Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

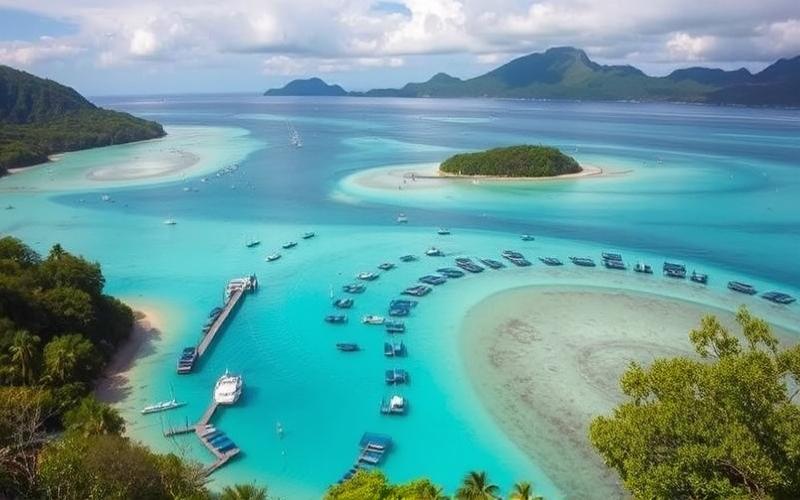

Located in the South Pacific, Vanuatu’s Archipelago is Attracting More and More Investors

Attracted by its paradise landscapes and rapidly expanding real estate opportunities, many investors are turning to Vanuatu. However, acquiring real estate in this country can prove complex for foreigners due to government restrictions and sometimes high costs.

Crowdfunding: An Innovative Solution for Investing in Vanuatu

This is where crowdfunding emerges as an innovative solution, allowing groups of investors to pool their resources to acquire promising properties.

Good to Know:

This method of participatory financing not only democratizes access to real estate in Vanuatu but also stimulates the local market by attracting an audience eager to diversify their portfolios.

A Modern Approach for Investors

Let’s dive together into the details of this modern approach that opens exciting new perspectives for potential investors.

Introduction to Real Estate Crowdfunding in Vanuatu

Real estate crowdfunding, or participatory real estate financing, refers to a method of raising funds via the internet that allows a large number of individual investors to collectively finance real estate projects proposed by developers. This mechanism relies on the use of specialized online platforms that connect project leaders (developers) with investors looking to place their money in real estate with a moderate entry ticket.

How Real Estate Crowdfunding Works:

- A developer presents their project (construction, rehabilitation, etc.) on a dedicated platform.

- Individual investors choose to participate starting from a generally accessible amount (often as low as 1,000 euros).

- The funds thus collected complement the developer’s own resources and/or their bank financing.

- Upon project completion, the invested capital is repaid to contributors with interest or potential capital gains depending on the chosen formula.

Comparison Table: Real Estate Crowdfunding vs. Traditional Investment

| Criterion | Real Estate Crowdfunding | Traditional Investment |

|---|---|---|

| Entry Ticket | Low | High |

| Management | None for the investor | Heavy (rental management) |

| Diversification | Easy | Difficult |

| Duration | Short/Medium | Long term |

Specific Advantages of Real Estate Crowdfunding:

- Increased Accessibility: possibility for individuals to invest in real estate without significant capital.

- Diversification: facilitated allocation across several different projects to limit overall risk.

- Simplicity and No Management: no need for individual investors to directly manage the property.

- Potentially High Returns: often higher than some traditional investments.

In the Context of Vanuatu’s Real Estate Market, Crowdfunding Presents Several Major Advantages:

List of Opportunities Offered:

- Opening to an international audience thanks to digital platforms

- Accelerated financing for local developers facing low banking penetration or lack of access to traditional credit

- Revitalization of the sector through rapid and flexible mobilization of necessary capital

- Possibility for foreign investors to indirectly participate in local development while diversifying their portfolios

Legally and Regulatorily, Vanuatu Has Had a Framework Conducive to Financial Innovations for Several Years. Several Legal Mechanisms Encourage the Creation or Hosting of International Digital Platforms; However, Some Local Specificities Remain:

Key Points Regarding Vanuatu:

- Attractive tax environment favoring the inflow of foreign capital

- Evolving regulation aimed particularly at financial transparency and protection against money laundering

- Growing but still limited presence of dedicated participatory financing platforms located in the South Pacific

The prospects are therefore favorable but require vigilance regarding risks related both to the relative youth of the sector and its still improvable regulation. Future success will depend as much on technological development as on continuous legal adaptation ensuring security and trust among all involved stakeholders.

Good to Know:

Real estate crowdfunding in Vanuatu is an innovative method that allows individuals to collectively invest in real estate projects, making the market accessible to investors who would not have the necessary resources to finance a project alone. This collaborative approach facilitates the diversification of investment portfolios and allows investors to benefit from potential returns without having to directly manage properties. In Vanuatu, the real estate market is rapidly expanding, thus offering unique opportunities for local developers and foreign investors, thanks to the gradual adoption of crowdfunding. Legal frameworks in Vanuatu encourage this type of financing through favorable laws and the emergence of dedicated platforms that simplify the investment process while ensuring compliance with current regulations. For example, platforms like Property Direct Vanuatu play a crucial role in connecting foreign investors to local projects, benefiting from the advantages of a welcoming economic environment and an attractive tax jurisdiction.

Advantages of Participatory Investment for Real Estate Projects in Vanuatu

Real estate crowdfunding allows small investors to participate in real estate projects by pooling financial resources, making access to this type of investment much more accessible than before. Thanks to the possibility of investing small amounts in several different projects, each investor can diversify their portfolio and thus limit the risk associated with a single project.

Comparison Table: Access & Diversification

| Criterion | Direct Investment | Real Estate Crowdfunding |

|---|---|---|

| Minimum Amount | High | Low |

| Possible Diversification | Limited | Easy |

| Risk | Concentrated | Pooled |

The very structure of participatory financing accelerates real estate development, particularly in dynamic markets like Vanuatu’s. Project leaders can quickly gather the necessary funds to launch or complete real estate operations, thereby reducing traditional delays associated with conventional bank financing.

Moreover, crowdfunding simplifies access to real estate investments for both nationals and international investors. This ease of entry promotes a constant flow of capital into the local sector and directly contributes to the country’s economic dynamism.

List of Advantages for the Community and Local Economy:

- Increased involvement thanks to transparency: regular monitoring of progress and access to key information

- Direct participation in local or sustainable projects according to one’s convictions

- Potential job creation during development and subsequent real estate operation

- Active support for harmonious urban development respectful of the environment

Crowdfunding also encourages enhanced community involvement: each investor can choose to specifically support a project that aligns with their values (sustainable development, urban revitalization). This participatory dimension generates not only personal satisfaction but also a concrete positive impact on the local social fabric.

Participatory investment thus offers a flexible and inclusive solution that accelerates real estate growth while maximizing local economic benefits and job creation.

Good to Know:

Participatory investment in real estate in Vanuatu allows small investors to enter real estate projects while reducing risks through portfolio diversification. This financing mode accelerates real estate development in a growing market by quickly bringing necessary funds, which is crucial for a region like Vanuatu. Moreover, crowdfunding offers simplified access to investors, both national and international, ensuring a constant flow of capital. This approach promotes increased community involvement, supported by project transparency and the possibility of engaging in initiatives focused on local development and environmental sustainability, thus stimulating the local economy and creating new job opportunities.

How to Choose Reliable Platforms for Investing in Vanuatu

The reputation and experience of real estate crowdfunding platforms are major criteria for securing your investment, especially in an international context like Vanuatu. An experienced platform inspires confidence through the robustness of its selection processes, financial stability, and quality of support.

Essential Criteria for Choosing a Platform:

- Reputation and track record demonstrated by investor reviews.

- Local or international regulation (e.g., AMF approval), a guarantee of seriousness and legal framework.

- Transparency on listed projects: access to financial documents, risk analyses, developer history.

- Detailed customer reviews allowing evaluation of overall satisfaction and management of unforeseen events.

- Presence of responsive customer support as well as access to personalized advice or expert guidance throughout the process.

Advantages of a Platform with Effective Support:

- Better understanding of local specificities (Vanuatu regulations).

- Assistance with legal or tax structuring adapted to the target country.

- Dedicated contact in case of problems or questions about financial flows.

Platforms Recognized for Their Reliability (International Platforms That May Operate in Vanuatu):

| Platform | Strengths | Regulation |

|---|---|---|

| Homunity | Transparency, intuitive investor space, Tikehau Capital partner | AMF |

| ClubFunding | Rigorous selection, competitive returns | AMF |

| La Première Brique | Accessibility from €1, community approach | ACPR/AMF |

| Anaxago | Wide sectoral choice including international | AMF |

Compare Fees and Investment Returns:

To compare effectively:

- List applied fees:

- Registration fees

- Annual management fees

- Commissions charged upon exit

- Analyze the average proposed return:

- Compare announced IRR versus historical performance

- Consider default rate

- Evaluate the average investment horizon proposed according to your profile

Simplified example:

| Platform | Fees (%) | Average Annual Return (%) |

|---|---|---|

| Homunity | 0–2 | 8–10 |

| ClubFunding | 0–3 | 7–9 |

Legal & Tax Aspects Specific to Vanuatu:

- Verify if the platform holds a local license authorizing financial intermediation in Vanuatu or collaborates with a licensed local partner.

- Ensure each project complies with Vanuatu land law (foreign access generally only possible via leasehold).

- Generated income may be subject to specific taxation depending on your tax residence; it is advisable to consult a tax expert familiar with the dual France/Vanuatu regime if you reside outside the country.

Key Takeaway: Choosing a reliable platform requires cross-analysis between reputation, effective regulation, documentary transparency, and user experience. Personalized support is an asset when facing the legal/tax subtleties inherent to each international real estate market such as Vanuatu’s.

Good to Know:

To choose reliable platforms for investing in real estate in Vanuatu via crowdfunding, it is crucial to evaluate their reputation and experience, particularly specialized platforms like EstateGuru and Crowdestate. Ensure they comply with local regulations and are recognized for their transparency regarding listed projects by consulting other investors’ reviews. Effective customer support and expert advice are major assets for guiding investment decisions. Verify that platforms respect legal aspects and tax considerations specific to Vanuatu. Carefully compare applied fees and potential investment returns, knowing that hidden costs can reduce net profits. These criteria will ensure a more secure and optimized approach to your real estate investment in this specific context.

Steps to Start Investing in Real Estate via Crowdfunding in Vanuatu

Understanding the local real estate market and regulations in Vanuatu

- Vanuatu’s real estate market is open to foreign investors, but with major specificities: foreigners cannot acquire full land ownership, only leasehold rights up to 75 years, renewable.

- The tax regime is attractive: no income tax, no capital gains tax on real estate, and no dividend tax. The only notable tax costs are 15% VAT on transactions and registration duties (2% for residents, 5% for non-residents).

- There are few international tax treaties; therefore, it is necessary to verify the impact in your country of residence.

- The involvement of a specialized local lawyer is strongly recommended to secure any transaction.

Research to Conduct on Crowdfunding Platforms

- Identify if international or local platforms offer access to real estate projects in Vanuatu (some global platforms sometimes include this emerging market).

- Check their reputation: consult customer reviews, history of funded projects, and success rates.

- Ensure they have the necessary authorizations or rely on a local partner compliant with current standards.

Selection Criteria for Potential Real Estate Projects

- Project location (tourist area? residential?)

- Remaining lease duration

- Expected profitability and associated risks

- Type of assets offered (hotel apartments, beach villas…)

- Developer experience/solvency

- Financial transparency and proposed reporting

- Guarantees offered in case of project failure or delay

| Criterion | Importance | Example/Note |

|---|---|---|

| Location | High | Tourist area = high rental potential |

| Remaining Lease Duration | Medium to High | Prefer >30 years remaining |

| Developer | Essential | Positive track record required |

| Announced Return | Evaluate cautiously | Beware of unrealistic promises |

Practical Steps for Investing via a Platform

- Select a reliable platform offering the Vanuatu market.

- Create an online account:

- Provide official identity,

- Banking/tax documents according to KYC/AML regulation,

- Accept general terms and conditions.

- Browse the list of available opportunities:

- Analyze technical and financial documents,

- Compare returns/risk profiles/rental projections.

- Invest the desired amount via bank transfer/card/cryptocurrency according to offered options.

- Track your investments via the user interface:

- Regular access to dashboard,

- Automatic periodic reports,

- Important notifications by email/app.

Diversification & Professional/Legal Advice

- Diversify across several projects/lessors/asset types to limit sectoral or geographic exposure;

- Systematically consult a specialized lawyer before any contractual commitment;

- If needed, use a tax advisor familiar with both local legislation and that of the investor’s country of residence.

⧫ Prudence always requires thorough due diligence before any international investment via crowdfunding ⧫

Good to Know:

To invest in real estate via crowdfunding in Vanuatu, start by understanding the local market and current regulations, which may differ from those in other countries. Conduct thorough research on available crowdfunding platforms, checking their reputation and user reviews to ensure the security of your investments. When evaluating potential real estate projects, consider location, project type, and expected return. To create an account on a platform, prepare necessary documents and complete required forms; this will allow you to make investments by following the platform’s specific instructions. Once invested, regularly track your investment performance and consider diversifying your investments to minimize risks. Do not hesitate to seek professional or legal advice to optimize your investment decisions and ensure their compliance with local laws.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.