Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

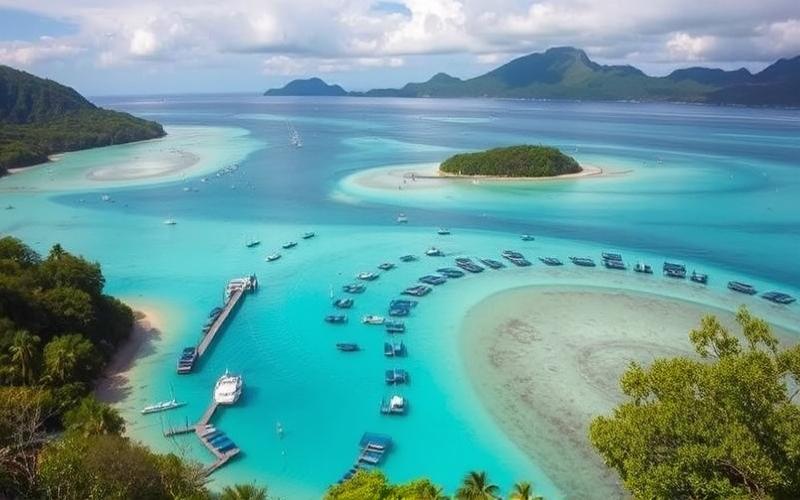

Vanuatu, a tropical archipelago in the South Pacific, is increasingly attracting foreign real estate investors drawn by its paradise-like living environment and rental potential. With a growing economy and a thriving tourism sector, long-term property rental in Vanuatu can be an interesting opportunity to generate regular income. However, embarking on long-term rentals in this country requires a good understanding of the local market specifics and adherence to certain rules. Here is a comprehensive guide to help you succeed in your rental investment in Vanuatu.

The Rental Market in Vanuatu: Untapped Potential

The long-term rental market in Vanuatu is booming, driven by several factors:

– Sustained population growth, with an average annual increase of 2.3% between 2010 and 2020. – A growing influx of expatriates and foreign retirees attracted by the quality of life. – Tourism development, with over 350,000 visitors in 2019 (pre-pandemic). – Significant investments in infrastructure and real estate.

Rental demand is particularly strong in the capital Port-Vila and on Efate Island, which concentrate the majority of economic and tourist activity. The most sought-after properties are 2 to 4-bedroom houses and apartments, ideally located near beaches or the city center.

Average rents range from $800 to $2,500 USD per month for an apartment or house, depending on size and location. Gross rental yields can reach 6% to 8% per year, which is attractive compared to other destinations.

Good to know:

The rental market in Vanuatu offers great opportunities, with potential yields of 6% to 8% per year and strong demand in tourist areas.

Legal Framework: Rules to Know for Peaceful Renting

Before starting long-term rentals in Vanuatu, it’s essential to understand the local legal framework:

Property rights for foreigners: Non-residents can buy real estate in Vanuatu, but only through a leasehold arrangement with a maximum term of 75 years. This lease can be renewed upon expiration.

Mandatory registration: Any owner wishing to rent their property must register with the Department of Tourism and obtain a rental license. This process ensures the property meets safety and quality standards.

Lease agreement: A written contract is mandatory for any rental over 3 months. It must specify the rental conditions, rent amount, lease duration, etc.

Taxation: Rental income is subject to income tax in Vanuatu, with a progressive rate from 0% to 17%. A property tax also applies, varying based on the property’s value.

It is highly recommended to consult a local lawyer specialized in real estate law to assist with procedures and ensure compliance with all legal obligations.

Good to know:

Foreigners can buy and rent properties in Vanuatu, but only through leasehold. Registration with authorities and a written contract are mandatory for long-term rentals.

Finding the Ideal Property: Winning Criteria for a Successful Investment

To maximize the rental potential of your investment in Vanuatu, consider these key criteria:

Strategic location: Prioritize areas with high rental demand like Port-Vila, Luganville, or popular beach resorts. Proximity to beaches, shops, and transportation is a major advantage.

Suitable property type: 2 to 4-bedroom houses and apartments are most in demand for long-term rentals. Ensure the property has modern amenities and outdoor spaces (terrace, garden), highly valued in this tropical climate.

Property condition: Choose a recent or renovated property requiring minimal work. Air-conditioned and furnished units rent more easily and at higher rates.

Appreciation potential: Assess development projects in the neighborhood (new infrastructure, tourist complexes, etc.) that could increase your property’s long-term value.

Rental yield: Carefully calculate potential yield considering all expenses (taxes, fees, maintenance) to ensure your investment’s profitability.

To find the ideal property, contact reputable local real estate agencies like First National Real Estate Vanuatu or Vanuatu Luxury Real Estate. They know the market well and can guide your search.

Good to know:

A strategic location, a property suited to local demand, and good appreciation potential are keys to a successful rental investment in Vanuatu.

Creating a Solid Lease: Essential Clauses for Protection

Drafting a strong lease agreement is crucial to secure your rental investment in Vanuatu. Here are the main clauses to include:

Lease duration: Clearly specify the rental period (usually 1 year renewable for long-term leases) and renewal or termination conditions.

Rent amount and payment terms: State the rent amount, due date, and payment method. Include an annual rent adjustment clause based on Vanuatu’s consumer price index.

Security deposit: Set the security deposit amount (usually 1 to 2 months’ rent) and conditions for its return at lease end.

Rental charges: Detail charges included in the rent and those the tenant is responsible for (water, electricity, garden maintenance, etc.).

Property inspection: Plan for detailed entry and exit inspections to avoid disputes.

Tenant obligations: Specify tenant responsibilities regarding routine maintenance, tenant repairs, and home insurance.

Termination clause: Define conditions under which the lease can be terminated by either party.

Subletting: Prohibit or strictly regulate the possibility of subletting to prevent misuse.

It is highly recommended to have your lease agreement drafted or reviewed by a local lawyer to ensure compliance with Vanuatu legislation and protect your interests.

Good to know:

A well-drafted lease agreement, including all essential clauses, is your best protection against potential disputes with tenants.

Setting the Right Price: How to Determine an Attractive and Profitable Rent

Determining the correct rent amount is crucial to attract tenants while ensuring investment profitability. Here’s how to proceed:

Market study: Analyze rents for similar properties in the same neighborhood. Check online listings, local real estate agencies, and expatriate forums for precise pricing insights.

Property features: Adjust rent based on your property’s assets (sea view, pool, recent renovation, etc.) and any drawbacks.

Seasonality: Consider seasonal demand variations, especially in tourist areas. Rents can be higher during peak season (June to September).

Charges and taxes: Include all charges and taxes you’ll pay as an owner to determine a rent that allows for a satisfactory margin.

Yield objective: Aim for a gross rental yield between 6% and 8% per year, considered attractive in Vanuatu.

As a guide, here are some monthly rent ranges observed in Port-Vila in 2025: – Studio/1-bedroom: $600 to $800 USD – 2-bedroom apartment: $800 to $1,500 USD – 3-4 bedroom house: $1,500 to $2,500 USD

Don’t hesitate to adjust your rent based on demand. It’s better to have a property rented at a slightly below-market price than to leave it vacant.

Good to know:

A well-calibrated rent, based on thorough market research and aiming for a 6% to 8% yield, will optimize your property’s occupancy and profitability.

Effectively Managing Tenant Relations: Keys to Peaceful Renting

Good management of tenant relations is essential for the success of your rental investment in Vanuatu. Here are some tips to achieve this:

Rigorous tenant selection: Conduct thorough checks on prospective tenants (employment status, income, references) to minimize risks of non-payment or damage.

Clear and regular communication: Establish open and transparent communication with your tenants from the start. Be responsive to their requests and inform them in advance of any planned interventions in the property.

Regular property maintenance: Ensure regular monitoring of the property’s condition and perform necessary repairs promptly. This helps maintain good relations with tenants and preserve your property’s value.

Compliance with legal obligations: Ensure you strictly adhere to your obligations as an owner (common area maintenance, compliance with standards, etc.) to avoid disputes.

Conflict management: In case of disagreement, always prioritize dialogue and amicable solutions. If necessary, use a professional mediator.

Payment tracking: Implement an effective system for tracking rent payments and respond quickly to any delays.

If you don’t reside in Vanuatu or prefer to delegate rental management, you can hire a local property management agency. Companies like Vanuatu Luxury Property Management or Pacific Property Management offer comprehensive rental management services, including tenant search, rent collection, property maintenance, and dispute resolution.

Good to know:

Proactive and professional tenant relationship management, based on clear communication and regular property maintenance, is key to peaceful and profitable renting in Vanuatu.

Optimizing Tax on Your Rental Investment in Vanuatu

Understanding and optimizing the tax aspects of your rental investment in Vanuatu is crucial to maximize profitability. Here are the main points to know:

Tax on rental income: Rental income is subject to income tax in Vanuatu, with progressive brackets from 0% to 17%. The brackets are as follows: – 0 to 750,000 VUV: 0% – 750,001 to 1,500,000 VUV: 6% – 1,500,001 to 3,000,000 VUV: 12% – Over 3,000,000 VUV: 17%

Property tax: An annual property tax applies, with the amount varying based on the property’s value. The rate is generally between 0.5% and 2% of the estimated property value.

VAT: VAT in Vanuatu is 15%. It applies to rents if your annual rental income exceeds 4 million VUV (approximately $34,000 USD).

Tax deductions: You can deduct expenses related to property management and maintenance, mortgage interest, insurance premiums, etc. Keep all receipts carefully.

Depreciation: Vanuatu allows depreciation of rental properties, which can significantly reduce your taxable base. The depreciation rate is generally 4% per year for buildings.

Tax treaty: Vanuatu has not signed a tax treaty with France. If you are a French tax resident, your rental income in Vanuatu will also be taxable in France, with a tax credit equal to the tax paid in Vanuatu.

To optimize your tax situation, it is highly recommended to consult an accountant or tax lawyer familiar with Vanuatu legislation. They can help structure your investment in the most advantageous way possible.

Good to know:

A good understanding and optimization of local taxation, especially by leveraging deductions and depreciation, can significantly improve the profitability of your rental investment in Vanuatu.

Anticipating Risks: Essential Insurance and Precautions

Investing in rental real estate in Vanuatu involves certain risks that are important to anticipate and adequately cover:

Home multi-risk insurance: Purchase insurance covering building damage, theft, water damage, etc. Ensure it includes coverage for natural disasters, as Vanuatu is exposed to cyclones and earthquakes.

Unpaid rent insurance: This coverage, though less common in Vanuatu than in France, can be valuable to protect against tenant payment defaults.

Non-occupier liability insurance: This insurance covers you for damages to third parties caused by your property.

Natural disaster prevention: Ensure your property complies with Vanuatu’s anti-seismic and anti-cyclonic construction standards. Plan for safety equipment (cyclone shutters, alert systems, etc.).

Legal security: Have a local lawyer verify the validity of your property title (leasehold). Ensure all necessary permits for rental have been obtained.

Geographic diversification: If investing in multiple properties, spread them across different islands or areas of Vanuatu to reduce risks associated with a specific local market.

Cash reserve: Build a financial reserve to handle unexpected events (urgent repairs, vacancy periods, etc.).

Market monitoring: Stay informed about real estate and rental market developments in Vanuatu to adjust your strategy if needed.

By taking these precautions and ensuring adequate coverage, you can approach your rental investment in Vanuatu with greater peace of mind.

Good to know:

Comprehensive insurance coverage, including risks specific to Vanuatu like natural disasters, is essential to protect your investment long-term.

Investing in rental real estate in Vanuatu can be an interesting opportunity to diversify your assets and generate regular income in a paradise setting. With sustained rental demand, attractive yields, and a favorable tax framework, the Vanuatu market offers promising prospects for savvy investors.

However, successful investment requires good preparation and rigorous management. It’s crucial to understand local market specifics, choose a property with strong rental potential, establish a solid lease agreement, and effectively manage tenant relations.

Remember that foreign real estate investment carries specific risks. Thorough due diligence, reliance on local professionals (lawyer, accountant, real estate agent), and good insurance coverage are essential to secure your investment.

Finally, keep in mind that Vanuatu’s real estate market, while promising, remains relatively small and can be subject to fluctuations. A long-term approach and diversification of your investments are recommended to optimize your chances of success.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.