Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

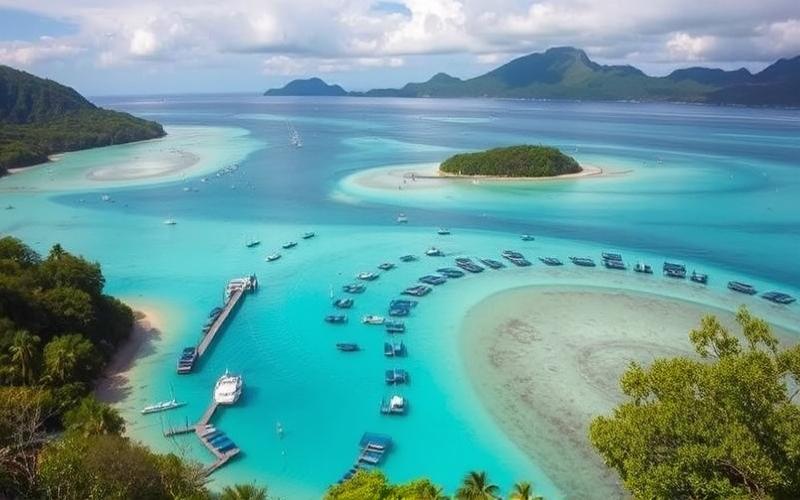

Located in the heart of the South Pacific, Vanuatu has established itself as a prime destination for real estate investors seeking tax optimization. This archipelago of 83 islands offers much more than its white sand beaches and crystal-clear waters: it provides a particularly advantageous tax framework that is attracting more and more international investors. Let’s explore together why Vanuatu has become a true real estate paradise and how you can benefit from it.

An Ultra-Competitive Local Tax System

Vanuatu stands out for its extremely advantageous local taxation for real estate investors. The complete absence of income tax, capital gains tax, and corporate tax makes it a particularly attractive destination. This zero-tax policy has been in effect since the country’s independence in 1980 and is one of the pillars of its economy.

For real estate investors, this means that rental income generated by their properties in Vanuatu is not subject to any direct taxation. Similarly, the sale of a property does not incur any tax on the capital gains realized. This absence of taxation allows investors to maximize their returns and rapidly increase their wealth.

It’s important to note that this tax policy applies equally to residents and non-residents, making it particularly interesting for foreign investors. Whether you choose to invest remotely or settle locally, you will benefit from the same tax advantages.

Good to Know:

Vanuatu practices a 0% tax policy on income, capital gains, and corporate profits, offering an exceptional tax framework for real estate investors.

Advantageous International Taxation

Beyond its attractive local taxation, Vanuatu also stands out for its advantageous position in terms of international taxation. The country has not signed any double taxation treaties, which may seem surprising at first glance. However, this absence of international tax agreements is explained by Vanuatu’s zero-tax policy: there is simply no double taxation to avoid!

This situation presents several advantages for international real estate investors:

- Administrative simplicity: the absence of complex tax agreements greatly simplifies the tax management of investments in Vanuatu.

- Enhanced confidentiality: Vanuatu does not automatically exchange tax information with other countries, ensuring a high level of privacy for investors.

- Tax flexibility: investors can structure their investments optimally without having to consider constraints related to tax treaties.

However, it’s important to note that investors must remain vigilant about their tax obligations in their country of residence. Although Vanuatu does not tax real estate income, some countries may require their residents to declare and pay taxes on their worldwide income, including that generated in Vanuatu.

Good to Know:

The absence of international tax treaties in Vanuatu offers great flexibility to investors while ensuring a high level of confidentiality. However, it is crucial to fully understand your tax obligations in your country of residence.

Minimal Property and Occupancy Taxes

Unlike many countries where property and occupancy taxes can represent a significant burden for owners, Vanuatu stands out for extremely moderate levies in this area. This light tax policy on real estate ownership enhances the country’s attractiveness for investors.

The property tax in Vanuatu is calculated based on the rental value of the property, with rates that vary depending on the location and use of the property. For residential properties, the rate is generally between 0.1% and 0.3% of the estimated annual rental value. This level of taxation is significantly lower than what can be observed in many other countries, where rates can reach several percent of the property’s value.

As for occupancy tax, it simply doesn’t exist in Vanuatu. Both owner-occupiers and tenants are therefore exempt from this charge, which can be substantial in other jurisdictions.

This lightened taxation on real estate ownership presents several advantages for investors:

- Reduced holding costs: low property taxes help maximize net rental yields.

- Attractiveness for tenants: the absence of occupancy tax makes rentals more affordable, which can facilitate property leasing.

- Wealth appreciation: low tax pressure helps support real estate prices in the long term.

Good to Know:

Property taxes in Vanuatu are among the lowest in the world, ranging between 0.1% and 0.3% of the annual rental value for residential properties. The absence of occupancy tax further enhances the country’s tax attractiveness for real estate investors.

Vanuatu vs. The Rest of the World: An Enlightening Comparison

To better understand Vanuatu’s tax appeal for real estate investors, it’s interesting to compare its system with other popular destinations. This comparison highlights the unique advantages offered by Vanuatu.

Vanuatu vs. France

France is known for its heavy real estate taxation. Rental income there is subject to income tax (marginal rate up to 45%) and social security contributions (17.2%). Real estate capital gains are taxed at 36.2% (19% tax + 17.2% social contributions), with a progressive allowance for holding period. Additionally, property tax and occupancy tax can represent a significant burden.

In comparison, Vanuatu offers zero taxation on rental income and capital gains, along with minimal property taxes, allowing for significant tax optimization.

Vanuatu vs. United States

In the United States, real estate taxation varies by state but is generally more advantageous than in France. However, rental income is subject to federal income tax (progressive rate up to 37%) and often state tax. Real estate capital gains are taxed up to 20% at the federal level, plus any state taxes.

Vanuatu stands out here again with its complete absence of taxation on income and capital gains, offering a considerable tax advantage.

Vanuatu vs. Portugal

Portugal has gained popularity in recent years thanks to its Non-Habitual Resident (NHR) regime, which offers tax benefits to new residents. However, even with this regime, rental income is taxed at 28% (or at the progressive rate) and real estate capital gains at 28%.

Vanuatu, with its zero taxation, therefore surpasses even the most advantageous tax regimes in Europe in terms of real estate tax optimization.

This comparison highlights Vanuatu’s exceptional tax attractiveness for real estate investors. No other major destination offers such a level of tax exemption across all aspects of real estate investment: rental income, capital gains, and low property taxes.

Good to Know:

Vanuatu’s tax regime for real estate is unparalleled worldwide, offering complete exemption from taxes on rental income and capital gains, whereas even destinations known for being advantageous like Portugal or certain U.S. states tax this income.

Optimization Strategies for Savvy Investors

With these unique tax advantages, Vanuatu offers savvy real estate investors numerous optimization opportunities. Here are some strategies to consider to make the most of this exceptional tax framework:

1. Real Estate Portfolio Diversification

Vanuatu’s zero taxation allows investors to diversify their real estate portfolio without fearing an increase in their tax burden. You can thus invest in different types of properties (residential, commercial, land) to spread risks and maximize return opportunities.

2. Short-Term Rental Strategy

The absence of taxation on rental income makes short-term rental strategy particularly attractive, especially for tourism. The potentially high yields from this type of rental are not eroded by taxation, unlike many other tourist destinations.

3. Real Estate Development

Real estate developers can benefit from a particularly favorable tax environment in Vanuatu. The absence of corporate tax and capital gains tax allows for maximizing profits on development projects, whether new constructions or renovations.

4. International Investment Structuring

For international investors, Vanuatu can serve as a base for structuring real estate investments in other Pacific region countries. Creating a holding company in Vanuatu can offer significant tax advantages for managing an international real estate portfolio.

5. Tax-Advantaged Retirement Strategy

For investors considering retirement abroad, Vanuatu offers the possibility to generate untaxed rental income while enjoying a tropical lifestyle. This strategy can prove particularly interesting for optimizing retirement income.

It’s important to note that implementing these strategies requires careful planning and a thorough understanding not only of Vanuatu’s taxation but also of tax obligations in your country of residence. Consultation with international tax and real estate investment experts is highly recommended to optimize your investment strategy in Vanuatu.

Good to Know:

Vanuatu’s unique tax framework paves the way for innovative real estate investment strategies, ranging from portfolio diversification to international investment structuring. A well-planned approach can maximize returns while minimizing overall tax burden.

Conclusion: Vanuatu, A Tax Haven for Real Estate Not to Be Overlooked

Vanuatu stands out as a premier destination for real estate investors seeking maximum tax optimization. Its exceptional tax regime, combining complete absence of taxation on rental income and capital gains with minimal property taxes, offers a unique framework for developing and growing real estate wealth.

Vanuatu’s tax advantages far exceed those offered by other destinations known for their advantageous taxation. Whether for diversifying an international portfolio, generating untaxed rental income, or developing ambitious real estate projects, Vanuatu offers unparalleled opportunities.

However, it’s crucial to remember that real estate investment in Vanuatu, like any international investment, requires a thoughtful and well-informed approach. Investors must not only understand the local tax advantages but also consider the tax implications in their country of residence, as well as the practical aspects of managing a property remotely.

Vanuatu represents a rare opportunity in today’s global tax landscape. For investors ready to explore new horizons and leverage an exceptional tax environment, this Pacific archipelago certainly deserves a prominent place in any international real estate investment strategy.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.