Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

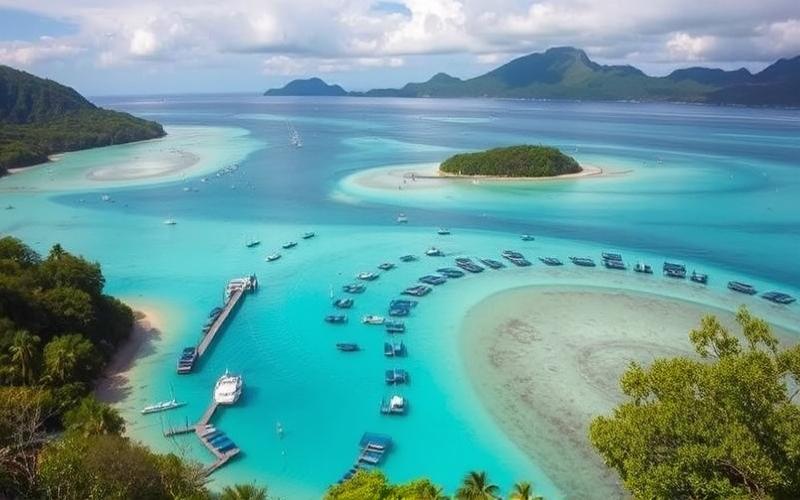

Dreaming of owning your own slice of paradise in the South Pacific? Vanuatu, with its white sand beaches, crystal-clear waters, and idyllic lifestyle, might just be your dream destination. This archipelago of 83 islands offers not only exceptional living conditions but also interesting real estate investment opportunities for foreigners. Let’s explore together the nuances of property purchasing in Vanuatu, from current regulations to tax benefits, including the necessary documents to make your project a reality.

The Dream Within Reach: Can Foreigners Really Buy Property in Vanuatu?

The good news for international investors is yes, foreigners can indeed acquire real estate in Vanuatu. However, it’s crucial to understand that the country’s land system has certain particularities. In Vanuatu, land ownership is primarily based on a leasehold system rather than freehold ownership.

Foreigners can obtain land leases for up to 75 years, with the possibility of renewal. These leases typically concern land located in urban or tourist areas. It’s important to note that customary lands, which represent a significant portion of the territory, are not available for purchase by foreigners.

Despite these restrictions, Vanuatu’s real estate market remains attractive to foreign investors. Beachfront properties, tourist complexes, and luxury residences are particularly sought after. The minimum investment required to obtain an investment residency permit is $130,000 USD, making Vanuatu relatively accessible compared to other paradise destinations.

Good to Know:

Foreigners can acquire real estate in Vanuatu through land leases with a maximum duration of 75 years, renewable. The minimum investment to obtain a residency permit is $130,000 USD.

Property purchasing in Vanuatu is governed by several regulations aimed at protecting both investors and local interests. Here are the main rules to know:

- Government approval: Any property purchase by a foreigner must be approved by the Vanuatu government. This procedure ensures the investment aligns with national interests.

- Customary land restrictions: Customary lands, traditionally owned by local communities, cannot be purchased by foreigners. Only leasehold lands are accessible.

- Lease duration: Land leases for foreigners are typically limited to 75 years but can be renewed.

- Mandatory registration: All leases and real estate transactions must be registered with Vanuatu’s Land Titles Office.

It’s also important to note that the Vanuatu government encourages investments that contribute to the country’s economic development. Real estate projects that create local jobs or promote tourism may receive preferential treatment.

Furthermore, Vanuatu has established an investment citizenship program, which can be particularly interesting for real estate investors. By investing a minimum of $130,000 USD in real estate, it’s possible to obtain Vanuatu citizenship, offering additional benefits in terms of freedom of movement and tax planning.

Good to Know:

Property purchases by foreigners in Vanuatu require government approval. Investments contributing to the country’s economic development are encouraged and may receive benefits.

The Pacific Tax Haven: Understanding International Taxation in Vanuatu

One of the most attractive aspects of real estate investment in Vanuatu is undoubtedly its advantageous tax regime. Vanuatu is recognized as a tax haven, imposing no income tax, corporate tax, or capital gains tax. This attractive tax policy makes it a prime destination for international investors seeking to optimize their wealth.

Here are the main tax advantages for real estate investors in Vanuatu:

- No income tax: Rental income generated by your properties in Vanuatu is not subject to local tax.

- No capital gains tax: If you decide to resell your property, you won’t be taxed on any potential capital gains.

- Exemption from inheritance tax: Vanuatu imposes no inheritance taxes, facilitating wealth transfer.

- No property tax: Unlike many countries, Vanuatu doesn’t apply annual property taxes.

It’s important to note that while Vanuatu offers an advantageous tax environment, investors must remain vigilant about their tax obligations in their home country. Many countries have implemented measures to combat tax evasion, and foreign-generated income often must be declared.

Furthermore, Vanuatu has taken measures in recent years to improve its tax transparency and comply with international standards. In 2016, the country joined the OECD’s Global Forum on Transparency and Exchange of Information for Tax Purposes, committing to respect international standards for tax information exchange.

Good to Know:

Vanuatu offers a very advantageous tax regime, with no income tax, corporate tax, or capital gains tax. However, investors must remain attentive to their tax obligations in their home country.

Preparing Your File: Documents Required for Property Purchase in Vanuatu

To successfully complete your property purchase project in Vanuatu, it’s essential to carefully prepare your file. Here’s the list of generally required documents:

- Valid passport: A certified copy of your passport is required to prove your identity.

- Proof of address: A recent document proving your current address.

- Criminal record extract: A document attesting to your good moral character, typically dated within the last 3 months.

- Proof of income: Bank statements or income declarations to prove your financial capacity.

- Bank reference letter: A document from your bank attesting to your creditworthiness.

- Investment plan: A document detailing your investment intentions in Vanuatu.

- Lease or purchase contract: The official document detailing the terms of your property acquisition.

It’s highly recommended to engage a local lawyer specializing in international real estate transactions. This expert can guide you in preparing your file and ensure all documents comply with local requirements.

Additionally, for investors wishing to benefit from the investment citizenship program, additional documents will be necessary, including:

- Duly completed citizenship application form

- Birth and marriage certificates (if applicable)

- Medical certificate

- Proof of investment made or planned

It’s important to note that all documents must be translated into English (the official language of Vanuatu) by a sworn translator if necessary.

Good to Know:

Preparing a complete and compliant file is crucial for property purchase in Vanuatu. It’s recommended to engage a specialized local lawyer to guide you through this process.

Making Your Dream Reality: Key Steps for Property Purchase in Vanuatu

Now that you know the rules of the game, here are the main steps to realize your property purchase in Vanuatu:

1. Property Search and Selection

Start by identifying the type of property that matches your objectives: secondary residence, rental investment, or development project. Vanuatu’s real estate market offers a variety of options, from beachfront villas to development land. Don’t hesitate to engage a local real estate agent to assist in your search.

2. Due Diligence

Once you’ve found a property that interests you, it’s crucial to conduct thorough due diligence. This involves verifying the property title, any potential easements or restrictions, and the general condition of the property. A local lawyer can assist you in this crucial step.

3. Negotiation and Purchase Offer

After completing necessary verifications, you can proceed to the negotiation phase. In Vanuatu, it’s common to make a conditional purchase offer, subject to obtaining necessary government approvals.

4. Government Approval Application

Once the offer is accepted, you’ll need to submit an approval application to the Vanuatu government. This step can take several weeks and requires presentation of a complete file.

5. Purchase Finalization

After obtaining government approval, you can proceed to signing the final contract and transferring funds. Using an escrow account to secure the transaction is recommended.

6. Lease Registration

The final step involves registering your lease with Vanuatu’s Land Titles Office. This formality is essential to guarantee your property rights.

Good to Know:

Property purchase in Vanuatu is a multi-step process requiring patience and rigor. Assistance from local professionals (real estate agent, lawyer) is highly recommended to navigate this process effectively.

Maximizing Your Investment: Opportunities and Challenges of Vanuatu Real Estate

Investing in Vanuatu real estate presents numerous opportunities, but also some challenges to consider:

Opportunities

- Growing market: Tourism in Vanuatu is expanding rapidly, offering excellent prospects for rental investments.

- Tax advantages: The absence of income and capital gains taxes allows optimization of your investment returns.

- Quality of life: Vanuatu offers exceptional living conditions, ideal for a secondary residence or retirement in the sun.

- Portfolio diversification: Vanuatu real estate can provide excellent diversification for your investment portfolio.

Challenges

- Natural risks: Vanuatu is exposed to cyclones and earthquakes. It’s crucial to consider these risks in your investment strategy.

- Limited market: Vanuatu’s real estate market is relatively small, which can affect your investment’s liquidity.

- Infrastructure: Although constantly improving, Vanuatu’s infrastructure can sometimes be limited, especially outside urban areas.

- Legal complexity: The leasehold land system and specific regulations can be complex for foreign investors.

Despite these challenges, Vanuatu real estate potential remains considerable for savvy investors. With a prudent and well-informed approach, it’s possible to make profitable investments while enjoying a paradise lifestyle.

Good to Know:

Vanuatu real estate offers interesting opportunities, particularly thanks to a growing tourism market and significant tax advantages. However, it’s important to properly assess risks, especially natural ones, and understand local market specificities.

Conclusion: Your Passport to Real Estate Paradise

Property purchasing in Vanuatu represents a unique opportunity to combine profitable investment with exceptional living conditions. With its tax advantages, growing market, and paradise natural environment, Vanuatu is attracting more and more international investors.

However, as with any foreign investment, it’s crucial to approach this project with caution and preparation. A thorough understanding of local regulations, rigorous due diligence, and assistance from local professionals are essential to succeed in your Vanuatu real estate investment.

Whether you’re seeking a dream secondary residence, a profitable rental investment, or a wealth diversification opportunity, Vanuatu offers a range of possibilities to realize your real estate ambitions in an idyllic setting.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.