Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

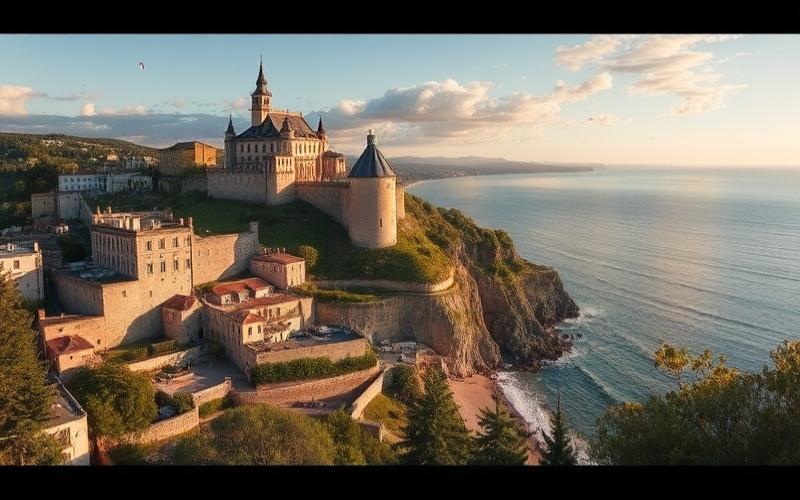

Purchasing property in Malta can be an excellent investment opportunity or a way to acquire a dream home in an idyllic Mediterranean setting. However, many buyers, particularly foreigners, make mistakes that can prove costly. Here is a comprehensive guide to the main pitfalls to avoid for a successful real estate acquisition in the Maltese archipelago.

Not understanding the specifics of the Maltese real estate market

One of the first mistakes made by foreign buyers is not sufficiently researching the particularities of the Maltese real estate market. Malta indeed has a unique property system, inherited from its British past but also influenced by its Mediterranean traditions.

The Maltese real estate market is characterized by high demand and constantly rising prices, particularly in sought-after areas like Valletta, Sliema, or St Julian’s. Not having a clear view of market trends can lead to unrealistic price expectations or cause you to miss good opportunities.

Furthermore, certain types of properties, like character homes or apartments with sea views, are particularly in demand and can be subject to fierce competition. It is therefore crucial to thoroughly understand market dynamics before embarking on a purchase.

Good to know:

Engage a reputable local real estate agent who can guide you on the specifics of the Maltese market and help you find a property that matches your criteria and budget.

Underestimating additional purchase costs

A common mistake is not accounting for all the fees associated with buying property in Malta. In addition to the purchase price, you should budget for:

- Stamp duty: typically 5% of the purchase price

- Notary fees: approximately 1% to 2% of the purchase price

- Real estate agency fees: usually 3% to 5% of the sale price, paid by the seller but potentially impacting the final price

- Property title search fees

- Potential renovation or compliance upgrade costs

Not anticipating these costs can seriously strain your budget and jeopardize your purchase project. It is recommended to set aside about 10% to 15% of the purchase price to cover all these fees.

Good to know:

Some properties may qualify for tax benefits, particularly under urban renovation programs. Consult with a local tax advisor to optimize your investment.

Neglecting legal and administrative aspects

The Maltese legal system, although largely inspired by British law, has particularities that are essential to master. Ignoring these aspects can lead to serious legal problems.

One of the most common mistakes is not thoroughly verifying the title deed of the desired property. In Malta, some properties may be subject to easements or involved in complex inheritance disputes. Thorough due diligence is essential to avoid any unpleasant surprises after purchase.

Additionally, foreigners must obtain an Acquisition of Immovable Property Permit (AIP) for certain types of properties, particularly secondary residences. Failure to comply with this requirement can result in the sale being voided.

Good to know:

Engage a lawyer specialized in Maltese property law to assist you with all legal and administrative procedures. This can save you from many inconveniences and unexpected costs.

Rushing into a purchase without knowing the area well

The excitement of finding the ideal property can sometimes lead buyers to neglect the environment in which it is located. This is a mistake that can prove very costly in the long term.

Each neighborhood in Malta has its own atmosphere and particularities. For example, St Julian’s is lively and touristy, ideal for seasonal rental investment, while Mdina offers a calmer historical setting, perfect for a secondary residence.

It is crucial to spend time in the neighborhood where you plan to buy, at different times of the day and week. This will allow you to assess:

- The level of noise and activity

- Proximity to shops and services

- Accessibility and transportation

- The area’s development potential

Good to know:

Don’t hesitate to talk with local residents to get a more accurate picture of daily life in the neighborhood. Their experience can provide you with valuable information you won’t find in real estate brochures.

Ignoring the specifics of Maltese construction

Maltese buildings have their own characteristics, related to the Mediterranean climate and local traditions. Not taking these into account can lead to bad surprises after purchase.

One crucial point to check is the property’s thermal and acoustic insulation. Many older constructions in Malta are not adapted to modern comfort standards, which can lead to significant renovation costs or high energy bills.

Similarly, humidity is a recurring problem in Maltese buildings, particularly in traditional limestone constructions. A thorough inspection by a building expert is essential to assess the property’s actual condition and anticipate any necessary work.

Good to know:

If you’re considering buying an older property, budget extra for potential compliance upgrades or comfort improvements. This may represent a significant investment but will substantially increase your property’s value and enjoyment.

Underestimating the importance of building permits

In Malta, as in many countries, any construction or significant modification of a building requires a building permit. However, many buyers neglect this aspect, which can have serious consequences.

Buying a property built or modified without the necessary permits can lead to significant financial penalties, or even the obligation to demolish non-compliant parts. It is therefore crucial to verify that all modifications to the property comply with Maltese legislation.

Additionally, if you’re considering post-purchase work, it’s important to research the possibilities and constraints related to building permits. Some areas, particularly historical ones, are subject to strict regulations that may limit your plans.

Good to know:

Before any purchase, ask to see the building permits and have them verified by a professional. If you have renovation plans, consult a local architect who can advise you on the feasibility of your plans in light of Maltese regulations.

Neglecting the tax aspects of real estate investment

Buying property in Malta can have significant tax implications, both in Malta and in your home country. Not anticipating these can lead to unpleasant financial surprises.

It is essential to understand the Maltese tax system well, particularly regarding property tax, rental income, and capital gains on real estate. For example, Malta applies a reduced tax rate on real estate capital gains for properties held for more than three years, which can influence your investment strategy.

Furthermore, if you are a tax resident of another country, you will also need to consider the tax implications in your home country. Double taxation can be a real risk if you don’t structure your investment correctly.

Good to know:

Consult an international tax expert before your purchase. They can help you optimize your investment and avoid the pitfalls of double taxation.

Relying solely on online photos and descriptions

In the digital age, it’s tempting to rely on online listings and virtual tours to choose a property. However, this approach can be very risky, especially in a foreign country like Malta.

Online photos and descriptions can be misleading, not always reflecting the reality of the property or its environment. Important details like the building’s actual condition, room brightness, or neighborhood noise levels are not perceptible through a screen.

Furthermore, the unique configuration of some Maltese properties, particularly in historical cities, can be difficult to grasp without an in-person visit. Traditional townhouses, for example, can have complex layouts that aren’t obvious on a floor plan.

Good to know:

Even if it requires an additional trip, always try to personally visit the property before committing. If this isn’t possible, engage a trusted agent who can conduct a detailed visit for you and provide a comprehensive report.

Not anticipating living and maintenance costs in Malta

Many buyers focus only on the property’s purchase price, without considering living and maintenance costs in Malta. This mistake can lead to long-term financial difficulties.

The cost of living in Malta, although generally lower than in many Western European countries, can vary considerably by area. Sought-after neighborhoods like Sliema or St Julian’s can have high living costs, particularly for dining and entertainment.

Additionally, maintaining a property in Malta can be more expensive than expected, particularly for older properties or those located by the sea. Humidity, sea salt, and intense sun may require regular maintenance work.

Good to know:

Establish a detailed projected budget including not only purchase costs but also ongoing expenses like community charges, local taxes, utility bills, and property maintenance. This will give you a more realistic view of your investment’s total cost.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.