Published on and written by Cyril Jarnias

Published on and written by Cyril Jarnias

Buying a Hotel in Madagascar: An Exceptional Investment Opportunity

Purchasing a hotel in Madagascar represents an exceptional opportunity for entrepreneurs seeking exotic destinations combining charm and tourism potential. Before embarking on this captivating adventure, it’s essential to master the different stages of the process to guarantee a successful investment.

This comprehensive checklist covers all necessary aspects, from evaluating legal aspects to analyzing potential pitfalls, including understanding the country’s cultural dynamics.

By adopting an informed and strategic approach, investors can not only diversify their portfolio but also contribute to the economic development of an island rich in biodiversity and culture.

Good to know:

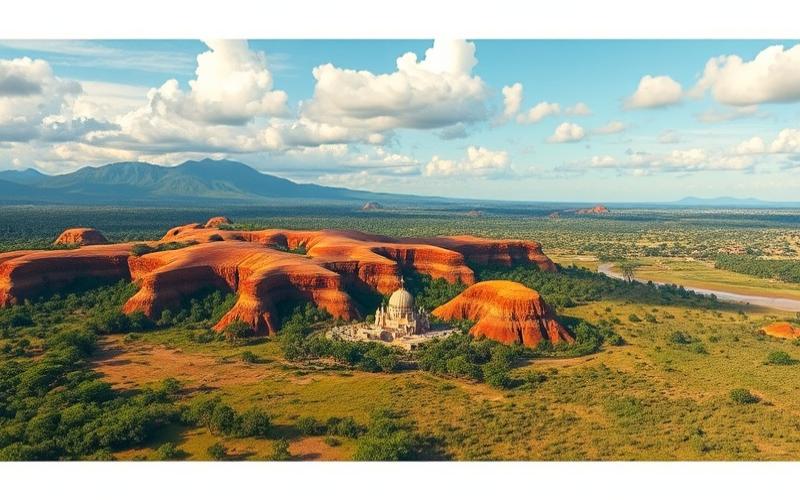

Madagascar offers an exceptional natural setting with unique biodiversity, making it a very attractive destination for tourists seeking authenticity.

Overview of Hotel Real Estate in Madagascar

The hotel real estate market in Madagascar is currently experiencing particularly favorable dynamics, driven by the growing tourism appeal of the Great Island. In 2025, this sector stands out as one of the most promising segments of the Malagasy real estate market, offering interesting prospects for local and international investors.

The Malagasy hotel market is characterized by strong concentration in certain strategic regions. Nosy Be, nicknamed “the perfume island,” stands out as Madagascar’s tourism jewel with a particularly dynamic real estate market in the vacation home and hotel complex sectors. Beachfront land for tourism projects, boutique hotels, and eco-lodges represent the most attractive opportunities in this region.

Madagascar’s coastal areas are also experiencing remarkable growth, particularly for vacation homes and hotel establishments. This expanding market meets growing demand from international tourists and investors seeking properties in exceptional natural settings.

| Region | Assets | Preferred Investment Types |

| Nosy Be | Preferred tourist destination, “perfume island” | Hotel complexes, vacation homes, eco-lodges |

| Coastal Areas | Exceptional natural setting, tourism potential | Vacation homes, beach hotels |

| Antananarivo | Economic center, business accommodation demand | Urban hotels, expatriate residences |

| Tamatave | Strategic port area | Business traveler accommodations |

Current Sector Trends

- Sustainable Development: Madagascar’s unique biodiversity and natural resources offer interesting opportunities for ecological and sustainable real estate projects, aligned with global trends.

- Emergence of an Urban Middle Class: Growing urbanization and economic development are fostering the emergence of a middle class, creating new demand for quality accommodation spaces.

- Growing Appeal for International Investors: Madagascar is increasingly attracting attention from foreign investors, particularly in tourism and hotel real estate sectors.

Opportunities for Investors

- Competitive Prices: Compared to other regional markets, Madagascar offers advantageous rates, particularly in tourist areas.

- Growth Potential: The progression of the tourism sector in destinations like Nosy Be, Antananarivo, or Sainte-Marie creates strong demand for rental properties, hotels, and vacation homes.

- Infrastructure Projects: The Malagasy government has launched several major infrastructure projects, particularly in transportation and energy, which should positively impact real estate values in affected areas.

Challenges to Consider

- Legal and Regulatory Aspects: It’s essential to thoroughly research the country’s legal specifics before investing.

- Need for Local Support: Partnership with Malagasy professionals is strongly recommended to effectively navigate the local business environment.

- Economic and Political Stability: Although the economy shows signs of progress thanks to foreign investments and tourism development, stability remains a factor to monitor.

Among recent successes, we can cite the development of boutique hotels and eco-lodges in Nosy Be, which perfectly meet new traveler expectations for authenticity and environmental respect. Similarly, the high-end residential complexes in Ivandry and Ankadimbahoaka in Antananarivo demonstrate the market potential for quality accommodations targeting expatriate executives and business travelers.

Good to know:

The hotel real estate market in Madagascar is experiencing stimulating dynamics, primarily concentrated in the tourist regions of Antananarivo, Nosy Be, and Sainte-Marie Island, where the influx of international visitors encourages investments. Despite the promising opportunities offered by exotic landscapes and unique biodiversity, the Malagasy hotel market must contend with economic challenges, complex regulations, and the importance of good relationships with local communities. Recent successes illustrate the market’s potential, such as a French hotel group that prospered after adopting a sustainable development and community engagement strategy in Nosy Be. For foreign investors, the key lies in a collaborative approach designed to overcome inherent obstacles in the local economy while respecting legal and cultural requirements.

Key Steps to Buying a Hotel in Madagascar

The process of purchasing a hotel in Madagascar requires following several essential steps and respecting certain conditions specific to the Malagasy context.

Real Estate Acquisition Procedure in Madagascar

Purchasing real estate in Madagascar, particularly a hotel, is now accessible to foreigners under certain conditions. The process begins with a research and selection phase where the buyer identifies a property matching their needs and investment objectives. It’s strongly recommended to consult a professional real estate agency or engage a reputable real estate agent to facilitate this first step.

Preliminary Verification (Due Diligence)

Once the property is identified, thorough verification is necessary:

- Comprehensive document examination

- Verification of ownership history

- Analysis of property titles

- Confirmation of absence of disputes or claims

If the property comes from a recognized real estate agency, they should normally have performed these verifications beforehand. Otherwise, this step is crucial to avoid future legal problems.

Legal and Notarial Aspects

Using a notary is recommended for real estate purchases in Madagascar. However, note that the Malagasy notary’s role is limited to:

- Drafting the sales deed

- Verifying required authentications

- Ensuring contract signature between seller and buyer

- Delivering the notarized deed to concerned parties

Other transactions like payment or obtaining the property title must be managed directly by the buyer and seller.

Obtaining the Property Title

To obtain the property title, the buyer must:

- Go to the Land Registry for Private Property

- Present the notarized deed delivered by the notary

- Provide a copy of the land title given by the seller during signing

- Wait approximately one week for title delivery

Opening Authorization for a Hotel Establishment

To operate a hotel in Madagascar, it’s necessary to obtain an opening authorization. Generally required documents include:

- Request letter

- Copy of preliminary notice

- Information sheet

- Certified copy of building permit and compliance certificate

Financial and Contractual Considerations

During purchase, it’s important to clearly define payment conditions and guarantees. Contracts should specify:

- Payment terms

- Property transfer conditions

- Each party’s responsibilities

- Recourse in case of dispute

General sales conditions should be carefully examined, as they define the parties’ rights and obligations within the transaction framework.

Key Steps in the Purchase Process Table

| Step | Description | Participants |

|---|---|---|

| Research | Identifying property matching criteria | Buyer, real estate agent |

| Due Diligence | Document and legality verification | Buyer, legal experts |

| Negotiation | Discussion of conditions and price | Buyer, seller, intermediaries |

| Contract | Drafting and signing sales deed | Notary, buyer, seller |

| Payment | Fund transfer according to agreed terms | Buyer, seller, banks |

| Property Transfer | Registration with competent authorities | Buyer, Land Registry |

| Authorization | Obtaining hotel operation permits | Buyer, administrative authorities |

Good to know:

To buy a hotel in Madagascar, it’s crucial to follow certain key steps: first, familiarize yourself with local legal procedures, including obtaining a residence permit for foreigners if necessary, and follow specific administrative procedures for real estate acquisitions in the country. Financially, it’s important to understand tax implications, including property and business taxes, and budget for potential hidden costs. It’s prudent to consult local real estate and legal experts to effectively navigate these steps. Rigorous verification of the establishment’s background is crucial to identify potential debts or ongoing disputes. Location choice should also be strategic, considering tourist access and surrounding infrastructure; skillfully negotiating with Malagasy sellers can often lead to better purchase conditions, so it’s advantageous to familiarize yourself with local negotiation methods to leverage the best opportunities.

Tips for Due Diligence in the Malagasy Hotel Sector

Due diligence in Madagascar’s hotel sector represents an essential process for any investor wishing to establish themselves in this promising market. This methodical process allows for evaluating risks and opportunities before any significant acquisition or investment.

Examination of Property Titles and Authorizations

Thorough analysis of property titles constitutes a fundamental step. In Madagascar, verification of land document authenticity is particularly critical due to specificities of the local registration system. Investors must ensure all building permits and operation authorizations are in order and compliant with current legislation.

Regulatory Compliance

Verification of compliance with local regulations should cover several aspects:

- Compliance with environmental standards

- Conformity with building codes

- Obtaining hotel operation licenses

- Compliance with hygiene and safety regulations

This assessment helps identify potential non-compliances that could lead to penalties or require additional investments.

Infrastructure Evaluation

Technical evaluation of existing infrastructure should include:

- General condition of buildings and facilities

- Electrical and plumbing systems

- Air conditioning and heating equipment

- Telecommunication infrastructure

- Access to drinking water and wastewater treatment

| Infrastructure Element | Attention Points | Potential Impact |

|---|---|---|

| Buildings | Age, structural condition, previous renovations | Maintenance costs, safety |

| Equipment | Age, operational status, part availability | Operational efficiency, customer satisfaction |

| Energy Systems | Energy source, reliability, efficiency | Operating costs, environmental impact |

| Access and Communication Routes | Road conditions, transport proximity | Customer appeal |

Financial Performance Analysis

Examination of historical financial data is crucial for evaluating the establishment’s economic viability:

- Revenues and profits from last 3-5 years

- Average occupancy rates and seasonality

- Average daily rate (ADR)

- Revenue per available room (RevPAR)

- Operational cost structure

- Recent and planned investments

Analysis of seasonal trends is particularly important in Madagascar where tourist flows can vary considerably throughout the year.

Understanding Cultural and Tourism Context

Thorough knowledge of Madagascar’s cultural and tourism landscape is essential for evaluating a hotel establishment’s potential. Madagascar offers significant opportunities in the tourism sector with its unique natural attractions and exceptional biodiversity. Investors must understand:

- Local and international tourism trends

- Target clientele preferences

- Tourism seasonality

- Local and regional competition

- Nearby cultural and natural assets

Impact of Economic and Political Factors

Economic fluctuations and government policies can significantly impact Madagascar’s hotel industry:

- Political and security stability

- Fiscal policies affecting tourism sector

- Regulations on foreign investments

- Exchange rate variations

- National transportation infrastructure

Madagascar presents significant opportunities in various sectors, particularly tourism, but investors must remain attentive to potential challenges related to the business environment.

Utilizing Local Experts

Using local experts is indispensable for effectively navigating the acquisition process:

- Lawyers specialized in Malagasy real estate and commercial law

- Accountants familiar with local tax system

- Hotel consultants knowledgeable about Malagasy market

- Technical experts for infrastructure evaluation

- Government relations specialists

These professionals can provide valuable advice on local specifics and help avoid common pitfalls in the acquisition process.

Environmental and Social Considerations

Complete due diligence should also include assessment of environmental and social aspects:

- Establishment’s environmental impact

- Relationships with local communities

- Existing social programs

- Employment opportunities for local population

- Sustainability of operational practices

Analysis of these social programs helps assess their relevance, scope, and performance regarding local stakeholder expectations.

Good to know:

During due diligence for purchasing a hotel in Madagascar, it’s crucial to authenticate property titles and ensure building permits are valid and up-to-date, while verifying compliance with local construction and safety standards. Thoroughly evaluate existing infrastructure to identify renovation or upgrade needs, and analyze the establishment’s financial performance, including recent occupancy rates, to assess profitability. Given potential impacts of local economic variations and government policies, it’s essential to well understand the country’s economic and tourism context. To navigate these complexities, seek help from local and legal experts who can offer informed advice tailored to the Malagasy market.

Analysis of Tourism Trends and Statistics in Madagascar

In 2024, Madagascar welcomed 308,275 international visitors, representing a 40% increase compared to the previous year. This figure also exceeds pre-pandemic levels, which were 274,119 tourists in 2019. December stood out as the peak period with 33,751 international arrivals, confirming the island’s tourism seasonality.

| Year | Number of International Visitors |

| 2019 | 274,119 |

| 2023 | ~220,000* |

| 2024 | 308,275 |

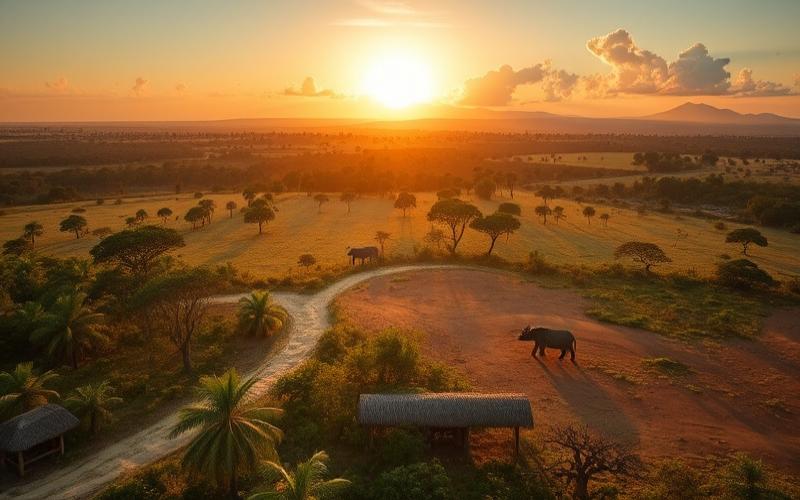

The most favorable periods for tourism in Madagascar generally correspond to the dry season (May to October), when climatic conditions are optimal for discovering national parks and enjoying the coastline. This influx increases pressure on the hotel sector, with marked increases in occupancy rates and prices during tourism peaks.

The hotel industry benefits from this growth, representing with restaurants nearly 14.9% of the national GDP projected for the following year. However, this dynamic imposes significant challenges related to infrastructure development (roads, accommodations) to ensure satisfactory and sustainable reception for growing visitors.

Factors Influencing Tourism:

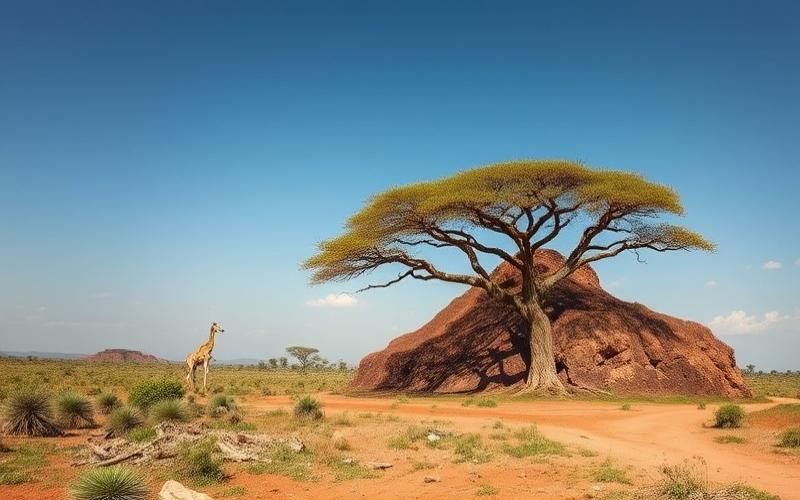

- Exceptional biodiversity (endemic lemurs, national parks such as Ranomafana or Andasibe)

- Paradise beaches (Nosy Be remains a flagship destination)

- Local cultural events

- Progressive but still insufficient improvement of road and airport infrastructure

The Malagasy government now aims for an ambitious objective: attract up to 3 million international tourists by 2028. To achieve this:

- Accelerated development of new tourism sites

- Specific projects in the capital Antananarivo

- Continuous infrastructure modernization

Tourist attendance remains dominated by travelers from Western Europe (particularly France), followed by those from the rest of the African continent and some emerging Asian markets.

Regarding trends:

- Average stay duration oscillates between 10 and 15 days, favored by the island character and regional diversity.

- Average expenditures vary by profile; however, regular increases are observed linked to gradual return toward high-end international tourism.

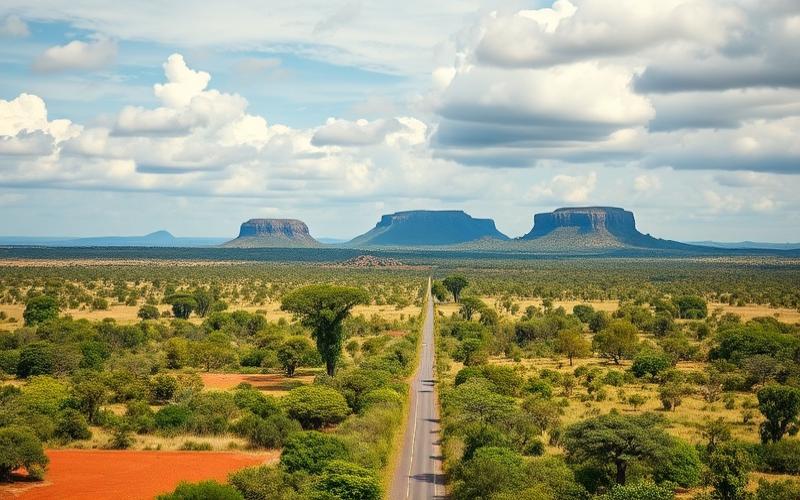

Geographical areas concentrating the majority of tourist flow—decisive information for any hotel project—include:

- Nosy Be (beach resorts)

- Antananarivo (cultural capital & main entry point)

- Major national parks like Andasibe-Mantadia or Isalo

- Sainte-Marie (beaches & whale watching)

The sector displays “very encouraging dynamism” according to the Malagasy Ministry of Tourism, which nevertheless emphasizes that only a proactive infrastructure policy will allow the country to reach its ambitious objectives for coming years.

Summary:

| Tourist Area | Main Assets |

| Nosy Be | Beaches – Water activities |

| Antananarivo | Culture – Business |

| National Parks | Endemic fauna/flora |

| Sainte-Marie | Diving – Whale watching |

Good to know:

Madagascar welcomed approximately 367,000 tourists in 2019, with peaks during July to September months, often coinciding with summer vacations from main tourist-emitting nations, particularly France. This high-traffic period benefits the hotel industry, although challenges remain, particularly regarding insufficient transportation infrastructure. The island’s unique biodiversity, combined with cultural festivals like the Donia Festival, attracts international clientele, especially European. On average, visitors spend about 9-10 days on the island, and it’s crucial to consider the sector’s projected growth of approximately 3% annually, fueled by increased demand for ecotourism and cultural experiences. The most popular regions include Nosy Be, Sainte-Marie Island, and Antananarivo, recommended for establishing a hotel given their tourism popularity and future development prospects.

Disclaimer: The information provided on this website is for informational purposes only and does not constitute financial, legal, or professional advice. We encourage you to consult qualified experts before making any investment, real estate, or expatriation decisions. Although we strive to maintain up-to-date and accurate information, we do not guarantee the completeness, accuracy, or timeliness of the proposed content. As investment and expatriation involve risks, we disclaim any liability for potential losses or damages arising from the use of this site. Your use of this site confirms your acceptance of these terms and your understanding of the associated risks.