Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

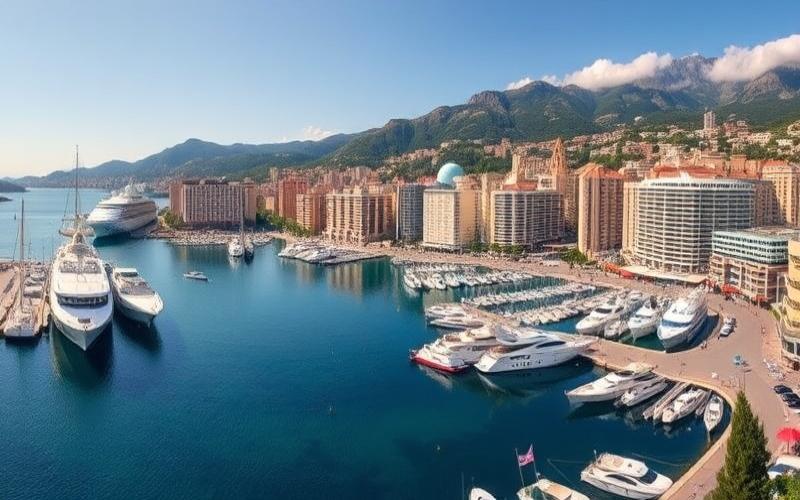

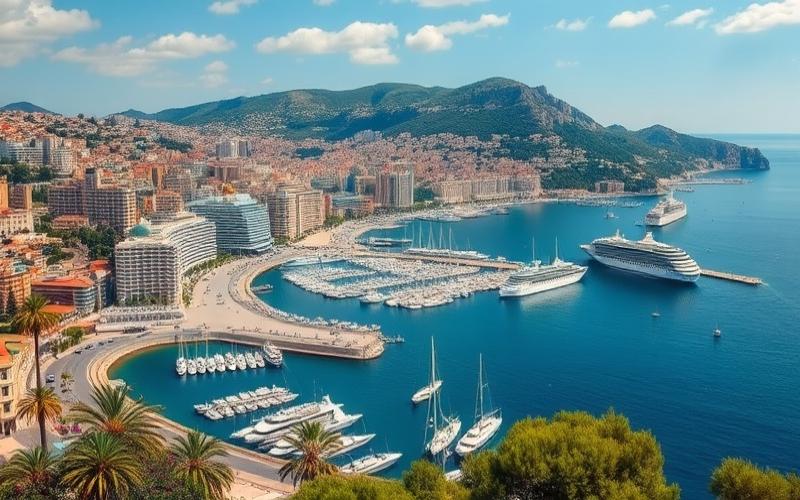

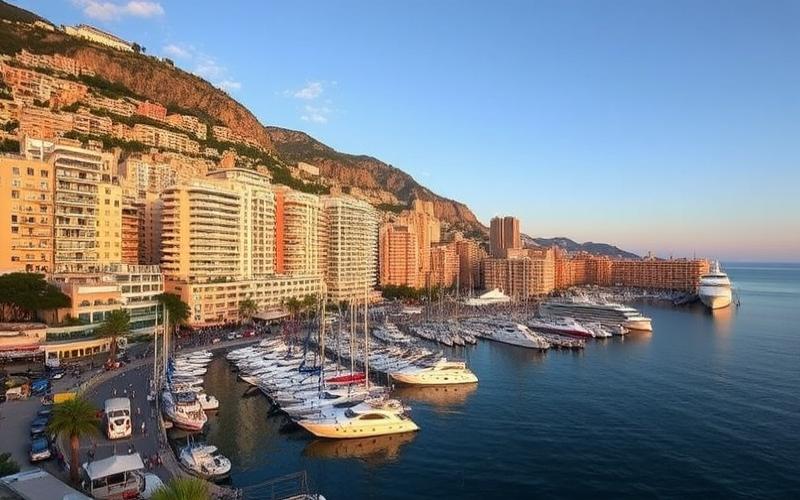

Monaco: A Competitive and Exclusive Real Estate Market

Monaco, this tiny sovereign state on the French Riviera, isn’t just synonymous with glamour and luxury, but also with an extremely competitive real estate market that attracts investors from around the world.

Real Estate Financing in Monaco

For those wishing to acquire property in this tax haven, understanding how to secure real estate financing becomes essential. Local banks offer customized solutions, but navigating the specifics of this unique market can be complex and intimidating.

Good to Know:

Eligibility conditions for a mortgage in Monaco can vary significantly between banks and based on the borrower’s profile.

Key Steps for a Successful Investment

Discovering the available loan options, eligibility conditions, and steps to follow is therefore crucial for succeeding in this strategic investment and maximizing opportunities in this exclusive real estate environment.

Acquiring Property in Monaco: Financing for Foreigners

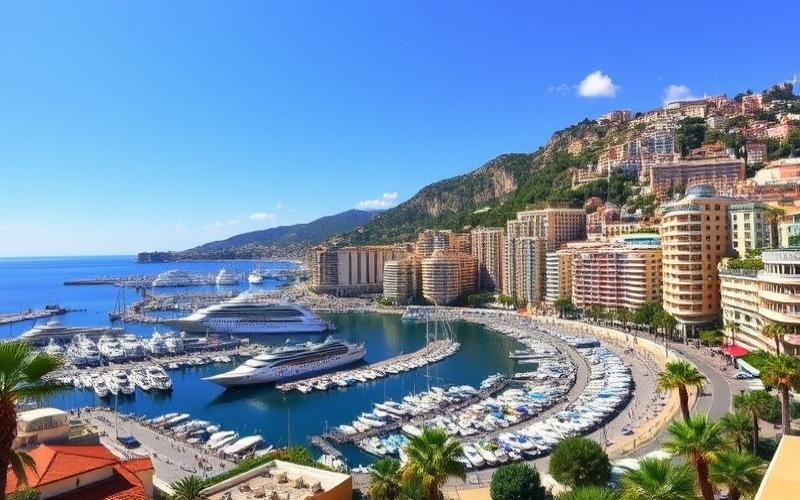

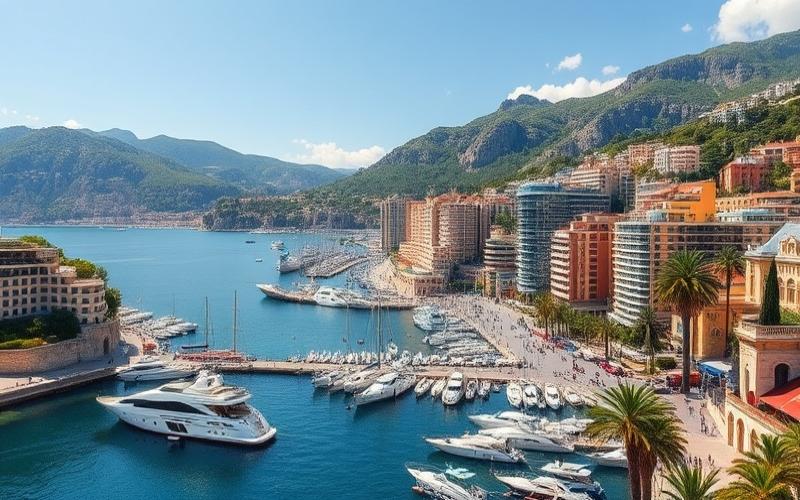

The Monegasque real estate market stands out due to its extreme scarcity, record prices, and strict regulatory environment, making it a sought-after destination for wealthy foreign investors.

Specifics of Monaco’s Real Estate Market and Appeal for Foreign Investors:

- Among the Highest Prices in the World: The average price per square meter exceeds €51,000, even reaching €100,000/m² in exceptional neighborhoods like Monte-Carlo or Larvotto.

- Legal Security and Political Stability: Monaco offers a stable institutional framework, with advantageous taxation (no wealth tax or capital gains tax on real estate for residents) and a high level of personal security.

- Limited Real Estate Supply: The Principality occupies only 2 km², creating constant tension between restricted supply and growing global demand for prestigious assets.

- Strong International Demand: The market is primarily driven by ultra-wealthy buyers seeking exclusive properties, with studios starting at around €1 million.

| Key Factor | Monegasque Specificity |

|---|---|

| Average Price/m² | >€51,000 |

| Most Expensive Neighborhood | Larvotto (>€97,500/m²) |

| Taxation | Very attractive for residents |

| Demand | Strong/International |

Prerequisites for Foreign Buyers (Eligibility for Financing)

Financial Requirements:

A personal down payment generally required around 30% of the total property amount, sometimes more depending on the financial profile.

Required Documents:

- Valid passport or ID

- Proof of income (pay stubs, balance sheets if self-employed)

- Recent tax returns

- Proof of equity (bank statement)

- Preliminary contract or sales agreement

Local banks systematically require a significant down payment to attest to the purchasing candidate’s financial solidity.

Steps to Obtain a Loan from Local Banking Institutions

- Prepare a complete file with all requested supporting documents

- Provide an explanatory letter on the origin of the funds used for the down payment

- Undergo a strict KYC (“Know Your Customer”) analysis phase, aimed at verifying financial integrity and absence of links to illicit activities

- Wait for preliminary approval before final signing with a notary

Typical Interest Rates & Required Guarantees

Rates generally vary between 2% and 3%, but can fluctuate based on the borrower’s profile, the requested amount, and the loan term.

Banks generally require:

- A mortgage registered on the financed property,

- Sometimes additional collateral on financial assets held in their books,

- Mandatory life and disability insurance,

Differences Between Residents & Non-Residents

| Criterion | Resident | Non-Resident |

|---|---|---|

| Minimum Down Payment | ~30% | Often >40%, or more |

| KYC Conditions | Standard | More rigorous |

| Access to Credit | Favored | More restrictive |

Non-residents often undergo enhanced analysis regarding their asset stability as well as their motivation to invest long-term in the Principality.

Practical Tips to Overcome Legal or Administrative Obstacles

- Engage a specialized local broker, familiar with Monegasque banking requirements

- Prepare in advance all proofs justifying the lawful origin of funds

- Consider opening a local bank account, which can greatly facilitate obtaining financing

- Anticipate administrative delays related to thorough anti-money laundering checks

Good to Know:

Investing in real estate in Monaco is particularly attractive for foreigners due to its advantageous taxation and exclusive market, marked by limited supply and strong demand, which ensures price stability. However, to obtain financing, foreign buyers often must meet strict conditions. Local banks frequently require a significant personal down payment, generally 30% to 40% of the purchase price. Documents to provide include proof of income, financial statements, and sometimes bank references. Compared to residents, non-residents may face slightly higher interest rates and additional guarantees, such as life insurance taken out in Monaco. The process generally requires a local intermediary, such as a lawyer or notary, to facilitate administrative procedures and overcome potential legal barriers. Obtaining a loan in the Principality involves a lasting banking relationship, often encouraged by prior deposits or investments with the chosen bank. It is advisable to work with experienced real estate advisors who understand the nuances of the Monegasque market and can navigate its specificities effectively.

To maximize their chances, wealthy foreign buyers are advised to surround themselves from the start of the project with legal/tax advisors specialized in Monegasque regulations.

Essential Documents for Your Mortgage

Banking institutions in Monaco require a rigorous list of documents for any mortgage application. Here are the essentials to gather:

| Required Document | Detail or Example |

| Valid ID | Passport, ID card, birth certificate |

| Proof of Current Residence | Recent bill (electricity, water…), lease agreement |

| Recent Bank Statements | Last 3 to 6 months |

| Proof of Income | Last 3 pay stubs or accounting balance sheets for self-employed |

| Most Recent Tax Notice | Official tax document |

| Sales Agreement/Promise to Sell | Signed by the parties |

| Property Appraisal | Report from a certified expert |

In certain specific cases:

- For non-residents or foreigners, certified translation of documents and a residence permit may be required.

- A nationality certificate may be requested if the transaction benefits from public aid.

- If there are existing loans, provide the amortization schedule.

Legal and Administrative Specificities Unique to Monaco

- Monegasque banks require all documents to be provided in original and officially translated if necessary.

- The loan amount generally must not exceed a certain percentage (sometimes 45%) of the estimated property price.

- A mortgage guarantee is almost systematic; therefore, anticipate costs related to the mortgage and sometimes a paid appraisal conducted by a local expert.

Specifics of the Monegasque Real Estate Market

The market is very selective with high demand and little supply: some banks may require additional guarantees (significant personal guarantees, high initial down payment), or even proof that you already have the necessary funds in your Monegasque accounts to pay the deposit or ancillary fees.

Practical Tips to Limit Delays

- Check the validity and consistency between your different supporting documents before submission.

- Anticipate official translation if you hold documents in a foreign language.

- Prepare a complete file from the start including all your official sources: this avoids time-consuming back-and-forth with the banking institution.

Practical Checklist

- Scan each document front/back

- Also keep each original in paper format

- Classify according to this scheme:

- Identity & Civil Status

- Banking & Tax Proofs

- Documents Related to the Targeted Property

Properly preparing your file not only speeds up its processing but also strengthens your credibility with Monegasque banks.

Good to Know:

To obtain real estate financing in Monaco, prepare a valid ID and proof of current residence. Gather your bank statements from the last three to six months and your proof of income, such as the last three pay stubs or your accounting balance sheets if you are self-employed, as well as your latest tax notice. A sales agreement or promise to sell and, if possible, a property appraisal are also required. In Monaco, administrative formalities may include specific legal requirements and demonstrating a solid relationship with a local bank can speed up the process. Consider potential additional guarantees or documents due to the specificities of Monaco’s exclusive real estate market. To limit delays, verify the accuracy and legitimacy of your documents before submission and consider the help of a local advisor to navigate Monegasque specificities effectively.

Proper Preparation: Key Conditions for Successful Financing

To obtain real estate financing in Monaco, it is essential to meet precise criteria, both financially and administratively.

Financial and Administrative Criteria:

- Minimum personal down payment required: generally 15% of the property value must be paid upon signing the deed.

- The loan amount cannot exceed a ceiling (for example, €762,000 for certain loans reserved for Monegasques) and the monthly payment must not exceed one-third of the household’s resources.

- Required supporting documents:

- Official ID documents

- Recent bank statements

- Tax returns

- Employment contract or proof of stable professional activity

- Amortization schedules of any current loans

| Criterion | Typical Requirement |

|---|---|

| Personal Down Payment | Minimum 15% |

| Debt-to-Income Ratio | Monthly payments ≤1/3 of income |

| Maximum Loan Amount | Legal ceiling or according to profile |

| Term | Generally between 5 and 15 years |

| Guarantees | Mortgage, bank guarantee, etc. |

Importance of a Strong Financial File:

A convincing file is based on:

- A controlled debt-to-income ratio (not exceeding one-third of resources)

- Tangible proof of stable income (pay stubs, accounting balance sheets)

- A healthy banking situation (no incidents)

- Solid guarantees like a mortgage or real collateral

Presenting these elements reassures lenders about your ability to repay the loan.

Understanding the Monegasque Real Estate Market:

The local market is characterized by:

- Very high prices per square meter

- Limited supply facing sustained international demand

This implies that banks are particularly vigilant about the real valuation of the financed property. It is essential to research local trends before any steps to anticipate financial feasibility.

Practical Tips for Preparing Your Interview with a Lender:

Preparatory list:

- Prepare all your original documents translated if necessary (deeds, statements, contracts)

- Clearly present your project: location, desired surface area, asset goal or primary residence

- Be transparent about your other financial commitments

Highlight your professional and financial stability as well as the adequacy between your income and the envisioned project.

Also highlight any differentiating elements (down payment higher than the minimum required, complete absence of other debts).

Strategies to Anticipate/Solve Common Obstacles:

Preventive list:

- Check your eligibility upfront with institutions specializing in Monegasque financing.

- Always plan a margin in your budget to cover ancillary fees (notary, file, appraisal).

Do not hesitate to solicit several banks to compare their criteria; also consider a specialized broker who will know how to optimize the presentation and defend your file with partner institutions.

“A rigorous file maximizes your chances in this demanding market”

Good to Know:

To obtain real estate financing in Monaco, it is crucial to prepare a solid file, with a good debt-to-income ratio and proof of stable income, while being able to demonstrate significant guarantees or personal down payments. Understanding the Monegasque market, known for its competitiveness and high prices, also directly impacts the financing process: knowing the trends can guide your strategy. During interviews with lenders, prepare to convincingly argue your real estate project; this may include details about the targeted property and how it aligns with market trends. Anticipate potential obstacles like reinforced guarantee requirements, and consider solutions, such as improving the veracity of your financial information, to show your seriousness and your ability to honor the loan.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.