Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

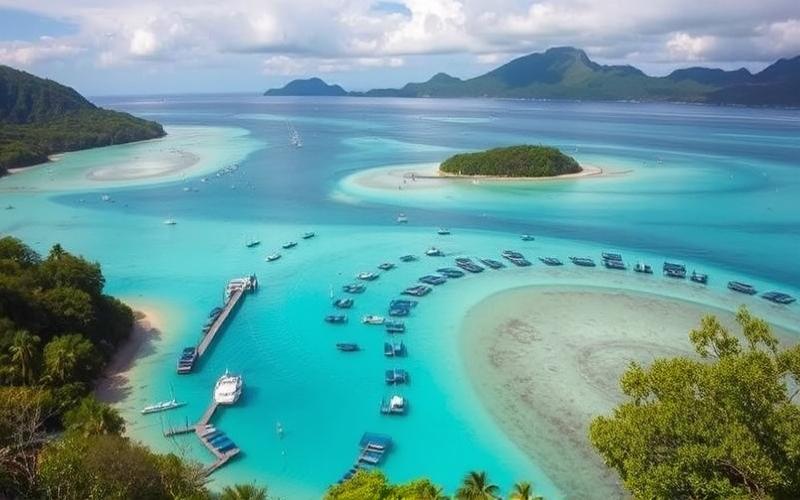

Vanuatu, a paradise archipelago in the South Pacific, is attracting an increasing number of foreign investors seeking unique real estate opportunities. With its white sand beaches, crystal-clear waters, and exceptional living environment, this country offers interesting investment potential for those looking to diversify their real estate portfolio internationally. However, obtaining real estate financing in Vanuatu can seem complex for non-residents. In this article, we will explore in detail the financing possibilities, required conditions, and necessary documents to realize your real estate project in this tropical paradise.

The Accessible Dream: Can Foreigners Really Obtain Real Estate Financing in Vanuatu?

The good news for foreign investors is that it is entirely possible to obtain real estate financing in Vanuatu. Although the mortgage market is less developed than in some Western countries, several options are available to non-residents wishing to invest in local real estate.

Local Banks Open Their Doors

Contrary to some misconceptions, major banks in Vanuatu, such as BRED Bank and National Bank of Vanuatu, offer real estate loans to foreigners. These institutions have developed specific products to meet the needs of international investors, aware of the country’s growing appeal to this type of clientele.

Conditions Adapted for Non-Residents

Vanuatu banks have adapted their offers to account for the particular situation of foreign buyers. Thus, it’s possible to obtain loans in foreign currencies, particularly in US dollars or euros, which helps limit exchange rate risks. Additionally, some banks offer repayment terms of up to 25 years, providing valuable flexibility for investors.

The Key Role of Specialized Brokers

To facilitate obtaining financing, many foreign investors turn to brokers specialized in international real estate. These professionals are thoroughly familiar with the specifics of the Vanuatu market and can help you build a strong application, thereby increasing your chances of obtaining a loan under the best conditions.

Good to Know:

Foreigners can indeed obtain real estate financing in Vanuatu, with adapted offers provided by local banks. The assistance of a specialized broker can greatly facilitate the process.

The Key to Your Loan: What Documents Are Required to Obtain Real Estate Financing in Vanuatu?

To maximize your chances of obtaining real estate financing in Vanuatu, it’s crucial to prepare a complete and strong application. Here are the main documents you will need to provide:

Identity and Residence Proof

- Valid passport

- Recent proof of address (less than 3 months old)

- Visa or residence permit for Vanuatu (if applicable)

Financial Documents

- Bank statements from the last 6 months

- Income verification (pay stubs, tax returns)

- Employer certificate or documents related to your professional activity

- Detailed statement of your assets (real estate, financial investments, etc.)

Documents Related to the Property

- Sales agreement or purchase promise

- Property appraisal by a certified expert

- Plans and building permits (for construction projects)

Guarantees and Insurance

- Borrower insurance proposal

- Proof of guarantees you can provide (collateral, pledge, etc.)

It’s important to note that some documents will need to be translated into English, which is one of the official languages of Vanuatu. Additionally, local banks may require additional documents depending on your personal situation and the type of property you wish to acquire.

The Importance of Financial Transparency

Vanuatu authorities and local banks place great importance on combating money laundering. It is therefore essential to be able to clearly justify the origin of the funds you plan to invest. Be prepared to provide detailed explanations and supplementary documents if necessary.

Good to Know:

A complete financing application for Vanuatu must include identity verification, detailed financial documents, information about the target property, and guarantees. Transparency about the origin of funds is crucial.

Keys to Success: What Are the Essential Conditions for Securing Real Estate Financing in Vanuatu?

Obtaining real estate financing in Vanuatu as a foreigner requires meeting certain specific conditions. Here are the main criteria that Vanuatu banks consider:

A Substantial Personal Contribution

Vanuatu banks generally require a larger personal contribution from foreign investors than from local residents. Typically, you will need to be able to contribute between 30% and 50% of the total acquisition amount. This requirement aims to limit risks for the bank and ensure your financial commitment to the project.

A Strong Financial Situation

Lending institutions will carefully examine your overall financial situation. They will be particularly interested in:

- Your regular income and its stability

- Your debt capacity (the monthly payment/income ratio generally should not exceed 33%)

- Your overall assets and other financial commitments

The stronger and more stable your financial situation, the better your chances of obtaining financing under favorable conditions.

A Viable Real Estate Project

The nature and quality of the property you wish to acquire also play an important role in the bank’s decision. The bank will ensure that:

- The property complies with local land ownership regulations

- The property value is consistent with the requested loan amount

- The rental or resale potential of the property is attractive (especially if you’re considering a rental investment)

Solid Guarantees

To secure the loan, Vanuatu banks generally require significant guarantees. This may include:

- A first mortgage on the financed property

- Borrower insurance covering death and disability risks

- In some cases, additional guarantees such as a pledge on financial investments or a personal guarantee

An Impeccable Banking History

Vanuatu banks pay particular attention to the banking history of foreign borrowers. A banking record without incidents and demonstrating responsible financial management will be a major asset for your financing application.

Good to Know:

To obtain real estate financing in Vanuatu, key conditions include a substantial personal contribution (30-50%), a strong financial situation, a viable real estate project, solid guarantees, and an impeccable banking history.

Winning Strategies: How to Optimize Your Chances of Obtaining Real Estate Financing in Vanuatu?

Securing real estate financing in Vanuatu as a foreigner may seem complex, but with the right strategies, you can significantly increase your chances of success. Here are some tips to optimize your application:

Use a Specialized Broker

A broker experienced in international real estate, particularly in Vanuatu, can be a valuable asset. They can:

- Direct you to banks most likely to accept your application

- Help you prepare a strong and complete application

- Negotiate the best loan terms on your behalf

- Guide you through the specifics of the local real estate market

Prepare a Detailed Business Plan

If you’re considering a rental investment, presenting a solid business plan can make the difference. This document should include:

- An analysis of the local rental market

- Realistic financial projections

- A strategy for property management and maintenance

- A risk and opportunity assessment

Build a Substantial Personal Contribution

The larger your personal contribution, the better your chances of obtaining financing. Aim for a contribution of at least 40% of the total acquisition amount to maximize your chances.

Anticipate Additional Costs

Don’t forget to include in your budget the additional costs associated with real estate purchase in Vanuatu, such as:

- Notary fees

- Acquisition-related taxes

- Bank processing fees

- Potential brokerage fees

Planning for these expenses from the start will show banks your seriousness and good understanding of the local market.

Be Transparent About the Origin of Funds

Financial transparency is crucial for obtaining financing in Vanuatu. Be prepared to provide detailed explanations and documentation about the origin of your personal contribution and income.

Consider Additional Guarantees

If possible, offer additional guarantees to reassure the bank, such as:

- A pledge on financial investments

- A guarantee from a bank in your home country

- A guarantee on real estate you own in your country

Good to Know:

To optimize your chances of obtaining real estate financing in Vanuatu, use a specialized broker, prepare a detailed business plan, build a substantial contribution, anticipate all costs, be transparent about the origin of funds, and consider additional guarantees.

Conclusion: Your Real Estate Project in Vanuatu Within Reach

Obtaining real estate financing in Vanuatu as a foreigner is a challenge that requires careful preparation and a good understanding of local specifics. However, with the right strategies and a strong application, your dream of investing in this tropical paradise can become reality.

Remember that each situation is unique and financing conditions may vary depending on your profile, the type of property targeted, and the economic climate. It is therefore essential to surround yourself with experienced professionals who can guide you throughout the process.

Whether you wish to acquire a secondary residence, make a rental investment, or even settle permanently in Vanuatu, appropriate real estate financing can enable you to realize your project under the best conditions.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.