Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

Real Estate Acquisition in the Dominican Republic

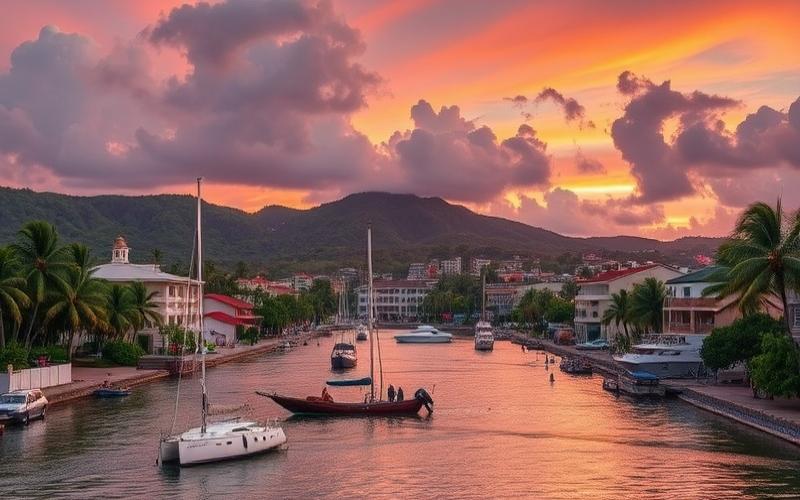

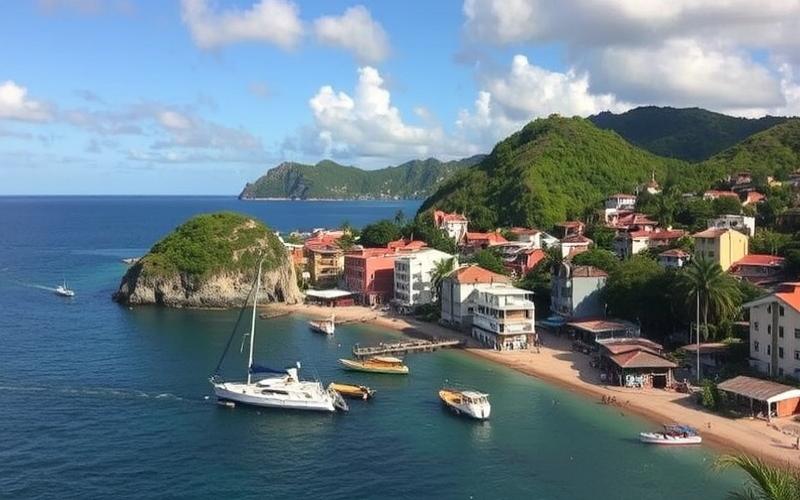

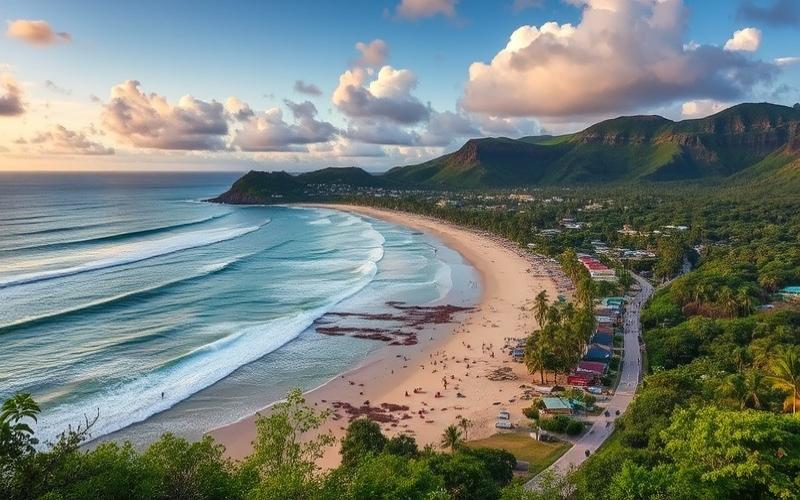

Purchasing real estate in the Dominican Republic is attracting more and more foreign investors, drawn by its paradise-like landscapes and tropical climate.

Good to Know:

However, venturing into this country’s real estate market requires a thorough understanding of mandatory insurance, often essential to protect your investment.

Essential Insurance

To navigate this complex environment, it’s crucial to know the different coverage options available as well as the legal requirements that can differ significantly from standards in other countries.

Complete Guide to Secure Your Investment

This guide aims to break down and compare the main essential insurance policies in the Dominican Republic, providing potential buyers with key information to secure their assets while enjoying the benefits of this dream destination.

Home Insurance Comparison in the Dominican Republic

| Company/Offer | Main Coverage | Indicative Price | Reputation & Financial Strength | Local Specifics | Main Advantages | Disadvantages |

|---|---|---|---|---|---|---|

| Local Insurers (e.g., Mapfre, Seguros Universal, Banreservas) | Fire, lightning, earthquake, hurricane, flood, vandalism, smoke, civil liability | Approximately 0.8% of purchase price/year | Well-established local networks | Subscription and management in Spanish | Good knowledge of local market Competitive rates | Coverage limits Sometimes slow service |

| International Insurers (e.g., Allianz via brokers) | Similar coverages with additional options for expatriates | Higher than local | Strong international guarantees | Multilingual contracts | International customer service Some tailored guarantees for expatriates | Higher prices |

| Expatriate Specialists (ACS…) | Protection adapted for non-residents: multi-risk home + liability + assistance | Varies by profile | International mobility expertise | Remote management possible | Contracts adapted to expatriate status | Limited local physical presence |

Essential Comparison Criteria

- Coverage Offered

- Standard risks covered: fire, tropical storm/cyclone/hurricane*, earthquake*, flood*, theft/vandalism*, water damage.

- Civil liability systematically included.

- Some policies add outdoor installations or recreational items.

- Premium Prices

- Typical annual premium: approximately 0.8% of the purchase price for a standard property.

- Rates vary by location (exposed cyclone zones), housing type, and chosen options.

- Reputation and Financial Strength

- Major insurers like Seguros Universal or Banreservas enjoy a good national reputation.

- International subsidiaries offer additional security but at a higher cost.

- Local Specifics Influencing the Market

- The Dominican Republic is highly exposed to climate risks: seasonal hurricanes (June-November), occasional earthquakes.

- Insurance not mandatory but strongly advised by all real estate professionals: protect your investment against these major risks.

Common Situations Covered by Home Insurance

- Damage caused by a hurricane or tropical storm

- Accidental domestic fire

- Break-in burglary

- Civil liability towards neighbors after water damage

Advantages & Disadvantages by Chosen Option

Local Insurer

- Advantages: fine adaptation to Dominican context; speed in local claims management; competitive rates

- Disadvantages: possible language barrier; sometimes lower ceilings than European standards

International Insurer / Expat Specialist

- Advantages: extended guarantees; multilingual support; international assistance useful for travel or complex disputes

- Disadvantages: higher premium; potentially extended delays for “out-of-network” claim settlements

Legal Obligations for Owners & Tenants

⚠️ There is no universal legal obligation requiring home insurance subscription in the Dominican Republic – neither for owners nor tenants.

However:

- To obtain a mortgage from local/international banks, minimum fire insurance on the financed property is generally required.

- Insurance remains recommended in all cases given the high natural risk.

Specific Options for Expatriates/Foreign Owners

- Possibility to subscribe via an international insurer from your home country if desired – but be sure to verify local recognition in case of a major claim.

- Some real estate programs dedicated to foreigners directly offer automatic integration of collective contracts in their annual fees.

- Bilingual assistance often offered by agencies specializing in foreign real estate support.

Good to Know:

In the Dominican Republic, home insurance is influenced by key parameters such as coverage against natural disasters, frequent in the region, thus affecting premium prices. Major companies, like Seguros Universal and Mapfre BHD, offer various policies covering notably fire, floods, and theft, with costs varying by location and value of insured assets. The insurer’s reputation and financial strength play a crucial role in the choice, with a preference for those with a stable track record and good claims management. For owners and tenants, legal obligations specify certain minimum protections, while expatriates must verify specific clauses for properties abroad. Common examples include coverage for temporary relocation costs after a claim. Among the disadvantages, some options may be more expensive for properties in seismic or island areas, but detailed comparison allows policyholders to choose policies suited to their specific needs and financial profile.

Important!!!

Home insurance is not legally mandatory but remains indispensable in practice given the natural risks specific to the Dominican Republic and to reassure foreign buyers and rental investors about their real estate assets located in this exposed island country!

Property Owner Liability: Obligations and Options

Property owners in the Dominican Republic are subject to precise legal obligations regarding civil liability, primarily governed by the Civil Code. They must ensure the maintenance and safety of their real estate properties to avoid any damage caused to others. If a building collapses due to lack of repair or a construction defect, the owner is presumed responsible and must prove that the ruin was not due to their negligence to be exonerated.

| Civil Code Article | Main Obligation | Consequence in Case of Default |

| 1382 | Liability for damages caused by oneself | Compensation for harm |

| 1384 | Liability for things under one’s guard | Compensation for harm |

| 1386 | Building ruin: defect or lack of maintenance | Presumption of liability |

Types of Damages Covered:

- Bodily injuries (harm to third parties)

- Material damages (damage to others’ property)

- Financial consequences related to the harm

Dominican obligations closely resemble the French and European model, with a presumption against the owner in incidents related to buildings.

Available Options for Liability Insurance Beyond the Legal Minimum:

- Basic mandatory insurance: covers unintentional damages to third parties.

- Optional extended insurance:

- Coverage of legal fees

- Coverage for claims related to domestic employees

- Extension for pets or special equipment

Advantages of Extended Coverage:

- Protection against high unexpected costs (legal fees, significant compensations)

- Broader coverage (damages caused by employees, dangerous animals)

- Peace of mind against various risks

Essential Criteria for Choosing a Suitable Policy:

- Maximum amount covered per claim

- Applied deductibles

- Specific exclusions (dangerous animals, intentional acts)

- Ancillary services (legal assistance)

International Comparison:

| Country | Property Owner Liability | Mandatory | Optional Options |

| Dominican Republic | Strong legal presumption | Yes | Various extensions possible |

| France | Mandatory multi-risk home insurance | Yes | Legal recourse guarantee |

| Canada/Quebec | Home-related liability recommended | Not always | Tenant/owner protection |

Concrete Example Illustrating Consequences:

A partial collapse in a Dominican building resulted in serious injuries to several passersby. The owner had not renewed their insurance after omitting several essential repairs reported by their tenants. Following the judicial investigation based on article 1386, they were sentenced not only to full payment of medical costs but also to moral compensation paid to the victims.

Synthetic List – Potential Consequences Without Adequate Coverage:

- Full direct payment of medical costs and material repairs.

- High risk of seizure on personal assets.

- Aggravated criminal prosecutions if negligence proven.

Voluntary subscription to extended liability insurance thus allows not only compliance with legal obligations but also proactive protection against all types of disputes involving real estate property.

Good to Know:

In the Dominican Republic, the civil liability of property owners obliges them to cover damages caused by their property to others, including bodily injuries and material damages. Although the law requires a minimum level of coverage, owners have the option to choose supplementary insurance offering extended protection, for example against natural disasters. These extended policies can prevent high costs associated with legal disputes or major repairs. In comparison, in some European countries, like France, liability coverage is often more strictly regulated and included in home insurance. A notable case involves a Dominican owner who suffered significant financial loss due to a fire that damaged neighboring properties, for lack of sufficient insurance coverage. When choosing suitable insurance, it is key to compare the offered coverage levels and consider the insurer’s reputation, the extent of protection, as well as potential exclusions.

Rental Risk Coverage: What You Need to Know?

Rental risk coverage in the Dominican Republic includes protection against damages to the rented property, non-payment of rent, and civil liability related to the occupancy or management of the dwelling. Responsibilities are shared:

- Tenant:

- Maintain the dwelling in good condition.

- Pay rent according to agreed terms.

- Repair damages caused by negligence or misuse.

- Owner:

- Provide a dwelling compliant with safety and habitability standards.

- Ensure maintenance of main equipment and installations.

- Subscribe to insurance covering their liability as a lessor.

Comparison Table of Rental Risk Insurance Policies

| Policy Type | Dominican Republic | France/Europe | Specific Legal Requirements |

|---|---|---|---|

| Multi-risk home | Often insufficient for seasonal rental, requires extension or dedicated policy | Generally mandatory for tenants; owner often covered via PNO | No strict obligation, but strongly recommended. |

| Non-Occupant Owner Insurance (PNO) | Adapted for rental investments; covers unoccupied or rented properties | Very common, often required by banks and real estate agencies | Legal obligation varies by country. |

| Unpaid Rent Guarantee | Available with some local/international insurers | Frequently offered; strict requirements on tenant file | Less widespread locally; less formal framework than in Europe. |

Main insurance policies generally cover:

- Material damages (fire, water damage, natural disasters)

- Unpaid rent

- Legal protection for disputes between lessor and tenant

- Civil liability towards third parties

To Subscribe to Rental Risk Insurance in the Dominican Republic:

- Choose a local or international insurer specialized in residential real estate.

- Provide:

- Copy of property title (Torrens System)

- Signed lease contract

- ID and proof of address

- Fill out a form detailing property characteristics (area, estimated value…)

- Pay the first premium after validation

Among the companies present in the Dominican market are:

- Seguros Universal: wide range including complementary guarantees for expatriates

- Mapfre BHD Seguros: international solutions with multilingual assistance

- La Colonial Seguros: reputed for products adapted to the tourism sector

Some French companies like AXA also offer extensions adapted for foreign investors.

Typical costs vary based on several factors:

- Value of insured property

- Geographical location (tourist area = higher premium)

- Selected guarantee level

- Claims/litigation history

On average:

For a standard villa rented short-term: approximately 0.5% – 1% of the estimated annual property value per year.

Practical Tips:

- Verify if your contract explicitly includes seasonal/furnished rental.

- Always request a specific extension if you change the main use of the dwelling.

- Do not neglect legal protection – it facilitates quick resolution of disputes with the tenant or third parties.

- Compare several quotes before signing; negotiate deductibles & compensation ceilings.

Not having rental risk insurance exposes both owners and occupants to major financial losses during serious incidents (fire, theft…), makes any effective legal action difficult against unpaid rent, and can constitute a contractual breach regarding local legal obligations – particularly in tourist areas where this type of coverage is strongly recommended or even required by some real estate intermediaries.

Synthetic List – Implications Without Insurance:

- Total risk on major claims

- Absence of structured legal assistance

- Difficulty renting through professional platforms

- Potential non-compliance with local/tourist regulations

Good to Know:

In the Dominican Republic, rental risk coverage is essential to protect both tenants and owners against unforeseen events like property damage, unpaid rent, and disputes. Local insurance policies vary and must meet specific requirements different from those in other territories. Covered risks often include legal protection, material damages caused by the tenant or third parties, and financial guarantees in case of rent payment default. To subscribe, it’s generally necessary to provide documents such as lease contracts and identity proofs, with a process often simplified online. Local companies like Seguros Sura and international ones like Allianz offer various advantages, including customization options. Costs are influenced by location, property value, and tenant risk profile; typically, monthly premiums are around 1-2% of the annual rent. Omitting this coverage can expose to financial losses and legal non-compliance, so it’s crucial to carefully compare offers and choose suitable insurance. To maximize protection, owners and tenants should clarify each party’s responsibilities upon contract signing and consider regular insurance audits to stay protected from any surprises.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.