Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

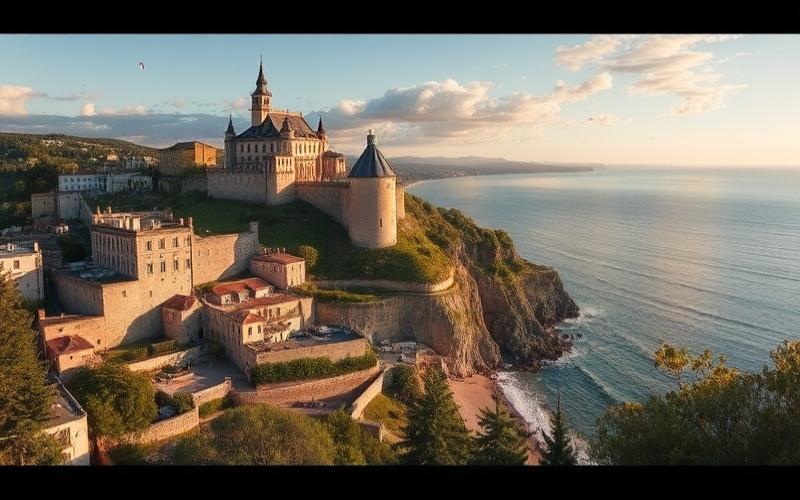

Located in the heart of the Mediterranean, Malta has become a prime destination for international real estate investors. With its pleasant climate, rich history, and favorable tax system, the Maltese archipelago is attracting an increasing number of foreigners eager to acquire property under the Mediterranean sun. However, before embarking on a real estate project in Malta, it’s crucial to thoroughly understand the current laws and regulations. This article will guide you through the essential aspects to know for a successful Maltese real estate investment in 2025.

Malta’s Doors Wide Open to Foreign Investors

An Open Policy for International Buyers

Good news for foreign investors: Malta has adopted a very open policy regarding property acquisition by non-residents. This liberal approach has significantly boosted the Maltese real estate market and contributed to the island’s economic attractiveness.

Limited Restrictions for Certain Areas

Although purchasing is generally free, there are some restrictions for so-called “Special Designated Areas” (SDA). In these areas, which include certain high-end development projects, foreigners can purchase multiple properties without limitation. Outside these areas, non-residents are typically limited to purchasing one property for personal use.

A Simplified Acquisition Process

The acquisition process for foreigners has been significantly simplified in recent years. In most cases, it’s sufficient to obtain an AIP (Acquisition of Immovable Property) permit from the Maltese Ministry of Finance. This permit is typically granted within 35 working days, thus facilitating real estate transactions for foreign buyers.

Good to Know:

European Union citizens benefit from even more favorable conditions, being able to acquire a primary residence without restriction and without needing to obtain an AIP permit after having resided in Malta for at least 5 years.

The Maltese Legal Framework: An Environment Conducive to Investment

A Legal System Inspired by Anglo-Saxon Law

The Maltese legal system, although based on civil law, was strongly influenced by Anglo-Saxon law during the British colonial period. This particularity offers a stable and predictable legal framework, appreciated by international investors.

The Condominium Act

For investments in apartments or residential complexes, the Maltese Condominium Act governs the rights and obligations of owners. It notably defines the rules for managing common areas and the procedures for decision-making within the condominium.

Tenant Protection

Maltese legislation offers balanced protection to tenants while preserving the rights of owners. The 2020 Residential Leases Act introduced new provisions aimed at regularizing the rental market, including mandatory registration of lease contracts.

Planning and Construction Regulations

The Planning Authority (PA) of Malta is responsible for planning and construction regulations. Investors should be particularly attentive to authorized development zones and building height restrictions, which vary across the island’s regions.

Good to Know:

Malta recently strengthened its construction standards to improve building energy efficiency. New constructions must now comply with strict criteria regarding insulation and energy consumption.

Maltese Taxation: A Major Asset for Investors

Attractive Tax Rates

Maltese taxation is one of the island’s main assets for real estate investors. The capital gains tax rate on real estate is 8% for properties held for more than 3 years, and 5% for properties located in urban renewal areas.

No Annual Property Tax

Unlike many European countries, Malta does not levy an annual property tax on real estate. This absence of recurring taxation is particularly appreciated by long-term investors.

Reduced Transfer Duties

Transfer duties upon purchase are relatively low in Malta, amounting to 5% of the purchase price. Furthermore, reductions are provided for first-time buyers and for the purchase of properties located in Gozo, Malta’s sister island.

Favorable Tax Regime for Non-Domiciled Residents

Malta offers a particularly attractive tax regime for non-domiciled residents. They are only taxed on their Maltese-source income and on foreign income remitted to Malta, thus offering interesting opportunities for tax optimization.

Good to Know:

The Maltese government recently introduced an “investment residency” program allowing for a residence permit in exchange for a minimum real estate investment of €320,000 (or €270,000 in Gozo), thus offering additional tax benefits to foreign investors.

Rights and Responsibilities of Property Owners in Malta

Full and Complete Property Rights

In Malta, owners enjoy full and complete property rights over their real estate assets. This right includes the possibility to sell, rent, or mortgage the property without major restriction.

Freedom to Rent

Owners have the right to rent their property, whether for long-term or seasonal rental. However, they must comply with current regulations, including the obligation to register lease contracts with the housing authority.

Property Maintenance

Owners are responsible for maintaining their properties and must comply with current safety and hygiene standards. For condominiums, maintenance costs for common areas are typically shared among owners in proportion to the surface area of their property.

Protection Against Expropriation

Maltese law strongly protects owners’ rights against expropriation. If expropriation is necessary for public interest reasons, fair and equitable compensation must be paid to the owner.

Good to Know:

Malta recently strengthened owners’ rights by introducing faster eviction procedures in case of non-payment of rent, thus improving the security of rental investments.

Regulatory Developments to Monitor

Strengthening Environmental Standards

Facing climate change challenges, Malta recently adopted new regulations aimed at improving building energy efficiency. Owners are encouraged to invest in green technologies, with tax incentives as a result.

Rental Market Regulation

The Maltese government is considering introducing new measures to further regulate the rental market, particularly concerning short-term rentals. These changes could impact investors targeting the tourist rental market.

Digitalization of Real Estate Procedures

Malta is committing to increased digitalization of administrative procedures related to real estate. A new online system for registering lease contracts and declaring rental income is expected to be implemented soon, simplifying procedures for owners.

Revision of Development Zones

The Planning Authority of Malta regularly conducts revisions of development zones. Investors should remain attentive to these changes which can influence property value and development potential.

Good to Know:

The Maltese government announced its intention to launch an ambitious urban renewal program in certain historical areas, potentially offering new investment opportunities in the coming years.

Real estate investment in Malta offers numerous opportunities for foreign investors. With a stable legal framework, favorable taxation, and a dynamic market, the Maltese archipelago positions itself as a prime destination for Mediterranean real estate. However, as with any foreign investment, it’s crucial to thoroughly research and surround yourself with local professionals to effectively navigate the Maltese regulatory environment.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.