Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

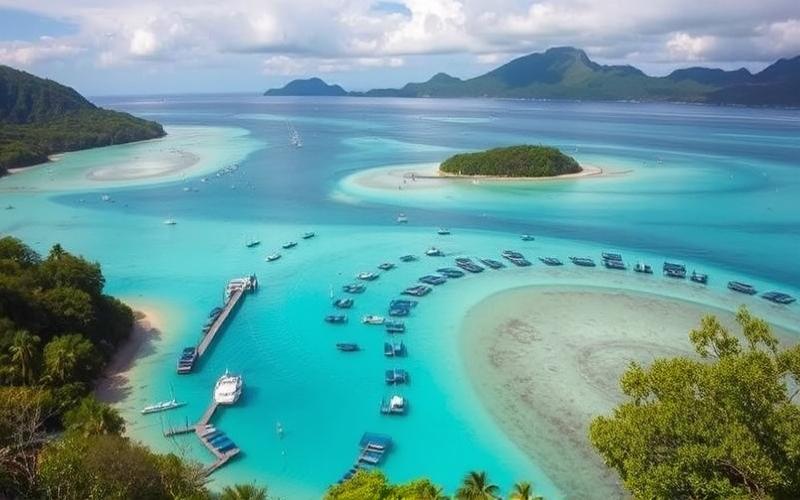

Vanuatu, an idyllic South Pacific archipelago, offers much more than its white sand beaches and crystal-clear waters. This small island nation is emerging as a prime destination for savvy real estate investors, particularly in the commercial sector. With a growing economy and a dynamic property market, Vanuatu presents enticing opportunities for those looking to diversify their international investment portfolio.

Vanuatu’s appeal for commercial real estate investment rests on several key factors. First, the country enjoys remarkable political and economic stability for the region. Additionally, its advantageous tax regime, with no income tax, corporate tax, or capital gains tax, makes it a legal and transparent tax haven. Finally, rapid tourism development and increasing foreign investment create an environment conducive to commercial real estate sector growth.

In this article, we will explore in detail the various facets of commercial real estate investment in Vanuatu, from available property types to current market trends, including potential returns and risks to consider. Whether you’re an experienced investor or considering your first foray into international real estate, Vanuatu certainly deserves your attention.

A Range of Opportunities: Commercial Property Types in Vanuatu

The commercial real estate market in Vanuatu offers surprising diversity for a small island nation. Investors can choose from several property types, each with its own advantages and return potential.

Retail spaces constitute a significant portion of the commercial real estate market in Vanuatu. In the capital Port Vila and popular tourist areas like Luganville, demand for well-located shops is constantly increasing. These properties benefit from growing tourist flows and improving local purchasing power. Modern shopping centers and street-front shops in commercial districts are particularly sought after.

Hotel and tourism real estate represents a major opportunity in Vanuatu. With tourism booming, demand for hotels, resorts, and vacation complexes continues to grow. Investors can consider purchasing existing establishments or developing new projects, particularly in less developed areas of the archipelago. Overwater bungalows and eco-lodges, aligned with sustainable tourism trends, are especially popular.

Office and workspace constitutes another promising segment. With increasing foreign investment and service sector development, demand for modern, well-equipped office spaces is rising, particularly in Port Vila. Office buildings offering quality facilities and good connectivity are scarce and therefore highly sought after.

Industrial and logistics properties represent a developing niche. With infrastructure improvements and increasing commercial exchanges, warehouses, distribution centers, and light industrial zones are attracting investor attention. These properties often offer stable rental yields and long-term leases.

Commercial land presents an interesting option for long-term investors. Purchasing well-located land, particularly in areas slated for future development, can offer significant appreciation potential. This land can be developed later or resold at a substantial profit.

Good to know:

Vanuatu offers a variety of commercial properties suited to different investor profiles, from retail spaces to development land, including hotel real estate and offices. Diversification is possible even in this small island market.

Profitability and Risks: Weighing the Pros and Cons of Investing in Vanuatu

Investing in commercial real estate in Vanuatu can prove very lucrative, but like any investment, it carries its own risks. Understanding both aspects is crucial for making informed decisions.

The potential profitability of commercial real estate in Vanuatu is one of its main attractions. Gross rental yields can reach 8-12% for well-located and well-managed properties, significantly higher than many mature markets. Hotels and resorts, in particular, can offer even higher returns during peak tourist season. Additionally, capital appreciation is significant in certain areas, with annual growth rates potentially exceeding 10% for prime properties.

The absence of income tax and capital gains tax in Vanuatu significantly increases investment net profitability. Investors can thus retain a larger portion of their profits, making the market particularly attractive for those seeking tax optimization.

However, risks should not be underestimated. Vanuatu’s real estate market is relatively small and can be subject to some volatility. The economy’s dependence on tourism can make certain investments vulnerable to seasonal fluctuations and global events affecting travel.

Natural risks also constitute a factor to consider. Vanuatu is located in an area prone to cyclones and earthquakes. Investors must ensure their properties are built to disaster-resistant standards and properly insured.

The legal framework for foreign investments, although generally favorable, can sometimes be complex. Land ownership, in particular, is governed by customary laws that can complicate transactions. Working with experienced local legal advisors is essential to navigate these waters.

Market liquidity can also be challenging. The pool of potential buyers for high-value commercial properties is limited, which can make resale more difficult and potentially longer than in more mature markets.

Despite these risks, many investors find Vanuatu’s opportunities worth exploring. The key lies in thorough due diligence, a well-thought-out investment strategy, and professional asset management.

Good to know:

Commercial real estate in Vanuatu offers potentially high returns, amplified by an advantageous tax regime. However, investors must be aware of risks related to market size, natural hazards, and legal complexity. A cautious, well-informed approach is essential.

Trends and Outlook: The Future of Commercial Real Estate in Vanuatu

The commercial real estate market in Vanuatu is evolving rapidly, influenced by local and global trends. Understanding these dynamics is crucial for investors seeking to anticipate future opportunities.

Sustainable tourism is redefining Vanuatu’s commercial real estate landscape. There is growing demand for eco-friendly properties, particularly in the hotel sector. Resorts and lodges incorporating sustainable practices, such as renewable energy use and responsible waste management, not only attract more customers but also benefit from better long-term valuation. This trend opens opportunities for developing innovative, environmentally respectful properties.

Economic diversification in Vanuatu also influences the commercial real estate market. The government aims to reduce tourism dependence by encouraging development in other sectors like offshore financial services and export agriculture. This strategy creates demand for new types of commercial spaces, particularly modern offices and agricultural processing facilities.

Infrastructure improvements play a crucial role in market evolution. Major projects, like Port Vila harbor expansion and improved international air connections, open new perspectives for commercial real estate. Areas around these enhanced infrastructures become particularly attractive to investors.

Technology is beginning to influence Vanuatu’s commercial real estate market. Demand for flexible workspaces and offices equipped with advanced technology is rising, reflecting global changes in work patterns. This trend creates opportunities for developing modern business centers and coworking spaces.

Increasing internationalization of Vanuatu’s real estate market is another notable trend. Growing interest from international investors, attracted by potential returns and advantageous tax framework, is evident. This internationalization brings new practices and standards to the market, potentially increasing sector sophistication and liquidity over time.

Finally, climate resilience is becoming increasingly important in evaluating commercial properties in Vanuatu. Investors and developers are paying more attention to constructing buildings capable of withstanding extreme weather conditions, which could influence long-term property values.

Good to know:

Key trends in Vanuatu commercial real estate include sustainable tourism, economic diversification, infrastructure improvements, adoption of modern technologies, and increasing market internationalization. Climate resilience is also becoming a crucial factor in property evaluation.

Winning Strategies for Investing in Vanuatu Commercial Real Estate

To maximize opportunities offered by Vanuatu’s commercial real estate market, investors must adopt well-thought-out strategies adapted to local specificities.

Portfolio diversification is a prudent approach in this market. Rather than putting all eggs in one basket, it’s wise to spread investments across different commercial property types. For example, combining an investment in Port Vila retail space with participation in a coastal resort can offer balance between stable income and growth potential.

Partnership with local players is often key to success. Foreign investors can greatly benefit from local real estate professionals’ expertise and networks. These partnerships can facilitate navigating legal and cultural complexities while providing access to opportunities not always visible on the open market.

Investment in sustainability can offer long-term benefits. Properties designed or renovated according to ecological principles not only attract quality tenants but may also benefit from better long-term appreciation. This approach also aligns with Vanuatu’s sustainable development goals, potentially facilitating relations with local authorities.

Focus on growth areas is a promising strategy. Identifying regions benefiting from infrastructure investments or planned tourism development can offer early purchase opportunities at advantageous prices. For example, areas around new port or airport projects may present significant growth potential.

Adopting a long-term perspective is crucial in this market. Although some investors may achieve quick gains, the true value of commercial real estate in Vanuatu often reveals itself over the long term. A “buy and hold” strategy, combined with active asset management, can maximize returns over 10-15 years or more.

Investment in professional property management is essential, especially for overseas-based investors. Quality local management can optimize rental income, maintain property values, and effectively manage relationships with tenants and local authorities.

Finally, staying informed and flexible is crucial in a rapidly evolving market like Vanuatu’s. Investors must keep abreast of regulatory changes, economic trends, and market developments to adjust their strategies accordingly.

Good to know:

Winning strategies for commercial real estate investment in Vanuatu include portfolio diversification, partnership with local players, investment in sustainability, focus on growth areas, adopting a long-term perspective, and investment in professional property management.

Understanding the legal and tax framework is essential for any investor considering Vanuatu’s commercial real estate market. Although the country offers a generally favorable environment for foreign investors, there are important nuances to consider.

The land ownership system in Vanuatu is unique. The Constitution stipulates that all land belongs to indigenous customary owners. Foreign investors can obtain long-term leases, typically for 75 years, with renewal possibility. These leases offer rights similar to freehold ownership, but ensuring all lease aspects are clearly defined and legally sound is crucial.

Acquisition of commercial properties by foreigners generally requires approval from Vanuatu’s Foreign Investment Promotion Authority (VFIPA). This process, although designed to be efficient, can take time and requires careful preparation. Working with experienced local legal advisors to navigate this process is recommended.

Vanuatu’s tax system is one of its main attractions for investors. The country imposes no income tax, corporate tax, capital gains tax, or inheritance tax. However, other taxes to consider include:

- 15% VAT (Value Added Tax) on most goods and services

- Stamp duty on real estate transactions

- Land taxes, varying by location and property use

Investment structuring is a crucial aspect to consider. Many investors choose to hold their Vanuatu commercial properties via offshore structures or local companies. Each approach has advantages and disadvantages regarding management, taxation, and asset protection. Consulting international tax experts to determine the most appropriate structure is essential.

Environmental regulations are becoming increasingly important in Vanuatu. Commercial developments, particularly in coastal or ecologically sensitive areas, may be subject to environmental impact assessments. Understanding and respecting these regulations from early project planning stages is crucial.

Dispute resolution is another aspect to consider. Although Vanuatu’s legal system is based on English law and generally considered fair, procedures can sometimes be slow. Including arbitration clauses in contracts can offer a faster, more flexible alternative for resolving commercial disputes.

Finally, investors must be aware of Vanuatu’s anti-money laundering regulations. The country has strengthened its laws in this area to comply with international standards. Significant real estate transactions may undergo increased scrutiny, and maintaining clear, complete documentation of all transactions is important.

Good to know:

Vanuatu’s legal and tax framework offers significant advantages to commercial real estate investors, including a favorable tax regime and long-term leases. However, carefully navigating the specifics of the land ownership system, foreign investment approval processes, and growing environmental regulations is essential.

Conclusion: Vanuatu, a Unique Investment Destination to Consider

Commercial real estate in Vanuatu presents a unique blend of opportunities and challenges for international investors. This small Pacific archipelago offers attractive return potential, an advantageous tax framework, and a growing market, all within a paradisiacal tropical environment.

The advantages are numerous: potentially high rental yields, significant capital appreciation in certain areas, and a particularly favorable tax regime. The diversity of investment options, ranging from retail spaces to hotel complexes, offices, and industrial properties, allows investors to build a diversified portfolio even in this small market.

However, investing in Vanuatu requires a thoughtful, well-informed approach. Challenges include navigating a unique land ownership system, managing natural risks, and adapting to a relatively small and sometimes less liquid market compared to more mature real estate markets.

Current trends, such as the focus on sustainable tourism, infrastructure improvements, and economic diversification, create exciting new opportunities. Investors who can anticipate and adapt to these trends will be best positioned for success.

To maximize success chances, adopting a well-thought-out investment strategy, partnering with local experts, and maintaining a long-term perspective are crucial. Thorough due diligence and clear understanding of the legal and tax framework are also essential.

Ultimately, Vanuatu offers a unique investment proposition for those willing to explore beyond traditional real estate markets. With a cautious, well-informed approach, investors can not only benefit from potentially attractive returns but also contribute to sustainable development of this beautiful island nation.

Good to know:

Vanuatu offers unique commercial real estate investment opportunities, combining potentially high returns and an advantageous tax framework. However, a cautious approach, thorough due diligence, and understanding of local specificities are essential for success in this developing market.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.