Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

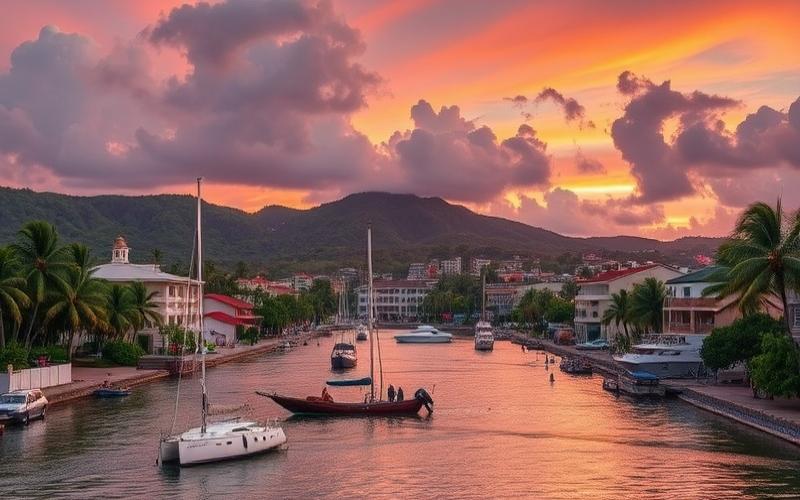

Commercial real estate in the Dominican Republic offers particularly attractive investment opportunities for savvy investors. With a growing economy, thriving tourism sector, and continuously improving infrastructure, the country is increasingly attracting attention from international investors. Let’s take a closer look at the different facets of this promising market.

A Diverse Range of Commercial Properties

The Dominican Republic offers a wide range of commercial properties suitable for different types of investments:

Shopping Malls and Retail Spaces

The retail sector is experiencing sustained growth in the Dominican Republic, particularly in major cities like Santo Domingo and Santiago. Modern shopping malls and street retail spaces are attracting numerous international brands, creating opportunities for investors.

Office Buildings

With the rise of the service sector and the arrival of international companies, demand for quality office space is increasing, particularly in Santo Domingo’s business districts. Class A office buildings offer attractive returns.

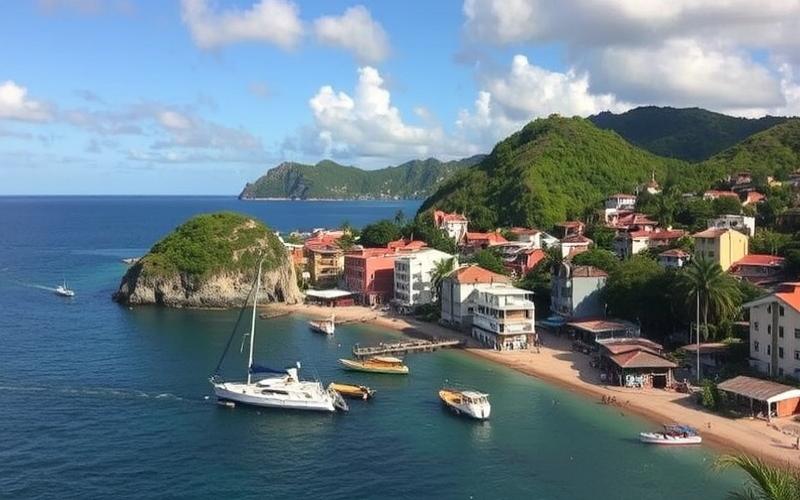

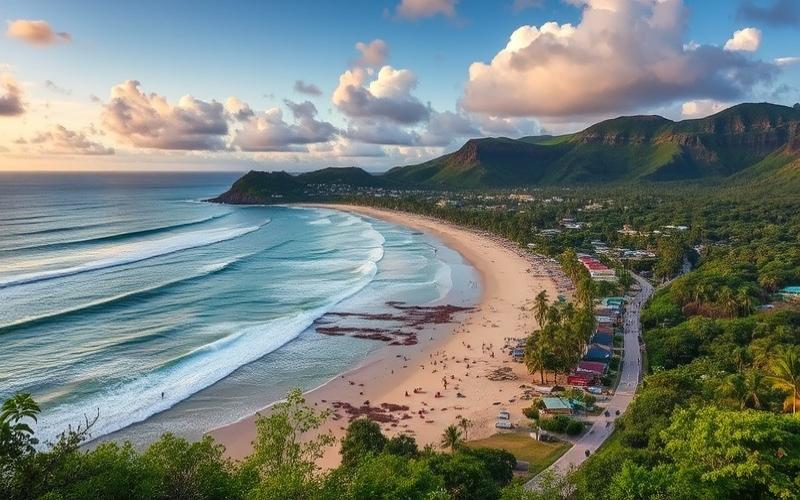

Hotels and Tourist Complexes

With tourism being a pillar of the Dominican economy, investment in hotel properties, beach resorts, or vacation rentals can prove very lucrative, especially in popular coastal areas like Punta Cana or Puerto Plata.

Warehouses and Logistics Spaces

The development of e-commerce and improvements in transportation infrastructure are driving demand for modern logistics spaces, offering interesting opportunities near major highways and port areas.

Attractive Profitability and Risk Management

Promising Returns

Commercial real estate in the Dominican Republic can offer attractive rental returns, often higher than those seen in many mature markets. Yield rates typically range between 7% and 12% depending on the property type and location, with long-term appreciation prospects.

Advantageous Tax System

The Dominican government has implemented tax incentives to attract foreign investors, particularly in the tourism sector. These benefits may include tax exemptions on profits for several years or reductions in property taxes.

Prudent Risk Management

Like any foreign investment, commercial real estate in the Dominican Republic carries certain risks that should be carefully assessed:

– Currency risk: potential volatility of the Dominican peso against strong currencies like the US dollar or euro. – Legal risk: importance of understanding the local legal framework and ensuring clarity of property titles. – Market risk: necessity to carefully study local demand and long-term economic prospects.

Thorough due diligence and the use of experienced local professionals are essential to minimize these risks.

A Rapidly Evolving Sector: Trends and Opportunities

Modernization and Sustainable Development

The Dominican commercial real estate market is experiencing a marked trend toward modernization and the adoption of sustainable practices. Green and energy-efficient buildings are gaining popularity, offering investment opportunities in high-value-added properties.

Growth of Coworking and Flexible Spaces

The growing demand for flexible and collaborative workspaces is creating new opportunities, particularly in major cities. Investors can consider converting traditional spaces into modern, attractive coworking centers.

Infrastructure Development

Government investments in infrastructure, particularly in transportation and telecommunications, are opening up new areas for commercial development. Savvy investors can leverage these improvements to identify emerging opportunities.

Digitalization and Innovation

The growing adoption of digital technologies in the Dominican real estate sector offers new possibilities, such as investing in properties equipped with smart building solutions or creating data centers to meet the growing demand for cloud services.

Good to Know:

Commercial real estate in the Dominican Republic offers attractive return potential but requires a prudent and well-informed approach. Portfolio diversification, thorough due diligence, and a deep understanding of local dynamics are essential for success in this rapidly evolving market.

Tips for Successful Investment

To maximize success chances in Dominican Republic commercial real estate, here are some key recommendations:

Conduct Thorough Market Research

Before any investment, it’s crucial to understand local dynamics, demand trends, and economic prospects of the target area. A detailed analysis of supply and demand for the considered property type is essential.

Surround Yourself with Local Experts

Using experienced local professionals (lawyers, real estate agents, accountants) is essential to effectively navigate the Dominican legal and tax context and avoid potential pitfalls.

Consider Local Partnerships

Establishing partnerships with local players can facilitate access to interesting opportunities and help overcome cultural and language barriers.

Stay Informed About Regulatory Changes

The regulatory framework for commercial real estate in the Dominican Republic may evolve. It’s important to stay informed about legislative changes that could impact investments.

Plan an Exit Strategy

From the beginning of the investment, it’s wise to consider different exit options, whether through resale, long-term leasing, or property conversion.

Good to Know:

Patience and a long-term vision are major assets for success in Dominican Republic commercial real estate. Investors who take the time to understand the market and build a strong local network are best positioned to take advantage of the opportunities offered by this dynamic market.

Conclusion: A Promising Market for Savvy Investors

Commercial real estate in the Dominican Republic presents significant potential for investors seeking attractive returns in a dynamic emerging market. The diversity of opportunities, combined with a growing economy and policies favorable to foreign investment, creates an environment conducive to success.

However, as with any international investment, a prudent and well-informed approach is essential. Investors who take the time to understand the specifics of the Dominican market, surround themselves with local experts, and adopt a long-term vision are best positioned to capitalize on the opportunities offered by this expanding market.

With careful planning and wise risk management, commercial real estate in the Dominican Republic can be a valuable addition to a diversified investment portfolio, offering both attractive returns and long-term growth potential.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.