Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

Vanuatu: A Real Estate Paradise with Specific Insurance Requirements

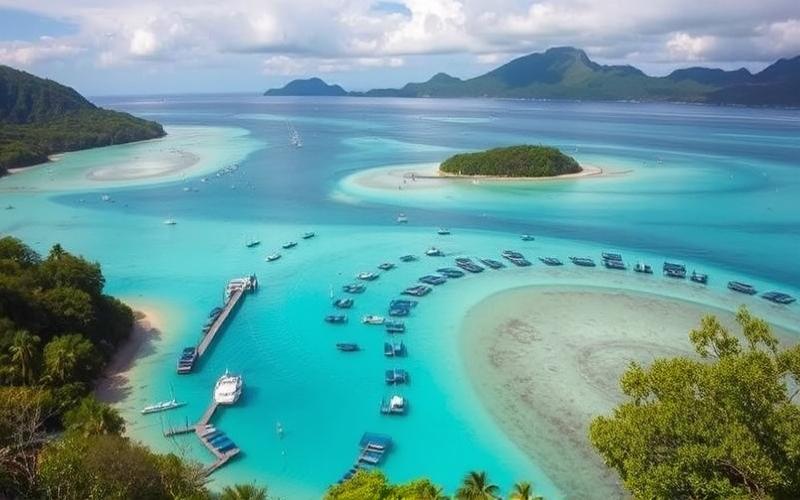

Vanuatu, with its paradise-like landscapes and tropical climate, is attracting more and more international investors and residents eager to acquire real estate in this idyllic archipelago.

However, property acquisition in this island nation isn’t limited to just aesthetic or economic considerations; it also involves understanding the legal requirements regarding mandatory insurance coverage.

A Comprehensive Comparison of Real Estate Insurance in Vanuatu

In this article, we provide a detailed comparison of the various insurance policies required by Vanuatu legislation for real estate investments.

From liability insurance to protection against natural disasters, discover the specifics and requirements that will allow you to navigate confidently through the complex world of Vanuatu’s insurance obligations.

Good to Know:

Mandatory insurance requirements may vary depending on the type of property (residential, commercial, vacant land) and geographic location within the archipelago.

Mandatory Home Insurance in Vanuatu: A Comparison

The legal context for home insurance in Vanuatu is distinguished by the absence of strict requirements for all property owners. There is no law systematically mandating subscription to standard home insurance; however, certain specific situations, such as condominium ownership or bank financing, may make this coverage mandatory. Furthermore, regulations allow for the use of local or international (offshore) insurance, subject to acceptance by the Reserve Bank of Vanuatu if no equivalent local product is available or if conditions are deemed unreasonable.

The main regulations governing this sector fall under general texts on contractual obligations and property protection, without any specific law making comprehensive home insurance mandatory in all cases.

Comparison of Available Options:

| Option | Coverage Provided | Estimated Cost | Associated Services |

|---|---|---|---|

| Local comprehensive insurance | Fire, theft, water damage, natural disasters | Varies by area and coverage; often higher for cyclone/seismic risk | Claims assistance |

| Non-occupant owner insurance | Non-occupant owner liability; third-party damages | Approximately 50% cheaper than standard insurance | Legal protection |

| International (offshore) insurance | Depending on chosen plan: similar to local offers or more extensive | Can be competitive if local premium is >20% higher | Management in English/French |

Main Criteria for Choosing Home Insurance in Vanuatu:

- Explicit coverage of major natural risks: frequent tropical cyclones and earthquakes.

- Compliance with anti-seismic/anti-cyclonic standards in the contract.

- Deductible level appropriate to the owner’s financial capacity.

- Speed and reliability of customer service during claims.

- Possibility to include unpaid rent guarantee for rental investors.

- Potential bank acceptance in case of real estate credit.

Local Specificities to Consider:

- The tropical climate creates significant exposure to extreme weather risks requiring specific “natural disaster” extension in the contract.

- The relative scarcity of the local market may limit offerings and lead some owners toward offshore insurance after regulatory approval.

Recent Statistics:

Home insurance adoption remains moderate in Vanuatu. Most expatriates systematically opt for comprehensive coverage while among locals outside urban condominiums or mandatory real estate loans, the rate is much lower—less than one in two households currently has comprehensive insurance. The high-end rental segment shows a higher rate due to contractual requirements set by some institutional landlords.

Main Industry Players:

- Van Care: Major player also offering some health/home solutions specifically adapted to the local context

- Some regional subsidiaries of Australian/New Zealand companies present mainly through local banking networks

- Brokers specialized in international offshore offerings

Examples of Key Offers:

- “Cyclone & Earthquake Cover” policy dedicated to exposed villas

- All-risk formula with included legal assistance

Typical Advantages:

- Coverage against weather events rare elsewhere but frequent here

- Ability to finely adjust coverage level

Common Disadvantages:

- Insured amounts sometimes capped relative to property’s actual value

- Sometimes lengthy administrative delays during post-claim processing

- High premiums when all options are included

Practical Tips for Choosing Home Insurance in Vanuatu:

Carefully verify that your policy explicitly covers cyclone and seismic risks.

Compare multiple quotes including deductibles/potential discounts based on installed passive security (cyclone shutters…).

Prioritize a locally recognized insurer with a network accessible quickly after a major weather event.

For foreign investors: work with a specialized broker who thoroughly understands Vanuatu regulatory requirements to secure your rights while optimizing your financial protection.

Good to Know:

In Vanuatu, home insurance is governed by laws that require property owners to protect themselves against frequent natural risks, such as cyclones and earthquakes. Offerings vary greatly between companies, with marked differences in terms of coverage, cost, and ancillary services like emergency assistance. Property owners should particularly consider policy adaptability to local weather conditions and actual risk levels. Statistics indicate a relatively high subscription rate, with increasing adoption of policies including specific protections against extreme weather events. Among dominant industry players, companies like National Bank of Vanuatu and Vanuatu Insurance represent a significant market share, each offering flagship products adapted to local needs. Although rates can be high, typical policies often include post-disaster renovation services as a notable advantage. Property owners should therefore carefully compare available policies, considering deductibles, exclusions, and customer service, to choose the insurance best suited to their specific needs.

Property Owner Liability: Understanding Legal Requirements

In Vanuatu, legislation regarding real estate owner liability is based primarily on respect for customary law, regulation of long-term leases, and several national laws that define property owners’ rights and obligations toward third parties. The Constitution guarantees the Supreme Court’s jurisdiction to adjudicate any civil or criminal case, including those related to real estate liability.

Specific Legal Obligations for Property Owners

- Regularly maintain the property to prevent any defects that could cause harm to others (for example, falling building elements or water infiltration).

- Respect pre-existing rights before new laws take effect.

- Bring the property into compliance with local safety and hygiene standards.

- Take all necessary measures to prevent any risk to third parties present in or around the property.

Types of Risks Covered by Property Owner Liability Insurance

| Risk Covered | Description/Example |

|---|---|

| Liability | Damages caused to a third party due to construction defects or maintenance failure (e.g., wall collapse). |

| Legal defense | Legal coverage if someone sues the owner in court. |

| Fire/storm | Damages related to fires, storms, or extreme weather events. |

| Water damage | Leak/infiltration causing damages to one’s own or others’ property. |

| Theft/vandalism | Compensation in case of theft or vandalism to the property. |

| Glass breakage | Repair/replacement after accidental window/glass breakage. |

Concrete Examples Where This Coverage Is Essential

- A visitor gets injured due to a fall caused by an unrepaired defective step.

- A leak from the residence causes significant damage to a neighbor’s property.

- A poorly secured sign falls into the street and injures a passerby.

Comparison with Other Countries/Regions

In Vanuatu, unlike some European countries where property owner liability insurance is strictly mandatory (like in France via the Alur law), there isn’t always a universal formal obligation but rather strong incentive due to legal risks incurred without adequate protection. Specific obligations may also vary depending on whether the land is held under customary regime or by emphyteutic lease.

Recent/Planned Changes in Local Legislation

Law No. 21/2019 consolidated some existing rights without affecting previously acquired ones; however, no major reform has recently established new strict obligations regarding private property liability insurance at the national level. Evolutions remain possible under international pressure related to growing tourism and real estate development.

Key Takeaway: Vigilance regarding regular property maintenance along with appropriate insurance remains essential to avoid costly disputes and potential penalties in Vanuatu as elsewhere in the island Francophone world.

Good to Know:

In Vanuatu, real estate owner liability is governed by laws that require covering accidental damages caused to third parties, such as neighbors and visitors, due to property ownership. Local insurers generally offer coverages that include incidents like falling objects or injuries on the owner’s property. Compared to other countries, this legal requirement may be less strict but remains crucial to avoid costly lawsuits. For example, a cyclone that damages neighboring properties could lead to claims against an uninsured owner. Recent legislative debates mention potential expansion of insurance obligations to better protect third parties, which could soon influence the current legal framework in Vanuatu.

Rental Risk Coverage: What Protections Are Necessary?

In Vanuatu, protection against rental risks relies primarily on insurance covering real and personal property, liability, and certain major natural risks.

Types of Rental Insurance Coverage Available in Vanuatu

- Comprehensive home insurance (for owners and tenants): Typically covers fires, water damage, theft, vandalism, and natural disasters.

- Liability insurance: Protects against damages caused to others in the context of property occupancy or ownership.

- Expatriate health insurance: Although not specific to real estate, it remains important for covering serious domestic accidents for foreign or local residents.

- Specialized coverages (cyclones/earthquakes): Some local policies offer extensions for cyclones or earthquakes given the geographic context.

Insurance Deemed Essential

| Insurance Type | For the Owner | For the Tenant |

| Comprehensive home insurance | Yes | Yes |

| Liability insurance | Yes | Yes |

| Natural disaster protection | Strongly recommended | Recommended |

Legal Obligations in Vanuatu

No strict obligation currently requires owners or tenants to purchase home insurance. However:

- Lease contracts may require insurance subscription by the tenant.

- Real estate lending institutions often impose minimum coverage when purchasing with credit financing.

International Comparison

Unlike some countries like France where home insurance is mandatory for all tenants and recommended for landlords, in Vanuatu the obligation stems more from contractual clauses than national regulatory requirements. In Madagascar for example, it becomes mandatory only if required by a landlord or lending institution; this logic also frequently applies in Vanuatu.

Specific Risks Encountered in Vanuatu

The territory is exposed to several major natural hazards that directly impact both owners and occupants:

- Frequent tropical cyclones capable of causing massive destruction

- Occasional earthquakes

- Sudden flooding during rainy season

- Theft during forced evacuations

Appropriate insurance then enables:

- Quick reimbursement for recognized claims (example: compensation within 15 days with some regional insurers)

- Immediate coverage of urgent repairs after cyclone or earthquake

- Legal protection in case of dispute with a third party following accidental damage caused by the rented property

Concrete Examples/Illustrative Cases

An owner who insured his villa against cyclones was able to quickly finance reconstruction after Cyclone Pam thanks to his comprehensive policy including a “natural disaster” clause. Another case concerns an expatriate couple whose apartment was flooded during their absence; their insurance covered not only their damaged personal effects but also temporary relocation during repairs.

Key Takeaway

Structuring any real estate investment—whether as landlord or occupant—with appropriate insurance not only protects assets but also secures income against the many climatic and structural uncertainties specific to the Vanuatu context.

Good to Know:

In Vanuatu, rental risk coverage is crucial due to natural risks like cyclones and earthquakes. Property owners and tenants should turn to comprehensive home insurance that includes these events to protect material assets and civil liabilities. Unlike some countries where home insurance is sometimes optional, in Vanuatu it is strongly recommended to guarantee coverage against natural disasters. Standard contracts can be enhanced with additional options for risks specific to exposed geographic areas. For example, during Cyclone Pam, many property owners avoided significant financial losses thanks to adequate coverage. Compared to other Pacific regions, legal requirements in Vanuatu are not as strict, but prudence dictates comprehensive coverage to mitigate potential financial impacts.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.