Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

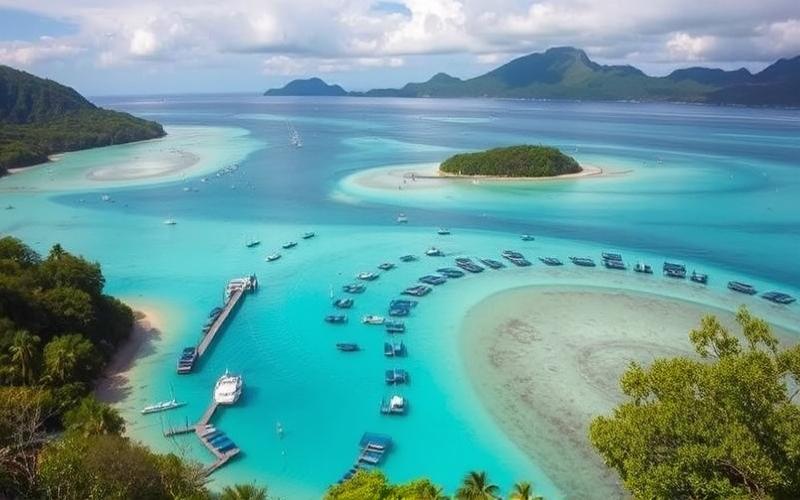

Dreaming of owning your own piece of tropical paradise? Vanuatu, with its white sand beaches, crystal-clear waters, and laid-back atmosphere, might just be the perfect place to make that dream come true. This South Pacific archipelago offers not only an idyllic living environment but also interesting real estate investment opportunities for foreigners. Whether you’re looking for a vacation home or a promising rental investment, our guide reveals everything you need to know about buying waterfront property in Vanuatu.

Vanuatu’s Hidden Gems: Where to Invest for Maximum Potential?

Vanuatu is full of exceptional sites for acquiring waterfront property. Each island has its unique charm, but some stand out particularly for real estate investment.

Efate, the main island, is often the first choice for foreign investors. Its capital, Port Vila, offers an appealing blend of modern infrastructure and tropical charm. Coastal areas like Pango Point or Havannah Harbour are particularly sought after for their breathtaking ocean views and proximity to urban amenities. Property prices there have seen stable growth in recent years, with an average increase of 5-7% annually according to Vanuatu Real Estate Association data.

Espiritu Santo Island, the largest in the archipelago, is increasingly attracting savvy investors. Its pristine beaches and turquoise waters make it a prime destination for high-end tourism. The areas of Luganville and Champagne Beach offer significant development potential, with land still affordable compared to Efate. Local statistics indicate a 15% increase in real estate transactions on Santo in 2024 compared to the previous year.

For those seeking authenticity and absolute tranquility, more remote islands like Tanna or Malekula present unique opportunities. Although less developed, these islands attract clients looking for exclusive ecotourism experiences. Investment there is certainly riskier but potentially more profitable long-term. The Vanuatu government also announced in 2025 an infrastructure development plan for these islands, which could boost their attractiveness in the coming years.

Good to Know:

Efate and Espiritu Santo are the most popular islands for real estate investment in Vanuatu, offering a good balance between development and authenticity. More remote islands like Tanna present interesting potential for bold investors.

Buying property in Vanuatu might seem complex for a foreigner, but with the right information and proper support, the process can be relatively straightforward.

Understanding the legal framework is the first crucial step. Unlike many Pacific countries, Vanuatu allows foreigners to purchase real estate as freehold property. However, it’s important to note that only urban zone land can be purchased by non-residents. Rural areas are reserved for Vanuatu citizens. This policy, established to preserve the country’s cultural heritage, is strictly enforced.

The purchasing process itself involves several steps:

- Property identification: Engage a reputable local real estate agent to assist with your search.

- Due diligence: Carefully verify the property title and any usage restrictions.

- Negotiation and offer: Once you’ve chosen a property, your agent will help you formulate a competitive offer.

- Sales contract: A local attorney must draft or review the contract to ensure compliance with Vanuatu law.

- Government approval: All foreign purchases must be approved by the Ministry of Lands, a process that typically takes 4-6 weeks.

- Finalization: Once approval is obtained, the property transfer can be registered and funds transferred.

Financing is a crucial aspect to consider. Local banks in Vanuatu rarely offer mortgages to non-residents. Most foreign buyers therefore opt for financing from their home country or pay cash. It’s recommended to budget approximately 5-7% of the purchase price to cover transaction costs, including attorney fees, registration fees, and government taxes.

Taxation in Vanuatu is another major advantage for investors. The country imposes no personal income tax, capital gains tax, or inheritance tax. However, an annual property tax applies, typically around 1% of the property’s estimated value. These favorable tax conditions make Vanuatu a sought-after destination for tax optimization, attracting many international investors.

Good to Know:

Foreigners can purchase freehold properties in Vanuatu, but only in urban areas. The purchasing process requires government approval and typically takes 2-3 months on average. Vanuatu offers a very favorable tax regime, with no income tax or capital gains tax.

Riding the Success Wave: Maximizing Your Investment in Vanuatu

Investing in Vanuatu real estate can prove extremely lucrative if you know how to navigate this unique market intelligently. Here are some strategies to optimize your investment:

Seasonal rentals are particularly promising in Vanuatu. With tourism booming – the country welcomed over 350,000 visitors in 2024 according to Vanuatu Tourism Office – demand for quality accommodations is strong. Well-located waterfront properties can generate rental yields ranging from 6-10% annually. To maximize your income, consider investing in high-end villas or apartments that attract affluent clients seeking exclusive experiences.

Real estate development also offers interesting opportunities. Vanuatu is experiencing growing urbanization, particularly around Port Vila. Buying well-located land to build modern housing can prove very profitable. Data from the Ministry of Urban Development indicates a 20% increase in building permits issued in 2024 compared to the previous year, a sign of a dynamic market.

Ecotourism is an expanding sector in Vanuatu. Investing in environmentally friendly properties using renewable energy and offering experiences in harmony with nature can set you apart in the market. The Vanuatu government offers tax incentives for ecological projects, which can increase your investment’s profitability.

Diversification is key to minimizing risks. Rather than investing all your capital in one luxury property, consider purchasing several smaller properties spread across different islands. This strategy allows you to leverage different local markets and reduce the impact of potential economic or climate fluctuations.

Don’t forget the importance of local management. Hiring a reputable property management company can make all the difference, especially if you don’t reside in Vanuatu. These professionals can handle maintenance, rentals, and daily property management, ensuring stable income flow and preserving your property’s value.

Good to Know:

Seasonal rentals and real estate development offer the best return opportunities in Vanuatu. Ecotourism is a growing sector supported by government incentives. Professional local management is crucial to maximizing your investment profitability from a distance.

Investing in Vanuatu offers many advantages, but it’s crucial to be aware of potential challenges to make an informed decision.

Natural risks are a reality in this Pacific region. Vanuatu is located on the “Ring of Fire” and is prone to tropical cyclones, earthquakes, and tsunamis. In 2015, Cyclone Pam caused significant damage, reminding everyone of the importance of solid construction and adequate insurance. According to the National Disaster Management Office, construction standards have been significantly strengthened since then, with a 40% reduction in damage during recent major weather events.

Infrastructure, while constantly improving, can still present challenges in some regions. Access to electricity, drinking water, and high-speed internet isn’t guaranteed everywhere. It’s essential to thoroughly research available infrastructure before investing, especially in more remote islands. The government launched an ambitious infrastructure development plan in 2024, planning to invest over $100 million over 5 years to improve connectivity and basic services throughout the archipelago.

Political and economic stability in Vanuatu, while generally good, can experience fluctuations. The country heavily depends on tourism and international aid, making it vulnerable to global economic shocks. However, Vanuatu has shown remarkable resilience, maintaining average economic growth of 3.5% annually over the past decade according to the World Bank.

Cultural challenges should not be underestimated. Vanuatu’s traditional land system is complex, and while urban area purchases are generally safe, it’s crucial to respect local customs and maintain good community relations. Hiring an experienced local attorney is essential to navigate these cultural and legal subtleties.

Finally, remote management can prove complex. Time zone differences, language barriers (although English is widely spoken), and cultural differences can complicate daily property management. This is why it’s strongly recommended to work with trusted local professionals for managing your investment.

Good to Know:

The main challenges of real estate investment in Vanuatu include natural risks, developing infrastructure, and the complexity of remote management. Thorough due diligence, good understanding of the local context, and working with experienced professionals are essential to overcome these obstacles.

Your Passport to Paradise: The Unique Benefits of Investing in Vanuatu

Despite the challenges, investing in Vanuatu real estate offers unique benefits that make it a preferred destination for many international investors.

The citizenship by investment program in Vanuatu is one of the most attractive in the world. By investing a minimum of $130,000 USD in real estate or a government fund, you can obtain Vanuatu citizenship in just 2-3 months. This citizenship offers many advantages, including visa-free travel to over 130 countries, including the United Kingdom and Schengen Area. In 2024, Vanuatu issued over 2,000 passports under this program, generating significant revenue for the country.

The favorable tax regime in Vanuatu is another major asset. With no income tax, capital gains tax, or inheritance tax, the country offers an extremely favorable tax environment for investors. This tax policy attracts not only real estate investments but also entrepreneurs and retirees worldwide seeking to optimize their tax situation.

The growth potential of Vanuatu’s real estate market is considerable. With tourism expanding rapidly – visitor numbers increased by 60% between 2015 and 2024 according to Vanuatu Tourism Office – demand for quality accommodations continues to grow. Property prices, while rising, remain competitive compared to other sought-after tropical destinations, thus offering interesting appreciation potential.

The exceptional quality of life that Vanuatu offers is a compelling argument for many investors. Ranked as one of the world’s happiest countries according to the “Happy Planet Index,” Vanuatu attracts with its relaxed lifestyle, preserved natural beauty, and welcoming culture. This idyllic environment makes it a prime destination for those looking to combine investment and quality of life.

The relative political and economic stability of Vanuatu, compared to other Pacific island nations, offers a reassuring framework for investors. The country has maintained stable economic growth in recent years, supported by government policies favorable to foreign investment and gradual economic diversification.

Good to Know:

The citizenship by investment program, favorable tax regime, and real estate market growth potential make Vanuatu an attractive investment destination. The exceptional quality of life and the country’s relative stability add to its appeal for international investors.

Investing in waterfront real estate in Vanuatu offers a unique opportunity to combine financial returns and paradise lifestyle. With a thoughtful approach, thorough understanding of the local market, and support from experienced professionals, you can transform your dream of tropical property ownership into a profitable reality. Whether you’re looking for an idyllic vacation home or a promising rental investment, Vanuatu has much to offer savvy investors willing to explore this South Pacific gem.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.