Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

In Vanuatu, Micro-Apartments: An Innovative Real Estate Solution

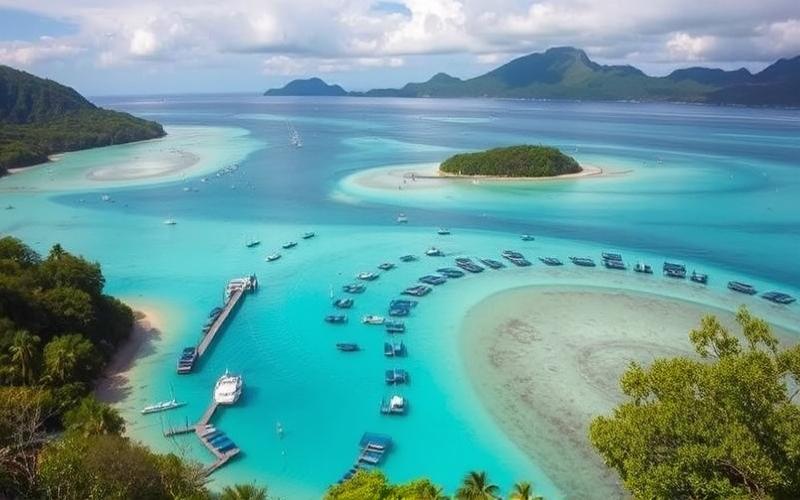

In Vanuatu, an archipelago renowned for its exotic landscapes, a surprising real estate trend is emerging: micro-apartments. These ingeniously designed living spaces are captivating more and more people looking to optimize their budget without sacrificing comfort.

They offer an attractive solution in the face of rising housing costs. In a context where financial accessibility is crucial, these compact homes position themselves as an appealing alternative for many residents, while seamlessly integrating into the country’s exceptional natural setting.

How Are These Micro-Apartments Transforming Residents’ Lives?

But how are these small architectural wonders actually transforming the lives of those who inhabit them?

Good to Know:

Micro-apartments in Vanuatu often combine local materials with modern designs to maximize space while respecting the environment.

The Microliving Concept in Vanuatu

The evolution of the microliving concept in Vanuatu fits within a context of rapid adaptation to the economic and social realities specific to small island states. Faced with urban population growth, land pressure, and the search for affordable housing, microliving has emerged as a pragmatic solution addressing the new needs of urban populations.

Economic and Social Factors Driving Adoption:

- Increasing land costs in urban areas

- Growing urbanization around Port-Vila and Luganville

- Economic vulnerability linked to external dependence and lack of diversification

- Pressure on infrastructure following frequent natural disasters

Local Initiatives to Promote Microliving:

| Initiative | Description |

|---|---|

| Private real estate projects | Construction of compact units near city centers |

| Government policies | Tax relief for developers engaged in compact social housing; support for architectural innovation adapted to the tropical climate |

| International partnerships | Collaboration with NGOs to integrate environmental sustainability |

Financial and Environmental Benefits:

- Significant reduction in construction costs per unit

- Easier access to housing for young professionals or single-parent families

- Reduced energy consumption through optimized living space

- Smaller ecological footprint (fewer materials, limitation of urban sprawl)

Challenges Related to Microliving:

– Increased risk of excessive urban density without adequate planning

– Sometimes insufficient infrastructure (drinking water, sanitation) in peri-urban areas

List of Major Challenges:

- Cultural acceptance of minimalist lifestyle traditionally absent locally

- Need to integrate shared outdoor spaces adapted to the climate

Resident Testimonials in Micro-Apartments:

“Living here finally allows me to be independent without going into debt. I have everything I need in the city, even if the space is limited. I now prioritize moments shared outdoors with my neighbors.”

“At first it was difficult because we’ve always lived in large family homes. Today I mainly see how it simplifies my daily life… but there should be more accessible green spaces near the buildings.”

Impact on Local Lifestyle and Access to Affordable Housing:

The development of microliving thus helps to energize the accessible rental market while encouraging a gradual evolution towards more sustainable urban planning. It particularly supports residential autonomy among younger generations while raising the crucial question of balance between built density and quality of life.

⧉ The microliving model now appears as an innovative lever against the structural challenges faced by Vanuatu, provided that its growth is accompanied by urban planning sensitive to island cultural specificities and local environmental resilience.

Good to Know:

In Vanuatu, the microliving concept has seen growing adoption, influenced by the need for affordable housing solutions in the face of an expanding urban population and increasing economic pressure. Local initiatives, supported by government policies encouraging green construction and sustainable development, have emerged to promote this lifestyle. Private real estate projects have also contributed to urban transformation, offering flexible and economical housing options. Micro-apartments particularly attract young professionals and students with their reduced costs and smaller ecological footprint. However, this lifestyle presents challenges, particularly in terms of increased urban density and necessary urban infrastructure, such as transportation and public services. According to residents living in these micro-homes, this lifestyle offers a new perspective on housing, emphasizing space optimization and proximity to urban amenities, while making housing more accessible to an economically diverse population.

Investing in Studios in Vanuatu: Opportunities and Challenges

Investment Opportunities in Studios in Vanuatu

The growing demand for affordable housing is one of the main drivers of the Vanuatu real estate market. Between 2020 and 2025, the market experienced average annual growth of 5.7%, and in 2024, the number of building permits issued increased by 15% compared to the previous year.

- Studios and micro-apartments are gaining popularity among local young professionals as well as expatriates attracted by economic stability (GDP growth of 3.2% in 2024) and favorable taxation (no income tax or capital gains tax on real estate).

- Urban areas like Port-Vila or Efate are particularly dynamic due to proximity to tourist infrastructure and marked appeal for compact housing.

| Criterion | Data/Observations |

|---|---|

| Annual growth | +5.7% (2020–2025) |

| Building permits | +15% in 2024 |

| New studio price | Starting from approximately $100,000 USD depending on location |

| Target tenants | Local young professionals & expatriates |

| Taxation | Absence of income/capital gains tax |

Potential Investment Challenges

Local regulations: The complex land tenure system can make certain administrative procedures lengthy. Obtaining permits often depends on local authorities who prioritize strict compliance with anti-cyclone standards.

Environmental considerations: As an archipelago exposed to cyclones and climate change, all construction must incorporate enhanced resistance to natural hazards. This implies additional costs to meet these standards.

Specific costs of the island context: Transporting materials from abroad significantly increases prices per square meter compared to other regional markets. This reality sometimes limits expected profitability.

- Restricted and therefore volatile market

- Strong dependence on material imports

- Need to adapt design/construction to climate constraints

Recent Vanuatu Real Estate Market Data

Prices vary significantly by location:

- New studio in Port-Vila: between $100,000 and $200,000 USD

- Premium seaside apartments: up to $800,000 USD

- Buildable inland land: from $50,000 USD

Ocean views or immediate proximity to urban services remain decisive factors in property valuation.

Balanced Professional Perspectives

Real estate agents emphasize that despite its recent dynamism, this market is not homogeneous—there is a marked disparity between popular tourist areas (with supply tension) and remote islands where demand is lower but where more accessible land opportunities are sometimes found.

“The relative scarcity of land in certain urban neighborhoods attracts foreign investors eager to bet on short-term rental development… But one must remain vigilant about the environmental and logistical viability of the project.”

Sustainable success therefore relies as much on strategic positioning—precisely meeting emerging needs like those related to affordable housing—as on rigorous anticipation of additional costs specific to the Vanuatu island context.

Good to Know:

Investing in studios in Vanuatu offers interesting opportunities, due to growing demand for affordable housing, particularly sought after by young professionals and expatriates. These micro-apartments are on the rise, representing about 30% of new constructions, according to a 2023 study. However, investors must navigate challenges such as strict building regulations and environmental considerations, like sensitivity to cyclones and coastal erosion. Construction costs can also be high due to dependence on imports for materials. Real estate experts recommend collaborating with local partners to overcome these obstacles and fully benefit from potential returns, estimated between 5% and 7% annually.

Financial Returns of Small Spaces in Vanuatu

Factors influencing the financial returns of small spaces in Vanuatu include several key elements:

- Initial acquisition costs: Purchase prices for micro-apartments are generally more affordable than for larger homes, facilitating access to ownership and diversification of real estate portfolios. In Vanuatu, 2023 trends show an attractive market with competitive prices in some tourist or urban areas.

- Maintenance expenses: Maintenance fees (common charges, routine repairs) are lower in small spaces due to their reduced surface area. This increases net profitability compared to larger spaces that involve higher recurring costs.

- Local real estate market trends: Demand is supported by tourist appeal and local economic growth. Prime areas like Port-Vila show growing demand, particularly for seasonal rentals.

Profitability Comparison

| Criterion | Micro-Apartment | Larger Home |

|---|---|---|

| Acquisition price | Low | High |

| Annual expenses | Reduced | Significant |

| Rental demand | Strong (short term) | Moderate to strong |

| Potential gross yield | 7% – 12% | 4% – 8% |

| Rental flexibility | High (short/long term) | Medium |

Potential Benefits Through Rental

- Short-term rental: Dynamic tourism in Vanuatu stimulates seasonal rentals with high occupancy rates during certain periods. Some owners report occupancy rates exceeding 80% during peak season in tourist neighborhoods.

- Long-term rental: For those aiming for rental stability, the yield remains attractive due to low expenses and moderate initial purchase price.

Concrete Examples

In downtown Port-Vila or on Efate:

- A micro-apartment acquired for around $45,000 USD rents for $300-$400/month long-term or up to $60/night short-term during high tourist season.

- Some investors have achieved annual gross returns exceeding 10%, particularly thanks to the dynamism of the Airbnb sector with international travelers.

Economic and Regulatory Impact

The local economy heavily depends on international tourism. A post-pandemic recovery has led to a notable increase in rental demand in the short-term segment—a key factor supporting rent appreciation and property valuation.

Local regulation:

- Real estate legislation strictly regulates foreign access to land ownership but facilitates investment in certain residential programs adapted to non-residents.

- Certain restrictions exist regarding urban or commercial zoning; it’s therefore advisable to verify before acquisition if the property can legally be used for short-term rentals.

Synthetic List of Key Factors:

- Affordable price facilitating access

- Low recurring expenses

- Strong periodic tourist demand

- Specific regulations based on foreign status/rental project

- Net yield often superior compared to larger spaces

The high profitability observed in some micro-apartments is mainly explained by their appeal to the international tourist market combined with controlled costs related to the compact format.

Good to Know:

In Vanuatu, the financial return of micro-apartments is influenced by various factors, including relatively low initial acquisition costs and maintenance expenses often lower compared to larger homes. The profitability of these small spaces is particularly enhanced by short-term rentals, supported by tourist influx, especially in regions like Port Vila and Luganville. For example, some owners have reported returns on investment of 8 to 10% per year through Airbnb and similar platforms. Local real estate trends show growing demand for these practical spaces, attracted by an expanding tourist market. However, it’s crucial to consider local regulations, which may limit certain short-term rental activities, making longer-term rentals a stable option. Small units stand out for their appeal to young professionals and expatriates, but it remains essential to analyze the country’s economic and tourist evolution to maximize returns.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.