Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

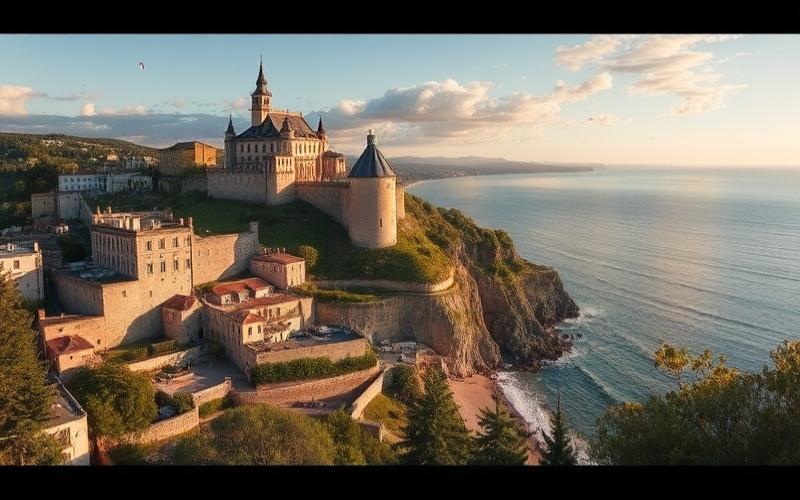

The Mediterranean island of Malta, with its sunny climate, rich historical heritage, and favorable taxation, is attracting an increasing number of foreign investors to the real estate sector. This article will guide you through the essential steps of the property purchase process in Malta for non-residents, addressing the legal, tax, and practical aspects of this promising investment.

The Maltese Dream: Yes, Foreigners Can Become Property Owners!

Good news for international investors: Malta welcomes foreign buyers with open arms! Unlike some countries that impose strict restrictions on non-residents, Malta has adopted an open policy favorable to foreign real estate investments.

However, there are some important nuances to be aware of:

- Citizens of the European Union enjoy the same rights as Maltese citizens for purchasing real estate, without any particular restrictions.

- Non-EU nationals can also acquire properties, but with certain limitations. They are generally allowed to purchase a single residential property for personal use.

- For multiple investments or the purchase of commercial properties, non-Europeans must obtain special authorization from the Maltese government, known as “AIP” (Acquisition of Immovable Property).

This openness of the Maltese real estate market to foreigners has significantly boosted the sector, creating a dynamic and competitive environment for investors worldwide.

Good to Know :

Although Malta is open to foreign investors, it is highly recommended to work with local professionals (lawyer, real estate agent) to effectively navigate the purchase process and avoid any legal or administrative pitfalls.

The Maltese regulatory framework for real estate is designed to protect both buyers and sellers while promoting a dynamic and transparent market. Here are the main regulations to know:

1. The Preliminary Contract (Konvenju)

After finding your dream property, the first formal step is signing the “Konvenju,” the Maltese equivalent of a sales agreement. This document binds both parties and sets the transaction conditions, including:

– The sale price – Payment terms – The final sale date – Any conditional clauses

2. Due Diligence

Once the Konvenju is signed, a “due diligence” period begins. During this phase, your notary or lawyer will conduct all necessary checks on the property:

– Title deed search – Building permit verification – Check for any mortgages or encumbrances

3. The Final Deed of Sale

If everything is in order, the final deed of sale (Att Finali) is signed before a notary. This is when the property is officially transferred and the final payment is made.

4. Registration in the Public Registry

The notary then registers the transaction with the Public Registry of Malta, officially confirming your status as the new owner.

Good to Know :

In Malta, the notary plays a central role in the property purchase process. They act as a trusted third party, safeguarding the interests of both parties and ensuring the legality of the transaction.

The Bottom Line: Taxation and Costs Associated with Property Purchase in Malta

Understanding the taxation related to property purchase in Malta is essential for properly budgeting your investment. Here are the main elements to consider:

1. Stamp Duty

Stamp duty is generally 5% of the property value. However, reduced rates may apply in certain cases:

– 3.5% for purchasing a first residence in Malta – 2% for purchasing a property in an “Urban Conservation Area”

2. Notary Fees

Notary fees are generally between 1% and 2.5% of the property value.

3. Capital Gains Tax

If the property is resold, an 8% capital gains tax applies to the difference between the purchase price and the sale price.

4. Property Tax

There is no annual property tax in Malta, which represents a significant tax advantage for property owners.

5. VAT on New Construction

For new properties, an 18% VAT applies, but it is generally included in the listed sale price.

International Taxation

For foreign investors, it is crucial to consider the tax implications in their home country. Malta has signed tax treaties with many countries to avoid double taxation. However, rental income generated in Malta may be subject to tax in your country of tax residence.

Good to Know :

Malta offers attractive tax benefits for residents, including a capped tax rate of 15% for qualified expatriates in certain sectors. If you plan to settle in Malta, these benefits can significantly improve the profitability of your real estate investment.

Paperwork in Order: Essential Documents for Your Purchase in Malta

To successfully complete your property acquisition project in Malta, you will need to prepare a complete file. Here is the list of essential documents:

1. Identity Document – Valid passport or identity card

2. Proof of Solvency – Bank statements for the last 6 months – Proof of income (pay stubs, tax returns)

3. Source of Funds – Documents proving the legitimate origin of funds used for the purchase (sale of a property, savings, inheritance, etc.)

4. AIP Authorization (for non-Europeans) – If necessary, the Acquisition of Immovable Property authorization

5. Maltese Tax Number – You will need to obtain a Maltese tax number, even as a non-resident

6. Power of Attorney (if necessary) – If you cannot be present for all steps, a notarized power of attorney will be required

7. Marriage Certificate (if applicable) – If purchasing as a couple, this document may be required

8. Proof of Address – A recent proof of address in your country of residence

9. Criminal Record Certificate – Some banks may request it for loan approval

Good to Know :

Meticulous preparation of your file is the key to a smooth purchase process in Malta. Do not hesitate to be assisted by a local lawyer specialized in real estate to ensure all documents comply with Maltese requirements.

Conclusion: Malta, a Land of Opportunities for Savvy Investors

Investing in real estate in Malta represents an attractive opportunity for foreign buyers. With its favorable regulatory framework, advantageous taxation, and dynamic market, the island offers fertile ground for profitable and secure investments.

However, as with any investment abroad, it is crucial to prepare well and surround yourself with competent professionals. In-depth knowledge of the local market, administrative procedures, and legal subtleties will be your best asset for succeeding in your real estate project in Malta.

Whether you’re aiming for a sunny second home, a base for your Mediterranean getaways, or a promising rental investment, Malta has all the assets to meet your real estate aspirations.

Good to Know :

The Maltese real estate market has experienced sustained growth in recent years, particularly in sought-after areas like Sliema, St. Julian’s, or the capital Valletta. Although prices have increased, they remain competitive compared to other leading Mediterranean destinations.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.