Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

Vanuatu: A Strategic Destination for Industrial Investment

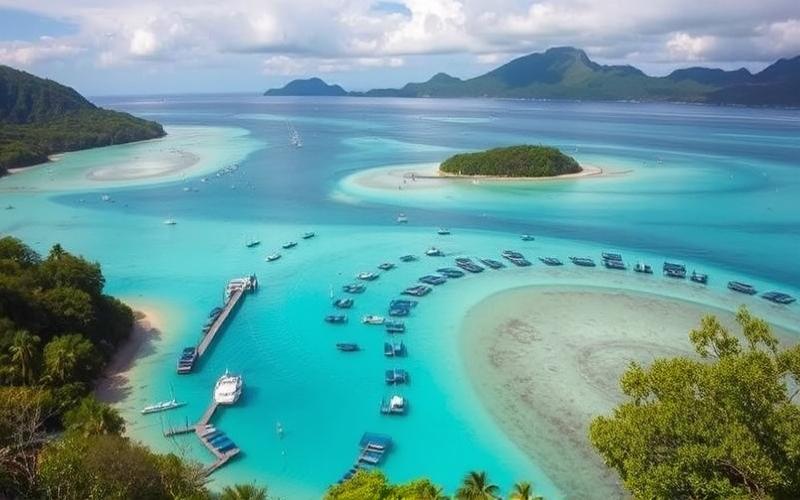

Vanuatu, often known for its paradise-like landscapes and relaxed atmosphere, is transforming into a strategic destination for industrial investment, thanks to its dynamic and booming free trade zones.

By offering attractive tax incentives and a favorable regulatory framework, these zones are becoming a hub for businesses seeking to establish themselves in the archipelago.

With privileged access to Pacific regional markets and growing international openness, Vanuatu is positioning itself as an essential crossroads for industries looking to benefit from both a competitive and innovative environment.

The Potential of Logistics Warehouses in Vanuatu

Vanuatu, an archipelago of 83 islands located in the heart of the South Pacific, benefits from a strategic position on major shipping routes connecting Australia, New Zealand, and other Pacific island nations. This geographical location fosters the development of logistics activities with regional and international scope.

Geographical Features Favorable to Logistics Activities:

- Direct proximity to major shipping lanes between Asia-Pacific and Oceania.

- Main ports (Port Vila on Efate, Luganville on Espiritu Santo, Lenakel on Tanna) accessible to international vessels.

- Network of 10 public ports/jetties distributed across the archipelago and three international airports facilitating multimodal connectivity.

| Geographical Advantage | Logistics Impact |

|---|---|

| Position in the center of the Pacific | Direct access to Asia-Oceania trade flows |

| Island dispersion | Development of a dense port network |

| Deep-water ports | Capacity to host international cargo ships |

Government Initiatives to Strengthen the Logistics Sector:

- Implementation of an integrated transport infrastructure plan aimed at modernizing roads, ports, and airport facilities.

- Deployment of maritime beacons to secure inter-island navigation.

- Partnerships with major players like Swire Shipping or Neptune Pacific Direct Line to integrate Vanuatu into regional circuits towards Australia/New Zealand/Fiji/Samoa.

- Creation or extension of free trade zones to attract foreign investment in the construction/management of modern warehouses.

Concrete Advantages for Companies Using Vanuatu as a Logistics Platform:

Competitive operational costs thanks to advantageous taxation (partial or total customs exemptions depending on the free trade zone).

Simplification of customs procedures via a single window and progressive digitalization of formalities.

Facilitated access to a regional market while optimizing transit times thanks to enhanced maritime connectivity.

Summary List of Benefits:

- Reduced taxation

- Accelerated procedures

- Ideal platform between Asia/Australia/New Caledonia

Growth Prospects for Logistics Warehouses in Free Trade Zones:

The rise of e-commerce is strongly stimulating local/regional demand for modern storage/distribution solutions. International trends—notably the increased need for decentralized stocks near consumer markets—make choosing Vanuatu as an intermediate hub attractive:

- Expected growth in regional e-commerce requiring more spaces dedicated to fast/secure storage before redistribution to Fiji, New Caledonia, or Australia.

- Increased international openness thanks to regional trade agreements boosting intra-Pacific exchanges.

| Key Factor | Expected Effect |

|---|---|

| E-commerce boom | Strong increase in warehouse demand |

| Dynamic free trade zones | Increased investor attractiveness |

| Infrastructure modernization | Increased reliability & speed |

Vanuatu’s central positioning combined with its ambitious public initiatives is giving rise to a very promising platform for all companies seeking an efficient relay point within the Pacific corridor.

Good to Know:

Vanuatu, thanks to its strategic position near Pacific shipping routes, is ideally located to become a logistics hub in the region. The Vanuatu government is implementing various initiatives to improve its logistics infrastructure, such as the development of ports and transport networks, which is attracting more and more investment in the sector. Companies choosing Vanuatu benefit from advantages such as reduced operational costs and competitive customs facilities, making it an attractive logistics platform. Furthermore, the demand for logistics warehouses in free trade zones is increasing with the rise of e-commerce and international trade trends, promising continuous sector growth in the coming years.

Tax Benefits of Free Trade Zones for Investors

Vanuatu stands out for an extremely advantageous tax policy for investors, particularly in its free trade zones. Several mechanisms make this territory particularly attractive for industrial real estate investments.

Main Tax Benefits of Vanuatu’s Free Trade Zones:

- Total corporate tax exemption: No tax on profits made by companies, whether from local or international activity.

- Absence of income tax and real estate capital gains tax: Investors and owners are not subject to tax upon resale or rental income from their properties.

- No inheritance taxes or gift duties.

- Very low property taxes: Generally between 0.1% and 0.3% of the annual rental value for residential real estate; there is no occupancy tax.

- Reduced or non-existent customs duties depending on the type of import related to an industrial project located in a free trade zone.

Comparative Summary with Other Tax Jurisdictions

| Criterion | Vanuatu | Cayman Islands | Uruguay (free zones) | Dubai (free zones) |

|---|---|---|---|---|

| Corporate Tax | 0% | 0% | 0% | Up to 9%, often reduced |

| Property Tax | Very low | Variable | N/A | Low |

| Real Estate Capital Gains | Not taxed | Not taxed | Often not taxed | Depending on structure |

| Occupancy Tax | None | Variable | N/A | None |

| Customs Duties (free zones) | Reduced/nonexistent | Nonexistent | Nonexistent | Nonexistent |

Vanuatu’s particularities lie in the unique combination of a total exemption from main direct and indirect taxes as well as streamlined administrative formalities. Unlike some offshore centers where only certain types of income are exempt or where significant indirect levies remain, the Vanuatu tax framework is generally neutral for both the company and its individual shareholder.

Specific Incentives for Foreign Companies

- Simplified access to offshore status with the possibility to open a company within days.

- Complete freedom to repatriate capital and dividends without local tax withholding.

- Possibility for foreigners to fully own their company without a mandatory local partner.

Concrete Examples of Successful Investments

Several international groups have established their regional logistics or commercial headquarters in Vanuatu in order to:

- Benefit from the neutral tax regime,

- Optimize their operational costs thanks to the near-total absence of tax charges,

- Facilitate their commercial expansion throughout the Pacific region thanks to its strategic geographical position.

Some companies specialized in port storage, light industrial processing (notably agri-food), or in the digital tertiary sector have seen their profitability significantly improved following the choice of Vanuatu as an operational base. Administrative simplicity has also enabled rapid development while maintaining a high level of international regulatory compliance.

Positive Economic Impact

For investors:

- Maximization of net return thanks to tax savings achieved

- Increased valuation of held real estate assets

For the local economy:

- Direct and indirect creation of skilled jobs

- Stimulation of local industrial sectors via subcontracting

- Accelerated development of port/logistics infrastructure

The combination of an almost total absence of direct/indirect taxation, reduced customs duties, and administrative ease makes Vanuatu’s free trade zones today a privileged ecosystem for industrial real estate investment compared to other comparable global locations.

In summary: these benefits make Vanuatu a flagship destination both for optimizing returns and diversifying industrial assets internationally.

Good to Know:

Vanuatu’s free trade zones offer notable tax benefits to investors, such as the complete exemption from corporate tax and reduced or non-existent customs duties, which differentiate this territory from other more restrictive tax jurisdictions. Incentives for foreign companies are particularly attractive, contributing to a significant increase in industrial real estate investments. A concrete example is the successful establishment of several logistics warehouses by Asian companies, leveraging these tax exemptions to optimize their operational costs. These zones, by favoring the establishment of foreign companies, stimulate the local economy through job creation and increased commercial activity. Vanuatu’s tax conditions, compared to other economic hubs, prove particularly advantageous, making this region a competitive option for industrial real estate investment projects.

Returns and Prospects of Industrial Real Estate in Vanuatu

The industrial real estate sector in Vanuatu currently shows attractive returns, although precise statistics on rental and occupancy rates remain limited due to the modest market size. Demand is mainly supported by the country’s stable economic growth, estimated at around 3.5% per year for the 2025-2030 period. This dynamic favors the development of modern logistics and industrial zones, particularly around key infrastructures like Port-Vila International Airport.

Economic Factors Influencing Returns

- Continuous growth in tourism and agriculture.

- Development of major infrastructure (ongoing airport projects).

- Progressive increase in foreign direct investment (FDI) flows, primarily directed towards agri-food, wood processing, and construction sectors.

Tax Incentives and Government Policies

The Vanuatu tax framework remains extremely advantageous for investors:

- No income tax or real estate capital gains tax for non-residents.

- Creation of free trade zones offering customs exemptions and specific tax incentives for industrial or logistics establishment.

- Simplification of administrative procedures via VIPA (Vanuatu Investment Promotion Authority) to attract foreign capital and technical expertise.

| Tax Incentive | Detail |

| Reduced corporate tax | Very low or zero rate depending on zone |

| VAT/duty exemption | Possible in certain free trade zones |

| Reduced customs duties | For imports related to industrial investment |

Concrete Examples of Recent or Ongoing Developments

- Rehabilitation of main airports with international support: this project facilitates national and regional industrial logistics.

- Recent launch of new multifunctional industrial spaces near major urban centers.

Future Prospects & Regional/Global Trends

Global trends favoring the partial relocation of logistics chains towards emerging markets benefit Vanuatu:

- Expected increase in regional trade thanks to better maritime/air connectivity.

- Growing attractiveness linked to ESG criteria: active promotion of eco-friendly constructions adapted to the island climate.

The government actively continues its pro-investment policy to strengthen its position against competing South Pacific markets while betting on regulatory and fiscal stability.

Potential Challenges for Investors

- Relative lack of secondary market liquidity

- Natural risks (tropical cyclones)

- Still incomplete infrastructure outside main urban areas

- Potential complexity related to customary land rights

Prospects are generally positive thanks to a favorable tax environment, a clear strategy focused on international attraction, and rapid modernization. However, it is advisable to integrate rigorous management of risks inherent to the local context.

Good to Know:

Industrial real estate in Vanuatu offers promising returns, with rising rental and occupancy rates, notably thanks to free trade zones that attract investors with attractive tax incentives. These zones benefit from a favorable regulatory framework and are strategically located to boost logistics and manufacturing activities. Government policies aim to reinforce these advantages, making the sector more competitive against regional competitors. Recent developments, such as port extensions and road infrastructure improvements, illustrate a positive dynamic. However, investors must be prepared to face potential challenges related to limited availability of industrial land and climatic hazards, while monitoring global trends like automation that could influence the future of the market.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.