St Julian’s, and Valletta offer the best rental yields, but with high purchase prices. Marsaskala and Mellieha present a good compromise between growth potential and more moderate initial investment.

Malta 2030: A Bright Future for Island Real Estate

The growth prospects for Maltese real estate are particularly encouraging for the coming years. Several factors contribute to this optimism:

A Booming Economy

The Maltese economy shows robust growth, supported by key sectors such as financial services, online gaming, and tourism. This positive dynamic directly impacts the real estate market, with sustained demand for both purchase and rental.

Continuously Improving Infrastructure

The Maltese government is heavily investing in the island’s infrastructure:

- Development of the road network to ease congestion in the busiest areas

- Modernization of public transport, including a proposed metro project under study

- Improvement of maritime connections between Malta and Gozo

These investments help make the island even more attractive and increase real estate value in the affected areas.

A Dynamic Rental Market

Rental demand in Malta remains very strong, driven by several factors:

- The constant influx of expatriates attracted by the island’s professional opportunities

- Tourism development, with a growing trend toward short-term rentals like Airbnb

- The arrival of international students, drawn to Malta’s increasingly reputable universities

An Attractive Tax Policy

Malta maintains favorable taxation for foreign investors, including:

- Competitive tax rates on rental income

- Specific programs to attract foreign retirees

- No capital gains tax on real estate after 3 years of ownership

Good to know:

Experts predict continued growth in Maltese real estate prices over the next 5 to 10 years, with rental yields among the highest in Europe.

Conclusion: Malta, a Land of Opportunities for Real Estate Investment

Investing in real estate in Malta represents a unique opportunity to combine financial returns with Mediterranean quality of life. Whether you choose the vibrancy of Sliema and St Julian’s, the historic charm of Valletta, or the growth potential of Marsaskala and Mellieha, the Maltese archipelago offers a range of possibilities for all investor profiles.

With solid growth prospects, a dynamic rental market, and an advantageous tax framework, Malta stands out as a prime destination for diversifying your international real estate portfolio. However, it’s crucial to thoroughly research the specifics of the local market and surround yourself with experienced professionals to maximize your investment’s chances of success.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.