Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

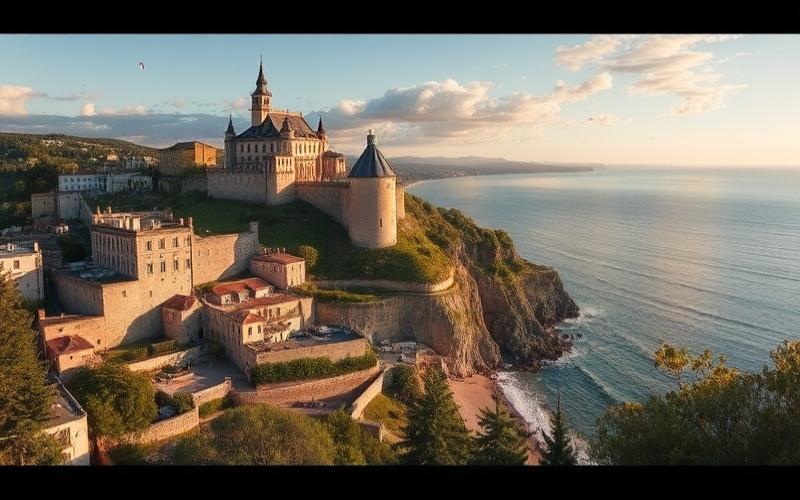

The Mediterranean island of Malta has become a prime destination for international real estate investors in recent years. Beyond its pleasant climate and picturesque landscapes, this small European Union member state offers a particularly advantageous tax framework. Let’s explore in detail Malta’s assets for real estate investors, from its attractive local taxation to its favorable international agreements.

A Local Tax System That Attracts Investors

Malta stands out with a tax regime particularly favorable to real estate investors, whether residents or non-residents. Here are the main advantages that make the island a true tax haven:

- No wealth tax: Unlike many European countries, Malta does not apply any tax on wealth or assets. Investors can therefore accumulate real estate holdings without fearing an annual tax on their value.

- No capital gains tax on real estate after 3 years: If a property is held for more than 3 years, its resale is completely exempt from capital gains tax. This measure encourages long-term investments.

- Reduced tax rate on rental income: Income from property rentals is taxed at a fixed rate of only 15%, significantly lower than in many European countries.

- No annual property tax: Malta does not levy a recurring property tax on real estate holdings, which considerably reduces holding costs.

Good to know:

To fully benefit from these tax advantages, it is recommended to consult a local tax expert who can guide you through the process and optimize your investment strategy in Malta.

International Agreements That Protect Foreign Investors

Beyond its attractive local taxation, Malta has developed an extensive network of international agreements aimed at avoiding double taxation and protecting foreign investors:

- Over 70 signed tax treaties: Malta has concluded double taxation avoidance agreements with numerous countries, including France, the United States, the United Kingdom, and Germany. These treaties prevent real estate income from being taxed both in Malta and in the investor’s country of residence.

- Special tax regime for non-domiciled residents: Foreigners who obtain resident status in Malta without being fiscally domiciled there can benefit from taxation limited to their Maltese-source income, thus excluding their foreign income.

- Protection of foreign investments: As a member of the European Union, Malta offers a stable and protective legal framework for foreign investors, ensuring the free movement of capital.

Reduced Local Taxes for Optimized Profitability

Unlike many countries where local taxes heavily burden property owners, Malta stands out with very limited levies:

- No occupancy tax: Both owner-occupiers and tenants are not required to pay an annual occupancy tax.

- Reduced transfer duties: When purchasing a property, registration fees amount to only 5% of the property’s value, a rate significantly lower than in many European countries.

- Symbolic municipal tax: An annual municipal tax exists, but its amount is generally very low, around a few dozen euros per year.

Good to know:

These low local taxes help optimize the profitability of real estate investments in Malta by significantly reducing recurring costs associated with property ownership.

Malta vs Other Destinations: An Ultra-Competitive Tax Regime

To better understand Malta’s tax attractiveness, let’s compare its regime to other popular real estate investment destinations:

- Malta vs France: While France heavily taxes rental income (up to 45% + 17.2% social charges) and applies an annual property tax, Malta only imposes a fixed rate of 15% on rents with no recurring property tax.

- Malte vs Spain: Spain taxes real estate capital gains at 19% for non-residents, while Malta completely exempts them after 3 years of ownership.

- Malta vs Portugal: Although Portugal offers tax benefits to foreign retirees, its tax rate on rental income (28%) remains higher than Malta’s (15%).

This comparison highlights Malta’s ultra-competitive position in terms of taxation, making it a prime destination for international real estate investors seeking tax optimization.

Conclusion: Malta, A Tax Haven for Real Estate in Europe

Malta stands out as a top destination for real estate investors seeking tax optimization within the European Union. Its attractive tax regime, combined with favorable international agreements and reduced local taxes, makes it a true haven for those looking to maximize the profitability of their real estate investments.

However, it’s important to note that the international tax context is evolving rapidly, with increasing pressure on tax havens. Investors must therefore remain vigilant and ensure the sustainability of Maltese tax advantages before committing to long-term investments.

Good to know:

To fully leverage Maltese tax benefits while remaining compliant with international regulations, it is highly recommended to consult a tax advisor specialized in real estate investment in Malta.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.