Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

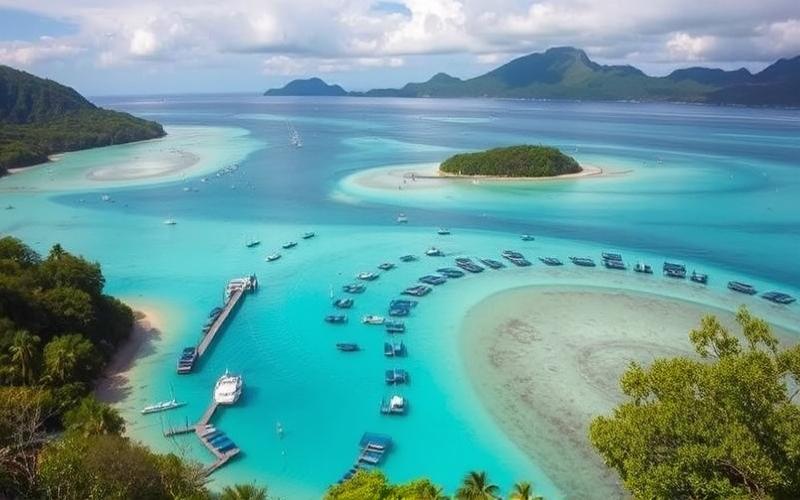

Vanuatu, a paradise archipelago in the South Pacific, is attracting an increasing number of international real estate investors drawn by its white sand beaches, unique culture, and growing tourism potential. However, purchasing real estate in this small island nation can prove to be a challenging process for the uninitiated. Between local legal specifics and market particularities, numerous pitfalls await the unprepared buyer. This article will guide you through the most common mistakes to avoid for a successful real estate investment in Vanuatu.

The Tax Haven Mirage: Understanding Vanuatu’s Legal Reality

One of the first mistakes made by foreign investors is considering Vanuatu solely as a tax haven, without taking into account the complexity of its legal system. Admittedly, the country imposes no income tax, capital gains tax, or corporate tax, making it an attractive destination for investors. However, this apparent tax simplicity hides a much more complex legal reality.

Vanuatu’s land ownership system is unique and can be confusing for foreigners. Unlike many Western countries, land in Vanuatu is traditionally owned by indigenous communities and cannot be sold. Foreign investors can only acquire long-term leases, typically for a duration of 75 years. Not understanding this nuance can lead to serious misunderstandings and risky investments.

Furthermore, the real estate acquisition process in Vanuatu involves navigating a hybrid legal system, blending customary law and British common law. Investors who neglect to engage local legal experts expose themselves to considerable risks. For example, in 2024, several foreign investors lost significant sums by purchasing properties with unclear land titles, due to failing to conduct the necessary legal checks.

Good to know:

In Vanuatu, foreigners cannot purchase land as freehold property, but only long-term leases. Thorough due diligence and the assistance of a local lawyer are essential to secure your investment.

The “Too Good to Be True” Illusion: Beware of Overly Tempting Offers

In a booming real estate market like Vanuatu’s, it’s not uncommon to come across offers that seem too good to be true. And for good reason, they often are! The classic mistake is rushing into a seemingly exceptional opportunity without performing the necessary checks.

Vanuatu’s real estate market has experienced spectacular growth in recent years, with price increases of around 15% per year between 2020 and 2024 in sought-after areas like Port Vila. Unfortunately, this dynamic has attracted its share of opportunists and scammers. Cases of real estate fraud have been reported, involving ghost properties or properties sold multiple times to different buyers.

To avoid these traps, it is crucial to exercise caution and diligence. Always verify the authenticity of property documents with the Vanuatu Lands Department. Don’t rely solely on online photos or descriptions; an on-site visit is essential. If possible, use a licensed and reputable real estate agent familiar with the local market.

A striking example is that of a group of European investors who, in 2023, purchased what they believed was a hotel complex under construction on Efate Island. They discovered too late that the project only existed on paper and that the land in question was actually protected, non-buildable areas. A simple check with local authorities could have saved them this costly misadventure.

Good to know:

Exceptionally advantageous real estate offers in Vanuatu deserve thorough examination. Always verify the authenticity of documents and the actual existence of the property before any financial commitment.

The Improvisation Trap: The Importance of Meticulous Planning

Real estate purchase in Vanuatu cannot be improvised. Yet, many investors underestimate the importance of rigorous planning and dive headfirst into a poorly prepared project. This approach can lead to major disappointments, both financially and legally.

The purchase process in Vanuatu can be long and complex, often requiring between 6 and 12 months to finalize. This duration is explained by the need to obtain various authorizations, including approval from the Council of Ministers for foreign investments exceeding certain thresholds. Not anticipating these timelines can lead to unexpected additional costs or the loss of opportunities.

Another often overlooked aspect is tax planning. Although Vanuatu is renowned for its advantageous taxation, foreign investors must consider the tax implications in their home country. For example, French tax residents investing in Vanuatu may be subject to the Real Estate Wealth Tax (IFI) on their properties held abroad. Consultation with an international tax expert before any investment is therefore crucial.

The story of an Australian investor perfectly illustrates the risks of poor planning. In 2024, this entrepreneur acquired land on Tanna Island with the aim of building an eco-lodge. However, he had not anticipated the complexities related to obtaining building permits and negotiations with local communities. After two years of delays and cost overruns, the project had to be abandoned, resulting in significant financial losses.

Good to know:

Meticulous planning, including consultation with legal and tax experts, is essential for a successful real estate investment in Vanuatu. Plan realistic timelines and anticipate hidden costs.

The All-Tourism Mistake: Diversify to Ensure Longevity

Vanuatu’s tourism sector is experiencing impressive growth, with a 35% increase in visitor numbers between 2019 and 2024. This trend has naturally attracted many real estate investors focused solely on tourism-oriented properties. However, this mono-sectoral approach can prove risky in the long term.

Excessive reliance on tourism exposes investors to seasonal fluctuations and geopolitical or health-related uncertainties. The COVID-19 pandemic was a harsh reminder of this reality, with an 80% drop in tourist arrivals in 2020, putting many rental property owners in difficulty.

To minimize these risks, it is wise to diversify your real estate portfolio in Vanuatu. Opportunities are plentiful:

- Residential real estate for expatriates and the expanding local middle class

- Office and commercial spaces in developing urban areas like Port Vila

- Agricultural projects, as Vanuatu is recognized for the quality of its products like vanilla or kava

An example of successful diversification is that of a group of New Zealand investors who, in 2022, acquired a mixed portfolio including tourist villas on Espiritu Santo Island, rental apartments in Port Vila, and agricultural land on Malekula. This approach allowed them to maintain stable income despite fluctuations in the tourism market.

Good to know:

Diversifying your real estate investments in Vanuatu beyond the tourism sector can offer better long-term stability. Explore opportunities in residential, commercial, and agricultural real estate.

The Myth of Total Autonomy: The Importance of Local Management

A common mistake among foreign investors is believing they can effectively manage their property remotely, without a presence on-site. This approach greatly underestimates the logistical and cultural challenges specific to Vanuatu.

Remote management of a property in Vanuatu can quickly become a logistical and financial nightmare. Communication infrastructure, although constantly improving, can still be unstable in some regions. Furthermore, cultural and linguistic differences (Bislama being the lingua franca) can complicate interactions with local service providers and authorities.

Maintaining real estate properties in Vanuatu also presents specific challenges. The humid tropical climate can accelerate building deterioration, requiring regular maintenance and frequent repairs. Cyclones, like the devastating Pam in 2015, remind us of the importance of constant monitoring and adequate preparation for natural disasters.

To illustrate the importance of local management, consider the example of a Canadian investor who purchased a luxury villa on Efate Island in 2021. Managing his property remotely, he faced recurring problems: unpaid bills, neglected maintenance, and ultimately, illegal occupation of his property. It was only after hiring a local management company that he was able to regain control of his investment and optimize its profitability.

- Hire a reputable real estate management company in Vanuatu

- Establish a local network of trusted professionals (lawyer, accountant, real estate agent)

- Plan regular visits to maintain a direct link with your investment

Good to know:

Professional local management is crucial for the success of your real estate investment in Vanuatu. It will allow you to overcome the specific logistical, cultural, and climatic challenges of the archipelago.

Forgetting the Environmental Impact: Towards Sustainable Investment

In the race for real estate investment in Vanuatu, many buyers neglect the environmental aspect, a mistake that can prove costly in the long term, both financially and reputationally. Vanuatu, ranked as one of the countries most vulnerable to climate change, has adopted strict environmental policies that investors cannot ignore.

The Vanuatu government has implemented increasingly strict environmental regulations, particularly regarding construction and land use. In 2023, a new coastal protection law imposed significant restrictions on construction near beaches, affecting many ongoing real estate projects.

Investors who neglect these environmental aspects expose themselves to several risks:

- Fines and sanctions for non-compliance with environmental standards

- Delays or cancellations of projects due to unfavorable environmental impact assessments

- Depreciation of property value in at-risk areas (coastal erosion, rising sea levels)

- Damage to reputation, in a context where sustainable tourism is gaining importance

An emblematic case is that of a luxury hotel complex on Aore Island, whose construction was halted in 2024 following local protests and a reassessment of its impact on the surrounding coral reefs. The investors had to completely revise their project, leading to considerable additional costs and delays of several years.

To avoid these pitfalls, savvy investors now systematically integrate sustainability into their real estate projects in Vanuatu:

- Use of sustainable and local building materials

- Integration of renewable energy systems (solar, wind)

- Implementation of ecological water and waste management systems

- Collaboration with local communities for environmentally beneficial projects

These sustainable approaches not only reduce regulatory risks but can also increase the attractiveness and long-term value of properties. For example, an eco-resort on Tanna Island, built in 2022 according to strict sustainability principles, saw its value increase by 40% in two years, while benefiting from an occupancy rate above the market average.

Good to know:

Integrating environmental considerations into your real estate project in Vanuatu is not only a legal obligation but also an asset for the value and longevity of your investment. Prioritize sustainable approaches and collaborate with local communities.

Neglecting Natural Risks: Anticipate to Better Protect

Vanuatu, due to its geographical location, is exposed to various natural risks that real estate investors cannot afford to ignore. Cyclones, earthquakes, tsunamis, and volcanic eruptions are among the potential threats that can significantly affect the value and safety of real estate properties.

Between 2015 and 2024, Vanuatu experienced an average of 2.5 major natural disasters per year, causing damages estimated at over 500 million US dollars. Cyclone Harold in 2020, for example, destroyed or damaged nearly 30% of tourist infrastructure on some islands.

The most common mistake of investors is underestimating these risks or believing that standard insurance will be sufficient to cover them. However, the reality is much more complex:

- Insurance policies in Vanuatu may have specific exclusions for certain types of natural disasters

- Reconstruction costs after a disaster can be significantly higher than expected, due to material scarcity and qualified labor

- Some high-risk areas may become uninsurable or see their insurance premiums increase drastically

A striking example is that of a hotel complex on Tanna Island, built in 2019 without considering volcanic risks. During the major eruption of Mount Yasur in 2023, the complex suffered significant damage from ash and associated earthquakes. Insurance covered only a fraction of the damages, leaving the owners with exorbitant repair costs.

To minimize these risks, savvy investors adopt a proactive approach:

- Conducting thorough geological and climatic studies before any purchase or construction

- Architectural design adapted to local risks (earthquake-resistant structures, cyclone-resistant roofing)

- Investment in early warning systems and evacuation plans

- Subscribing to specific insurance covering all potential risks

- Geographical diversification of investments to spread risks

An example of good practice is that of a group of investors who, in 2024, developed a residential complex on Efate Island. By integrating resilient construction technologies and implementing a comprehensive risk management plan, they not only secured their investment but were also able to negotiate more advantageous insurance premiums.

Good to know:

Taking natural risks into account in your real estate investment strategy in Vanuatu is crucial. A proactive approach, combining adapted design, adequate insurance, and risk management plans, can significantly reduce your exposure and protect your investment in the long term.

Lack of Knowledge of Local Communities: A Neglected Key Success Factor

One of the costliest mistakes for foreign investors in Vanuatu is underestimating the importance of relationships with local communities. In this archipelago where land ownership is intrinsically linked to cultural identity, neglecting this aspect can lead to the outright failure of a real estate project.

In Vanuatu, over 80% of land is governed by customary law, and local communities play a crucial role in decisions concerning land use. Ignoring this reality can lead to conflicts, costly delays, or even the outright cancellation of real estate projects.

Investors who succeed in Vanuatu are those who understand and respect local social and cultural structures. Here are some crucial points to consider:

- The need to consult and involve customary chiefs and local communities from the earliest stages of a project

- The importance of understanding and respecting cultural practices and sacred sites

- The added value of creating employment and training opportunities for local populations

- The interest in contributing to community development beyond the real estate project itself

A revealing case study is that of a luxury resort project on Malekula Island, launched in 2022. Despite significant initial investments, the project encountered strong local opposition due to a lack of consultation and concerns about environmental and cultural impact. After two years of disputes and negotiations, the project had to be completely revised, resulting in additional costs of several million dollars and considerable delay.

Conversely, a success story is that of an ecotourism development on Pentecost Island, initiated in 2023. The investors worked closely with local communities from the project’s design phase, integrating traditional practices into the resort’s design and operation. This approach not only facilitated the rapid obtaining of necessary authorizations but also created strong local support, contributing to the project’s commercial success.

To navigate this complex cultural context effectively, savvy investors adopt several strategies:

- Engaging local community relations experts from the initial project phases

- Establishing profit-sharing programs with local communities

- Integrating local crafts and traditions into the design and operation of real estate projects

- Organizing regular consultations and community forums to maintain open dialogue

Good to know:

Positive engagement with local communities is not only an ethical obligation in Vanuatu, it’s also a key success factor for any real estate investment. A project that enjoys local support has a better chance of long-term success and can even become a model for sustainable development.

Conclusion: Towards Enlightened Real Estate Investment in Vanuatu

Investing in real estate in Vanuatu offers unique opportunities but requires a meticulous and well-informed approach. By avoiding the common pitfalls we have explored – from ignorance of the legal framework to neglect of natural risks, including the crucial importance of community relations – investors can significantly increase their chances of success.

Vanuatu’s real estate market, despite its challenges, continues to offer attractive prospects. With stable economic growth (3.2% on average between 2020 and 2024) and a booming tourism sector, opportunities are real for savvy investors. However, the key to success lies in a holistic approach that takes into account not only financial aspects but also the unique legal, environmental, and socio-cultural dimensions of this Pacific archipelago.

Investors who succeed in Vanuatu are those who:

- Surround themselves with local experts (lawyers, real estate agents, property managers)

- Adopt a long-term vision, integrating sustainability and resilience into their projects

- Cultivate positive relationships with local communities

- Remain flexible and adaptable in the face of the unique challenges of this developing market

Ultimately, investing in real estate in Vanuatu is not just a financial transaction, it’s an immersion into a rich culture and an exceptional natural environment. Investors who embrace this reality, while skillfully navigating the market’s complexities, are those who will reap the best benefits from the unique opportunities offered by this Pacific paradise.

Good to know:

A successful real estate investment in Vanuatu requires a comprehensive approach, combining local expertise, cultural sensitivity, and long-term vision. By avoiding common mistakes and adopting an enlightened strategy, investors can not only achieve attractive returns but also contribute positively to the sustainable development of this unique archipelago.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.