Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

Buying a Hotel in Vanuatu

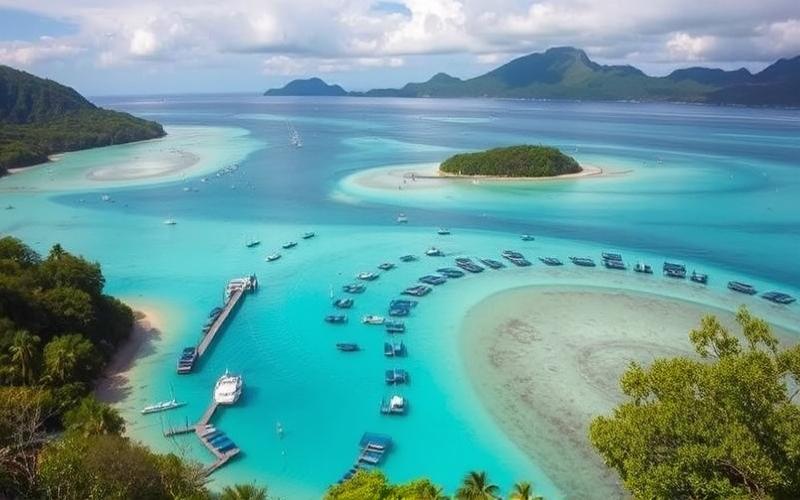

Buying a hotel in Vanuatu might seem like an exotic dream, but it’s also a fascinating investment opportunity. Located in the South Pacific, this country is attracting more and more investors seeking new horizons.

However, before embarking on this adventure, it’s crucial to familiarize yourself with the legal procedures, cultural norms, and essential financial aspects that guarantee the success of your project.

Whether you want to leverage the tourism boom or simply experience a unique entrepreneurial adventure, our comprehensive checklist will guide you through each key step of the process, allowing you to realize your business expansion dream with complete peace of mind.

Overview of Vanuatu’s Hotel Real Estate Market

The hotel real estate market in Vanuatu is currently experiencing dynamics marked by tourism growth, economic diversification, and increased interest in eco-friendly properties. These trends are accompanied by rising prices in the most attractive areas and gradual infrastructure development.

Average Prices and Popular Geographic Areas

- Hotels and resorts located in Port-Vila (capital) or on Efate Island are particularly sought after, with selling prices ranging from $300,000 to several million U.S. dollars depending on the standard, capacity, and proximity to the coast.

- Buildable seaside land starts around $50,000 U.S. dollars but can reach several hundred thousand for premium locations.

- The main attraction remains the ocean view and access to major tourist infrastructure.

| Asset Type | Price Range (USD) | Key Location |

|---|---|---|

| Luxury apartments/hotels by the sea | 300,000 – >1 million | Port-Vila, Efate |

| Villas with ocean view | 500,000 – Several million | Coastal areas |

| Buildable land | From 50,000 (inland), up to several hundred thousand (seaside) | Inland/Efate |

Economic Factors Influencing the Market

- Steady GDP growth supported by tourism, export agriculture, and an expanding offshore financial sector.

- Growing demand for tourist accommodations linked to a continuous influx of international visitors.

- Notable improvements in port and airport infrastructure making some peripheral areas more attractive.

- Possible volatility due to the low overall volume of the local market: any major new construction can significantly impact supply.

Major Sector Trends

Strong push towards sustainable tourism: resorts incorporating renewable energy, ecological waste management, or local materials are experiencing increased demand. These establishments also benefit from better long-term asset valuation.

Local Regulations Impacting Hotel Acquisition/Management

- Real estate acquisition is regulated to preserve national interests: foreign investors often need to obtain a special license or operate through a local partnership.

- Hotel management must comply with various environmental standards strengthened in recent years under international pressure (coastal protection, wastewater management…).

Historical Occupancy Rates & Forecasts

“The historical average rate hovers around 60% in the low season, sometimes reaching 85% during peak tourist seasons, particularly between May and October.”

Forecasts anticipate maintenance or a slight increase thanks to regional air development and the country’s growing positioning as a leading ecotourism destination in the South Pacific.

Recent Examples of Successful Investments

- Successful deployment over the last three years of new high-end eco-focused lodges on Efate: all showed rates close to or above the national average in their first year thanks to their virtuous model (“eco-lodges”).

“The continued demand for this type of establishment illustrates not only tourist interest but also the local capacity to innovate in the face of environmental challenges.”

In summary:

Port-Vila, Efate remain at the heart of the hotel market; environmental sustainability is becoming essential; protective but conditional regulatory framework; positive outlook both in terms of occupancy and asset valuation.

Good to Know:

The hotel real estate market in Vanuatu shows stable growth, with Port-Vila and Espiritu Santo areas attracting the most investments due to their tourist popularity. Average hotel prices range from $500,000 to several million dollars, depending on location and establishment size. Although occupancy rates slightly decreased during the pandemic, they are gradually returning to pre-COVID levels, with optimistic projections for the next five years. Economic factors influencing the market include continuous tourism growth and government tax incentives for foreign investors. Local regulations require several licenses for operation, a detail to anticipate for new buyers. Recent investments, such as the acquisition of hotel complexes by New Zealand groups, highlight the sector’s lucrative potential. According to John Smith, an expert in Oceanian real estate, “Vanuatu offers unique opportunities thanks to its economic stability and investor-friendly policies,” making the country attractive for those looking to diversify their hotel portfolio.

Key Steps to Acquire a Hotel in Vanuatu

Key steps for acquiring a hotel in Vanuatu:

- Conducting an in-depth market study to assess:

- Local tourism potential

- Existing competition

- Visitor expectations and profiles

- Profitability prospects

- Administrative procedures to anticipate:

- Obtaining necessary business licenses from local authorities (Business License)

- Filing an application with the Vanuatu Investment Promotion Authority (VIPA) if the buyer is foreign, including a detailed business plan

- Specific permits related to tourist accommodation, particularly regarding health and fire safety

- Tax registration (Taxpayer Identification Number)

- Negotiation and acquisition process:

- Legal analysis of the land title (freehold/leasehold)

- Verification of any debts related to the property or operating company

- Price negotiation with the seller, drafting of a secure transfer contract by a local notary or lawyer

- Complete financial and legal due diligence

- Renovation/adaptation work:

| Step | Main Objectives |

|---|---|

| Technical audit | Assess the building’s general condition |

| Compliance upgrades | Meet local regulations |

| Modernization | Adapt infrastructure to current expectations |

| Decoration | Enhance the setting according to marketing positioning |

- HR strategies to ensure a smooth transition:

- Local recruitment prioritizing experience in hospitality/tourism

- Planning an intensive training phase on expected quality standards, customer service, foreign languages if necessary

Potential Advantages

A dynamic tourism sector favored by the country’s unique natural beauty

Attractive tax opportunities for foreign investors

Main Challenges

Increased administrative complexity for non-residents

Need for significant investments in compliance upgrades and modernization

Economic dependence on international tourist flow

Good to Know:

To acquire a hotel in Vanuatu, start by obtaining the necessary licenses and permits, particularly those related to hospitality and the environment, by consulting local authorities. An in-depth market study is crucial to assess tourist demand and identify your competitors, thus maximizing your project’s viability. When negotiating the purchase, consult a lawyer to navigate the complex legal and financial aspects, including taxes and land law. Plan renovation work to meet local standards while considering international client expectations. For staff, develop a recruitment and training plan to ensure quality customer service and a smooth transition. Although acquiring a hotel in Vanuatu offers attractive potential, prepare for challenges related to resource supply and fluctuating tourist traffic by integrating flexible strategies to mitigate these risks.

Due Diligence in Vanuatu’s Hospitality Industry

Legal Aspects to Consider

- Thorough verification of property titles to ensure they are valid, free of disputes or encumbrances, and properly registered in the cadastre.

- Analysis of existing contracts (leases, supplier contracts, commercial partnerships) to detect any restrictive clauses or ongoing obligations that could impact future operations.

- Review of administrative authorizations: hotel operating permits, business licenses, and compliance with local regulations.

Administrative and Tax Requirements Specific to Vanuatu

- Compliance with reporting obligations to the Vanuatu Financial Intelligence Unit (FIU), particularly for foreign investments or significant financial transfers.

- Verification that the establishment is in order with applicable local taxes (VAT, tourist service taxes) as well as local employment legislation.

- Examination of the tax regime applicable to the chosen legal structure for acquisition.

Evaluation of the Hotel’s Financial Performance

Indicative list:

- Detailed analysis of recent annual accounts (recommended last 3 years).

- Study of revenue by segment: accommodation, food and beverage, other ancillary services.

- Assessment of operational profitability via key indicators like RevPAR (revenue per available room), average occupancy rate, and net margin.

- Identification of any doubtful debts or receivables.

Summary Table:

| Indicator | Last Fiscal Year | N – 1 | N – 2 |

| Revenue | |||

| Occupancy Rate | |||

| RevPAR | |||

| Net Margin |

Verifications Regarding Compliance with Standards

Checklist:

- Compliance with local fire safety standards: certified fire extinguishers, accessible and marked emergency exits.

- Strict adherence to health regulations concerning food quality and general hygiene in kitchens/restaurants.

- Rigorous application of the local labor code regarding occupational health/safety: personal protective equipment provided to staff, formalized procedures to prevent accidents.

Strategic Analysis: Risks Related to Location & Local Hotel Market

List:

- Precise identification of local natural risks: frequent tropical cyclones in Vanuatu requiring appropriate insurance and a robust crisis management plan.

- In-depth analysis of the current tourist market: seasonal/annual trends in international/domestic attendance; potential impact on the average daily rate per rented room (ADR).

Comparative Table – Local Competition:

| Establishment Name | Category | Number of Rooms | Estimated Occupancy Rate (%) |

| Hotel A | 4 stars | 50 | 65 |

| Hotel B | Boutique | 20 | 75 |

Essential Use of Local Experts

Systematically consult:

- A lawyer specialized in local/real estate law to secure all land transactions/contracts;

- A certified accountant mastering Vanuatu’s tax specifics;

- An experienced real estate advisor with thorough knowledge of the local hotel landscape.

The combined use of these experts drastically reduces hidden legal/fiscal risks.

Practical Tips for Organizing Your Due Diligence Effectively

- Prepare a comprehensive checklist gathering all necessary documents/information before the site visit

- Prioritize electronic then physical collection from the seller/their advisors from the start

- Schedule a complete technical visit with your own specialists

- Establish a tight schedule with milestones validated by each expert involved

- Document all identified anomalies/malfunctions in a summary report to be used later in potential negotiations

Methodical organization not only allows for reliable assessment but also better ability to negotiate or renegotiate certain conditions before final signing.

Good to Know:

When buying a hotel in Vanuatu, conducting thorough due diligence is essential to minimize risks. Start by verifying property titles and existing contracts to avoid any legal surprises. Engage local lawyers to ensure compliance with the country’s specific administrative and tax requirements. Analyze recent annual accounts to assess the establishment’s financial performance and ensure the hotel meets safety standards and occupational health and safety regulations. Consider potential risks related to the location and evaluate tourist market trends and local competition to anticipate future challenges. Hiring local experts such as accountants and real estate advisors is recommended to navigate the process’s complexity. Finally, organize your due diligence effectively by creating a detailed schedule and maintaining smooth communication between all involved parties.

The Impact of Tourism Statistics on Hotel Investment

Analysis of recent tourism trends in Vanuatu reveals a gradual sector recovery post-pandemic, with international arrivals estimated at 82,400 in 2020. Projections indicate continued growth, driven by economic recovery and increased regional purchasing power, suggesting a return to pre-pandemic levels and even a possible rise by 2026.

The main source markets are traditionally Australia, New Zealand, and New Caledonia. Seasonality remains marked: peak visitation typically occurs during the dry months from May to October, preferred by tourists for favorable climatic conditions.

Table: Main Origin of International Visitors

| Country of Origin | Estimated Share (%) |

|---|---|

| Australia | >40 |

| New Zealand | ~20 |

| New Caledonia | ~15 |

| Others (Asia/Europe) | <25 |

The recent opening of eco-friendly resorts like Ratua Island Resort & Spa illustrates how statistical analysis (international profile, seasonal demand) guides investment targeting the luxury-nature segment. Similarly, some investors have chosen peripheral small islands—motivated by data on the high proportion of Australian visitors attracted by island exclusivity—to build establishments focused on wellness and disconnection.

Systematic use of tourism statistics thus allows:

- Adjusting hotel capacities according to expected flows,

- Diversifying types of accommodation offered,

- Anticipating logistical needs (inter-island transport).

Future prospects announce a significant impact on hotel development: according to recent economic forecasts, the sector’s average annual growth should strongly stimulate investment in new infrastructure such as high-end residences or complexes respectful of local and environmental heritage. Investors who can leverage this data will therefore continue to fully benefit from the structural dynamism displayed by Vanuatu in its regional and international tourist attractiveness.

Good to Know:

Recent statistics show that Vanuatu has seen a notable increase in visitors, mainly from Australia and New Zealand, with a peak during the summer season. This trend boosts hotel investments, guiding developers towards accommodations that meet these tourists’ preferences, such as ecotourism-focused complexes and luxury hotels. For example, the opening of Havannah Vanuatu successfully captured the luxury market by capitalizing on this data. Investors leverage these statistical insights to identify emerging opportunities, particularly in developing more eco-friendly infrastructure. With favorable tourism growth forecasts, new projects are emerging, including the construction of eco-responsible resorts, anticipating demand for more conscious and sophisticated tourism.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.