Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

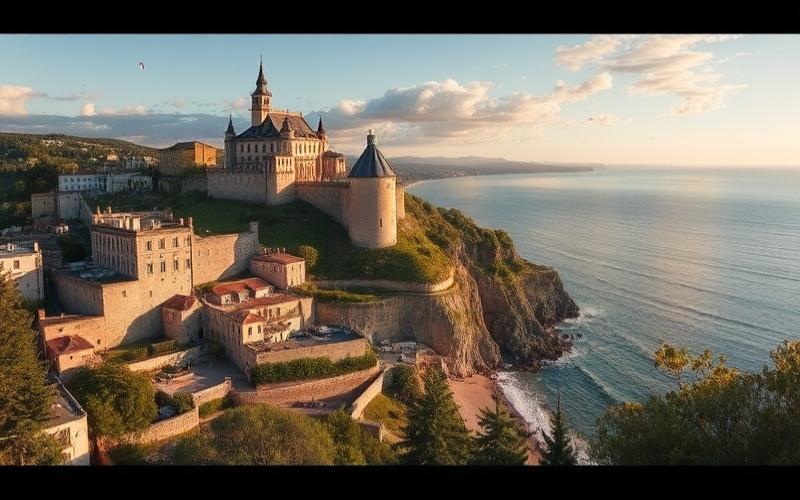

Malta, the jewel of the Mediterranean, attracts millions of visitors each year drawn to its sunny climate, dream beaches, and rich historical heritage. This growing popularity makes it a prime destination for real estate investors looking to enter the short-term rental market. Let’s explore together the opportunities this thriving market offers and the keys to success in this promising sector.

A Goldmine for Property Owners: The Advantages of Short-Term Rentals

Short-term rentals in Malta offer numerous benefits for savvy property owners:

High Potential Income: Due to strong tourist demand, particularly during peak season, rental rates can be very attractive. A well-located apartment can generate significantly higher income than traditional long-term rentals.

Appreciable Flexibility: Short-term rentals allow you to use your property yourself when it’s not rented out. This way you can combine rental investment with a personal vacation home.

Portfolio Diversification: Maltese real estate offers an interesting opportunity to diversify investments in a stable and growing market.

Capital Appreciation Potential: Property values in Malta tend to increase over the years, offering interesting long-term capital gains prospects.

- Favorable Taxation: Malta offers an attractive tax regime for foreign investors, including reduced tax rates on rental income.

- Year-Round Dynamic Market: Although the summer peak season is most lucrative, Malta attracts visitors throughout the year thanks to its mild climate and numerous cultural attractions.

Good to Know:

The most sought-after areas for short-term rentals are Valletta, Sliema, St Julian’s, and popular coastal resorts like Mellieha or St Paul’s Bay. These strategic locations guarantee strong demand and high occupancy rates.

Maximizing Your Investment: Secrets to Effective Management

To get the most out of your short-term rental property in Malta, rigorous management is essential:

Rate Optimization: Adjust your prices according to seasonality and local events to maximize your income. Yield management tools can help you dynamically adjust your rates.

Targeted Marketing: Showcase your property on the most popular online booking platforms (Airbnb, Booking.com, etc.) with quality photos and attractive descriptions. Don’t hesitate to create your own website for increased visibility.

Personalized Welcome: Offer quality service to your guests with a warm welcome, information about local attractions, and small touches that make a difference. Positive reviews are essential for attracting future tenants.

Regular Maintenance: Keep your property in perfect condition to ensure customer satisfaction and preserve your investment’s long-term value.

- Task Automation: Use automated management tools to simplify bookings, customer communication, and cleaning management between rentals.

- Local Collaboration: Establish partnerships with local service providers (cleaning, maintenance, concierge) to ensure effective management even from a distance.

Good to Know:

Many specialized agencies offer comprehensive management services for owners who don’t wish to handle the daily management of their short-term rental property themselves.

Although the short-term rental market is thriving in Malta, it’s crucial to respect the current legal framework:

Mandatory License: All short-term rentals in Malta require a license issued by the Malta Tourism Authority (MTA). This license ensures the property meets required safety and quality standards.

Income Declaration: Income generated from short-term rentals must be declared to Maltese tax authorities. A local accountant can help you optimize your tax situation legally.

Compliance with Standards: Your property must meet certain criteria regarding equipment, safety, and comfort to obtain and maintain the tourist rental license.

- Condominium Rules: Ensure short-term rentals are permitted in your building or residence. Some condominiums may have restrictions regarding this.

- Appropriate Insurance: Obtain specific insurance for short-term rentals, covering risks associated with this activity.

Good to Know:

Short-term rental regulations in Malta evolve regularly. It’s recommended to stay informed about the latest updates from the Malta Tourism Authority or consult a specialized lawyer to ensure ongoing compliance.

Future Outlook: An Expanding Market

The short-term rental market in Malta presents very encouraging prospects for the coming years:

Tourism Growth: Malta continues to attract growing numbers of visitors, with diversification of source markets promising sustained demand.

Infrastructure Development: Investments in tourism infrastructure and transportation enhance the island’s attractiveness and facilitate access to different regions.

Trend Evolution: Growing demand for authentic and personalized travel experiences favors the short-term rental market over traditional hotels.

- Sector Digitalization: Growing adoption of technology in the tourism sector offers new opportunities to optimize property management and marketing.

- Sustainability: The trend toward more responsible tourism can be an advantage for owners offering eco-friendly accommodations.

Good to Know:

Savvy investors might consider positioning themselves in specific niches, such as business tourism or medical tourism, sectors experiencing rapid growth in Malta.

Short-term rentals in Malta represent an attractive investment opportunity for those who know how to navigate this dynamic market. With effective management, compliance with local regulations, and a customer-oriented approach, property owners can benefit from attractive income while participating in the tourism development of this fascinating Mediterranean island.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.