Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

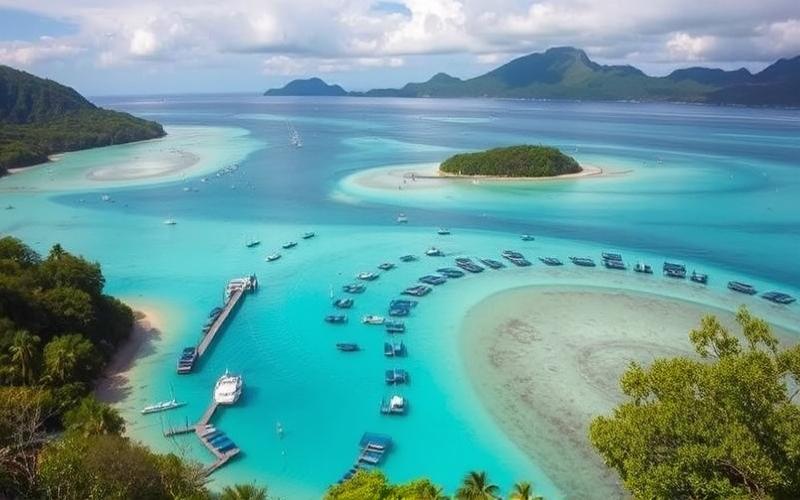

Vanuatu: An Attractive Real Estate Destination

Vanuatu, an enchanting archipelago nestled in the South Pacific, is attracting more and more investors seeking profitable real estate opportunities.

Leverage: A Key Strategy for Investors

For those looking to maximize their investment potential, using leverage proves to be an essential strategy. Through an accommodating banking system and attractive financing conditions, Vanuatu offers fertile ground for exploiting this financial approach.

Optimizing Your Real Estate Investments in Vanuatu

This article explores ways to optimize real estate purchases in Vanuatu by judiciously using leverage, while navigating a favorable tax framework that appeals to investors worldwide.

Good to Know:

Vanuatu offers a particularly advantageous tax environment with no income tax, capital gains tax, or inheritance tax.

Understanding Leverage in Vanuatu Real Estate

Leverage in real estate refers to the financial mechanism of using borrowing to invest in a property worth more than one’s equity. This principle allows an investor to increase their investment capacity and build wealth without using all their savings.

How It Works in the Real Estate Context:

- The investor takes out a bank loan to finance a significant portion or the entire purchase price.

- Rental income generated serves to repay the loan while gradually building equity.

- If net rental profitability exceeds the loan interest rate, leverage amplifies potential gains.

| Personal Contribution | Amount Borrowed | Total Property Price | Impact on Yield |

|---|---|---|---|

| €100,000 | €0 | €100,000 | Direct yield |

| €20,000 | €80,000 | €100,000 | Yield multiplied through leverage |

Advantages of Real Estate Leverage in Vanuatu:

- Enables investing with little savings and diversifying one’s real estate portfolio more quickly.

- Increases potential rental income and accelerates wealth building.

- Opportunity to fully benefit from real estate price increases with a reduced initial outlay.

Associated Risks:

- If rental profitability falls below financial charges (high rates, vacancy), the effect can become negative and amplify losses.

- Increased risk in case of market downturn (price drops or rapid rate increases).

Concrete Example Adapted to Vanuatu:

An investor wants to acquire a villa in Port-Vila for VT 40 million. They contribute VT 8 million (20%) and finance the rest through a bank loan. If the market progresses and the villa increases by +10% in value (VT 4 million), this gain represents +50% on the initial contribution – illustrating the full power of leverage when mastered.

Specific Conditions Influencing Leverage in Vanuatu:

- Bank interest rates generally between 7% and 12%, depending on borrower profile, duration, type of asset financed.

- Loans accessible mainly through local banks with strict requirements regarding mortgage guarantees and sometimes a high minimum contribution for non-residents.

- Market characterized by stable demand in certain tourist areas but exposed to regional economic and climate uncertainties; valuation also dependent on specific land regulations for foreigners.

Practical Tips for Investors Wanting to Use Leverage in Vanuatu:

- Carefully analyze expected gross/net profitability before any operation.

- Systematically compare the total cost of proposed financing against real local market prospects.

- Negotiate banking conditions (fixed vs. variable rates, duration) as much as possible to secure cash flow.

- Plan sufficient margin in your financial plan to cover unforeseen events or periods without rental.

- Get precise information on applicable land rights according to your nationality before any commitment.

Mastering leverage involves strict financial discipline, fine knowledge of the local market – particularly economic cycles, demographic/tourist trends – as well as realistic anticipation of unfavorable scenarios.

By intelligently using this mechanism, it’s possible not only to accelerate wealth building but also to sustainably optimize real estate returns in Vanuatu.

Good to Know:

Leverage in Vanuatu real estate allows investors to borrow funds to purchase properties by mobilizing only part of their capital, thus increasing their potential return. However, this mechanism also amplifies risks, especially if economic conditions deteriorate. In Vanuatu, leverage is particularly influenced by relatively stable interest rates, but it’s crucial to monitor loan conditions that can vary. For example, an investor could purchase a property with a minimal down payment and benefit from a rising market but should be cautious during periods of fluctuation. Current trends show a moderate increase in real estate prices, which could encourage higher risk-taking. To maximize benefits, investors should carefully assess their ability to repay loans, diversify their portfolio, and consult local experts to navigate the country’s specific legal and financial aspects.

Smart Debt Strategies: Maximizing Your Investments

Smart debt in real estate refers to the thoughtful use of debt to increase investment capacity, optimize capital returns, and accelerate wealth growth. In Vanuatu, this principle takes on a particular dimension due to the local regulatory framework and specific real estate market characteristics.

Definition and Principles of Smart Debt in Vanuatu

- Using loan financing allows acquiring larger or multiple properties without mobilizing all capital.

- Leverage involves financing a significant portion of an investment through a loan while benefiting from generated income (rents or capital gains) to repay the credit.

- In the Vanuatu market, stable economic conditions, sustained demographic growth, and anti-speculation policies create an environment conducive to this strategy.

Practical Tips to Maximize Real Estate Investments Through Leverage

- Compare local interest rates offered by banks or specialized institutions. The local rate directly impacts profitability; therefore, negotiate best according to your profile.

- Prefer a reasonable down payment (e.g., 20% to 30%) to preserve liquidity while reassuring the lender about your solvency.

- Ensure expected rental income largely covers (ideally >120%) the loan installment amount.

Comparative Table: Leverage – Advantages vs Risks

| Advantages | Risks |

|---|---|

| Maximization of return on investment | Potential decrease in real estate prices |

| Rapid portfolio diversification | Sudden increase in interest rates |

| Tax optimization | Excessive debt if rents are insufficient |

Analysis and Proactive Risk Management

To limit exposure:

- Maintain a moderate debt ratio adapted to overall income

- Plan a financial margin to handle unforeseen events (vacancy, repairs)

- Diversify assets to not depend solely on the local real estate market

- Regularly monitor local economic evolution to anticipate any unfavorable variations

Concrete Examples from the Vanuatu Market

An investor who purchased three apartments with 30% down payment each was able to:

- Fully benefit from continuous growth since 2020

- Generate sufficient rents (>5% to 8% net yield) largely covering bank installments

- Partially resell some units after two years with profit while maintaining long-term exposure

This scheme illustrates how calibrated debt allows not only multiple acquisitions but also strategic flexibility (arbitrage/successive resales).

Intelligent Evaluation of Opportunities via Leverage

Before any decision:

- Meticulously analyze each project: projected net profitability after charges/taxes/interest

- Carefully study local regulations on real estate credit that can influence your possibilities:

- Loans are generally backed by solid mortgage guarantees required by local financial institutions

- Strict control against speculation limiting certain forms of quick “buy-sell”

- Simulate different macroeconomic scenarios: political/demographic stability/bank benchmark rates

Practical Checklist Before Taking on Debt:

- Calculate your maximum capacity without compromising overall financial security

- Systematically negotiate your conditions with several local banks

- Anticipate applicable taxation for non-residents/foreign investors according to chosen status

Good to Know:

Smart debt in Vanuatu real estate involves using leverage to optimize capital by borrowing at an advantageous rate, thus exploiting local market growth opportunities. Banks in the archipelago often offer competitive credit conditions, favoring property acquisition. However, it’s crucial to properly assess risks, such as rate fluctuations or regulatory changes, and diversify investments to mitigate these uncertainties. For example, some investors have successfully increased their wealth by financing tourism projects through local loans while maintaining a prudent debt ratio. To maximize returns, analyze market trends, particularly the tourism boom, and consider local partnerships aligned with current legal provisions.

The reasoned use of credit in Vanuatu real estate can constitute a formidable wealth catalyst if each step – economic analysis, rigorous property selection, proactive management – is conducted with discipline.

Calculating Return on Investment in Vanuatu Real Estate

Return on investment (ROI) in real estate represents the percentage of gain or loss generated by a property relative to the amount invested. It allows evaluating the profitability of an investment by considering rental income, property appreciation, and incurred costs.

Main Costs Related to Property Purchase in Vanuatu:

- Property purchase price

- Property taxes (often moderate but variable by municipality)

- Notary and legal fees

- Rental management costs (especially if using an agency)

- Regular maintenance and repairs

- Property owner insurance

To Calculate Revenue Generated by Your Investment:

Rental Income: from either seasonal rentals (very dynamic in tourist areas) or long-term rentals.

- Example: A 3-bedroom villa in Port-Vila can rent between $200 and $400/night in high season with an average annual occupancy rate around 60%, thus generating between $50,000 and $100,000 gross/year.

- In long-term rental, a two-bedroom apartment can yield between $12,000 and $18,000/year.

Property Appreciation: potential evolution of market price over the years.

Recent Data to Contextualize Yields in Vanuatu:

| Type/Location | Estimated Gross Annual Income | Typical Net Yield |

| Seasonal Villa | $50k – $100k | 5% – 8% |

| Long-term Apartment | $12k – $18k | 4% – 6% |

Local Factors Influencing ROI:

- Fluctuations in local real estate market, particularly linked to tourist demand that remains strong in certain areas like Port-Vila or Efate

- Political regulations concerning foreign or tax ownership that can evolve rapidly

- Overall economic stability of the country

- Tourist demand sustained by natural beauty but susceptible to climate uncertainties

Concrete Example:

A villa purchased for $600,000 generates $75,000/year in gross income with about $20,000/year in total charges. The net yield is therefore (75,000 – 20,000)/600,000 × 100 = 9.16%.

Practical Tips to Improve ROI:

- Use leverage through bank financing when possible to increase return on equity.

- Diversify real estate portfolio (seasonal/long-term; different islands).

- Optimize off-peak periods through marketing strategy adapted to international tourists.

- Firmly negotiate all ancillary fees during acquisition.

Useful Formulas:

Tools like specialized calculators also allow automating these calculations according to your specific data.

Good to Know:

Return on investment (ROI) in Vanuatu real estate is a key indicator to evaluate project profitability, taking into account purchase price, taxes, notary and management fees. To calculate ROI, first estimate potential rental income and property appreciation; recent studies show yields oscillating between 6% and 7% thanks to growing tourist demand. Consider market variations, impact of local policies, and potential real estate appreciation these factors can generate. A concrete example of a property in Port Vila shows that capitalizing on leverage and diversifying one’s portfolio can significantly boost ROI. Use the formula ROI = (Net Annual Revenue / Total Investment) × 100 for your calculations, and explore online tools for quick and precise estimates.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.