Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

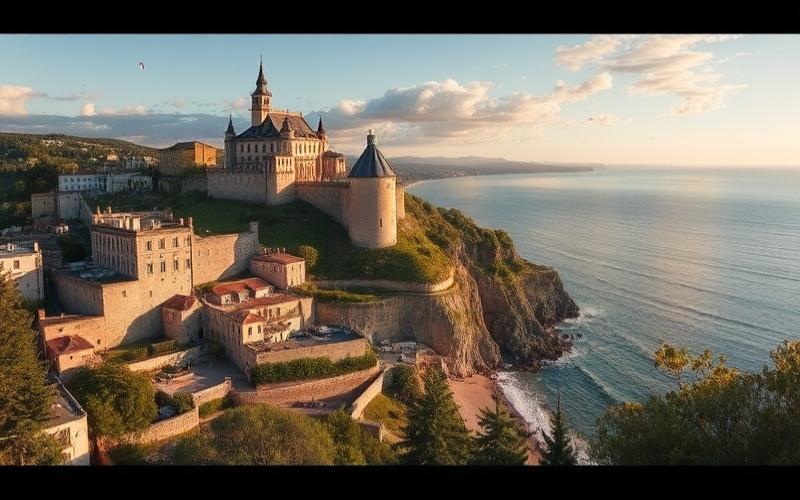

Malta, the Mediterranean gem, is attracting more and more real estate investors seeking waterfront properties. With its crystal-clear waters, sunny climate, and rich historical heritage, the Maltese archipelago offers an exceptional living environment. Here is a comprehensive guide to help you realize your dream of acquiring property along Malta’s coastlines.

Malta’s Coastal Gems: Where to Invest for Maximum Potential?

Malta is full of picturesque seaside locations, each with its unique charm. Here is a selection of the best places to invest:

1. St Julian’s: The Jewel of the North Coast

- Vibrant nightlife and gourmet restaurants

- Luxury residential complexes with sea views

- Strong rental demand, ideal for investors

2. Sliema: Seaside Elegance

- Seafront promenades lined with cafes and shops

- Modern apartments with panoramic views

- Proximity to Valletta, the capital

3. Marsaxlokk: The Authentic Charm of the South

- Its picturesque harbor with colorful fishing boats

- Character homes by the sea

- Peaceful atmosphere, away from tourist crowds

4. Mellieha: Between Golden Beaches and Preserved Nature

- Malta’s most beautiful sandy beaches

- Luxury villas with pools and sea views

- Preserved natural environment

5. Gozo: The Sister Island with Bucolic Charm

- Wild coves and spectacular cliffs

- Renovated farmhouses by the sea

- A slower, more authentic pace of life

Good to Know:

Real estate prices vary significantly by region. St Julian’s and Sliema are the most expensive, while Gozo offers opportunities at more affordable prices.

From Search to Purchase: Key Steps to Realize Your Maltese Real Estate Project

Buying a seaside property in Malta requires following certain crucial steps:

1. Define Your Budget and Criteria

- Your maximum budget, including additional costs

- The type of property sought (apartment, villa, character home)

- Your essential criteria (sea view, pool, proximity to shops)

2. Hire a Local Real Estate Agent

- Present you with a selection of properties matching your criteria

- Advise you on the best investment opportunities

- Guide you through administrative procedures

3. Visit Multiple Properties

- Compare different options in multiple locations

- Visit properties at different times of the day

- Evaluate the potential of each property

4. Make a Purchase Offer

- Negotiate the price with your agent’s help

- Write a detailed purchase offer

- Pay a deposit to reserve the property

5. Conduct Necessary Checks

- Have a technical audit of the property performed

- Verify property titles and building permits

- Ensure the property is free of any mortgages

6. Sign the Final Contract with the Notary

- Sign the deed of sale before a Maltese notary

- Pay the balance and additional costs

- Receive the keys to your new seaside property

Good to Know:

Acquisition fees in Malta are approximately 5% of the sale price, including notary fees and registration duties.

Legal and Tax Aspects: What You Need to Know Before Investing in Malta

Regulations for Foreign Buyers

- Requirement to obtain government authorization (AIP)

- Limitation to one residential property

- Minimum investment required depending on the area

Real Estate Taxation in Malta

- No annual property tax

- 8% capital gains tax upon resale

- Tax optimization possibilities for residents

Financing Your Purchase

- Competitive interest rates

- Repayment terms up to 30 years

- Typically minimum 30% personal contribution

Good to Know:

Malta offers investment residency programs, allowing you to obtain a residence permit by purchasing a property of a defined minimum value.

Maximizing Your Investment: Opportunities in Malta’s Rental Market

Investing in seaside real estate in Malta can be very profitable, particularly thanks to the dynamic rental market:

- Strong potential in tourist areas (St Julian’s, Sliema)

- High returns during peak season (May to October)

- Possibility to rent through platforms like Airbnb

- Growing demand from expatriates and students

- Stable rental income throughout the year

- Simplified management with less tenant turnover

- Constantly growing Maltese real estate market

- Significant appreciation of seaside properties

- Interesting resale potential after a few years

Good to Know:

Rental demand is particularly strong in Malta, with an average occupancy rate of 75% for well-located seasonal rentals.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.