Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

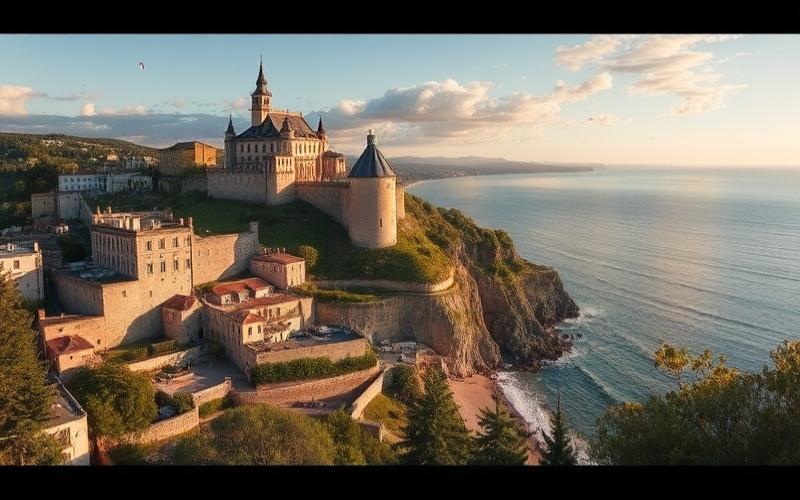

Malta, a small Mediterranean gem, is attracting an increasing number of real estate investors thanks to its pleasant climate, quality of life, and dynamic rental market. Long-term property rental on the island can prove to be particularly profitable for savvy owners. In this article, we will explore the essential aspects of long-term rentals in Malta, from drafting the lease to managing tenant relationships.

The Maltese Rental Market: A Golden Opportunity for Investors

Before diving into long-term rentals in Malta, it’s crucial to understand the specifics of the local real estate market. The island is attracting more and more foreign residents, particularly professionals from the financial sector and retirees, seeking a higher quality of life and tax benefits. This growing demand creates a favorable environment for owners looking to rent out their properties.

The Maltese rental market is characterized by:

- Sustained demand for quality apartments and houses, especially in sought-after areas like Sliema, St Julian’s, and Valletta

- Relatively high rents, particularly for modern and well-located properties

- A preference for furnished and equipped homes

- Tenant stability, with leases often signed for several years

These characteristics make Malta an attractive destination for real estate investors seeking stable long-term rental income.

Good to know:

The occupancy rate for rental properties in Malta is generally high, averaging over 95% in the most sought-after areas, ensuring good profitability for owners.

Drafting a Solid Lease Agreement: The Key to a Smooth Landlord-Tenant Relationship

Establishing a clear and detailed lease is essential for a successful long-term rental in Malta. Here are the key elements to include in your rental contract:

- Identity of the parties: complete contact details of the owner and tenant

- Accurate description of the rented property: address, square footage, included amenities

- Lease duration: typically between 1 and 3 years for long-term rentals

- Rent amount and payment terms

- Security deposit: usually equivalent to one or two months’ rent

- Allocation of expenses between owner and tenant

- Maintenance and repair conditions for the property

- Specific clauses: pets, subletting, etc.

It is highly recommended to consult a local lawyer specializing in real estate law to draft or review your rental contract. This will ensure all clauses comply with Maltese legislation and protect your interests as an owner.

Good to know:

In Malta, rental contracts must be registered with the Housing Authority within 10 days of signing. This step is mandatory and allows for certain legal protections.

Setting a Competitive Rent: The Art of Maximizing Your Rental Income

Determining the right rent amount is crucial for attracting quality tenants while maximizing your return on investment. Here are some factors to consider when setting the rent:

- Property location: central and tourist areas command higher rents

- Size and type of property: apartment, house, number of bedrooms

- Condition and amenities of the home: recent renovations, modern appliances, etc.

- Season: rents can vary throughout the year, even for long-term rentals

- Lease duration: longer leases may justify a slight reduction in monthly rent

To ensure you set a competitive rent, don’t hesitate to:

- Check similar listings in your neighborhood

- Consult a local real estate agent for a professional appraisal

- Use online rent estimation tools specific to the Maltese market

Example of average rents in Malta (2025):

– Studio in city center: €800-1000 per month – 2-bedroom apartment in suburbs: €700-900 per month – 3-bedroom house in a residential area: €1500-2000 per month

Good to know:

In Malta, it’s common to index rents to the Consumer Price Index (CPI) to allow for an annual increase. Make sure to include this clause in your rental contract.

Cultivating Harmonious Relationships with Your Tenants: The Recipe for Long-Term Success

Effective management of tenant relationships is essential for a successful long-term rental in Malta. Here are some tips for maintaining positive and lasting relationships:

- Clear and regular communication: stay available and responsive to your tenants’ requests

- Respect for privacy: avoid unannounced visits and give advance notice for necessary inspections

- Proactive maintenance: anticipate repairs and regularly perform improvement works

- Reasonable flexibility: be open to legitimate tenant requests (e.g., for minor modifications)

- Quick problem resolution: address complaints and repair requests promptly

- Compliance with legal obligations: ensure you follow all current regulations in Malta regarding rentals

Remember that satisfied tenants are more likely to stay long-term and take good care of your property, which translates to better profitability for your investment.

Good to know:

In Malta, it’s common for owners to use property management agencies to handle daily maintenance and tenant relations. These services can be particularly useful if you don’t reside on the island.

Conclusion: A Promising Investment with the Right Tools

Long-term property rental in Malta can prove to be a highly lucrative investment strategy, provided you master the specifics of the local market. By establishing a solid lease, setting a competitive rent, and effectively managing tenant relationships, you’ll maximize the chances of success for your investment.

Malta offers a particularly favorable tax and legal framework for owners, making it a prime destination for rental investment. However, as with any real estate investment, it’s crucial to do thorough research and, if necessary, surround yourself with competent professionals to navigate the subtleties of the Maltese market.

With a thoughtful approach and rigorous management, your rental property in Malta can become a stable source of long-term income, while also offering you the opportunity to enjoy this beautiful Mediterranean country during your visits.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.