Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

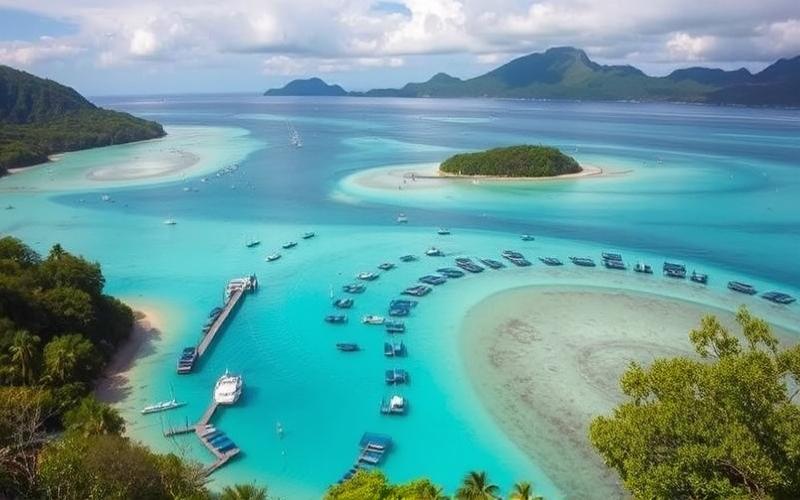

Vanuatu, a paradise archipelago in the South Pacific, is attracting an increasing number of foreign investors drawn by its idyllic setting and advantageous tax regime. However, before embarking on property acquisition in this small island nation, it is crucial to fully understand the specific legal and tax frameworks governing the local real estate market. This guide outlines the main laws and regulations you need to know to invest with peace of mind in Vanuatu.

Property Rights for Foreigners: Facilitated but Regulated Access

Unlike many countries that restrict property access for non-residents, Vanuatu has adopted a relatively open policy towards foreign investors. Since the land law reform in 2014, foreigners can acquire real estate in full ownership, under certain conditions.

- Urban land in full ownership

- Built real estate on urban land

- Apartments or units in residential complexes

However, the purchase of customary land, which represents about 80% of the territory, remains reserved for Vanuatu citizens. Foreigners can nonetheless obtain long-term leases (up to 75 years) on these lands, after negotiation with customary owners and government approval.

- Obtaining a foreign investment certificate from the Vanuatu Investment Promotion Authority (VIPA)

- Verification of the property title with the Land Registry

- Signing a sales contract before a local lawyer

- Registration of the property transfer with the Land Registry

It is highly recommended to engage a local lawyer specialized in real estate law to ensure the legality of the transaction and avoid any future disputes.

Good to Know:

Foreigners can buy real estate in Vanuatu, but access to customary land is limited to long-term leases. A foreign investment certificate is required for any acquisition.

The Real Estate Legal Framework: Between Modernity and Traditions

Vanuatu’s legal system is a unique blend of customary law, British common law, and French civil law, a legacy of its colonial past. This particularity is reflected in the laws governing real estate, which must reconcile modern practices with respect for local traditions.

- Land Reform Act of 1980: defines the fundamental principles of the land tenure system

- Land Leases Act: governs land leases

- Strata Titles Act: regulates condominium ownership

- Foreign Investment Act: regulates foreign investments

The Land Reform Act of 1980 established the principle that all land belongs to the customary owners of Vanuatu. This law was amended in 2014 to allow foreigners to acquire urban land in full ownership, while preserving the rights of local communities over customary lands.

The Strata Titles Act, introduced in 2000 and revised in 2019, modernized the legal framework for condominium ownership, thereby facilitating the development of residential and tourist complexes. This law defines the rights and obligations of co-owners, as well as the rules for managing common areas.

- Recognition of customary rights over land

- System of long-term leases for access to customary lands

- Obligation to consult customary chiefs for any large-scale project

- Possibility to create “joint ventures” with local owners

It is crucial for any foreign investor to fully understand these particularities and respect local customs to ensure the longevity of their investment.

Good to Know:

Vanuatu’s legal system blends modern law and traditional customs. The law recognizes the rights of customary owners while allowing real estate development through long-term leases and condominium ownership.

Real Estate Taxation: An Attractive Regime for Investors

One of Vanuatu’s main assets for foreign investors is its particularly advantageous tax regime. Indeed, the country levies no income tax, no corporate tax, and no capital gains tax. This attractive tax policy also applies to the real estate sector, with a few nuances to be aware of.

- Absence of annual property tax

- No tax on real estate capital gains

- Moderate registration fees upon acquisition

- Value Added Tax (VAT) of 15% on real estate transactions

Registration fees for acquiring a property amount to 2% of the property value for residents, and 5% for non-residents. These rates remain competitive compared to many other countries.

The 15% VAT applies to real estate transactions, but it can be recovered by companies registered in Vanuatu. For individuals, it represents an additional cost to consider in the acquisition budget.

- Exemption from tax on rental income

- No tax on dividends for real estate companies

- Possibility to structure investments via offshore companies

- Limited tax treaties, reducing the risks of double taxation

It is important to note that although Vanuatu offers an attractive tax environment, investors must remain vigilant about their tax obligations in their country of residence. Some countries may tax income generated abroad, even if it is not taxed locally.

Good to Know:

Vanuatu offers a very advantageous tax regime with no income or capital gains tax. The main tax costs are limited to registration fees and VAT on real estate transactions.

Owner Rights and Obligations: A Balance to Be Found

Being a property owner in Vanuatu confers a number of rights, but also involves specific responsibilities. It is essential to fully understand this framework to effectively manage your investment and maintain good relations with the local community.

- Right to use and enjoy the property

- Right to rent or sell the property

- Protection against expropriation (except for public interest with compensation)

- Right to develop the property in compliance with local regulations

Foreign owners generally enjoy the same rights as local owners regarding the use and disposition of their properties. However, certain restrictions may apply, especially for large-scale development projects that require specific authorizations.

- Compliance with local regulations on urban planning and environment

- Payment of taxes and fees related to the property (condo fees, utilities)

- Maintenance of the property and compliance with safety standards

- Respect for customary rights and local practices

An important particularity in Vanuatu is the need to respect customary rights, even for properties in urban areas. This may involve consulting local chiefs for certain projects or participating in traditional ceremonies.

For condominium properties, owners must comply with the rules established by the body corporate. These rules may concern the use of common areas, restrictions on short-term rentals, or structural modifications to apartments.

Rental Management and Tenant Rights:

The rental market in Vanuatu is relatively unregulated compared to other countries. Lease agreements are generally governed by common contract law. It is recommended to establish detailed written leases to avoid any disputes.

- Provide decent and safe housing

- Perform necessary repairs

- Respect tenant privacy

Good to Know:

Property owners in Vanuatu enjoy considerable freedom in using their properties but must respect local regulations and customary practices. Rental management is lightly regulated, giving owners significant leeway.

Regulatory Developments: Towards Modernizing the Sector

The regulatory framework for real estate in Vanuatu is constantly evolving, aiming to modernize the sector while preserving local specificities. These changes seek to attract foreign investment while protecting the interests of local communities.

- Amendment of the land law in 2014 to facilitate property access for foreigners

- Revision of the Strata Titles Act in 2019 to modernize condominium management

- Strengthening of controls on foreign investments via VIPA

- Implementation of a digital cadastre system to secure property titles

These reforms have helped improve the transparency and legal security of the Vanuatu real estate market. The digital cadastre system, in particular, has reduced the risks of land disputes by clarifying property boundaries and associated rights.

Trends and Perspectives:

- Simplification of building permit procedures

- Strengthening of construction standards to improve resilience to natural hazards

- Development of special economic zones with enhanced tax benefits

- Improvement of foreign investor protection

These developments are part of a broader economic development strategy for Vanuatu, which aims to diversify its economy beyond tourism and agriculture.

Environmental and Sustainability Issues:

- Mandatory environmental impact studies for large projects

- Incentives for green and energy-efficient construction

- Restrictions on development in sensitive coastal areas

- Promotion of local and sustainable building materials

These measures aim to preserve Vanuatu’s exceptional environment, which is one of its main assets for attracting investors and tourists.

Good to Know:

The regulatory framework for real estate in Vanuatu is evolving towards greater modernity and transparency, while strengthening environmental protection. Investors must stay informed of these developments to adapt their projects accordingly.

Conclusion: A Promising Market to Approach with Caution

Real estate investment in Vanuatu offers attractive opportunities, particularly thanks to an advantageous tax regime and a constantly improving regulatory framework. The country has managed to create an environment favorable to foreign investors while preserving its cultural and environmental specificities.

However, as with any investment abroad, it is crucial to approach the Vanuatu market with caution and to thoroughly research the legal, tax, and cultural aspects. The complexity of the land system, blending modern law and traditional customs, requires an in-depth understanding and often the assistance of local professionals.

Potential investors must also consider the specific challenges of Vanuatu, such as its geographical isolation, vulnerability to natural hazards, and the need to respect customary practices. A respectful approach towards local communities and the environment is essential to ensure the success and longevity of any real estate project in the archipelago.

Despite these challenges, Vanuatu remains a promising destination for real estate investment, offering an exceptional living environment and interesting development prospects. With proper preparation and adequate support, investors can take advantage of the opportunities offered by this evolving market.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.