Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

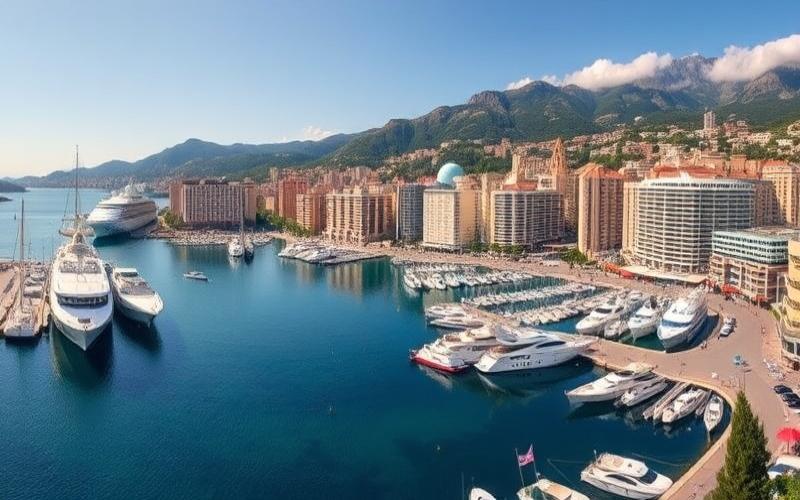

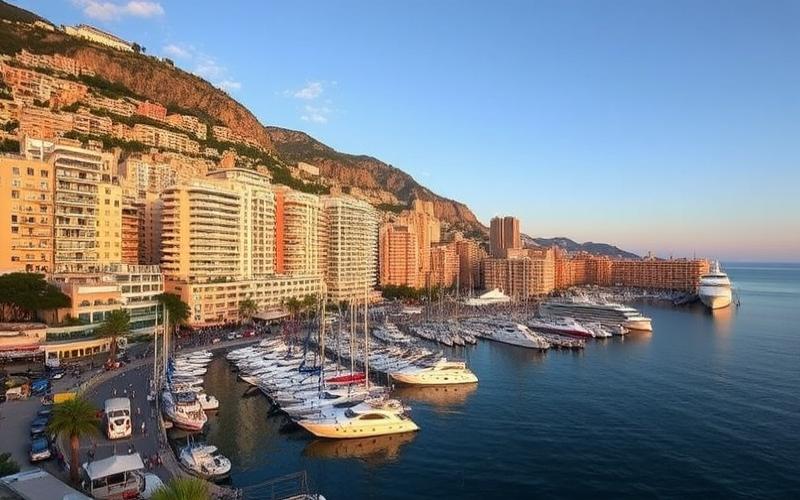

Acquiring Property in Monaco

With its idyllic setting and prosperous economy, Monaco presents an enticing prospect for many foreign investors. However, the real estate purchasing process in this unique principality requires a thorough understanding of local regulations and the specific steps involved.

Between legal aspects, property selection criteria, and tax nuances, each element plays a crucial role in ensuring a successful transaction.

This article will guide you through the particularities of the Monegasque real estate market, offering expert advice to effectively navigate this complex journey and make a strategic investment in one of the world’s most exclusive markets.

Understanding Real Estate Regulations in Monaco

Real estate regulations in Monaco are strict and aim to preserve market scarcity, ensure property quality, and maintain an attractive tax environment. They apply to both residents and foreign buyers, with some notable specificities.

Key Laws and Restrictions for Foreign Buyers:

- No nationality restrictions: Foreigners can freely purchase real estate in Monaco.

- Obtaining residency: To live locally after purchase, one must apply for a resident card. Approval depends on financial criteria (ability to support oneself), wealth examination, and reasons for stay. Purchasing or renting local housing is mandatory to prove local ties.

- Reserved public sector: Certain public or “domaine” properties are reserved for Monegasques or under strict conditions (recurring income, family composition). These properties are not available for free purchase by foreigners.

Notary’s Role in the Process:

Appearing before a Monegasque notary is mandatory for all real estate purchases. The notary verifies legal compliance, drafts the authentic deed, and secures the property transfer.

In Monaco as in France, the buyer first signs a preliminary agreement then the final deed at the notary’s office.

Taxes and Fees Related to Real Estate Purchase:

| Fee Type | Approximate Amount | Details |

|---|---|---|

| Registration fees | 4–6% | Calculated on the price stated in the deed |

| Notary fees | Approximately 1–2% | Regulated amounts |

| Additional fees | Variable | Bank charges for local/foreign loans; high initial deposit required |

Note that there is no wealth tax or capital gains tax for non-commercial individuals.

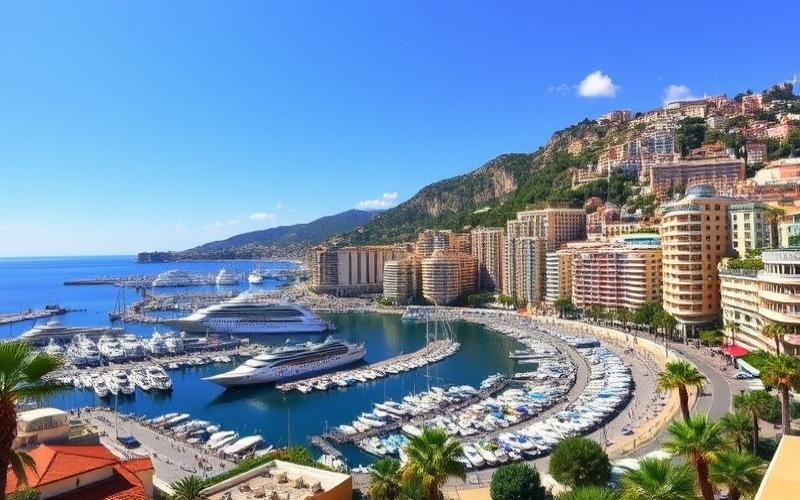

Competitive Market & Regulatory Impact:

“The Monegasque market is very limited (a few hundred properties/year) with extremely high prices”

Natural land scarcity (2 km²), combined with restrictions targeting speculative traders – new financial obligations since 2024 – artificially limits opportunistic operators to make “the market more accessible to local buyers and permanent residents” while curbing excessive inflation.

- Prepare financial documentation before any steps: solid proof of necessary resources

- Consult with a recognized local real estate agent to avoid pitfalls related to limited availability

- Open a Monegasque bank account if using local credit; plan for significant initial deposit

- Anticipate that certain property types remain inaccessible based on your family or statutory profile

- Engage a Monegasque notary from the start to guide you through all specific legal aspects

Good to Know:

In Monaco, real estate regulations are strict and require foreign buyers to familiarize themselves with several aspects before acquiring property. Buyers often need to obtain a change of use permit for certain properties, particularly commercial ones. The notary’s role is crucial, not only for ensuring transaction legality but also for guiding buyers through local law complexity. Registration fees amount to approximately 6%, plus notary fees reaching about 1%. Due to the competitive nature of the Monegasque real estate market and rigorous regulations, property prices remain high. Foreign buyers are advised to consult a real estate agent familiar with these laws and allow sufficient time for administrative procedures, considering potential delays for special permits.

Key Takeaway: Buying in Monaco remains open but heavily regulated – few to no direct restrictions based on nationality but strict economic screening; each step requires administrative rigor; financial anticipation essential; systematic consultation with local professionals recommended.

Tax Obligations for Foreign Residents

Tax Residency Criteria in Monaco for Foreigners

To be considered a tax resident in Monaco, several conditions must be met:

- Have housing in the Principality.

- Possess sufficient financial resources to live there.

- Present no risk to public order.

- Actually reside in Monaco at least 183 days per year or demonstrate that your main center of interests (family, economic, social) is located in Monaco.

Other factors strengthening status: children enrolled locally, partner residing in the Principality, investments or professional activities primarily based locally.

| Criterion | Required Detail |

|---|---|

| Housing | Ownership or rental of real estate |

| Financial resources | Proof of necessary means |

| Actual stay | Minimum presence: typically 183 days/year |

| Center of interests | Family and economic life primarily based in Monaco |

Tax Obligations of Foreign Residents

Monaco is renowned for its absence of certain direct taxes:

- No income tax for individuals (except French residents subject to bilateral agreements).

- No real estate wealth tax (IFI), except specific provisions for French nationals.

- Property taxes and local taxes are non-existent in the Principality: there is neither property tax nor standard residence tax.

However:

- Transfer duties are due during real estate purchases (approximately 4–6% depending on cases).

- Inheritance taxes apply according to a scale depending on degree of kinship. Example:

- 0% between spouses/registered partners and children,

- Up to 16% between non-relatives.

List of typical obligations:

- Declare status to Monegasque authorities

- Comply with CRS (Common Reporting Standard) regulations: automatic transmission of banking information to certain countries

- Maintain complete documentation proving actual residence

Main Differences with National Residents

There are no officially separate tax regimes for nationals and foreigners. However:

| Situation | National Resident | Foreign Resident |

|---|---|---|

| Income tax | No | No |

| IFI | No | Except French |

| Inheritance | Same scale |

The main exception concerns French nationals, who must continue paying French income tax and IFI even after official transfer of tax domicile if certain conditions are not met.

International Agreements and Double Taxation

Monaco has signed specific agreements, particularly with France. This convention generally avoids double taxation but still subjects certain worldwide income earned by a Monegasque resident with strong remaining ties to France to French tax regime.

Other countries: For many jurisdictions outside France, there isn’t necessarily a formal agreement; however, through CRS application, all relevant information will be transmitted to competent tax authorities of the concerned country. This may lead to additional taxation in their home country according to national legislation.

Common Examples

An Italian family living more than six months per year in Monaco purchases an apartment: they only pay transfer duties related to the purchase; no annual local taxes will be due as long as they remain fully compliant with Monegasque criteria – but must carefully monitor time spent outside the principality to prevent Italian tax authorities from challenging their actual residence.

A British entrepreneur fiscally domiciled in Monaco must declare locally opened bank accounts to British tax authorities per CRS; if maintaining significant family or professional foothold in the UK without solid proof of actual transfer of main interests to Monaco, they risk reclassification by HMRC as UK resident taxable worldwide.

Practical Tips

- Systematically maintain precise records attesting to your annual physical presence in the Principality.

- Centralize documents related to local housing (notarized lease/notarized deed).

- Avoid any ambiguity regarding remaining family/professional centers in your original country.

- Regularly consult specialized tax advisors to secure your situation with both Monegasque and foreign authorities.

Good to Know:

In Monaco, foreign residents can benefit from an attractive tax regime, as the country imposes neither income tax nor wealth tax. To be considered a tax resident in Monaco, one simply needs to spend at least six months per year in the territory. Residents must however pay property taxes and inheritance taxes for properties located in Monaco, although these are often lighter than in other countries. Unlike national residents who might benefit from certain local exemptions, foreigners must also be attentive to double taxation agreements Monaco has signed with certain countries, which can influence taxation on income or properties located abroad. For example, a British Monegasque resident might be subject to inheritance taxes depending on British legislation. To minimize tax surprises, consulting an international tax specialist is recommended to assess the impact of these agreements on investments upfront and effectively plan one’s tax situation.

Essential Documents for Purchasing Property in Monaco

Main Documents Required for Real Estate Purchase in Monaco (Particularly for Foreigners)

- Valid passport

- Proof of current residence (lease contract or property deed)

- Income verification:

- Recent pay stubs

- Bank statements showing sufficient savings

- Proof of self-employment or company activity

- Letter/certificate if financial support provided by relative, spouse, or partner

- Criminal record extract from countries where applicant resided during the past five years (proof of good conduct)

- Monegasque residence certificate (mandatory for non-residents before purchase)

- For non-Europeans:

- Long-stay type D visa issued by France

- Prior administrative authorization from Monegasque government, particularly for subsequent residency permit applications

| Category | Main Document | Observations |

|---|---|---|

| Identity | Valid passport | For everyone |

| Residence | Lease contract / property deed | Last official address |

| Income/resources | Pay stubs, bank statements | Or bank certificate in Monaco |

| Criminal record | Recent extract | Current country + previous countries |

| Administrative certificate | Monegasque residence certificate | Especially for non-residents |

| Visa | French long-stay visa (type D) | Non-Europeans only |

Depending on status and targeted property, additional documents may be required:

- Supplementary proof of fund origin (per anti-money laundering obligations)

- Official French translations and legalization/apostille if issued outside EU/EEA.

Foreign documents generally must be translated into French by a sworn translator and authenticated according to their origin.

Notary’s Role in Monaco

The notary acts as legal guarantor:

- Verifies legal compliance of deeds

- Prepares preliminary then authentic deed

- Centralizes and controls all transaction funds

- Ensures official land registration with Monegasque cadastre

Associated fees:

Notary fees represent approximately 6% of purchase price, plus potential other specific taxes or duties.

Specific Points by Profile

For non-European buyers:

Prior obtaining of French long-stay visa essential. Procedure may be longer with enhanced capital origin checks.

For properties subject to special restrictions:

Special authorizations may be required from the Princely Government, particularly for listed buildings or those with special status.

Good to Know:

To acquire real estate in Monaco, foreigners generally must provide several essential documents, including a valid passport, proof of residence such as a lease contract, and income verification to demonstrate financial capacity, like bank statements or pay stubs. Special authorization may be necessary for those outside the EU. The notary’s role in Monaco is crucial, as they secure the transaction, ensuring legal compliance, and their fees can reach 6% of purchase price. Translation and authentication of foreign documents are sometimes required, especially for non-European buyers, and additional documents may be needed depending on property characteristics or buyer status. In summary, guidance by a local professional will facilitate this potentially complex process.

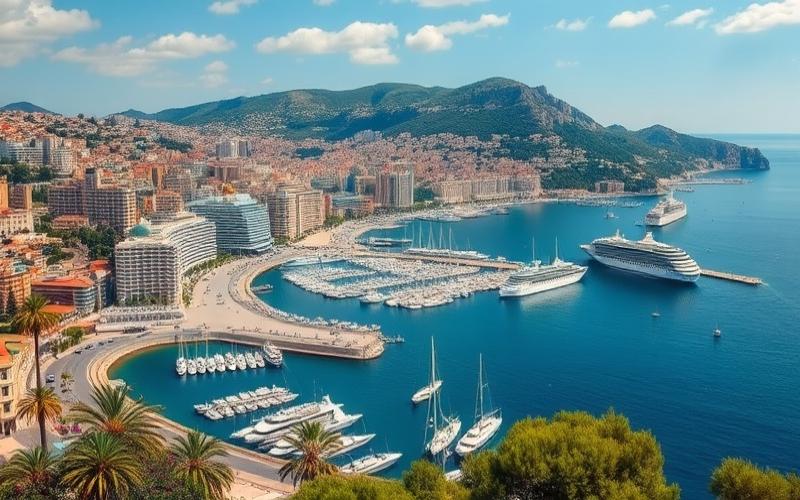

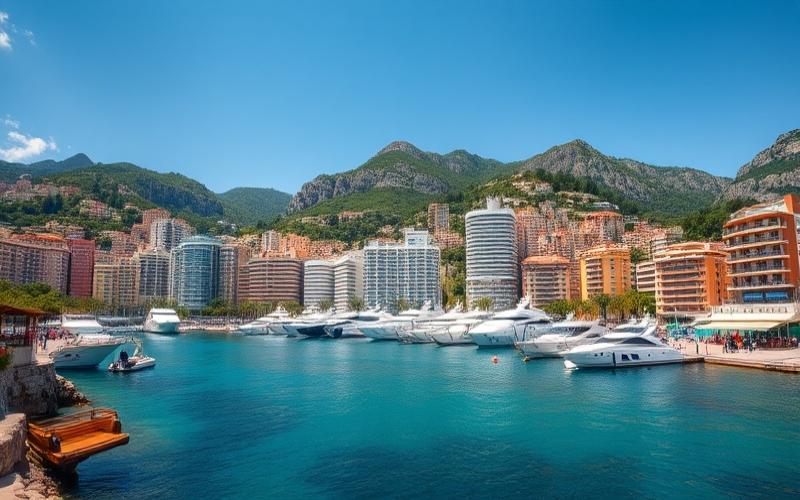

Real Estate Acquisition: Opportunities for Foreigners

Monaco offers a particularly attractive environment for real estate acquisition by foreigners, notably thanks to its advantageous tax framework and market stability. Foreigners can freely purchase real estate in the principality, whether for residence or investment.

Main Tax and Financial Advantages:

- Absence of income tax for Monegasque residents (except French), attracting international clients seeking tax optimization.

- Stable and growing market, with approximately 75% price increase over the last decade, according to Monaco’s Real Estate Observatory.

- High patrimonial value, reinforced by land scarcity and international prestige associated with Monaco.

Facilitative Legal Framework:

The purchase process is open to foreigners without major restrictions; it follows steps similar to those practiced in France (preliminary agreement, visit to Monegasque notary).

Non-residents must obtain a residence certificate if they wish to settle permanently. This process is regulated but accessible through acquisition or rental of local housing.

Recent regulations aim to facilitate international investor reception by simplifying certain administrative procedures related to residency.

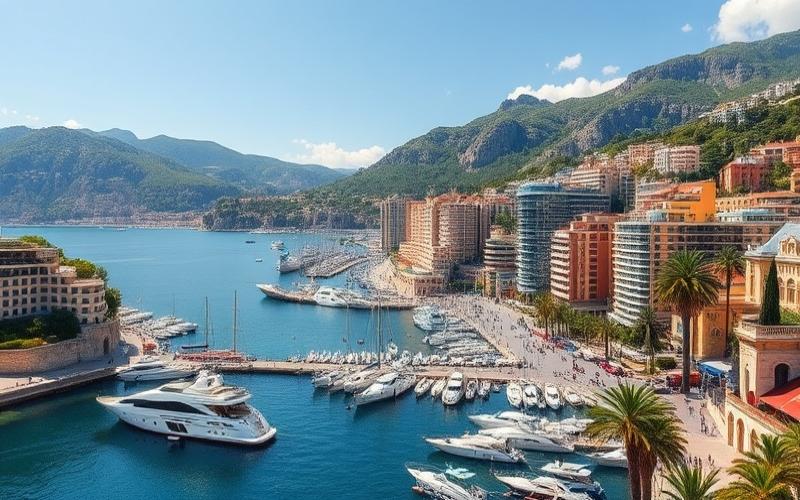

Concrete Real Estate Opportunities:

| Neighborhood/Project | Main Advantage | Opportunity Type |

|---|---|---|

| Monte-Carlo | Prestigious address | Luxury new/old residences |

| Fontvieille | Urban expansion | Recent apartments, sea views |

| Larvotto | Seafront renovation | High-end new projects |

| Jardin Exotique | Under development | Modern programs, terraces |

Recent projects:

- Developments like Testimonio II or Mareterra offer contemporary apartments with exclusive services.

- Opportunities in renovated historic buildings, offering classic charm and current amenities.

Available Specialized Services:

- Comprehensive support from local real estate agents perfectly mastering the Monegasque market and its legal and tax specificities.

- Specialized law firms ensuring transaction compliance to secure each process step.

- Local banks offering mortgage loans adapted to international profiles; often required: high personal contribution and prior opening of local account.

Potential Challenges & Suggestions for Successful Acquisition:

List of Main Challenges:

- Highly competitive market: limited number of available properties annually facing high global demand

- Among world’s highest square meter prices

- Demanding administrative process (residence certificate) requiring anticipation

Practical Suggestions:

- Engage a recognized local real estate agent from the start

- Prepare solid financial file including patrimonial proof

- Be responsive to new listings or new project launches

To maximize chances in this exclusive market, foreign investors are strongly advised not only to rely on local expertise but also to adopt a proactive approach to quickly seize any attractive opportunity.

Good to Know:

In Monaco, real estate acquisition by foreigners is facilitated by a favorable legal framework and attractive tax advantages, such as absence of income tax and moderate wealth taxation. The new urban plan offers interesting opportunities with development projects in Fontvieille and La Condamine neighborhoods, and luxury renovations in Monte-Carlo. According to recent regulations, new residential buildings are particularly sought after, highlighting market dynamism. Specialized services, provided by experienced real estate agents, accompany investors through their process, navigating challenges represented by high demand and competitiveness. To stand out, being responsive and having solid financing is recommended.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.